In September, cryptocurrency exchange FTX US guaranteed the winning bid for that assets of embattled crypto broker Voyager Digital having a bid of roughly $1.4 billion. The bid was comprised of the fair market price of Voyager’s crypto holdings “at a to-be-determined date later on.”

Based on Voyager, at market prices, the fair worth of its holdings was believed around $1.3 billion, and also the deal incorporated an “additional consideration,” believed to become worth roughly $111 million.

Since that time, new information on the situation emerged, with court filings showing the cash compensated for Voyager Digital itself was just $51 million. The $1.31 billion FTX offered for Voyager crypto holdings are going to be given to qualified credits on the pro-rata basis, based on the filings.

The $111 million incorporated within the deal are, consequently, split between your $51 million being compensated for Voyager’s assets, ip and users list, and also the $60 million that includes an accrued $50 account credit for every user who onboards with FEX along with a $20 million earnout.

Voyager’s users look for solutions

While news of FTX’s winning bid trickles in through court papers along with other scarce sources, people that use the bankrupt firm continue trying to find solutions, organizing through social networking to amass just as much information as you possibly can.

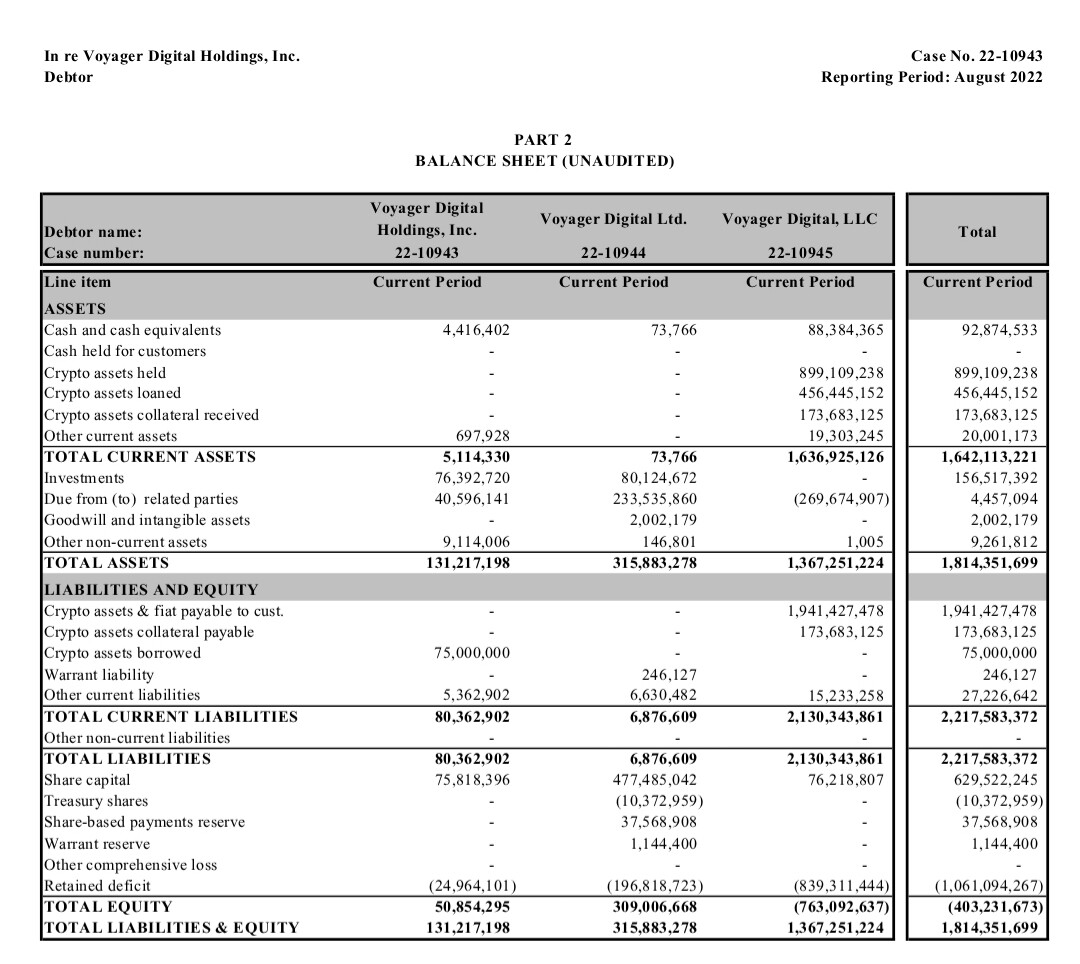

Initial math made by users taking Voyager’s balance sheet into consideration has recommended that users who proceed to FTX can anticipate getting a haircut well over 30% around the assets they held. With a, seeing any kind of return is preferable to seeing nothing following the platform went under.

FTX’s Chief executive officer Mike Bankman-Fried has stated that it is bids were “generally based on fair market cost,” with the organization buying up assets to provide it well to customers.

to become obvious — in Voyager, our bids are usually based on fair market cost, no discounts goal is not to earn money buying assets at cents around the dollar, it’s to pay for $1 around the $1 and obtain the $1 to customers.

When we would get involved with Celsius, it might be exactly the same.

— SBF (@SBF_FTX) October 2, 2022

Voyager’s problems emerged following the firm extended financing of $670 million to crypto hedge fund Three Arrows Capital, which defaulted at the end of June. FTX’s bid excluded the 3 Arrows Capital loan.

Because it stands, it appears users who’ll receive their assets back will need to flock to FTX’s buying and selling platforms when the court approves the offer. The Voyager application would, consequently, achieve its finish while FTX’s users list would swell considerably.

Recent: Is payments giant Quick get yourself ready for a blockchain-bound future?

To users who may soon be relocating to FTX, there’s a couple of concerns that they must be familiar with when they decide to remain on the brand new platform.

FTX offers its users an earn program that enables these to earn interest on their own cryptocurrency holdings, although with annual percentage yields (APYs) which are usually less than individuals users were making other crypto lending platforms, including Voyager.

FDIC insurance snafu

Before Voyager Digital went under, regulators directed it to get rid of “false and misleading statements” that it is users’ deposits were insured through the Fed and also the Federal Deposit Insurance Corporation (FDIC) as though these were regular savings accounts.

Inside a joint letter, Seth Rosebrock and Jason Gonzalez, assistant general counsel in the FDIC, recommended that Voyager’s representations “likely fooled and were relied upon” by customers placing funds around the platform.

While FTX has been seen a beacon of hope trying to backstop contagion within the cryptocurrency industry following a run for liquidity brought towards the collapse of countless firms, the FDIC also cautioned it to prevent making “misleading” statements concerning the insurance status of users’ deposits.

FTX received a cease-and-desist letter in the FDIC to prevent suggesting user funds around the platform were insured. The letter specified that Brett Harrison, obama of FTX US, stated inside a tweet that direct deposits from employers were kept in FDIC-insured accounts in users’ names.

While Harrison responded on social networking by stating that he deleted the publish and didn’t mean to point that cryptocurrencies kept in FTX are insured through the FDIC, his statements might have fooled users flocking for safety.

Contagion risks

As users proceed to FTX either simply because they benefit from the platform, wish to diversify from Binance or Coinbase or want the opportunity to earn interest on their own tokens, the organization grows.

It’s unclear whether FTX’s tries to backstop contagion within the cryptocurrency space might be departing the exchange itself vulnerable, although experts believe what it’s doing is dangerous.

Talking with Cointelegraph, Richard Gardner, Chief executive officer at fintech firm Modulus, stated it’s vital that you recognize the “FTX gambits” for what they’re, as tries to “buy up dangerous assets at very cheap prices to grow a la Andrew Carnegie.”

Gardner added that Bankman-Fried is “attempting to consolidate the industry” by betting on high-risk endeavors. He concluded:

“This recession is within its earliest stages, and also the smarter play would be to allow the Fed’s financial policy shifts engage in and save capital. Within the relatively not too distant future, you will see companies, filled with better fundamentals and greater viability, looking for a bailout. Individuals companies would be the better investment. FTX is just playing roulette at this time.”

Investors who might be gone to live in FTX may should also take into account that the organization is involved with American politics since it’s digital markets co-Chief executive officer Ryan Salame has campaigned together with his girlfriend Michelle Bond, a brand new You are able to Republican running for Congress.

Salame has apparently spent millions on political donations within the 2022 election cycle by donating to cryptocurrency-focused super political action committees (PACs). Super PACs can raise limitless levels of money to aid candidates but cannot donate for them directly.

A few of the funds Salame deployed, according to invest in reports, have been funneled into Bond’s race after a number of money transfers. Bond herself holds cryptocurrencies.

Alameda Research and FTX

Alameda Scientific studies are a crypto quantitative buying and selling firm and market maker founded by FTX’s Chief executive officer Mike Bankman-Fried. The firm frequently appears to fly individually distinct, nevertheless its buying and selling volume and incredible profit of $1 billion in 2021 make the job harder over the years.

Alameda Research’s influence continues to be seen by a few like a potential conflict of great interest, considering its relationship with FTX. Cory Klippsten, Chief executive officer of crypto startup Swan Bitcoin, continues to be quoted stating that FTX and Alameda happen to be “able to profit from the regulatory gap which has permitted these to trade and make money from cryptocurrencies” without following a same rules traditional banking institutions do.

Because of its part, Mike Bankman-Fried has stated Alameda is really a “wholly separate entity” that will get no preferential treatment. As Bloomberg reported in September 2022, questions persist because Bankman-Fried and Alameda’s Chief executive officer Caroline Ellison have until lately shared a condo with eight other colleagues.

Recent: Man and machine: Nansen’s analytics gradually labeling worldwide wallets

Ellison has addressed these concerns, saying they’re “arm’s length out on another have any different treatment using their company market makers.” Alameda was FTX’s largest trader, as with its beginning, the exchange had limited use of liquidity. Based on Bankman-Fried, it’s no more the platform’s greatest market maker.

As the potential conflict of great interest can often mean regulators will quickly target FTX once more, the organization is apparently positively in talks using the U . s . States Registration (SEC), which reduces regulatory risk.

As users flock to FTX — or other centralized entity — it’s vital that you always think about the benefits and drawbacks of keeping funds with that platform. As Bitcoin (BTC) advocate Andreas Antonopoulos famously stated: not your keys, not your coins.