The outlook over the cryptocurrency ecosystem still dim because the sharp downtrend which was initially sparked through the collapse of Terra now seems to possess claimed the Singapore-based crypto investment capital firm Three Arrows Capital (3AC) since it’s next victim.

As large crypto projects and investment firms start to collapse every week, the possibilities of a lengthy, attracted out bear marketplace is a real possibility investors are starting to simply accept.

With different recent Twitter poll conducted by market analyst and pseudonymous Twitter user Plan C, 41.6% of respondents established that they thought the Bitcoin (BTC) bottom will fall between your $17,000 to $20,000 range.

Addresses holding a minimum of 1 BTC hits a brand new high

In the middle of the increased volatility and rapid cost decline for Bitcoin, many would anticipate seeing traders dumping their holdings and fleeing towards the sidelines inside a bid to keep their purchasing power.

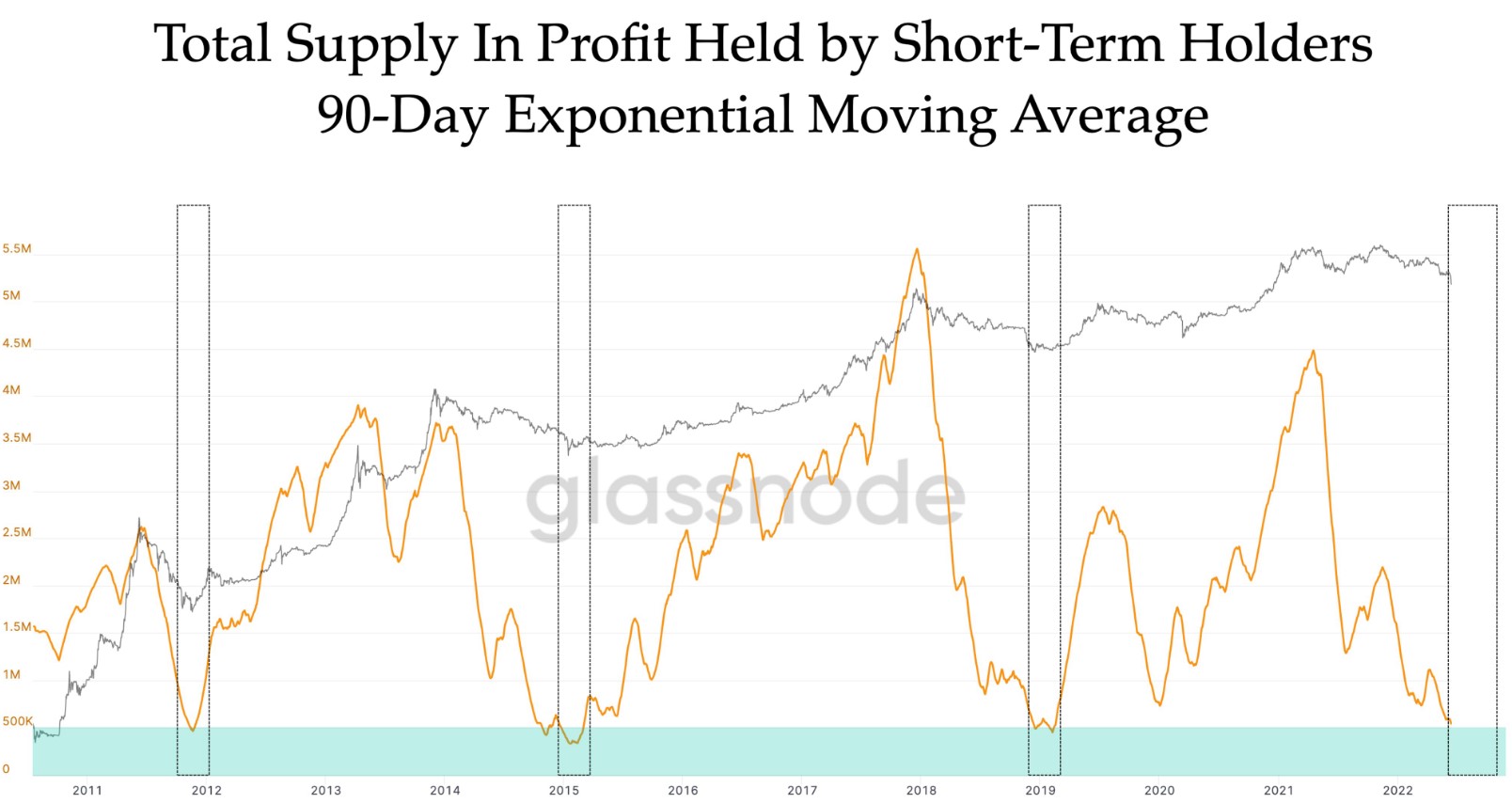

Although it has indeed been the situation that falling prices and liquidations have pressed many traders from the market, low-priced Bitcoin has additionally attracted some clients who have with patience been waiting for the best access point.

Data implies that the amount of Bitcoin addresses that hold a minimum of 1BTC has hit a brand new all-time high also it seems that it’ll increase soon if sub-$20,000 BTC is constantly on the attract buyers.

Related: May be the bottom in? Raoul Pal, Scaramucci stock up, Novogratz and Hayes weigh in

“BTC cost less of computer looks”

Market tops and bottoms are often overreactions to developments and retail traders possess a inclination to FOMO once the cost is booming, yet they’re quick to market when not so good news begins to spread.

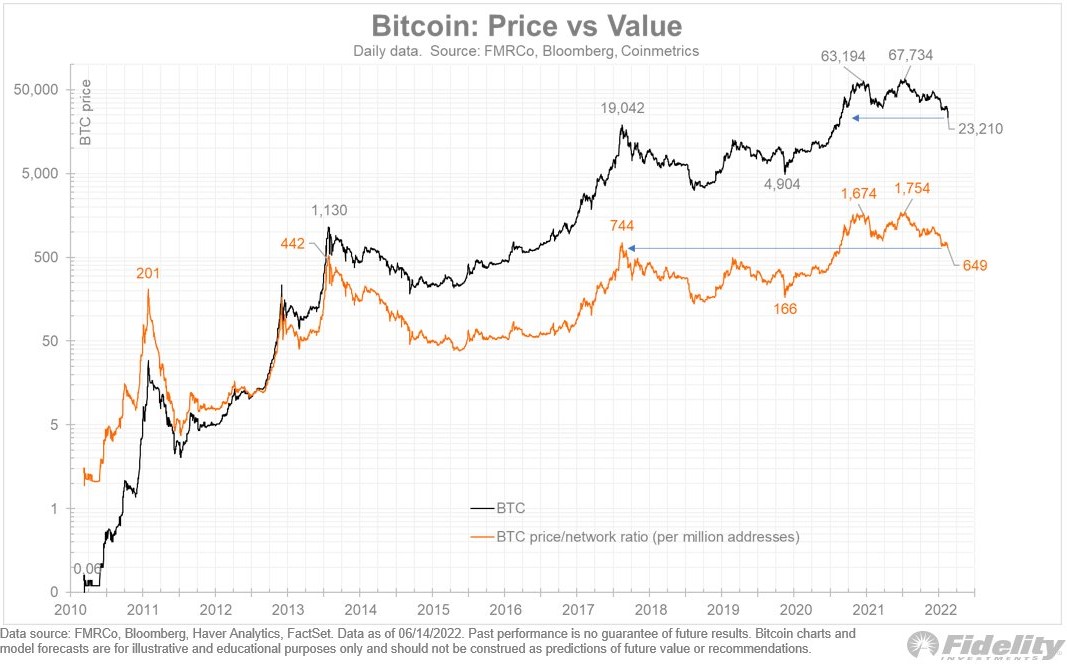

A far more nuanced research into the current worth of Bitcoin was discussed by Jurrien Timmer, director of worldwide macro at Fidelity, who published the next chart and asked if “BTC cost less of computer looks?”

Timmer stated,

“If we think about a simple “P/E” metric for BTC is the cost/network ratio, then that ratio has returned to 2017 and 2013 levels, despite the fact that BTC is only to late 2020 levels. Valuation frequently is much more important than cost.”

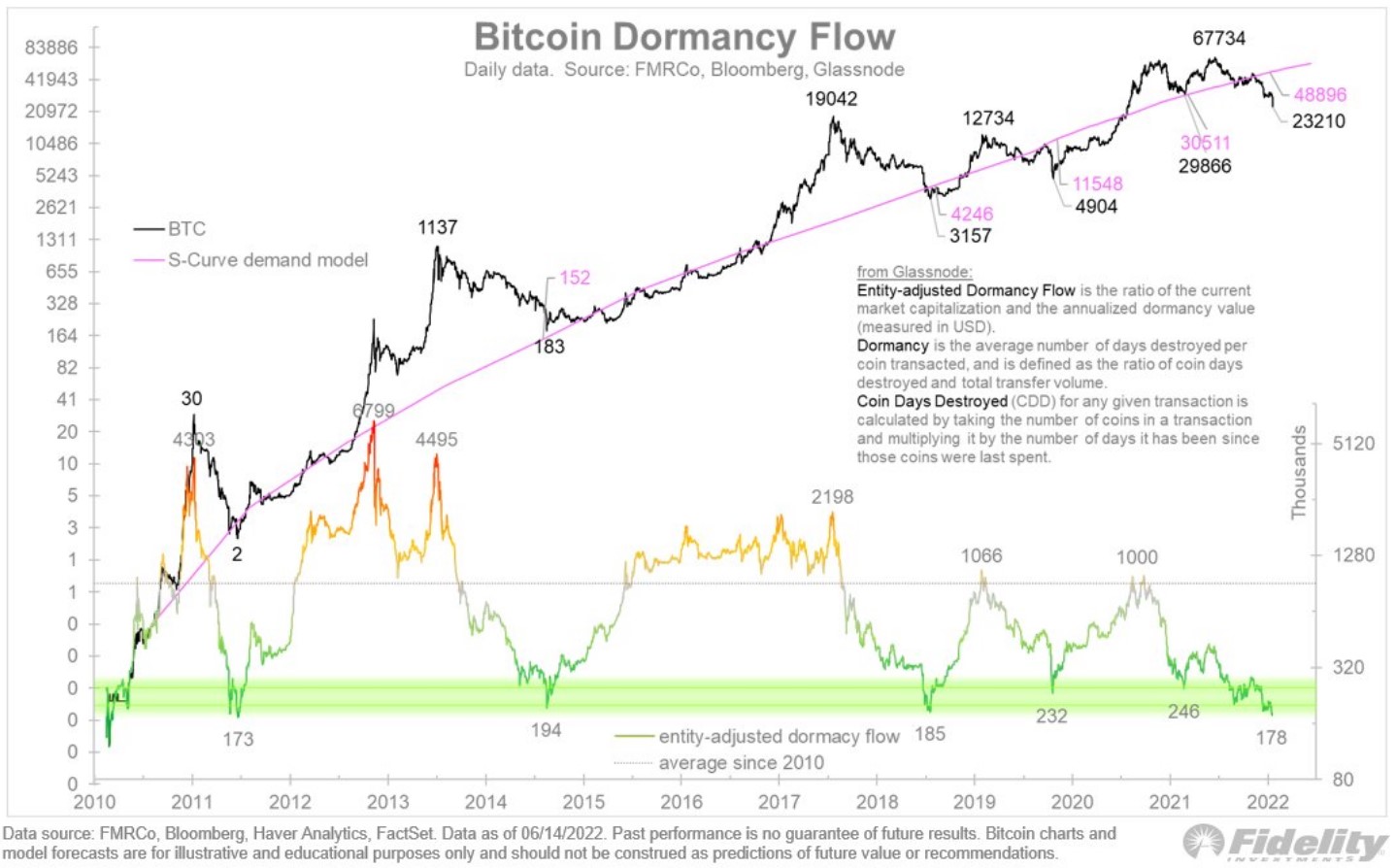

Timmer added that BTC is presently priced below its fair market price using the Bitcoin dormancy flow indicator, which shows “how technically oversold [it] is.”

Timmer stated,

“Glassnode’s dormancy flow indicator has become to levels not seen since 2011.”

Taken together, the increase in Bitcoin addresses holding greater than 1 BTC combined with asset’s in the past oversold cost and undervalued cost/network ratio shows that the down-side possibility might not be badly as numerous traders think.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.