The beginning of May has witnessed a continuation from the weakness in crypto and equities markets and right now, there’s no symbol of any short-term factors that may turn back bearish trend.

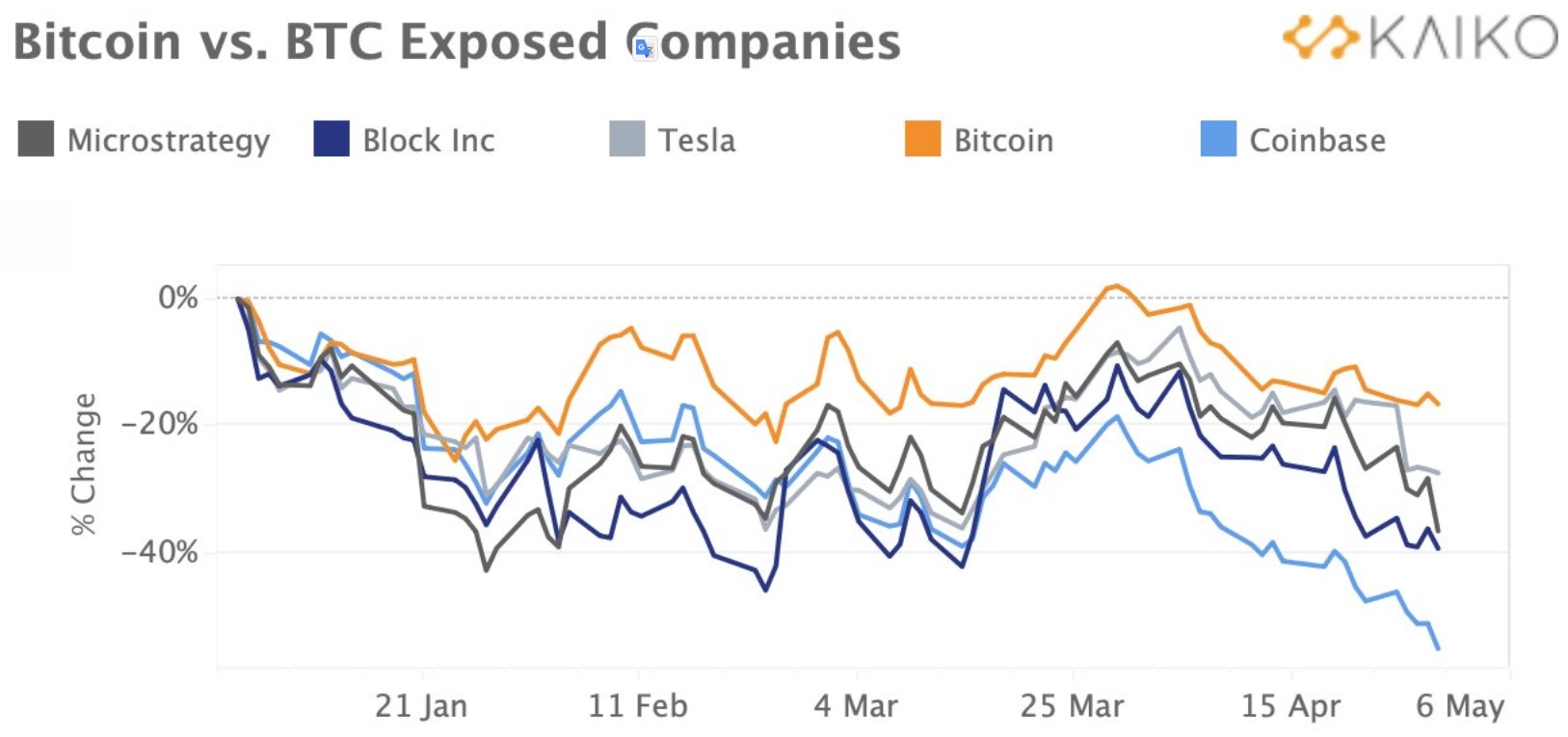

Equities financial markets are and in a downtrend and according to investigator Clara Medalie, the cost of stocks from companies with contact with Bitcoin (BTC) also have taken a notable hit.

Medalie stated:

“Block, Tesla, Microstrategy and Coinbase are lower between 20%–50%.”

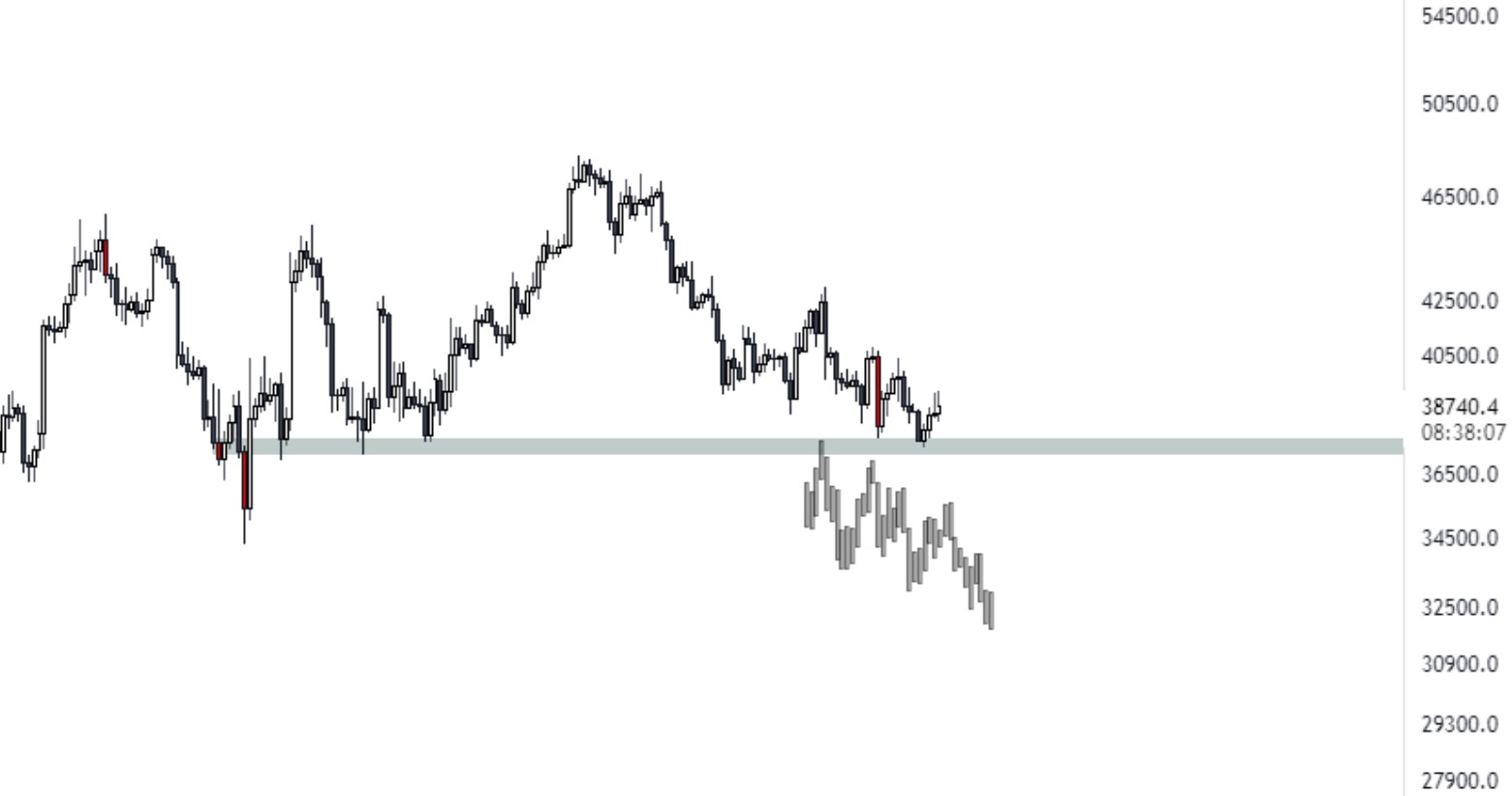

Data from Cointelegraph Markets Pro and TradingView implies that an earlier morning attempt by Bitcoin (BTC) bulls to rally above $39,000 was easily defended by bears, producing a pullback towards the $38,200 level.

Here’s a glance at what several analysts say concerning the current cost action and just what ‘abnormal’ amounts to keep close track of within the situation of further decline.

More downside before the 200-EMA flips to aid

Based on independent market analyst Rekt Capital, watching for any close over the 200-day exponential moving average (EMA) is a straightforward method to measure the current weakness of Bitcoin. The analyst described the metric being an “indicator of lengthy term investor sentiment towards Bitcoin.”

Rekt Capital stated,

“Since mid-2021, BTC has not had the ability to hold over the black 200-day EMA for too lengthy. Each time BTC would break over the EMA, it might quickly lose it as being support and retrace lower.”

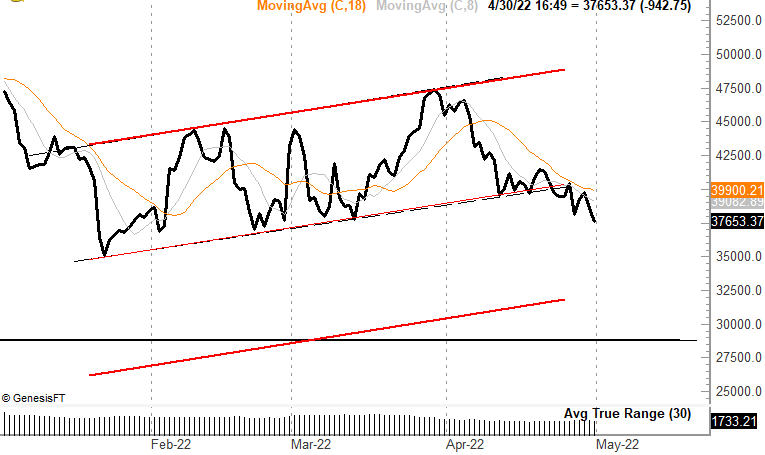

$28,000 may be the macro bottom

Understanding of what could come next for that BTC cost was discussed by crypto trader and pseudonymous Twitter user ‘Cantering Clark’, who published the next chart highlighting the similarities between your current cost action and BTC’s cost action in This summer 2021.

Cantering Clark stated,

“Similar pattern of powerful sell-offs adopted by weak tries to pop upward once we saw in This summer 2021, again following a longer-term sideways range had forms and lows started to become favored. Possible trap setup.”

Veteran trader Peter Brandt also shared an identical sentiment, noting the Bitcoin cost could break lower to new lows when the current “bear funnel” plays out.

Brandt stated:

“The completing a bear funnel typically produces a decline comparable to the width from the funnel, or perhaps in this situation a tough test of $32,000 approximately — my prediction is $28,000.”

Related: Bitcoin ‘bear market’ might take BTC cost to $25K, states trader with stocks due capitulation

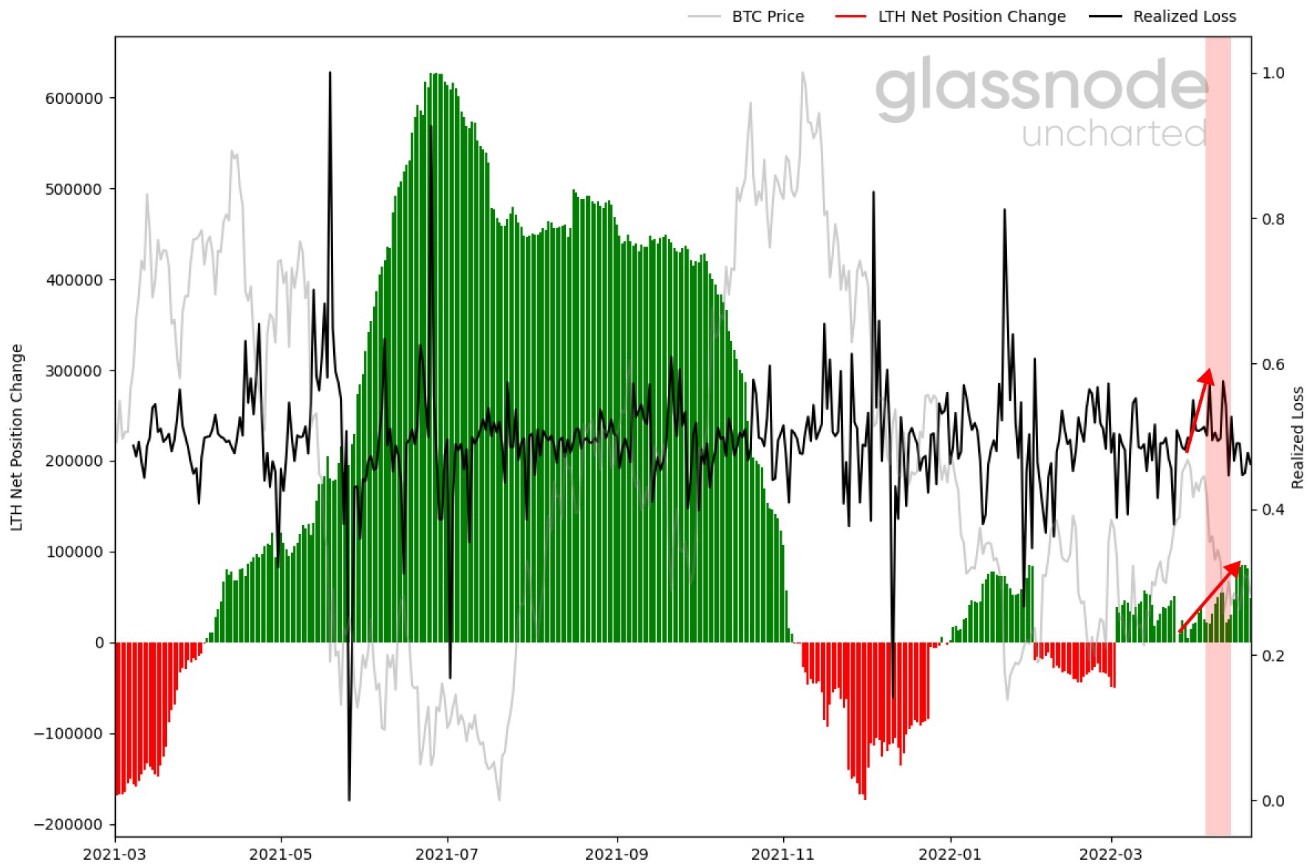

Lengthy-term accumulation continues

Regardless of the current downtrend, data from glassnode shows that BTC accumulation is constantly on the increase, a well known fact highlighted by Twitter account Negentropic.

The analysts stated:

“Panicking short-term holders recognized losses as the lengthy-term holder internet position change elevated.”

The general cryptocurrency market cap now is $1.72 trillion and Bitcoin’s dominance rates are 42.5%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.