The St. Louis Fed stirred up a mixture of amusement and curiosity in the crypto community on Tuesday, May 7, after publishing a publish showing how the price of eggs in Bitcoin (BTC) has fluctuated during the last 14-several weeks when compared to U.S. dollar.

On June 6, the Given research arm published your blog publish entitled “Buying eggs with bitcoins – a glance at currency-related cost volatility.”

The FRED Blog compares egg prices in U.S. dollars versus. bitcoins. Browse the publish to determine what costs are more stable https://t.co/Qfy9w8zgBk pic.twitter.com/qpFH4ny33S

— St. Louis Given (@stlouisfed) June 6, 2022

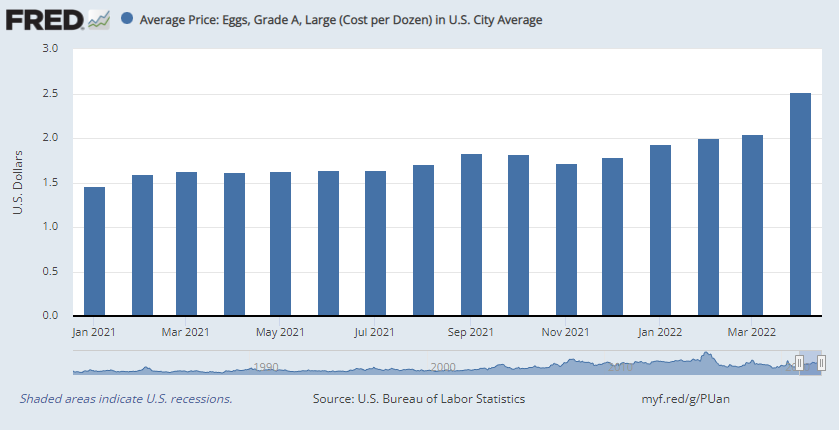

The publish initially includes a graph showing the historic cost of eggs in U.S. dollars for each month since The month of january 2021, noting the prices fluctuated between $1.47 and $2.52 within the 14-month period.

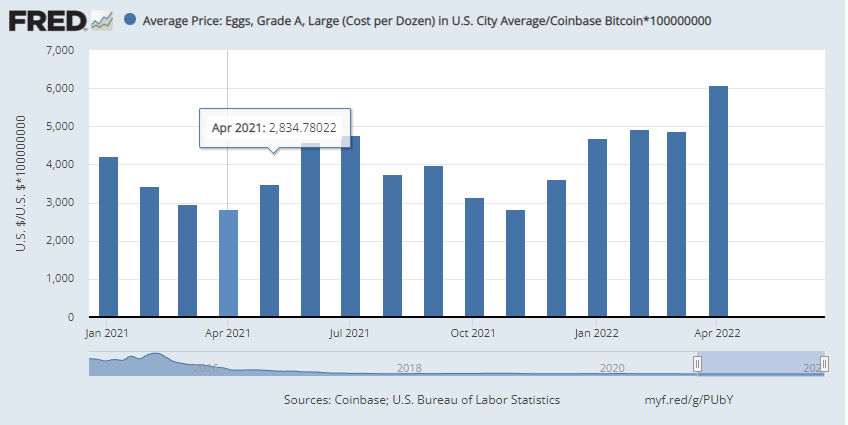

After that it follows this track of a graph showing how Bitcoin has socialized in the same time frame period, noting that the cost fluctuated “much greater than it did for that U.S. dollar cost.”

The report didn’t stipulate if the cost of eggs had elevated or even the dollar had devalued, or both, as causes for that trend.

“What can the graph seem like when we purchased that very same carton of eggs with bitcoins rather of U.S. dollars?”

Additionally, it came focus on Bitcoin’s transaction charges, so it states can fall between $2 and $50.

“Plus, you’d have to give a bitcoin transaction fee, that has been about $2 recently, but which could spike above $50 occasionally. Hopefully, should you be causeing this to be purchase with bitcoin, you’d put several more eggs inside your basket,” it authored.

Crypto Twitter reacts

Your blog publish ultimately came ire in the crypto community on Twitter, with lots of quarrelling the given was “cherry-picking” the timeframe to push the narrative of Bitcoin’s instability, instead of “zooming out”, which may rather show the huge devaluation from the U.S. dollar.

The Given authored a publish showing the cost of eggs in USD and Bitcoin, evaluating on them the this past year, showing Bitcoin as increasing numbers of volatile and unpredictable.

Only problem was they didn’t remember to zoom outhttps://t.co/WrCyaI4NP6 pic.twitter.com/rJVbedAs2z

— Nick Neuman (, ) (@Nneuman) June 6, 2022

A Twitter user going through the name @MapleHodl stated the apparent by stating the USD is continuously depreciating with time and Bitcoin is volatile temporary, though appreciating, so “stack yolks accordingly.”

Other Twitter users stated that for that Given to even recognize Bitcoin like a unit of account like a internet positive sign for that king crypto.

The Given is beginning to cost consumer goods in BTC. Bullish.

Cost of eggs going lower. No inflation. pic.twitter.com/hbeR38PWdx

— Joe Burnett ()³ (@IIICapital) June 6, 2022

“No matter the way they place it. They used Bitcoin like a unit of account to check. That’s really big.”

Related: Given money printer adopts reverse: Exactly what does it mean for crypto?

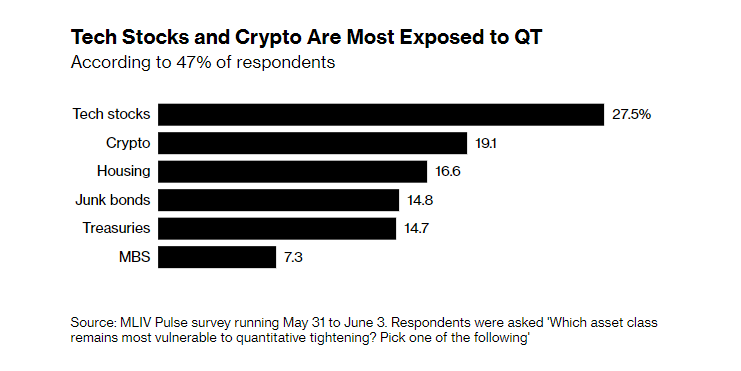

The current publish in the Fed Bank of St. Louis may come as market research from Bloomberg’s MLIV Pulse on June 6 says crypto and tech stocks are “acutely vulnerable” to quantitative tightening plans through the U.S. central bank targeted at dampening inflation.

“The historic shift is viewed as a notable threat to tech equities and digital tokens — both risk-sensitive assets that soared within the Covid-era market mania before cratering within this year’s mix-asset crash.”

Since 2009, when Bitcoin first has been around since, the U.S. dollar has lost 26% of their value, tracking a typical inflation rate of two.32% each year since that time, based on this inflation calculator.

However, one Bitcoin, which began in a worth of $.00 in ’09, has become worth $29,495 during the time of writing.

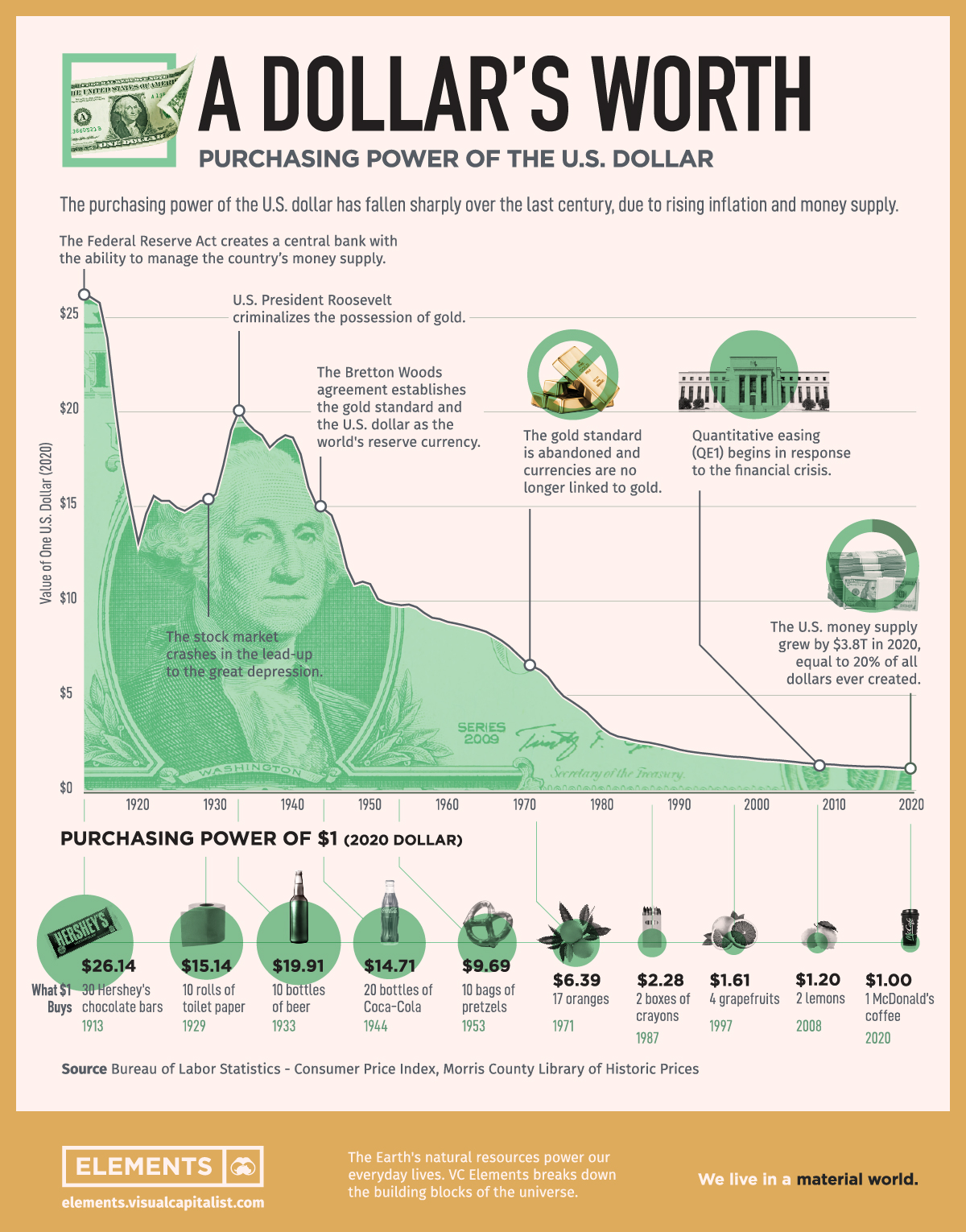

The below chart shows the purchasing power one U.S. dollar in the current terms. In 1913, one U.S. dollar could buy 30 Hershey’s sweets. In 2020, it may buy only one Burger king coffee. Furthermore, the cash supply (M2) within the U.S. has skyrocketed during the last 2 decades, growing from 4.6 trillion in 2000 to $19.5 trillion in 2021.