On Wednesday, the US Fed (Given) elevated rates by 75 basis points, consistent with most analysts’ forecasts. Cryptoassets mostly reacted by buying and selling greater within the first hour following the news was announced. (This can be a developing story and it is being constantly updated.)

“[…] the Committee made the decision to boost the prospective range for that federal funds rate to 1‑1/2 to at least one-3/4 % and anticipates that ongoing increases within the target range is going to be appropriate,” the statement in the Given stated.

Bitcoin (BTC) reacted towards the news by immediately buying and selling lower on the market, before later reversing towards the upside. one hour in to the announcement, the main cryptocurrency had risen 2% to USD 21,560. Simultaneously, ethereum (ETH) traded up with a much more powerful 6% to USD 1,180. Stocks reacted similarly, using the broad S&P 500 index rising by .17% within the first hour following a announcement.

Today’s statement in the Given also stated the central bank intends to continue reducing its holdings of Treasury securities, agency debt, and mortgage-backed securities, while reiterating that it’s “strongly committed” to getting inflation to its 2% target. Meanwhile, future rate projections in the Given now reveal that it intends to start cutting rates in 2024.

The speed hike is greater compared to 50-basis point hike Given officials have formerly indicated they’d choose, but consistent with what most market participants believed following a greater-than-expected inflation report was launched a week ago.

Powell has inside a previous interview using the Wall Street Journal stated when the central bank doesn’t see “clear and convincing evidence that inflation pressures are abating,” it’ll “consider moving more strongly.”

At its last meeting in May, the Given elevated rates by 50-basis points. The rise then marked the very first such increase since 2000. 75-basis point hikes are rarer, and also have not happened since November 1994 when then-Given chair Alan Greenspan was trying to combat rising inflation.

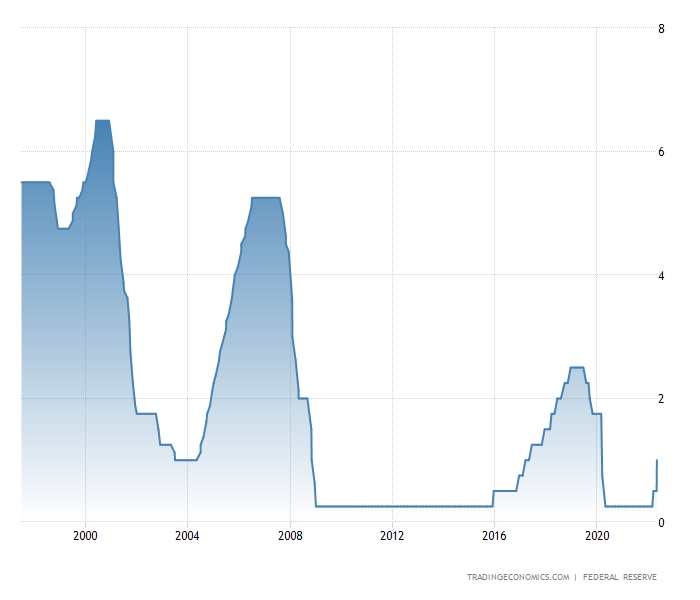

Federal Funds rate in front of Wednesday’s hike:

Commenting in front of today’s Given announcement, crypto broker GlobalBlock analyst Marcus Sotiriou stated that the aggressive Given – unlike conventional knowledge – may be the best outcome for markets today.

“I think a really aggressive Fed may be our advice for markets, so the Fed can resume [quantitative easing] sooner,” Sotiriou stated within an emailed comment.

He added that quantitative easing (QE) through the Given is exactly what has fueled the increase in both crypto along with other risk assets recently, which a tightening in the Given means investors “are made to unwind their positions,” inevitably resulting in affordable prices.

“Investors can’t realistically expect risk assets to possess a more sustained upward trend before the Given pivots,” Mikkel Morch, Executive Director at crypto/digital asset hedge fund ARK36, stated within an emailed comment, adding that bitcoin (BTC) “continues to be really caught within the crossfire these past couple of days.”

Based on him, there’s still an enormous gap between nominal rates and real rates so there’s a lot more room for that Given along with other central banks to hike within the several weeks in the future.

“So bitcoin is hit having a double whammy which is most likely that we will see sub-[USD 20,000] prices soon,” Morch stated, adding that requires USD 12,000 per BTC have “a comparatively low probability for the time being.”

Meanwhile, asset manager DoubleLine Capital Chief executive officer Jeffrey Gundlach, referred to as Bond King, recommended the Given ought to be much more aggressive, saying on Twitter that 3% would, in the opinion, be a suitable level for that Given Funds rate.

In front of today’s hike, the Given Funds rate was at .75% to at least onePercent.

Also pushing for aggressive action was Mohamed A. El-Erian, a properly-known economist and President of Cambridge College’s Queen’s College, who authored inside a Bloomberg opinion piece the Given “desperately must get back charge of the inflation narrative.”

The Fed’s failure to do this risks turning its status to something which resembles “an emerging market bank that lacks credibility and unintentionally plays a role in undue financial volatility,” El-Erian authored.

Also commenting in front of the hike, Peter Brandt, an experienced trader, stated the Given has “never in modern Given history been to date behind the bend.”

“Solution: Given rate hike by 400 [basis points], let stock exchange collapse after which hit the reset button,” Brandt recommended to his greater than 600,000 Twitter supporters.

ECB addresses market turmoil

The move through the Given came on the day that because the European Central Bank’s (ECB) Governing Council collected to have an emergency meeting to deal with the turmoil looking for European government bonds.

Based on a statement in the ECB following the meeting, the central bank will “apply flexibility” with regards to reinvesting arises from its pandemic-era bond-buying program.

It added that it’ll accelerate focus on the style of a brand new “anti-fragmentation instrument” that’ll be set up for consideration through the Governing Council. The statement didn’t specify what this kind of anti-fragmentation instrument could seem like.

“Anti-fragmentation” describes work the ECB gives prevent variations in market conditions for government bonds over the eurozone from getting too big.

____

Find out more:

– For This Reason Given Might Attack Inflation More Strongly

– Your investment Market Slump – Inflation Will Define Bitcoin This Season and Beyond

– Given Has ‘Limited Firepower’ for Rate Hikes, Current Expectations Already Priced set for Bitcoin – CoinShares

– When Bitcoin Meets Inflation

– Get ‘Mentally Ready’ for Lower Bitcoin Prices as Rates Rise, Bitcoin 2022 Panelists Warn

– Davos Watch: Real Rates Of Interest to stay at ‘Nothing or Alongside Nothing’ & Greater Inflation Target

– As inflation ‘Mellows Out’, a Bottom in Crypto is probably in ‘The Back 1 / 2 of 2022’ – VC Investor

– Inflation Ought To Be Considered Public Enemy # 1