The United States Fed (Given) elevated rates of interest by .5 percentage points, to .75%-1%, consistent with what analysts expected and just what Given Chair Jerome Powell has formerly conveyed.

“The invasion of Ukraine by Russia causes tremendous human and economic difficulty. The implications for that U.S. economy are highly uncertain. The invasion and related occasions are coming up with additional upward pressure on inflation and will probably weigh on business activities. Additionally, COVID-related lockdowns in China will probably exacerbate logistics disruptions. The Committee is extremely mindful to inflation risks,” the Given stated, adding that ongoing increases within the target range is going to be appropriate because they expect inflation to go back to its 2% objective and also the labor sell to remain strong.

Also, the central bank made the decision to start reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1.

Bitcoin (BTC) and ethereum (ETH) fluctuated immediately after the announcement, while stocks rose, the USD fell, and bonds also fluctuated.

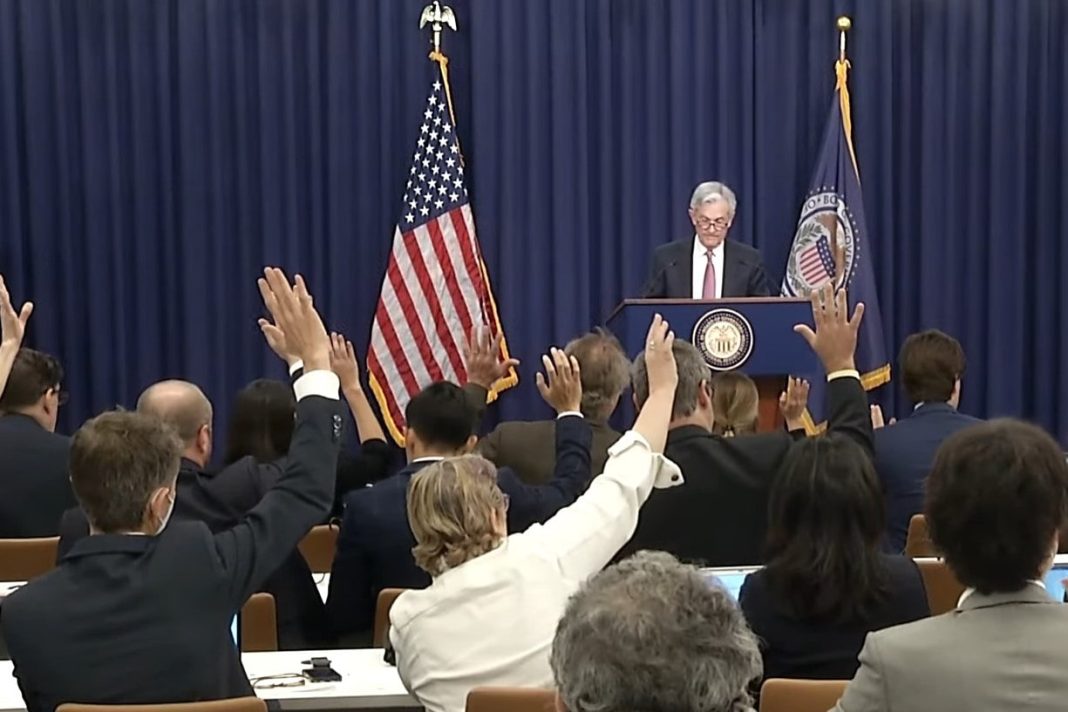

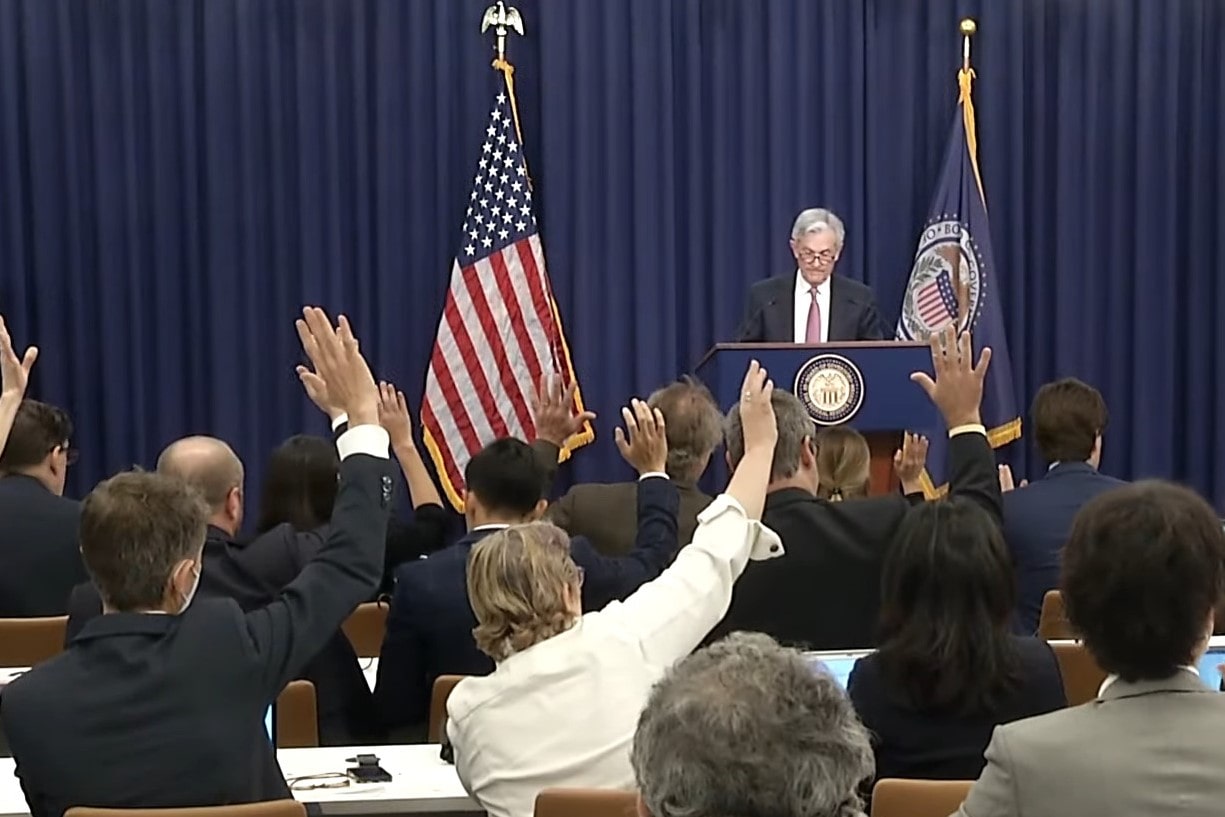

Throughout his press conference today, Powell stated the 75 basis points increase “isn’t something we are positively thinking about.”

The choice today adopted comments from Given Chair Powell at the end of April, saying in relation to rate of interest hikes that “it is suitable in my opinion to become moving a bit more rapidly.” Your comments ought to came because the US is battling using the greatest inflation because the early 1980s.

Based on multiple sources, together with a Bloomberg report as well as an article by economist Mohamed A. El-Erian, rate of interest swap traders have previously fully priced in 50-basis point hikes for each one of the next three Given conferences – in June, This summer, and September.

Whether it would materialize, this type of hiking trajectory will be the most aggressive seen in the Given in 30 years.

Market watching for clues

Commenting in front of the announcement in the Given, Tony Farren, md at Mischler Financial Group, stated traders are watching carefully if the central bank seems available to much more aggressive action, like a 75-basis point hike, at its next meeting in June.

“The market would take that as hawkish. For his comments to appear dovish, he’d need to shut lower the talk of 75 basis points. Even though I do not think he’ll endorse it, I do not think he’ll shut it lower,” Farren told Bloomberg.

Meanwhile, the legendary trader Paul Tudor Johnson told CNBC on Tuesday that he’s still “modestly invested” in crypto regardless of the challenging macro atmosphere.

“Right now, I am modestly invested and that i would believe that it is going to possess a vibrant future once we roll with these rate hikes,” Johnson stated, while adding:

“A large amount of this will depend on which our central bank does. A variety of it depends upon how serious we’re about fighting inflation.”

Writing on Twitter , the most popular crypto trader and economist Alex Krüger made an appearance bullish given his view that “max hawkishness is nearly fully priced in.”

“I lean bullish into what is a very hawkish [Given statement],” Krüger stated, adding the Given can continue to surprise whether it delivers tightening plans which are bigger or quicker than anticipated. “I see major bottoms everywhere, across [altcoins] & single name stocks. Only need some help from the Given,” the trader added.

An identical view seemed to be held through the Singapore-based crypto buying and selling firm QCP Capital, saying inside a report that “we’ve possibly arrived at a brief-term peak in fear,” adding the bearishness on the market might be “slightly over-extended.”

“Our view would be that the market has priced in rate hikes too strongly that could then result in the next couple of Given conferences surprising around the dovish side,” the firm authored.

Meanwhile, as reported, Credit Suisse analyst Zoltan Pozsar, that has formerly stated that BTC might move greater because of the war in Ukraine, estimates that greater oil costs are likely which the federal government “will need a ton of money” to cope with these challenges. Because of this, “the Given is going to do [quantitative easing, QE] again by summer time 2023,” the analyst concluded.

____

Find out more:

– Bitcoin Funds Sees Largest Weekly Outflows each year, ‘Hawkish Rhetoric’ responsible

– Given Tightening ‘More of the Chance Than the usual Threat’ – Grayscale Chief executive officer

– When Bitcoin Meets Inflation

– Why We Can’t Just ‘Stop Printing Money’ to obtain Inflation Lower

– Financial Stability Risks Grow as War in Europe Complicates Push to Contain Inflation

– Get ‘Mentally Ready’ for Lower Bitcoin Prices as Rates Rise, Bitcoin 2022 Panelists Warn

– When the Given Pauses, Bitcoin is ‘Going towards the Moon,’ Novogratz States