Bitcoin (BTC) starts a brand new week with much to compensate for after its worst April performance ever.

The monthly close placed BTC/USD firmly within its established 2022 buying and selling range, and fears happen to be that $30,000 or perhaps lower is next.

That stated, sentiment has improved as May begins, even though crypto broadly remains associated with macro factors, on-chain information is pleasing instead of panicking analysts.

Having a decision on U . s . States economic policy due Wednesday, however, the approaching days can be a few knee-jerk reactions as markets make an effort to align themselves with central bank policy.

Cointelegraph analyzes the these along with other factors set to shape Bitcoin cost activity now.

Given during the spotlight

Macro financial markets are — out of the box the standard — on edge now as the second U.S. Fed meeting looms.

As inflation runs rampant worldwide, it’s expected that Chair Jerome Powell can make good on his previous pledges and announce key rate of interest hikes.

Wednesday is going to be pivotal.

The Given is anticipated to verify a $95B monthly sell program which hasn’t yet been unleashed available on the market. https://t.co/gRRwd059Lw

— Charles Edwards (@caprioleio) May 2, 2022

How severe and just how rapidly they’re applied is really a matter for debate, along with a separate debate concerns whether markets have previously “priced in” various options.

Any shocks will probably spark a minimum of temporary volatility across markets, and in the last six several weeks approximately, crypto continues to be the same.

Attention is thus around the Federal Open Markets Committee (FOMC) meeting to become held Tuesday and Wednesday.

“First came the Given. Then your Netflixpocalypse. Then your Russian invasion. Then your sanctions. Then your Given and also the largest treasury dump ever. Now it had been earnings. In a few days the Given again,” macro analyst Alex Krueger summarized over the past weekend.

“The Fed’s QT announcement on Get married determines the fate from the market.”

Krueger was talking about an insurance policy referred to as “quantitative tightening” (“QT”) — the counterpart to quantitative easing, or QE, which describes the interest rate of monetary support withdrawal through the Given inside a bid to lessen its $9 trillion balance sheet.

Risk assets, already responsive to a conservative atmosphere, are meanwhile already tipped by Bitcoiners to get rid of big within the coming several weeks, taking crypto lower together.

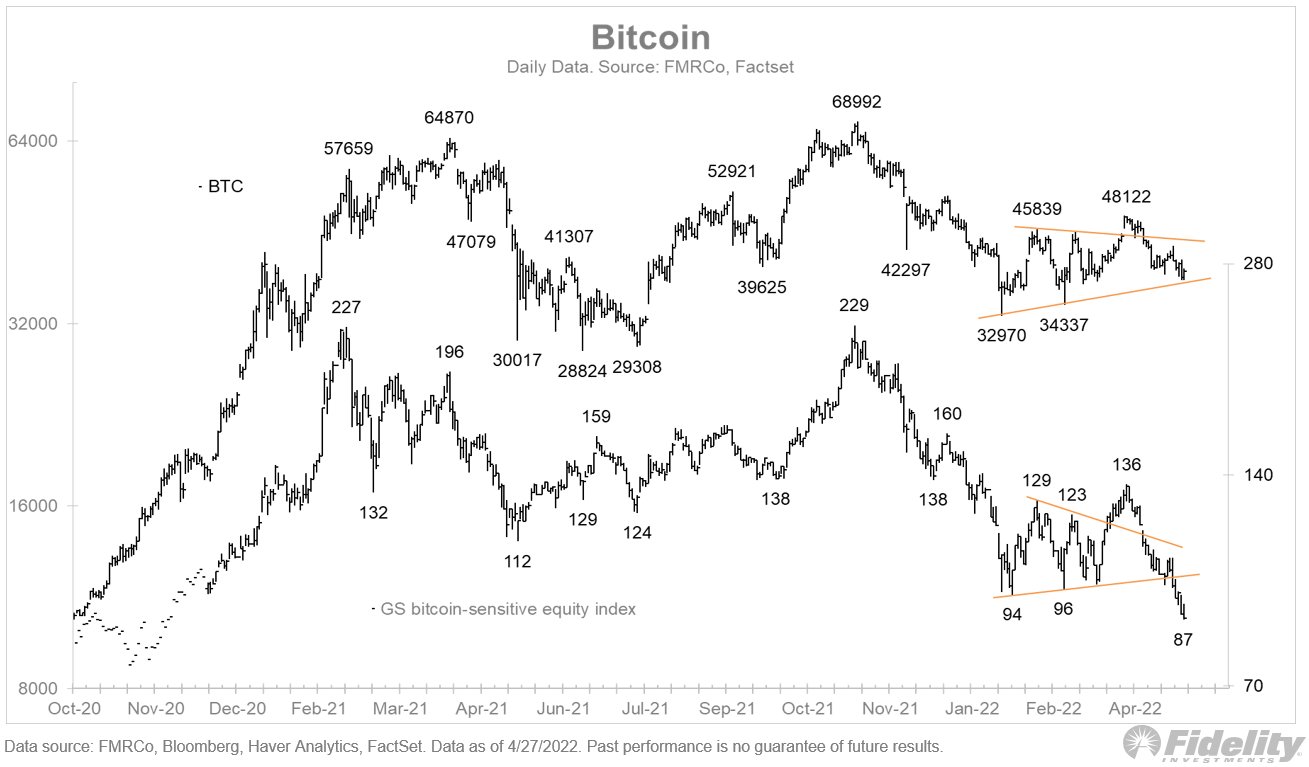

“It’s simple to overlook this, because of the broad retreat from the market a week ago, but: Together with meme stocks, the Bitcoin-sensitive equity basked has already been making new lows,” Jurrien Timmer, director of worldwide macro at asset management giant Fidelity Investments, added.

An associated chart from the Goldman Sachs Bitcoin-sensitive equity index — 19 major cap stocks with contact with crypto — typed the relative discomfort already being experienced.

In a few days might find the main focus shift back towards inflation itself using the publication of U.S. consumer cost index (CPI) data for April.

Here we are at $28,000 Bitcoin?

Around $37,600, April’s monthly close was decidedly uninspiring for Bitcoin hodlers, data from Cointelegraph Markets Pro and TradingView shows.

Despite subsequently regaining some ground, BTC/USD has reaffirmed a minimum of a brief-term need to exchange a narrow range well below the top of the its 2022 buying and selling corridor of $46,000.

Expectations were formerly high that April would deliver better performance, however in the finish, 2022 became Bitcoin’s worst April on record with overall losses of 17.3%, data from on-chain monitoring resource Coinglass confirms.

On the rear of that, it’s thus little question the mood among analysts is every bit careful.

“The BTC chart is heavy at this time, & a rest below $35k might cause a hurry for that exit… However I don’t trust breakdown patterns within this range. We have seen short squeezes and ATH breakout traps in the last year,” popular trader Chris Dunn tweeted Sunday.

“Risky you may anticipate, easier to react… I’d love a $26k washout.”

Dunn is way from alone in with a capitulation event to accept sell to $30,000 or under.

“In relation to its talk of capitulation, I have faith that it might require Bitcoin to visit below $30k,” analyst Matthew Hyland contended in one of many tweets about Bitcoin’s volume profile.

“Low volume since May of this past year which introduced BTC to $30k. Low volume = low turnover of consumers. Below 30k would unlock the clients who bought pre-65k at the begining of 2021.”

Hyland described that low-volume markets are inclined to see bigger cost swings, along with a significant BTC cost dip might be essential to reignite engagement among a general insufficient participation at current levels.

To unlock greater volume, it might require Bitcoin to purge below 30k

In line with the volume levels between 20k-30k (which BTC spent under 3 days in), I would not expect it to complement the amount profile we had last May nevertheless it would still standout when compared with current volume: pic.twitter.com/msQRmz9UVi

— Matthew Hyland (@MatthewHyland_) May 1, 2022

Over the past weekend, meanwhile, calls emerged for any near-term visit to $35,000.

U.S. dollar strength maintains pressure

April might have come and gone, however the ogre from the U.S. dollar index (DXY) remains firmly within the room.

Just one day’s consolidation on April 29 has already been history, as well as on Monday, DXY had been trying to continue an outbreak that has seen dollar strength hit its greatest since 2002.

At 103.4 by press time, DXY shows no indications of a far more significant pullback, much towards the disappointment of Bitcoiners subject to inverse correlation.

“At as soon as, the inverse relationship between bitcoin and also the DXY… depicts when the index holds over the 102 DXY level of resistance, this might weaken bitcoin, and also the cost action could retrace towards the $35k and below area, specifically if the rising DXY could be related to the tightening of financial policy,” on-chain analytics firm Glassnode’s latest Uncharted e-newsletter described.

In case, 102 was little problem for DXY, which might are in position to gain much more if the Given rate hike decision perform top of the finish from the spectrum.

“The growth and development of the USD is extremely determined by the Fed’s plan of action. The increasing inflation and potential 50bps rate hike at the begining of May could strengthen the DXY,” Glassnode added.

As Cointelegraph reported, other major world currencies have endured together with crypto in USD terms in recent days, having a particular concentrate on the fate from the Japanese yen. Japan, unlike the U.S. is constantly on the print huge amounts of liquidity, devaluing its currency even more.

Trader: Illiquid supply outweighs cost dip significance

A week ago saw a new record for that proportion from the Bitcoin supply dormant for more than a year — 64%.

As seasoned hodlers — or at best individuals who bought prior to the This summer 2021 bottom near $28,000 — there’s thus a conclusion to not capitulate yet.

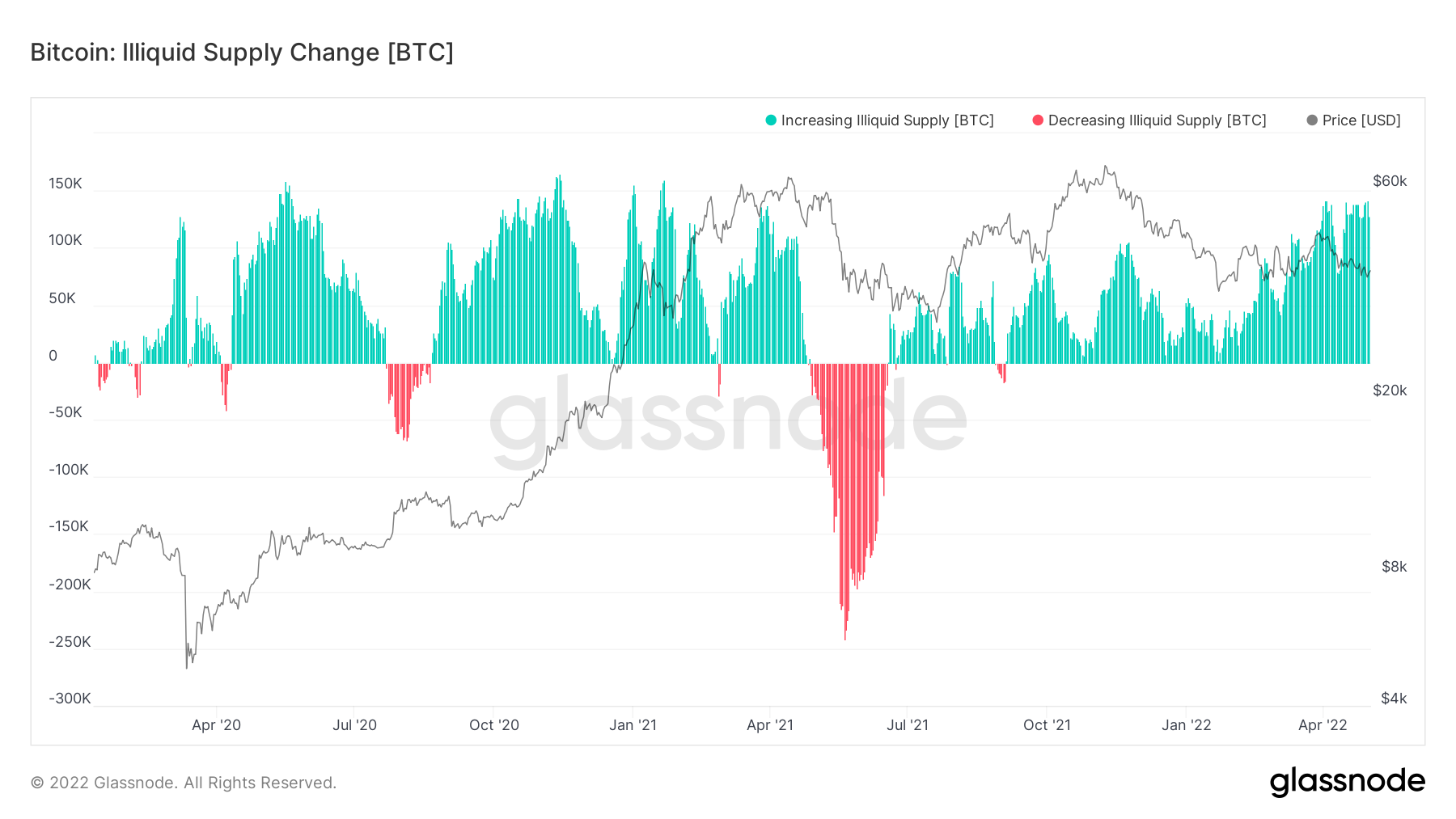

Now, more data continues to be put into this mixture, also it comes by means of illiquid supply.

Based on Glassnode’s Illiquid Supply Change indicator, recent days have created large increases within the overall segment from the BTC supply that is now no more available to buy.

It makes sense Illiquid Supply Change reaching levels not seen since late 2020, when BTC/USD started to demonstrate indications of a “supply shock” as market participants stacked into that which was already a solidly “hodled” asset class.

“This number is reaching peak high figures, which we have also observed in 2020 (the build-up). Ultimately, a lot of coins are ‘illiquid’, which increases the potential of the possible supply shock,” Cointelegraph contributor Michaël van de Poppe stated included in comments around the figures.

Ongoing, Van de Poppe contended the indicator “tells a lot” and may even take a few of the fear from a dip to $30,000.

“Yes, the marketplace can continue to create a new lower low where the bear market continues (relatively the altcoin bear marketplace is presently already active for any year, meaning retail is finished) along with a hit of $30K could be arrived at. But, essentially, the information informs a great deal,” he added.

Crypto sentiment “crosses over” macro

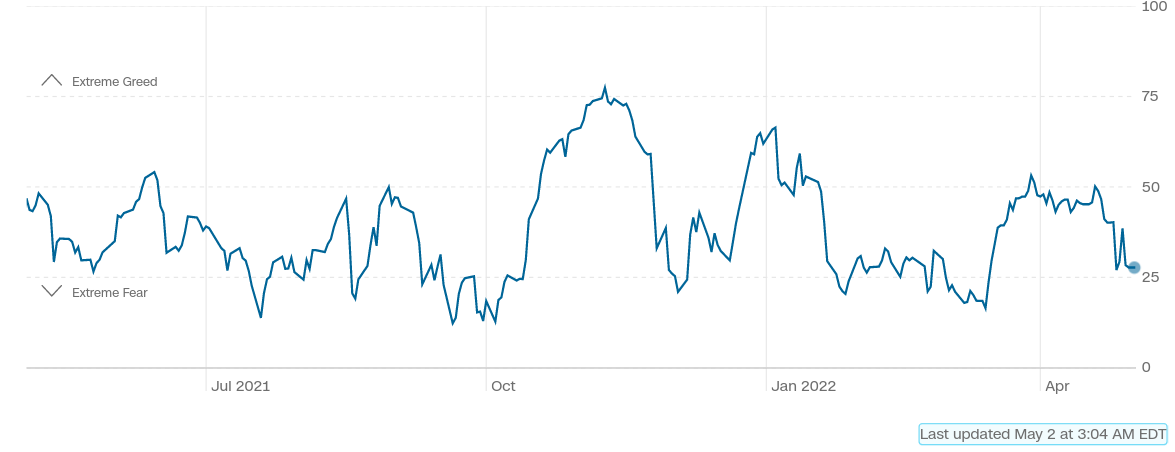

In what is a silver lining under current conditions, crypto sentiment has already been pointing greater now, even while traditional market sentiment remains nervous.

Related: 5 Best cryptocurrencies to look at now: BTC, LUNA, NEAR, VET, GMT

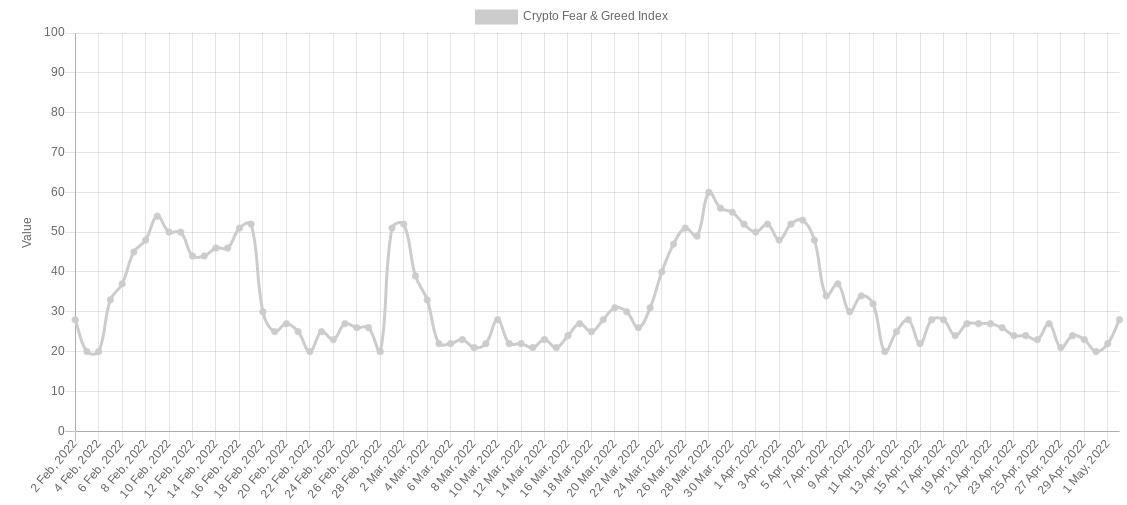

The Crypto Fear & Avarice Index, getting hit two-week lows of 20/100 a week ago, has exited its “extreme fear” zone.

At 28/100, Crypto’s index has become even above its TradFi counterpart, the Fear & Avarice Index, which on Monday measured 27/100.

Should crypto still fulfill its function like a bellwether of market moves in the future, there might be modest reason for relief in the data.

28/100 marks Crypto’s best studying since April 17.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.