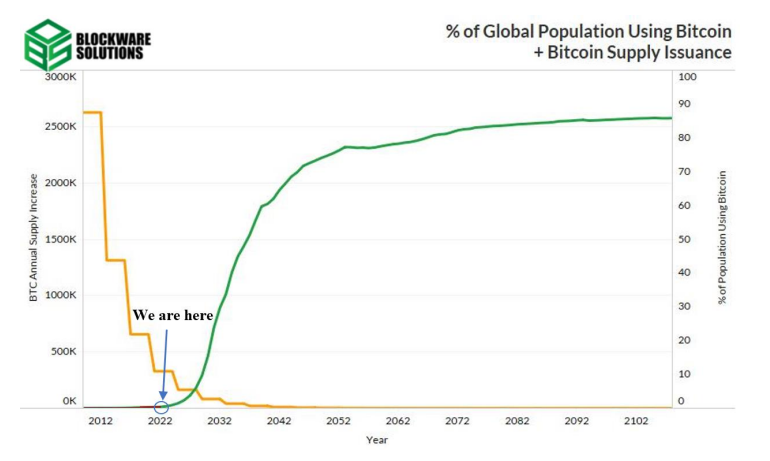

The adoption of Bitcoin (BTC) could occur more quickly compared to adoption of past disruptive technologies for example automobiles and electrical power, with global take-up prone to hit 10% by 2030 according to a different report.

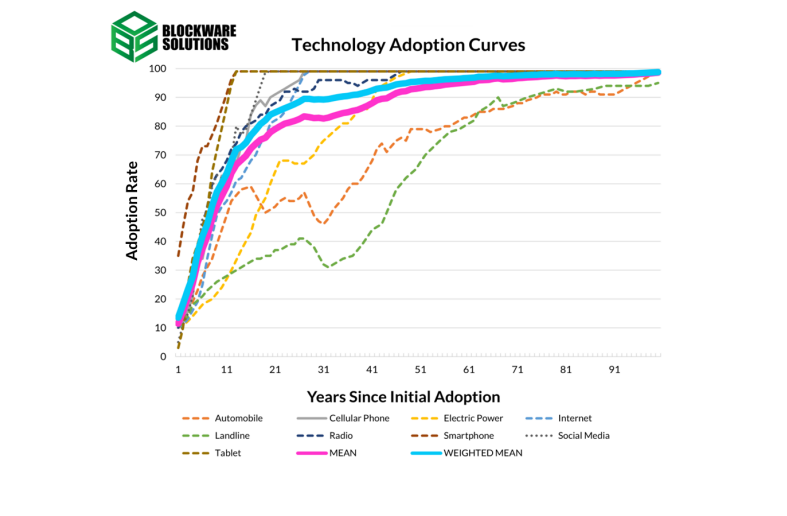

In the June 21 report, Blockware Intelligence stated it showed up only at that forecast by analyzing historic adoption curves for nine past disruptive technologies, including automobiles, electrical power, smartphones, the web, and social networking, combined with the rate of growth of Bitcoin adoption since 2009.

“All disruptive technologies consume a similar exponential S-curve pattern, but […] newer network-based technologies continue being adopted considerably faster compared to market expects.”

While using average and weighted average of historic technology adoption curves, along with the rate of growth of Bitcoin adoption, the report ended up being able to reach its conjecture.

It stated that with different metric known as Cumulative Amount of Internet Entities Growth and Bitcoin’s predicted “CAGR of 60% we forecast that global Bitcoin adoption will break past 10% around 2030.”

Blockware Intelligence may be the research arm of Blockware Solutions, a Bitcoin mining and blockchain infrastructure company, so you may expect so that it is bullish on adoption.

The intelligence unit stated it expects Bitcoin adoption to achieve saturation faster than a number of other disruptive technologies, given direct financial incentives to consider, the present macro-atmosphere, and since adoption growth is going to be faster through the internet.

“From someone perspective, past technologies had convenience/efficiency-related incentives to consider them: adopting automobiles permitted you to definitely zoom beyond the horse and buggy, following a mobile phone permitted you to definitely call people without having to be associated with a landline,” the report explains.

“With Bitcoin direct financially incentivized adoption results in a game theory by which everyone’s best fact is to consider Bitcoin.”

Bitcoin, such as the internet, smartphones, and social networking, also derives benefits the greater people who adopt we’ve got the technology, which is called the “network effect”.

“Case in point should you be the only real user on Twitter will it be associated with a value? It wouldn’t. More users make these technologies worth more.Inches

Related: 75% of shops eyeing crypto payments within 24 several weeks: Deloitte

However, the authors from the Blockware report stressed the model accustomed to predict the speed of adoption was just conceptual at this time, adding it’s neither intended to be utilized as investment recommendations nor a brief-term buying and selling oral appliance it might continue being refined. However:

“The general trend is obvious there’s a good venture that Bitcoin’s global adoption will grow considerably to return and thus same goes with cost.”

The report and model was reviewed by a number of crypto investors and analysts, including executives from Ark Invest, Arcane Assets, AMDAX Asset Management, and M31 Capital.

Cryptocurrency adoption continues to be growing quickly during the last couple of years. In 2021, global crypto possession rates arrived at typically 3.9%, with more than 300 million crypto users worldwide, based on data from TripleA, a worldwide cryptocurrency payment gateway.

Blockchain data platform Chainanalysis this past year says global adoption of bitcoin and cryptocurrency surged 881% from This summer 2020 to June 2021. It found Vietnam to achieve the greatest cryptocurrency adoption, leading 154 countries examined, adopted by India and Pakistan.

In April, market research conducted by cryptocurrency exchange Gemini discovered that crypto adoption skyrocketed in 2021 in countries like India, South america, and Hong Kong as over fifty percent of respondents from the 20 countries polled mentioned they began purchasing crypto in 2021.