As a result of falling Bitcoin (BTC) prices, total revenue earned by miners in transaction charges and mining rewards dropped to the one-year lows at nearly $15 million on This summer 4. However, a concurrent fall in graphic cards or GPU prices is placed to assist miners offset their operational costs among a continuing bear market.

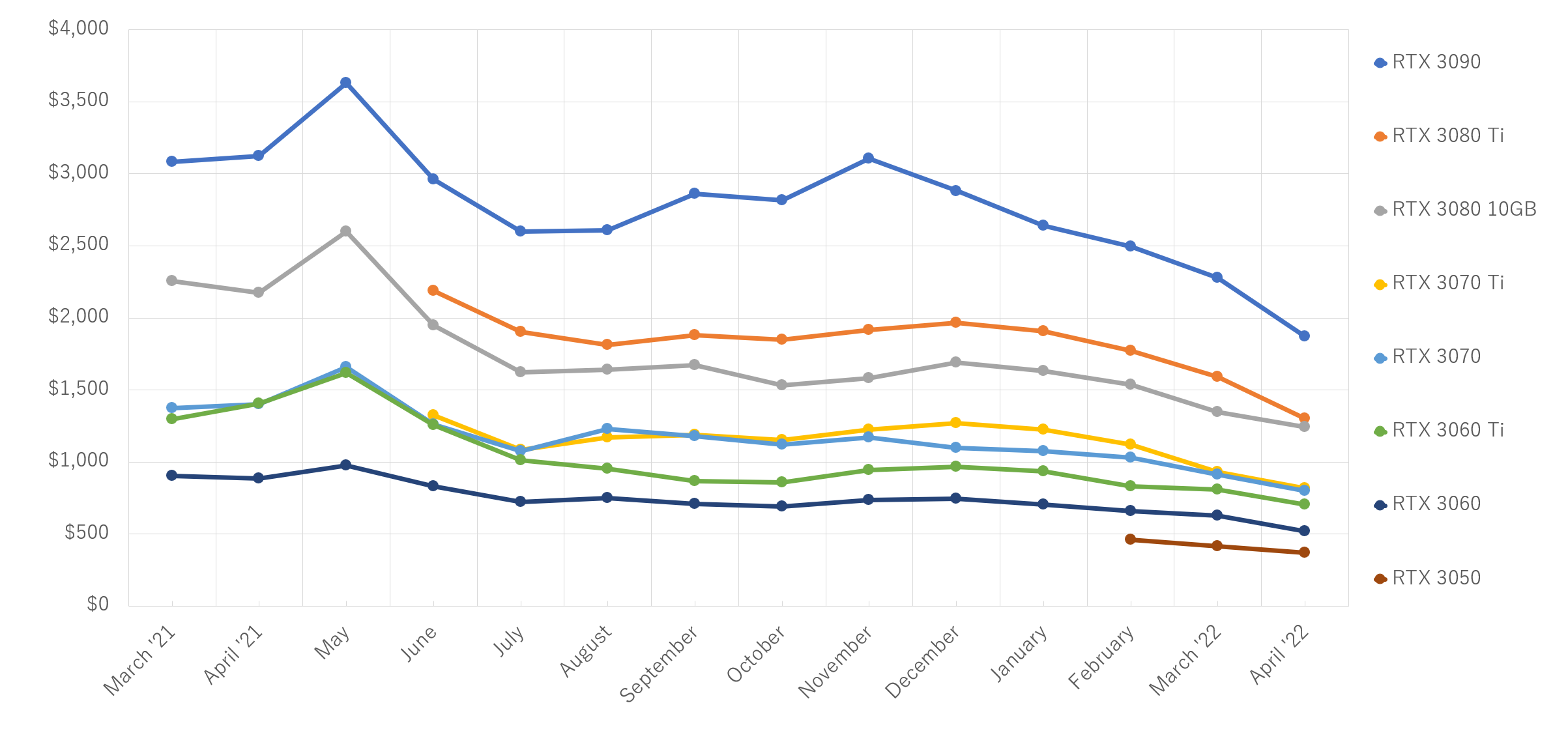

Bitcoin mining revenue fell 79.6% during a period of 9 several weeks, since reaching an exciting-time a lot of $74.4 million on March. 25, 2021. Additionally, a worldwide nick shortage and also the coronavirus pandemic increased prices of the most basic a part of a mining rig — the graphics processing unit (GPU) — further impacting the miners’ main point here.

With card manufacturers resuming operations around the globe, GPU prices have experienced an enormous decline with a few cards selling for below MSRPs. In May alone, GPU prices dropped over 15% typically as supply exceeded the marketplace demand. Furthermore, the current increase in GPUs has forced sellers around the secondary markets to create lower their exorbitant prices on used mining rigs.

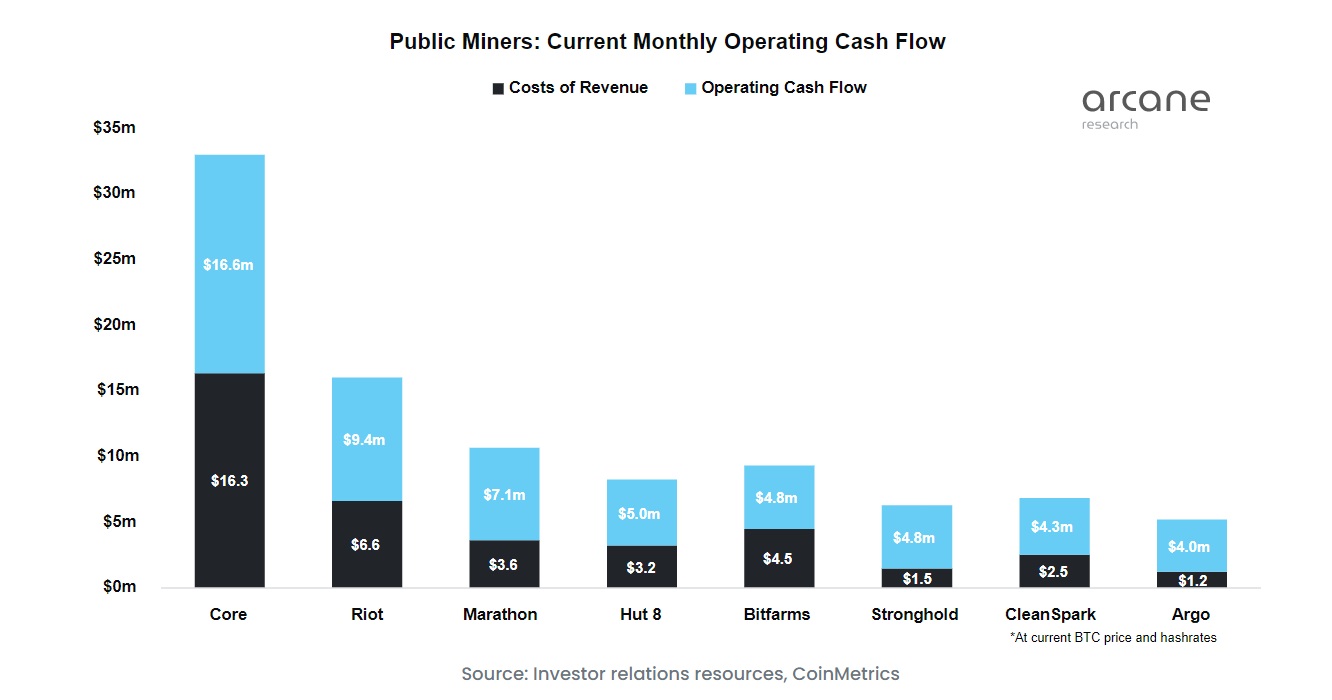

Cointelegraph formerly reported that several public Bitcoin miners are very well-positioned to outlive the prolonged bear market because the low revenue is constantly on the sustain the operational costs from the mining facilities. As proven below, Argo, CleanSpark, Stronghold, Marathon and Roit are the miners having a stable mining revenue to operational cost ratio — a good symbol of a healthy body.

Furthermore, the meteoric stop by GPU prices opened up up a little window of chance for small-time miners to obtain a bit of more effective and efficient mining equipment. Along with lower hash rate needs of 203.6 exa hashes per second, miners now require lower computing capacity to effectively mine a block around the Bitcoin blockchain.

Related: Marathon Digital continues mining despite BTC cost slump

Regardless of the apparent stop by mining revenue, Marathon Digital Holdings revealed to carry on stacking BTC via mining while being “fairly well insulated and well-positioned.”

Talking with Cointelegraph, Charlie Schumacher, VP of corporate communications at Marathon Digital, shared insights on their own overall operations:

“For reference, in Q1 2022, our cost to make a Bitcoin was roughly $6,200. We have fixed prices for power, so we’re not susceptible to alterations in the power markets.”