The arch-bitcoin (BTC) skeptic Peter Schiff has stated that BTC’s actual cost is a lot less than what we are presently seeing, that it’ll drop considerably more, which bitcoin mania is “over”.

A week ago, inside a Twitter thread, Schiff shared his opinion on recent Grayscale’s bitcoin trust (GBTC) performance, concentrating on the internet asset value (NAV), and just what which means for that cost of bitcoin.

And based on him, this means that BTC is buying and selling “well below” $10,000 already.

“I believe this is actually the real cost of Bitcoin, as whenever you sell GBTC you receive compensated actual money. However when you sell BTC you receive compensated Tether. To obtain cash for Bitcoin you have to pay a huge discount.”

Not surprisingly he was (again) heavily belittled for his posts through the crypto community, most of which jokingly claimed that Schiff themself is really a BTC buyer searching for sellers. Other medication is ‘begging’ the crypto critic to inform them where and when they are able to buy BTC below $10,000.

That stated, Schiff ongoing advocating individuals to abandon the earth’s most widely used crypto, saying:

“GBTC is buying and selling in a 46% discount now. New record. Something is certainly happening. Bitcoin is within real trouble. Escape when you can!”

He continued to go over possible reasons for the low NAV, stating that GBTC might have loaned out its bitcoin and also the customer can’t pay back the borrowed funds, or even the BTC was stored having a custodian who dropped it – however that the NAV might be “a real lot lower.”

On their own side, cryptoasset manager Grayscale Investments mentioned on Friday that “the laws and regulations, rules, and documents that comprise Grayscale’s digital asset products stop digital assets underlying these products from being given, lent, or else encumbered.”

All digital assets that underlie Grayscale’s digital asset products, it added, are stored underneath the child custody of Coinbase Child custody Trust Company, proclaiming that:

“To become perfectly obvious: the BTC underlying Grayscale Bitcoin Trust belong to GBTC and GBTC alone.”

As well as in their announcement about this subject, the organization claimed that,

“Child custody from the digital assets underlying Grayscale’s digital asset products is unaffected, and our products’ digital assets remain safe and sound. “

More in the future

Schiff also looked back on a single of his older BTC-related tweets, stating that it did not take lengthy for his conjecture in the future true. The tweet under consideration, published in This summer, contended that the necessity to sell BTC would worsen because the recession deepens so that as “many HODLers lose their jobs, especially individuals employed by potential bankrupt blockchain companies.”

But, Schiff claimed on Thursday,

“The lion’s share from the selling hasn’t even began yet. Bitcoin continues to have a lengthy method to fall.”

Also, he switched his focus towards the subject from the month – the disastrous collapse from the FTX exchange and also the subsequent distributing contagion, proclaiming that the previous Chief executive officer Mike Bankman-Fried was ‘obviously’ a conman.

Yesterday, he again commented around the collapse of FTX, however this time with regards to regulation, stating that more government regulation is unnecessary, with free market regulation, and for the finish of america Fed, the country’s central bank, and also the Securities and Exchanges Commission (SEC), amongst others.

He contended that,

“The good thing about free market capitalism is it self-regulates. Competition for status and profit and loss be more effective regulators than easily taken bureaucrats.”

‘Bitcoin mania is over’

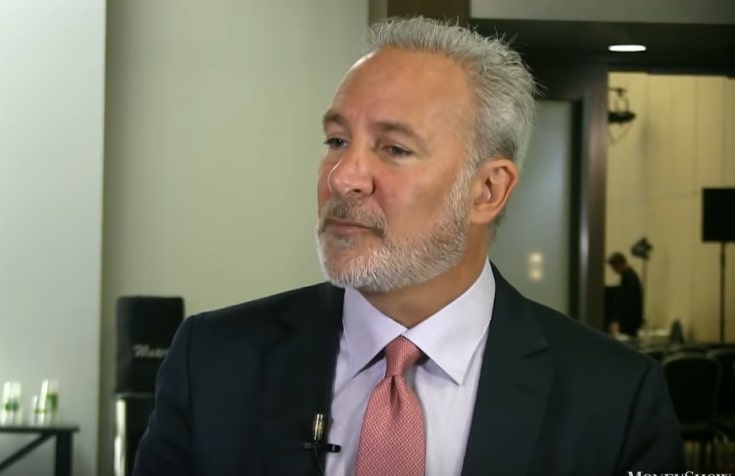

Schiff is definitely an blunt stock broker and also the Chief executive officer of Euro Off-shore Capital, who evangelizes gold-buying being an investment strategy, but claims that BTC is really a scam. He’s become pretty infamous in the realm of crypto Twitter through the years, where he frequently trolls BTC advocates.

This prolonged downturn in crypto markets gave him lots of chance to again declare crypto dead and also to urge individuals to purchase gold.

“Bitcoin mania has ended. Buy gold,” he stated today.

He further claimed that the need for stablecoins would “soon” exceed the need for bitcoin.

At 10:00 UTC on Monday morning, BTC was buying and selling at $16,119. It’s lower 3% per day, over 1% per week, 16% inside a month, and 73% each year.

BTC 30-day cost chart:

____

Find out more:

– Bitcoin Millionaire Michael Saylor Will get Into Twitter Spat with Gold Bug Peter Schiff

– Peter Schiff Will get an Unpredicted Lesson in the advantages of Bitcoin as Banking Woes Bite

– Billion-Dollar Crypto Fund Grayscale Will not Publish Proof-of-Reserves – Next Firm to break down?

– Grayscale Ramps Up Efforts Against SEC For Rejecting Bitcoin ETF

– Wealthy Father Poor Father Robert Kiyosaki Calls FTX Founder ‘Bernie Madoff of Crypto’, States ‘Bitcoin isn’t the Problem’

– Binance Now Holds Nearly 600,000 Bitcoin Worth $9.6 Billion – Largest BTC Holder on the planet?