Bitcoin (BTC) faces another week of “huge” macro bulletins following the cheapest weekly close since This summer.

After times of losses following a latest inflation data in the U . s . States, BTC/USD, like altcoins and risk assets more broadly, has unsuccessful to recuperate.

The biggest cryptocurrency has yet to switch $20,000 to convincing support, and because the third weeks time of September begins, the risk is once more that that much cla could work as resistance.

Bulls have lots to bother with — the approaching days might find the Fed choose the following key rate hike, something which will modify the market beyond mere sentiment.

Additionally, the aftermath from the Ethereum (ETH) Merge is constantly on the engage in, while at defunct exchange Mt. Gox, reimbursements to creditors add another potential cloud towards the Bitcoin cost landscape.

Cointelegraph analyzes five potential market-moving factors to keep close track of in Bitcoin within the coming week.

Given rate hike “sledgehammer” in focus

The primary event for that week comes by means of the government Reserve’s decision on key rates of interest.

Following the Consumer Cost Index (CPI) print for August arrived “hotter” than expected, the Given is going to be pressurized to reply.

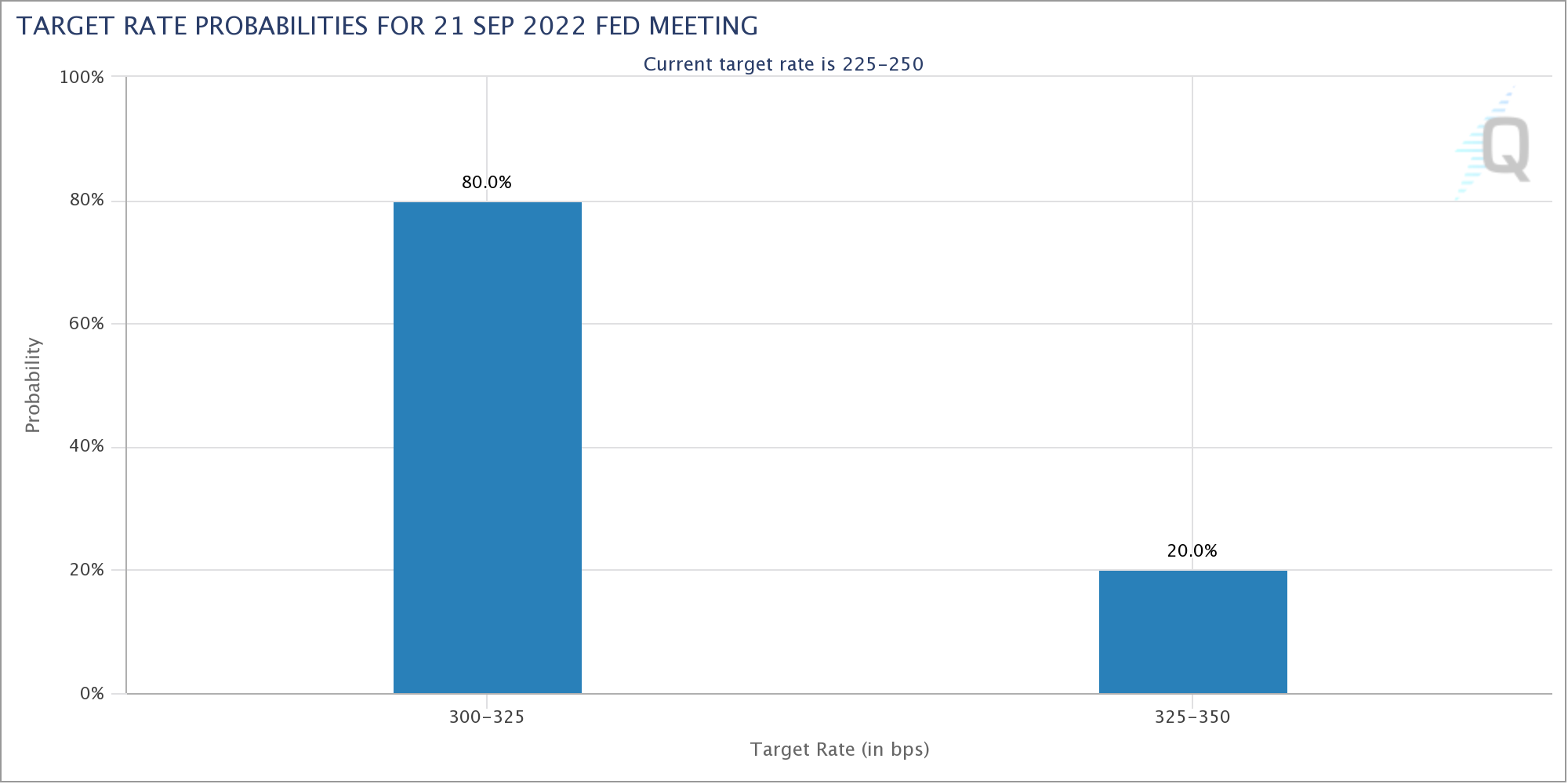

As a result, the marketplace has fully priced inside a minimum 75-basis-point hike for that Given funds rate, and isn’t discounting the likelihood of 100 basis points, based on the CME FedWatch Tool by Sep. 19.

One Hundred-point increase will be the Fed’s first such action because the early 1980s.

The Government Open Market Committee (FOMC) is a result of meet on Sep. 20-21, and can create a statement confirming the hike and Given support for that figure involved.

“The Given won’t be easing in the near future, and it is classic human instinct because we now have the advantage of understanding how far within the mistakes they provided by easing an excessive amount of,” Mike McGlone, senior commodity strategist at Bloomberg Intelligence, stated within an interview with Kitco over the past weekend.

Risk asset growth because the March 2020 crash had “swung far too far to 1 side,” he stated, which is now “very clear” that the reversal will require hold.

Crypto will estimate the general market reset, and Bitcoin may ultimately emerge ahead, McGlone ongoing, reiterating a lengthy-held theory concerning the cryptocurrency’s future. Gold may also outshine, however for both, discomfort would be to come first.

“Unfortunately, for that Given to prevent this sledgehammer, risk assets need to make them visit tightening on their behalf,” he summarized.

One Hundred-basis-point move now would hasten that process, that is now seeing catalysts from central banks past the U.S. after they were initially slow to start raising rates to combat inflation.

Popular Twitter analytics account Games of Trades meanwhile stated it had become crunch here we are at the S&P 500 in front of the oncoming of Wall Street buying and selling.

#SP500 has arrived at its “line within the sand” level.

This is actually the reason for sink-or-go swimming. Fly-or-fall. Fish-or-cut-bait. pic.twitter.com/ZaCfAfcHcE

— Bet on Trades (@GameofTrades_) September 18, 2022

“In occasions such as this, with major uncertainty overall, the Crypto marketplace is not gonna do much without permission from equities,” analyst and commentator Kevin Svenson added.

Place cost sinks after poor weekly close

Yesteryear week has witnessed tailwinds compare for Bitcoin, resulting in BTC cost action falling in kind.

BTC/USD lost over $2,000 in one weekly candle, closing below $20,000 in what’s the cheapest such close since This summer, data from Cointelegraph Markets Pro and TradingView shows.

The close was adopted with a sharp downturn where the pair fell under $19,000.

The bearish mood is possibly understandable — the Ethereum Merge grew to become a “sell this news” event, and together with macro triggers led to a brand new risk asset flight.

Now, analysts are thinking about the likelihood of the downtrend remaining in position a minimum of before the Given rate announcement passes.

“BTC has chopped with the weekend, there is however always possibility of some volatility prior to the close,” on-chain analytics resource Material Indicators told Twitter supporters partly of the publish on Sep. 18.

“Huge economic and Given bulletins in a few days can make things spicy again.”

An associated chart demonstrated the condition of experience the Binance order book, with support around $19,800 since neglecting to sustain cost action.

Your day prior, Material Indicators had reasoned there was likewise little reason for imagining that the much deeper drop could be prevented. Knowing in the order book, putting in a bid action was still being not sufficiently strong to aid current levels.

If #Bitcoin really was close to the BOTTOM, do you consider there will be a liquidity gap between $18k – $18.5k, and right also expect there to become solid bids a minimum of towards the June low at $17.5k? #FireCharts

I’ve forget about questions. pic.twitter.com/Xstusqg2T8

— Material Indicators (@MI_Algos) September 16, 2022

Thinking about whenever a macro bottom could occur, meanwhile, popular trader Cheds bet on Q4 this season, describing Bitcoin as “right on track” to do this.

“$BTC weekly beginning to press range lows,” he added inside a further tweet in to the weekly close.

Shorts were stacking up during the time of writing on Binance and FTX, suggesting a concerted effort they are driving the marketplace lower by derivatives traders. This, fellow popular account Ninja contended, wouldn’t ultimately be effective past the Wall Street open.

U.S. dollar coils beneath multi-decade peak

Acutely eyeing a possible macro high, meanwhile, may be the U.S. dollar, that has rebounded from losses seen publish CPI print.

A vintage headwind for crypto, the U.S. dollar index (DXY) presently sits just under 110, getting consolidated for a few days.

The Index hit 110.78, its greatest since 2002, earlier this year, while staying away from long lasting significant retracements.

Analyzing the immediate future a week ago, Hyland cautioned that the “new blow off top” for DXY would accompany a “capitulation event” in risk assets.

We’re heading toward a capitulation event

-Gold

-BTC

-StocksWe’re also heading toward a blow off the surface of the US Dollar

When? Not a clue but there’s nothing that states the DXY has capped

It’s really presently in place for that greatest weekly close of the season: pic.twitter.com/UHrJfYsSQP

— Matthew Hyland (@MatthewHyland_) September 15, 2022

Phone inverse correlation between DXY and BTC/USD meanwhile confirms the outcome of sharp upwards moves from the former around the latter.

Ethereum will get the publish-Merge blues

Within the week following the much-vaunted Merge, Ethereum is experiencing a significant comedown in the hype.

Inside a move which might skew market cap share in Bitcoin’s favor, ETH/USD declined 25% a week ago.

Presently buying and selling under $1,300, its cheapest since This summer 16, the happy couple is seeing bearish prognoses from analysts and traders overall.

“Ethereum neglecting to hold critical support,” Svenson cautioned because the weekly close unsuccessful to attract a line underneath the losses.

Analyst Matthew Hyland meanwhile gave a target of $1,000 for ETH/USD, adding that $1,250 “should hold as some support.”

$ETH There’s even the grab from the $1355 little as I pointed out will be a good level to get.

Will the bulls have the ability to run it back?

A 4H close above $1355 could be decent for that bulls. Otherwise, I’d be targetting $1285 next. https://t.co/LZACSzzJok pic.twitter.com/Za2Ln5ydgj

— Daan Crypto Trades (@DaanCrypto) September 18, 2022

Against BTC, Ethereum was lower as much as 19% within the week, with Bitcoin’s share from the overall crypto market cap growing 1.2% since Sep. 14.

For well-known trader CryptoGodJohn, everything was nevertheless happening for any “generational entry” chance around the pair.

Less passionate was Samson Mow, Chief executive officer of Bitcoin adoption startup JAN3, who noted that although ETH/USD was still being above its 200-week moving average (WMA) at current levels, Bitcoin was below its very own equivalent.

#Bitcoin is buying and selling 16% below its 200 WMA.#Ethereum is buying and selling 7% above its 200 WMA.

ETH is lower 6% during the day, while BTC is simply lower 2%. ETH continues to be buying and selling confined according to Merge expectations and may go so much lower. ETH 16% below 200 WMA could be ~$1k. pic.twitter.com/jh7j13ivMd

— Samson Mow (@Excellion) September 18, 2022

The 200 WMA functions being an important trendline during crypto bear markets, and reclaiming it after its loss as support has in the past signified coming back to strength.

Dormant Bitcoin supply is constantly on the age

Even while recent cost volatility sees an uptick in on-chain activity, hodlers are keeping their resolve, on-chain data confirms.

Related: Here’s why a .75% Given rate hike might be bullish for Bitcoin and altcoins

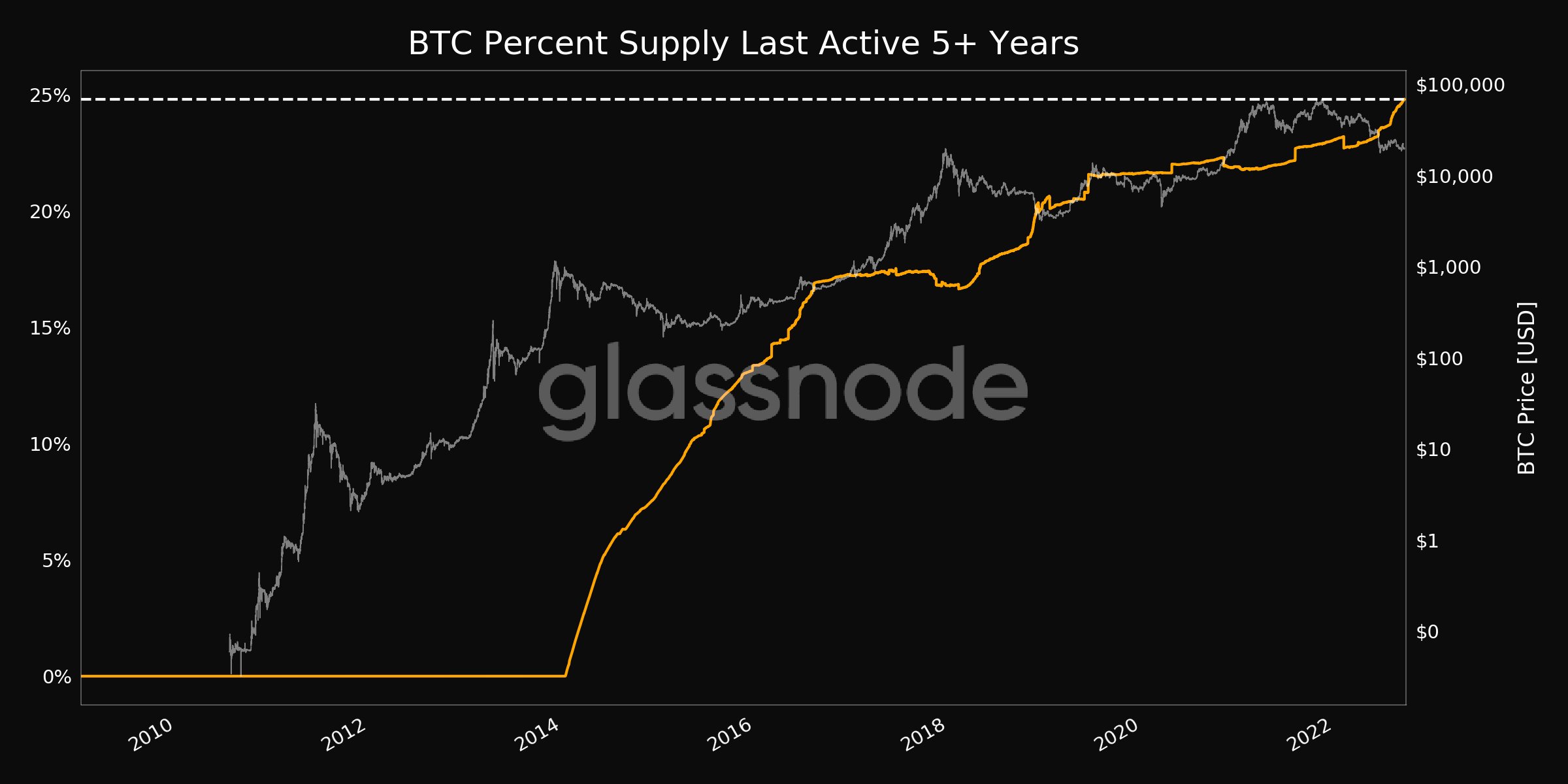

Based on analytics firm Glassnode, coins held for a minimum of 5 years are showing only one trend — up.

In fresh data at the time, Glassnode confirmed the number of the BTC supply last active in September 2017 or earlier arrived at a brand new all-time a lot of 24.8%.

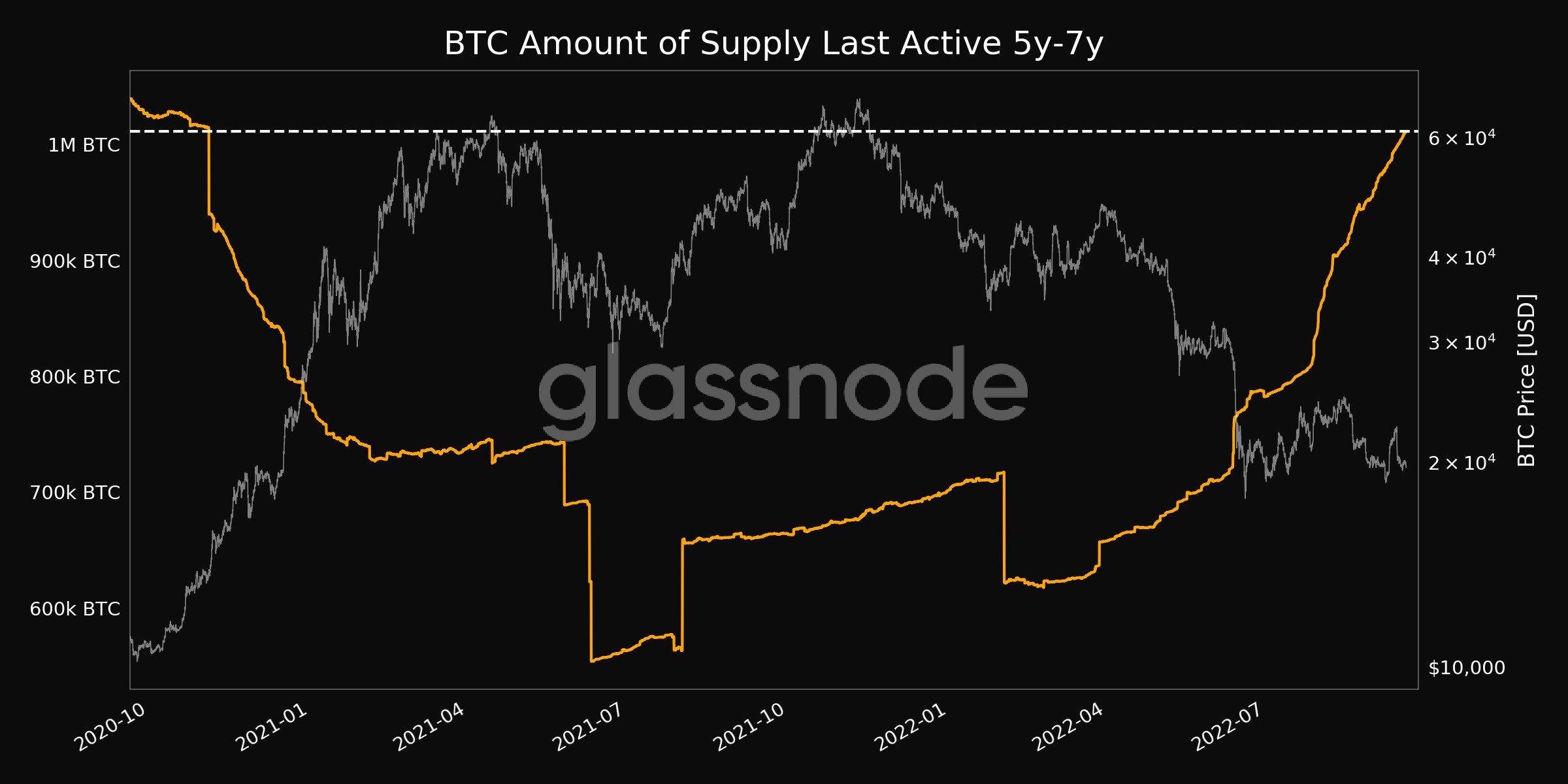

The quantity of the availability last active between five and 7 years back, meanwhile, hit its greatest in almost 2 yrs — 1.01 million BTC.

Simultaneously, “younger” coins will also be on the go, using the 6-one year bracket seeing five-month highs of their own.

Nevertheless, the lengthy-term trend among seasoned investors is obvious with regards to Bitcoin, as evidenced through the supply portion held by lengthy-term holders (LTHs).

“LTH Supply is the level of Bitcoin that has been dormant for 155-days, and it is statistically minimal apt to be spent during market volatility,” Glassnode described a week ago because the metric hit all-time highs of 13.62 million BTC.

Following the CPI event, as Cointelegraph reported, Bitcoin flows to exchanges saw their largest single-day tally in a number of several weeks.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.