Central banks in countries that face a danger to be sanctioned through the US could shift their worldwide reserves to incorporate bitcoin (BTC), a brand new Harvard College research paper has contended.

The study paper based the thought of central bank risk hedging with bitcoin on the truth that many central banks – especially individuals facing a greater chance of US sanctions – recently have elevated the proportion of the reserves composed by gold, a conventional central bank reserve asset.

Based on the author, adding a BTC allocation additionally to gold would further boost the resilience against sanctions of these countries. This is also true in instances where the nation struggles to get enough physical gold, the writer contended.

Entitled Hedging Sanctions Risk: Cryptocurrency in Central Bank Reserves, the recently printed research paper is presented by Matthew Ferranti, a PhD candidate in financial aspects at Harvard College.

“The ability of fiat reserve issuers to freeze transactions, which constitutes a kind of de facto default around the underlying obligations, calls into question fiat reserve currencies’ status as ‘safe haven’ assets,” Ferranti authored.

Ukraine war might make central banks interested in Bitcoin

Within the paper, Ferranti pointed towards the freezing of Russia’s worldwide central bank reserves as a direct consequence from the invasion of Ukraine to illustrate why this has become more relevant than ever before.

“[…] it’s timely look around the question of methods, and how much, the chance of financial sanctions may motivate alterations in central bank reserve composition,” the PhD candidate noted within the paper.

Proof-of-jobs are censorship-resistant

Ferranti also noted in the paper that bitcoin, like a proof-of-work-based digital asset, is especially helpful like a sanction hedge.

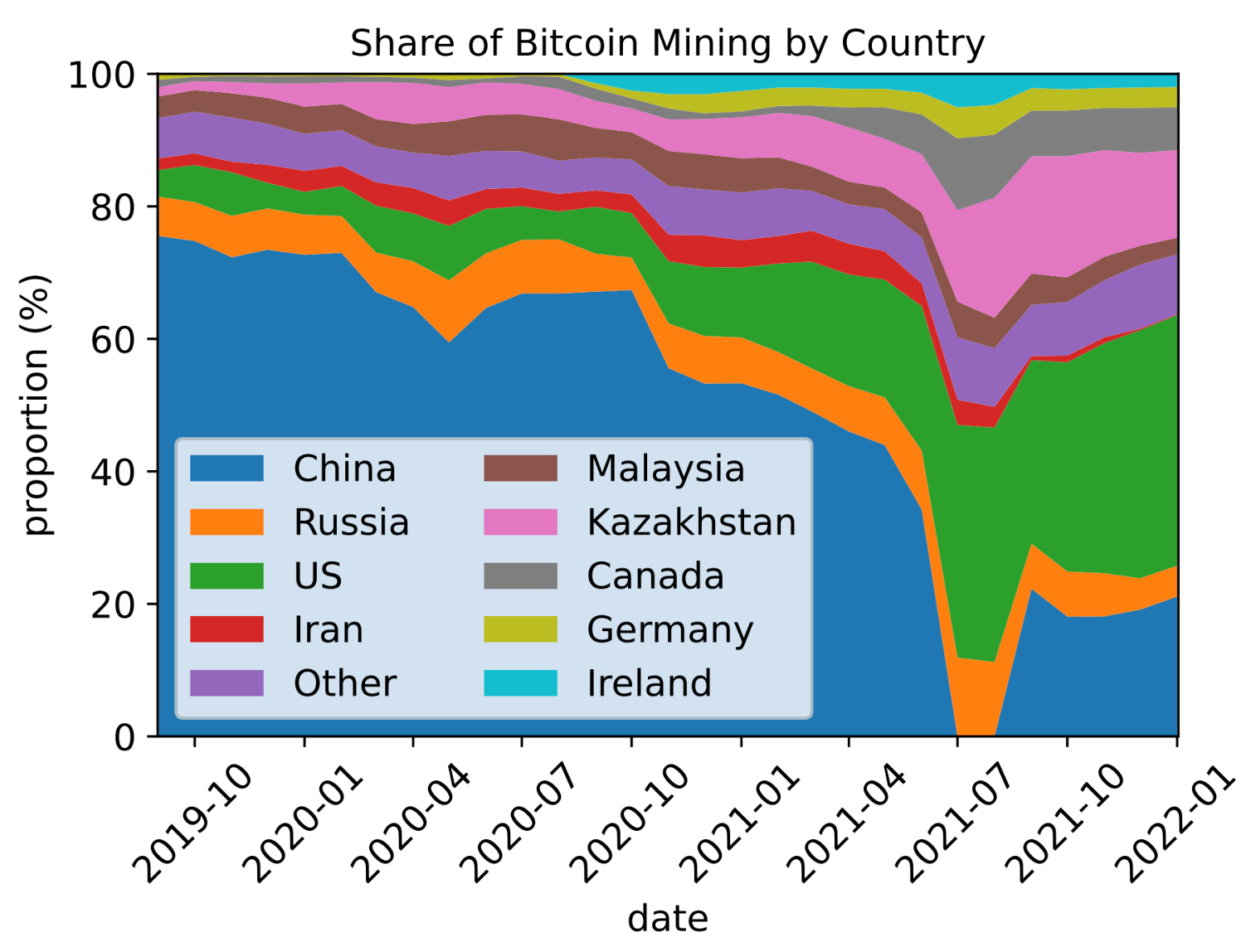

“Under an evidence-of-work system, the opportunity to censor transactions around the blockchain requires achieving ‘majority hash power,’ and therefore the censor must control a minimum of 51% from the computing power utilized by all miners,” the paper stated.

It added that achieving this type of status is unfeasible “due towards the sheer volume of computing power focused on Bitcoin mining, along with the quantity of electricity needed to power the mining chips.”

To conclude, Ferranti accepted that no asset is “totally safe” in the existence of sanctions, however that cryptocurrencies like bitcoin can provide “some protection,” even though the protection includes greater volatility.