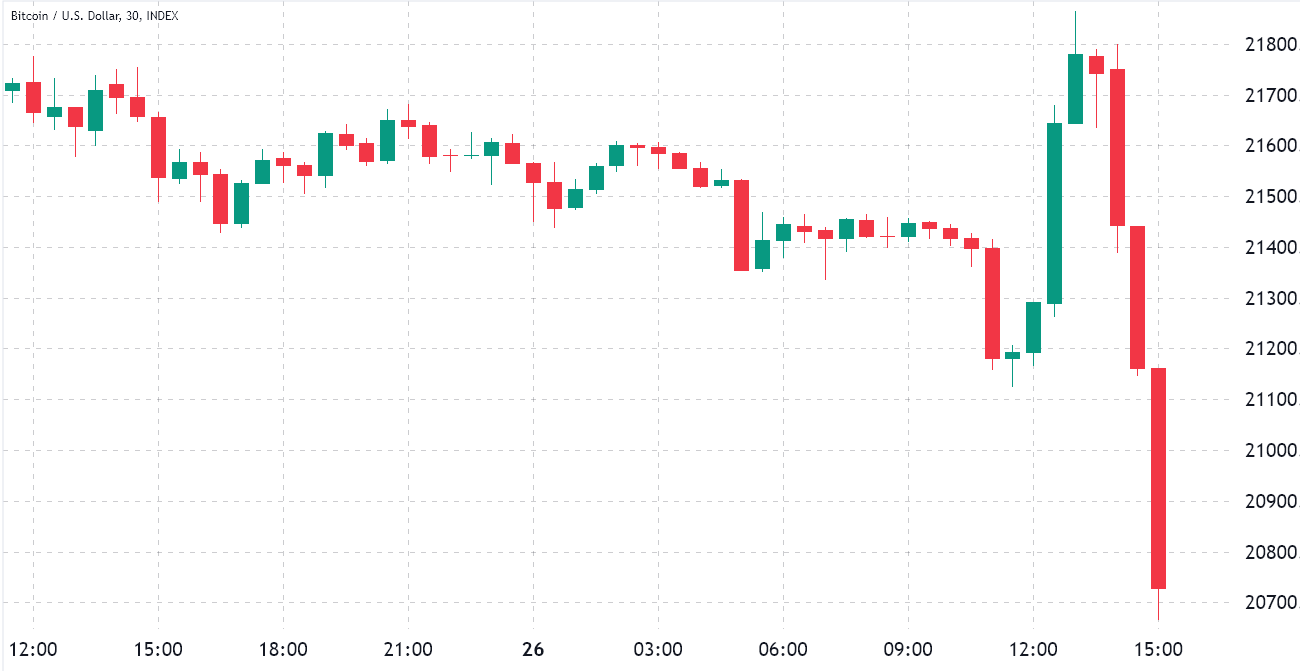

A $750 pump on August. 26 required Bitcoin (BTC) from $21,120 to $21,870 in under two hrs. However, the movement was completely erased after comments from U.S. Fed Chair Jerome Powell reiterated the bank’s dedication to contain inflation by tightening the economy. Following Powell’s speech, BTC cost dropped as little as $20,700.

At Jackson Hole, Powell particularly pointed out that “the historic record cautions strongly against prematurely loosening policy.” Immediately after individuals remarks, the U.S. stock exchange indexes reacted negatively, using the S&P 500 shedding 2.2% inside the hour.

Around the Bitcoin chart, the affable “Bart candle,” a mention of form of Bart Simpson’s mind, along with a descriptor of BTC’s up and lower cost action, surfaced. Outdoors of those unpredictable technical analysis indicators, there are more indicators that pointed to Bitcon’s broader neutral-to-bearish sentiment.

Regulators in the pace on crypto legislation

Newsflow for cryptocurrencies continues to be negative for quite a while which is also weighing on investor sentiment. On August. 24, the U.S. Federal Deposit Insurance Corporation (FDIC) issued cease and desist letters to 5 companies for allegedly making false representations about deposit insurance associated with cryptocurrencies, including FTX US.

On August. 25, India-based crypto exchange CoinSwitch had its premises looked by Anti-Money Washing agents over alleged violations of foreign exchange laws and regulations. Launched in India in 2020, CoinSwitch effectively elevated capital from Coinbase Ventures, Andreessen Horowitz, Sequoia and Tiger Global.

Lastly, on August. 26, the U.S. Registration postponed a choice for any Bitcoin place exchange-traded fund (ETF) by global investment firm VanEck. Although the approval odds were remote, it reinforced the anti-crypto sentiment in the regulator.

Consequently, crypto investors have to face lingering uncertainty regardless of the apparently useful inflationary scenario, that ought to favor supply capped assets. Because of this, analyzing crypto derivatives is important to understanding whether investors happen to be prices greater likelihood of a downturn.

Pro traders were neutral-to-bearish in front of the dump

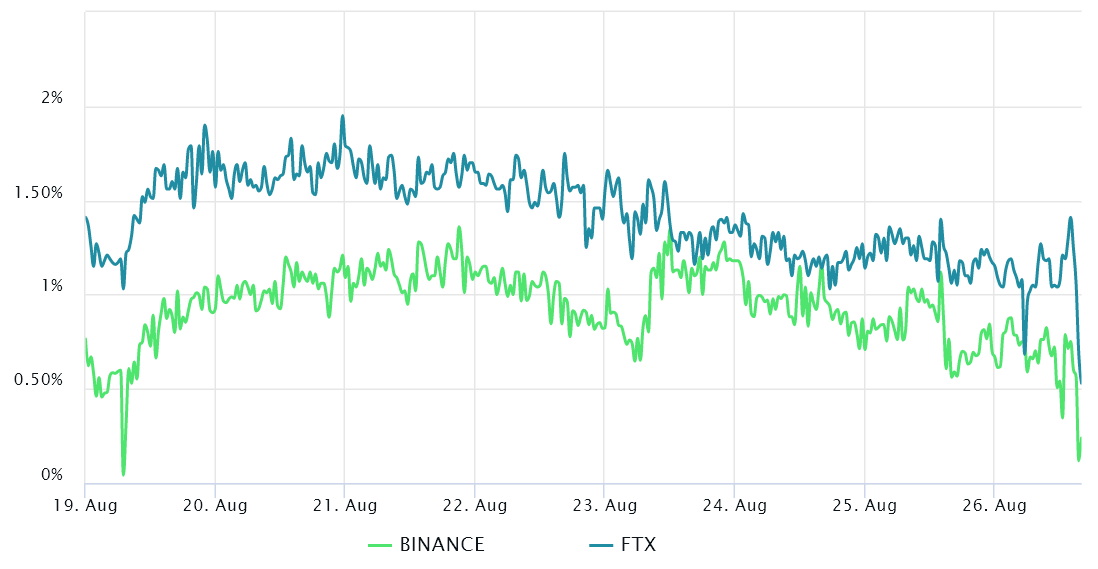

Retail traders usually avoid quarterly futures because of their cost difference from place markets. Still, they’re professional traders’ preferred instruments simply because they prevent the perpetual fluctuation of funding rates that frequently happens in an agreement.

In healthy markets, the indicator should trade in a 4% to eightPercent annualized premium to pay for costs and connected risks. Yet, that is not the situation since the Bitcoin futures premium continued to be below 1.8% the whole time. This data reflects professional traders’ unwillingness to include leveraged lengthy (bull) positions.

Related: CME Bitcoin futures see record discount among ‘very bearish sentiment’

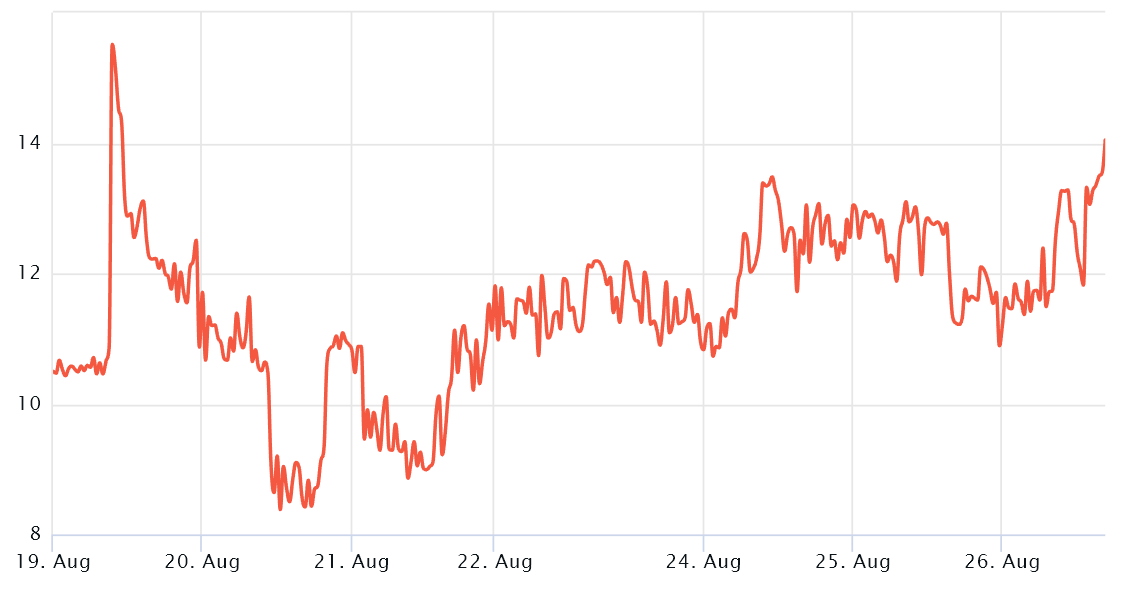

You have to also evaluate the Bitcoin options markets to exclude externalities specific towards the futures instrument. For instance, the 25% delta skew is really a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give greater odds for any cost dump, resulting in the skew indicator to increase above 12%. The 30-day delta skew have been varying close to the neutral-to-bearish threshold since August. 22, signaling options traders were less inclined to provide downside protection.

Both of these derivatives metrics claim that the Bitcoin cost dump on August. 26 may have adopted the standard stock exchange performance, but crypto traders were certainly not expecting an optimistic move.

Derivatives data leaves no room for bullish interpretations since the sentiment worsened after Powell’s comments plus they further indicate weakening market conditions.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.