On Sept. 12, Bitcoin (BTC) does Bitcoin things as always. Since Sept. 9, the cost has damaged out nicely, booking an almost 16% gain and rallying in to the lengthy-term climbing down trendline, which seems to possess resistance at $23,000.

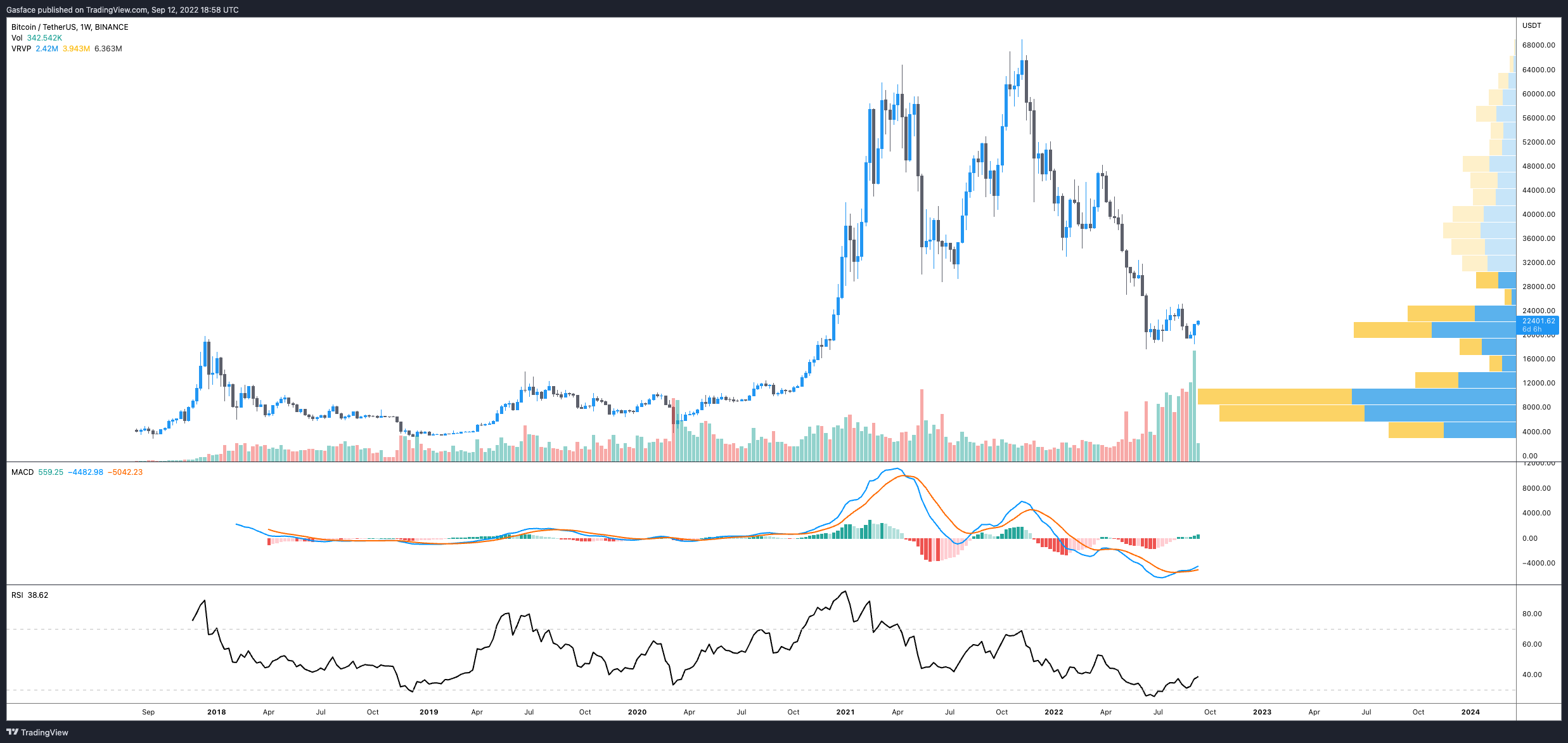

Possibly BTC and also the wider market are turning bullish in front of the Ethereum Merge that is scheduled for Sept. 14, or elusive bottom is finally in. Weekly chart data from TradingView implies that on June 27 and August. 15, Bitcoin’s relative strength index had dropped to lows not seen since 2019.

Presently, the metric has rebounded from the near oversold 31 to the current 38.5 studying. Some traders may also note a bullish divergence around the metric, in which the RSI follows an climbing trendline while Bitcoin’s weekly candlesticks trend downward. Bitcoin’s moving average convergence divergence (MACD) has additionally entered over as purchasing volume surged and BTC cost tries to break from the current 90-day range.

As pointed out above in a previous analysis, since Jan. 21, the Bitcoin cost has simply been range buying and selling with what have switched to be successive bear flags that visit a continuation to new yearly lows. Cost has consistently experienced resistance in the overhead climbing down trendline and also the cost action observed today and previously 90-days isn’t a deviation in the trend.

Traders should watch out for BTC cost to push secure a couple of daily closes over the trendline resistance and setting a regular greater high above $25,400, or perhaps a breakout towards the 200-MA at $30,000 could be a great sight of whether trend change or at best an advantage to a different consolidation range. Until occurring, the conventional practice among traders would be to not go lengthy at lengthy-term resistance and wait to determine if the bullish momentum holds or even the prevailing trend remains intact.

Related: The Given, the Merge and $22K BTC — 5 items to know in Bitcoin now

Obviously, there are a few other on-chain and derivatives metrics that could add valuable context to Bitcoin’s current cost action, but the objective of this brief analysis would be to simply give a quick, snapshot interpretation of BTC’s market action and think about what traders may be thinking within the short-term.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.