Bitcoin (BTC) sagged with U . s . States equities in the March. 19 Wall Street open as markets anticipated tech earnings.

Eurozone sees fresh all-time high inflation

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD circling $19,000 after falling continuously overnight.

Still held in a good range, the happy couple offered couple of cues to traders seeking beneficial short-term plays, although some sources contended that overall, current levels symbolized solid buy levels.

“With little calendar occasions up until the next FOMC at the begining of November, crypto ongoing to lag behind equities, and skews near flat, protective downside structures would be the least expensive levels they’ve been since June,” buying and selling firm QCP Capital concluded to Telegram funnel subscribers at the time.

QCP Capital was talking about the approaching meeting from the U.S. Federal Reserve’s Federal Open Market Committee, where a choice on rate of interest hikes could be made.

Individuals figures could be likely to spark risk asset volatility, using the U.S. more influential in crypto markets than other nations with regards to inflation.

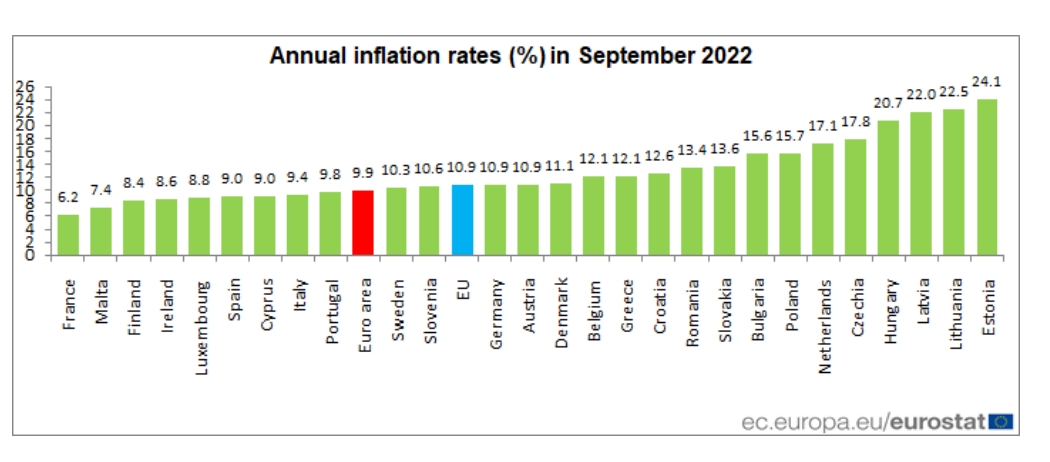

The Uk reported a brand new 40-year full of year-on-year inflation at the time, reaching 10.1% as food prices required their toll. The eurozone told an identical story, with annual inflation hitting 10.9% in September — the greatest ever recorded.

“The euro area annual inflation rate was 9.9% in September 2022, up from 9.1% in August. Last year, the speed was 3.4%,” an announcement from Eurostat confirmed.

“European Union annual inflation was 10.9% in September 2022, up from 10.1% in August. Last year, the speed was 3.6%. These figures are printed by Eurostat, the record office from the Eu.”

Analyst eyes dollar parabola break

Elsewhere, japan yen was on the right track hitting the psychologically significant 150 per dollar level.

The U.S. dollar index (DXY) rose at the time, trying to crack 113 inside an overall consolidation structure.

Related: Bitcoin mirrors 2020 pre-breakout, but analysts at odds whether this time around differs

Your day prior, market analyst Kevin Svenson designed a bold conjecture for that dollar, quarrelling that Bitcoin would see explosive growth if the DXY 2022 “parabola” break lower for sure.

“The $DXY is going to break underneath the parabola folks,” he summarized.

“If it will an enormous BTC rally will probably occur.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.