Bitcoin has attempted and unsuccessful to interrupt and hold over the $25,000 level let’s focus on five from the last six days. Some technicians believe that this isn’t always a poor factor, because the world’s largest cryptocurrency by market capital is developing an climbing triangular structure that may proceed a surge greater for the next major resistance area surrounding $28,000.

But other medication is worrying this year’s rally which has seen the BTC cost already increase near to 50% might be stalling. Prices in Bitcoin derivatives markets is an excellent method to gauge how investors feel around the outlook for BTC, in addition to towards its possibility of volatility. Here’s what options financial markets are saying right now…

Investors Neutral around the BTC Cost Outlook

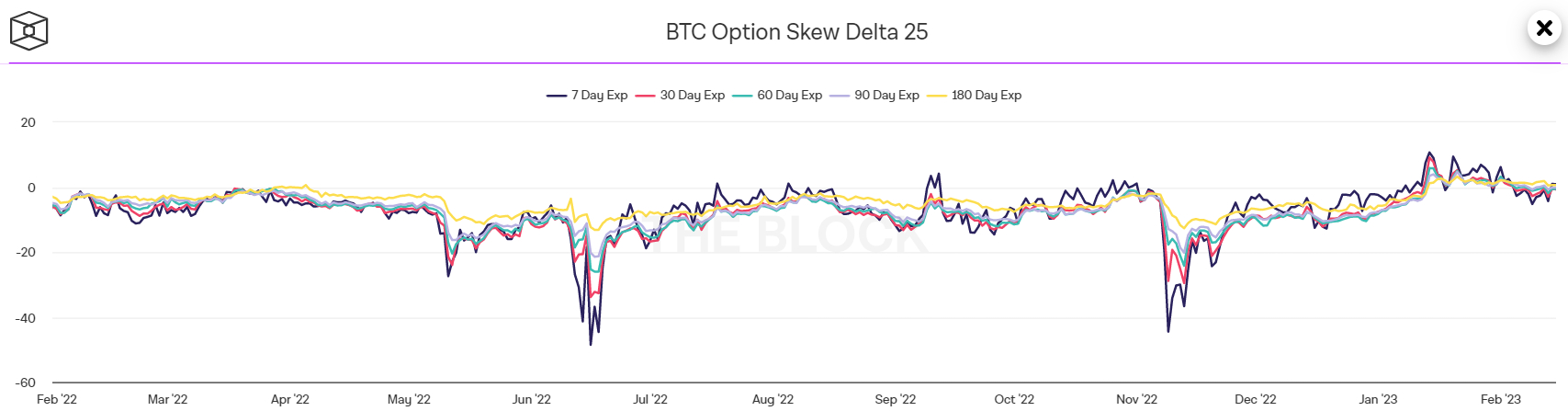

Based on the broadly adopted 25% delta skew of Bitcoin options expiring in 7, 30, 60, 90 and 180 days, investors are presently roughly internet neutral within their outlook for that Bitcoin cost. Based on data supplied by crypto analytics firm The Block, all five 25% delta skews are negligable, up substantially from last year’s immediate publish-FTX collapse lows, but additionally lower slightly from highs printed captured around.

The 25% delta options skew is really a popularly monitored proxy for that degree that buying and selling desks are gone or undercharging for upside or downside protection through the put and call options they’re supplying investors. Put options give a trader the best although not the duty to market a good thing in a predetermined cost, while a phone call option gives a trader the best although not the duty to purchase a good thing in a predetermined cost.

A 25% delta options skew above shows that desks are charging more for equivalent call options versus puts. This means there’s greater interest in calls versus puts, which may be construed like a bullish sign as investors tend to be more wanting to secure protection against (or bet on) a boost in prices.

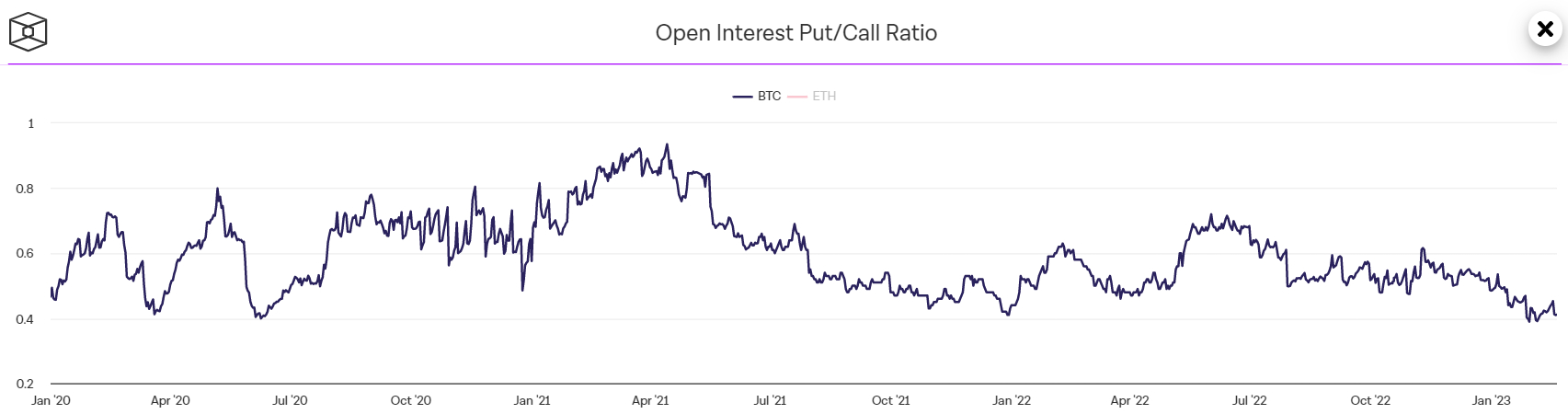

However, another option market indicator of investor sentiment is delivering a far more bullish sign. Based on data presented through the Block, outdoors Interest Put/Call Ratio of Bitcoin options was last at .41, still not far from the record lows printed at the end of The month of january/early Feb. A Wide Open Interest Put/Call Ratio below 1 implies that investors favor owning call options (bets around the cost rising) over put options (bets around the cost shedding).

Investors Are Positioning For Uptick in Volatility

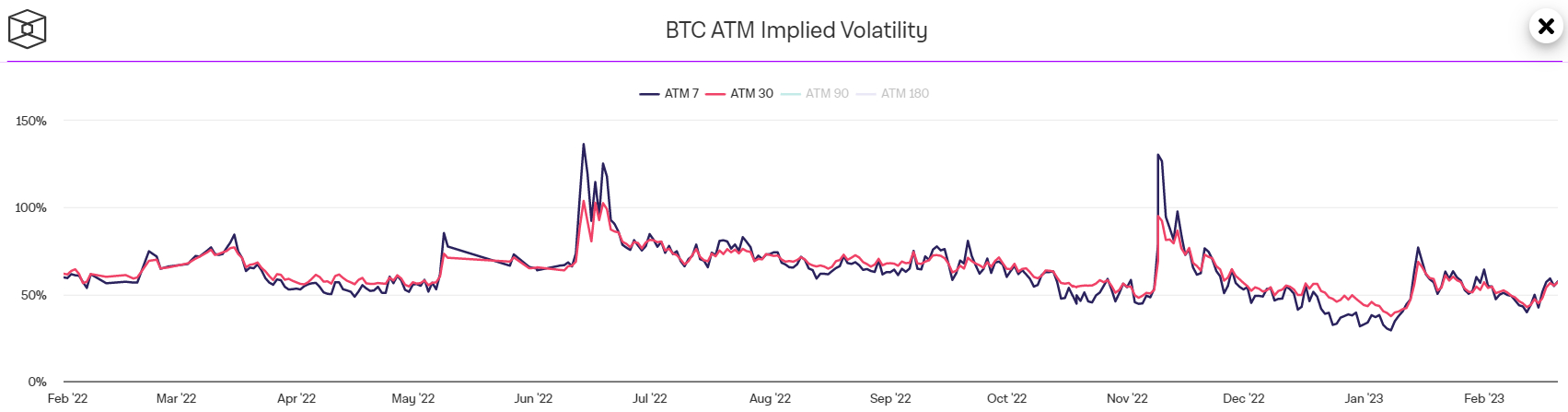

Bitcoin’s 7-day Implied Volatility based on At-The-Money (ATM) options market lately neared its greatest degree of the month, based on data presented through the Block. On Saturday, it rose to simply under 60%, up from earlier monthly lows of below 40%. 30-day ATM Implied Volatility, meanwhile, seemed to be at roughly 60% and consistent with its earlier monthly highs.

The most recent uptick in volatility expectations, according to ATM options markets, went hands in hands using the Bitcoin market’s recovery from earlier monthly lows within the $21,000s. It’s important to note that, Bitcoin ATM Implied Volatility expectations remain subdued by historic comparison and well below recent mid-The month of january 2023 and November 2022 highs.