In the last nine days, Bitcoin’s (BTC) daily closing cost fluctuated inside a tight range from $28,700 and $31,300. The May 12 collapse of TerraUSD (UST), formerly the 3rd-largest stablecoin by market cap, negatively impacted investor confidence and also the path for Bitcoin’ cost recovery appears clouded following the Nasdaq Composite Stock Exchange Index stepped 4.7% on May 18.

Disappointing quarterly is a result of top U . s . States retailers are amping up recession fears as well as on May 18, Target (TG) shares dropped 25%, while Walmart (WMT) stock stepped 17% in 2 days. The possibilities of a fiscal slowdown introduced the S&P 500 Index towards the fringe of bear market territory, a 20% contraction from the all-time high.

Furthermore, the current crypto cost drop was pricey to leverage buyers (longs). According to Coinglass, the mixture liquidations arrived at $457 million at derivatives exchanges between May 15 and 18.

Bulls placed bets at $32,000 and greater

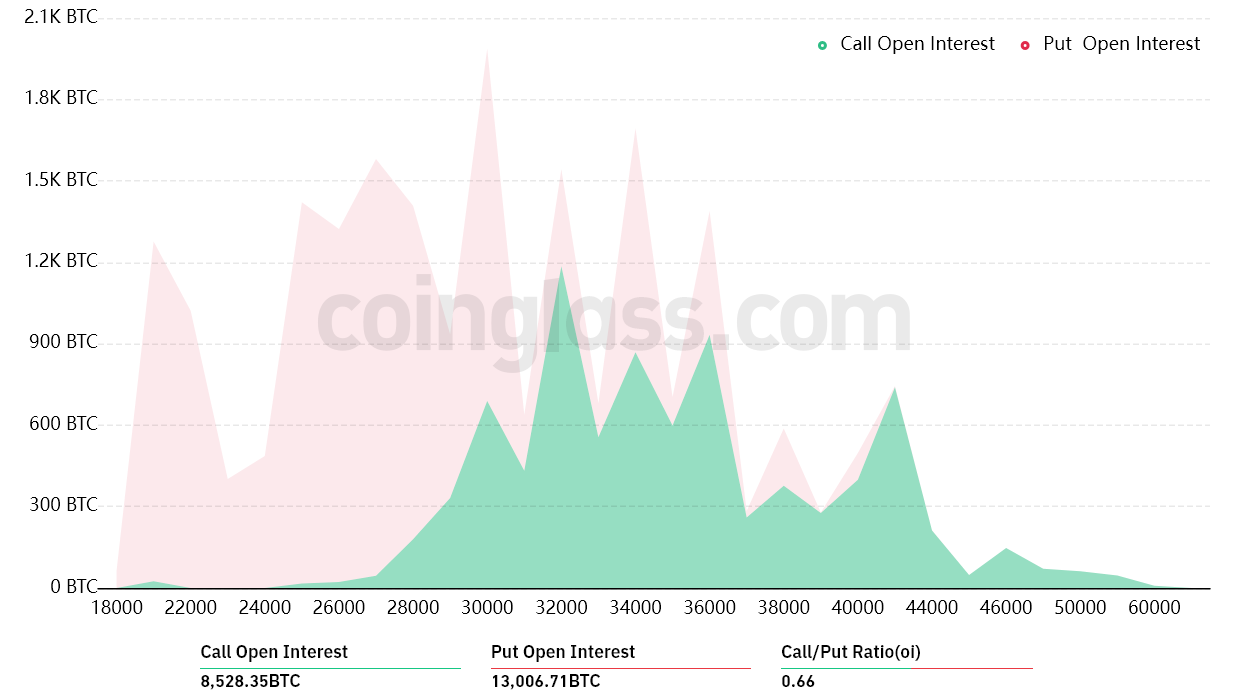

Outdoors interest for that May 20 options expiry is $640 million, however the actual figure is going to be reduced since bulls were excessively-positive. Bitcoin’s recent downturn below $32,000 required buyers unexpectedly and just 20% from the call (buy) choices for May 20 happen to be placed below that cost level.

The .66 call-to-put ratio reflects the dominance from the $385 million put (sell) open interest from the $255 million call (buy) options. However, as Bitcoin stands near $30,000, most put (sell) bets will probably become useless, reducing bears’ advantage.

If Bitcoin’s cost remains above $29,000 at 8:00 am UTC on May 20, only $160 million price of these put (sell) options is going to be available. This difference is really because the right to market Bitcoin at $30,000 is useless if BTC trades above that much cla on expiry.

Sub-$29K BTC would benefit bears

Here are the 3 probably scenarios in line with the current cost action. The amount of options contracts on May 20 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $28,000 and $29,000: 300 calls versus. 7,100 puts. The internet result favors the put (bear) instruments by $190 million.

- Between $29,000 and $30,000: 600 calls versus. 5,550 puts. The internet result favors bears by $140 million.

- Between $30,000 and $32,000: 1,750 calls versus. 3,700 puts. The internet result favors the put (bear) instruments by $60 million.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a put option, effectively gaining positive contact with Bitcoin over a specific cost, but regrettably, there is no good way to estimate this effect.

Bulls haven’t much to achieve within the short-term

Bitcoin bears have to pressure the cost below $29,000 on May 20 to have a $190 million profit. However, the bulls’ best situation scenario needs a push above $30,000 to reduce the harm.

Thinking about Bitcoin bulls had $457 million in leveraged lengthy positions liquidated between May 15 and 18, they ought to tight on margin needed they are driving the cost greater. Thus, bears will attempt to suppress BTC below $29,000 in front of the May 20 options expiry which lessens the likelihood of a brief-term cost recovery.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.