Up to April 25, Bitcoin (BTC) bulls have been protecting the $38,000 level, but bulls were caught off-guard through the recent drop. As Bitcoin stepped from $46,700 to $37,700 between April 5 and 26, the majority of the bullish bets for that approaching $1.96 billion monthly options expiry grew to become useless.

Regulatory concerns still pose a menace to Bitcoin as well as on April 26, the brand new You are able to Condition Set up passed an invoice banning new proof-of-work (Bang) cryptocurrency carbon-based mining facilities within the condition. Fortunately for Bitcoin, mining devices are portable so there is no real risk towards the Bitcoin network’s security however the steady threat of anti-crypto legislation can have an affect on cost.

Geopolitical tension in Europe also brought investors to prevent riskier assets and lots of are trying to find protection in U.S. dollar-denominated assets. CNBC reported the impact of Russian condition energy firm Gazprom’s decision to prevent gas supplies to Belgium and Bulgaria produced concerns in regards to a much deeper economic slowdown within the Eurozone region.

Investors will also be obsessive about the possibility U.S. Fed 250 basis point rate hike planned throughout 2022. The maneuver aims to contain inflationary pressure however it could spin global economies right into a recession which is one more reason why investors are staying away from highly-volatile assets like cryptocurrencies.

Bulls didn’t expect prices below $40,000

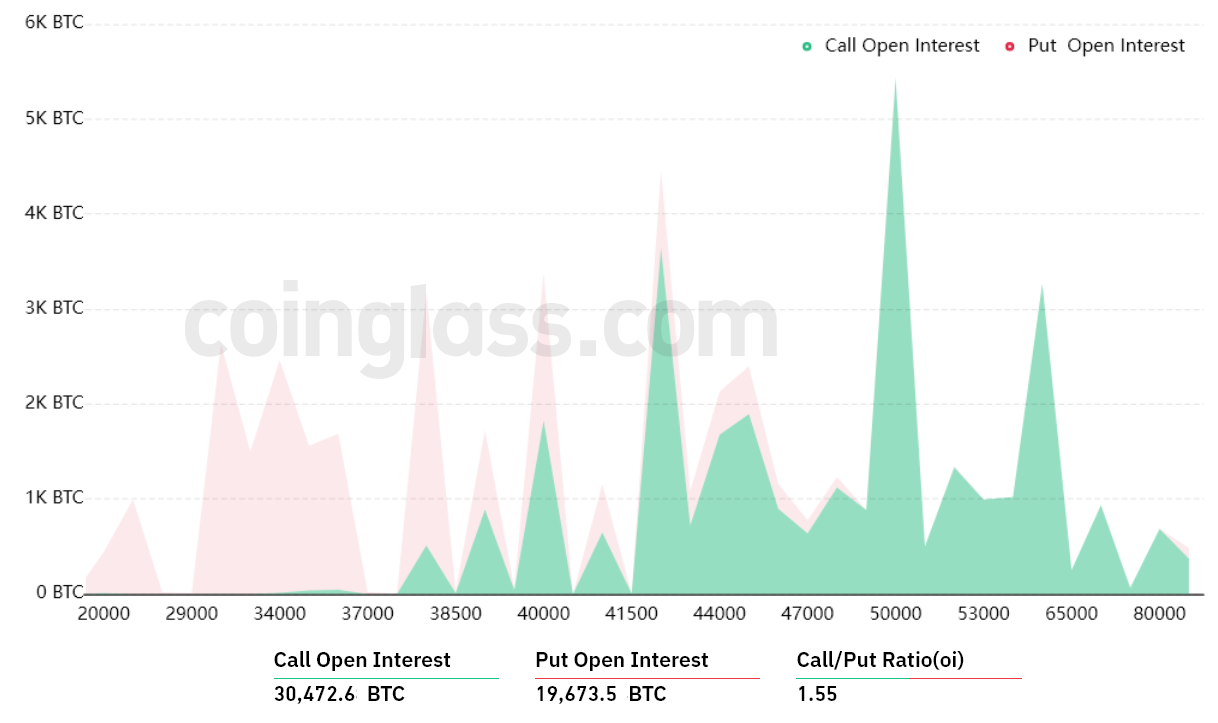

Outdoors interest for that April 29 options expiry in Bitcoin is $2 billion, however the actual figure is going to be reduced since bulls weren’t expecting the BTC cost to decrease below $40,000.

These traders may have been fooled as Bitcoin held above $45,000 between March 27 and April 6, placing enormous bets for that monthly options expiry above $50,000.

The Fir.55 call-to-put ratio shows more sizable bullish bets because the call (buy) open interest is $1.19 billion from the $770 million puts (sell) options. Nonetheless, as Bitcoin stands near $39,000, most bullish bets will probably become useless.

For example, if Bitcoin’s cost stays below $40,000 at 8:00 am UTC on April 29, only $60 million price of these calls (buy) options is going to be available. This difference is really because there’s no use within the authority to buy Bitcoin at $40,000 whether it trades below that much cla on expiry.

Bulls need $41,000 to balance the scales

Here are the 3 probably scenarios in line with the current cost action. The amount of options contracts on April 29 for call (buy) and set (sell) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $37,000 and $39,000: 600 calls versus. 9,800 puts. The internet result favors the put (bear) instruments by $350 million.

- Between $39,000 and $40,000: 1,500 calls versus. 8,300 puts. The internet result favors bears by $260 million.

- Between $40,000 and $41,000: 3,400 calls versus. 5,600 puts. Bears remain better positioned by $90 million.

- Between $41,000 and $42,000: 4,100 calls versus. 4,700 puts. Favors the put (bear) instruments by $$ 30 million.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a put option, effectively gaining positive contact with Bitcoin over a specific cost but regrettably, there is no good way to estimate this effect.

Bears are targeting a $350 million profit

Bitcoin bears have to pressure the cost below $39,000 on April 29 to have a $350 million profit. However, the bulls’ best situation scenario needs a 6% cost push above $41,000 to chop their losses to $$ 30 million.

Bitcoin bulls had $330 million leverage lengthy positions liquidated previously 7 days, so that they may have less margin needed they are driving Bitcoin cost greater. Knowing that, bears will probably attempt to suppress BTC below $39,000 before the April 29 options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.