On 12 ,. 14, Bitcoin (BTC) cost hit a 1-month high and saw a short resurgence in bullish momentum, however the Federal Reserve’s Federal Open Market Committee (FOMC) hawkish report and comments from Given chair Jerome Powell sent BTC for an intraday low at $17,659.

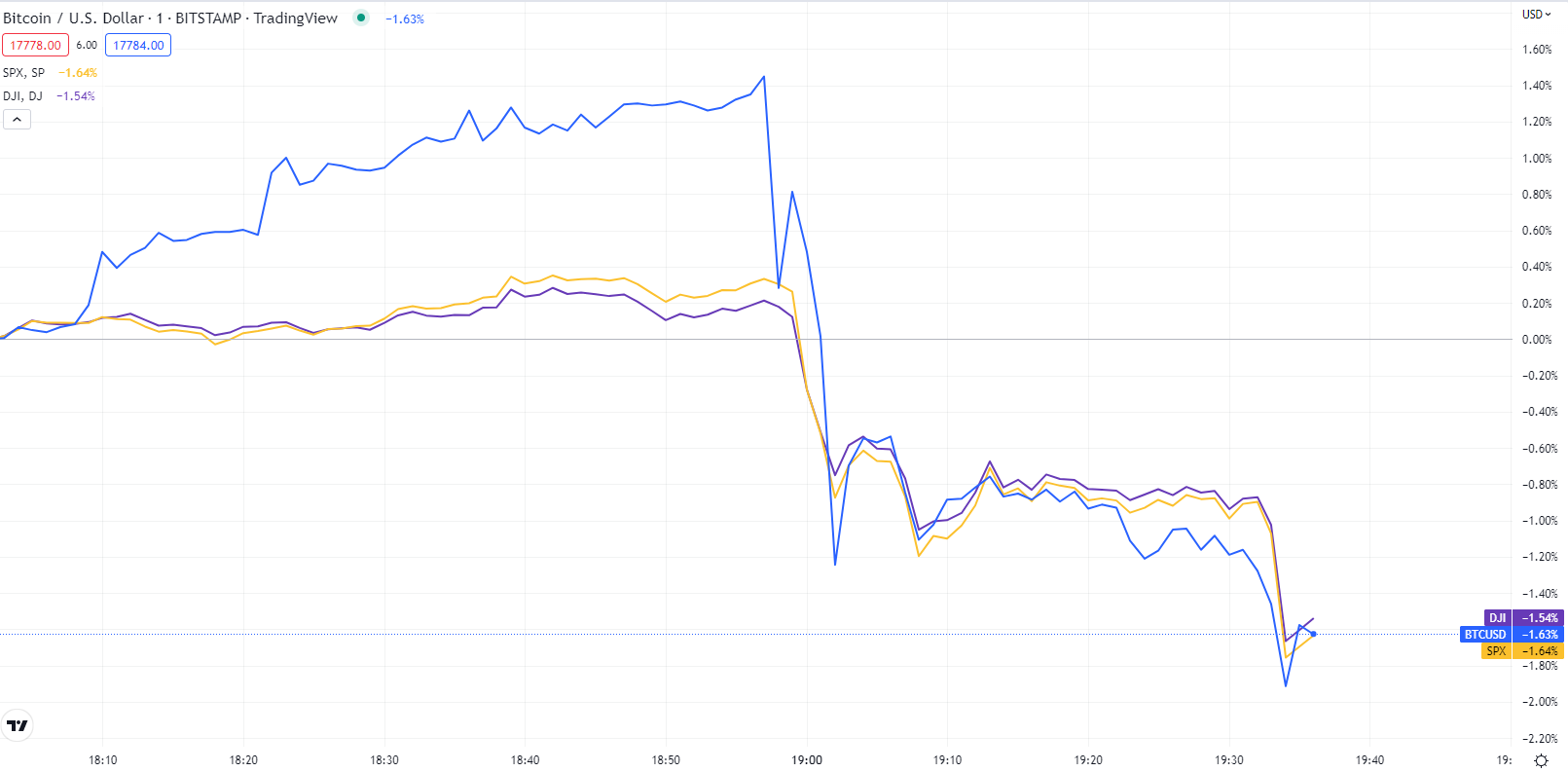

Stocks and Bitcoin began your day slightly up but rapidly retracted around the FOMC report. Up to now, Bitcoin cost remains carefully correlated to equities and most investors have concerns concerning the impact of further rate increases later on.

Rising rates of interest and hawkish talk from Powell impact BTC cost

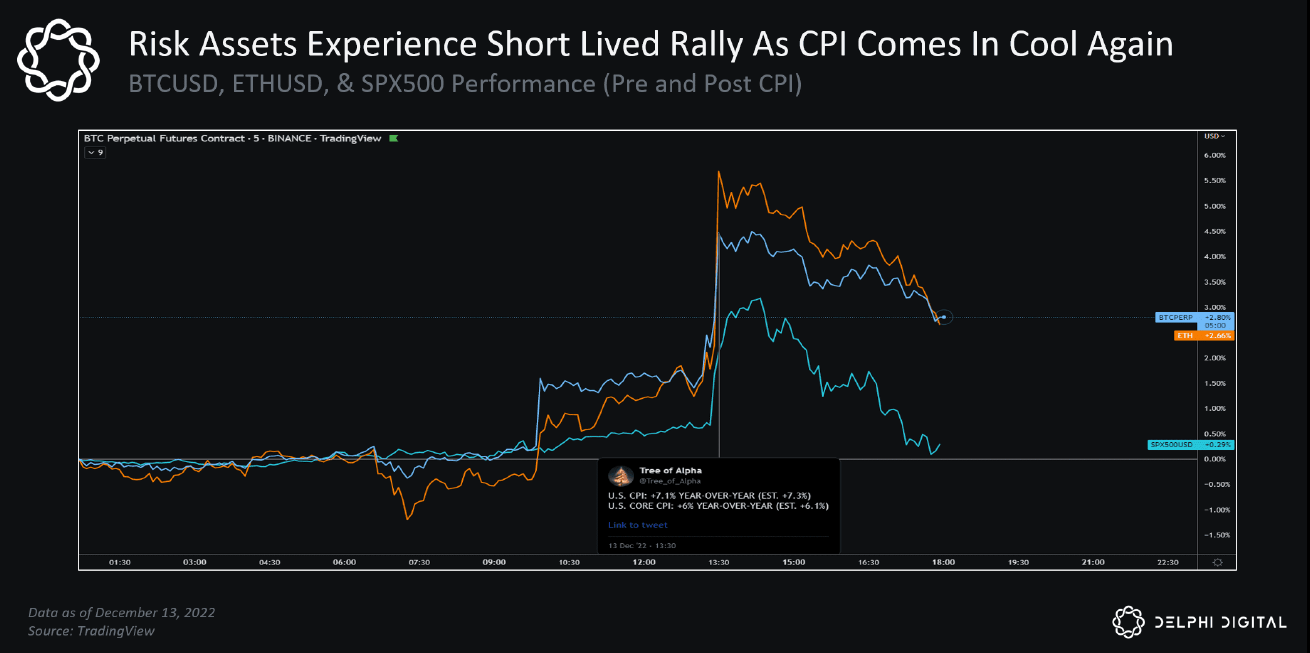

As the Consumer Cost Index (CPI) report demonstrated easing inflation at 7.1%, Powell still really wants to achieve 2% overall inflation. Inflation is a figuring out element in raising rates of interest and also the current .5% hike had consensus among FOMC participants. The Given people also agree that rate hikes should continue in 2023.

Throughout the 12 ,. 14 press conference, Powell mentioned:

“We could see greater rates a bit longer to offer the 2% inflation goal”

This hawkish tone, combined with FOMC survey shows rates of interest continuously rise for that near future.

What’s going to Bitcoin do next?

Rapid-resided Bitcoin rally in front of Powell’s speech correlated towards the cost action seen across other risk assets. Following the FOMC and Powell’s speech, these assets ongoing to retrace and a few analysts begin to see the recent dip like a metric to purchase more Bitcoin.

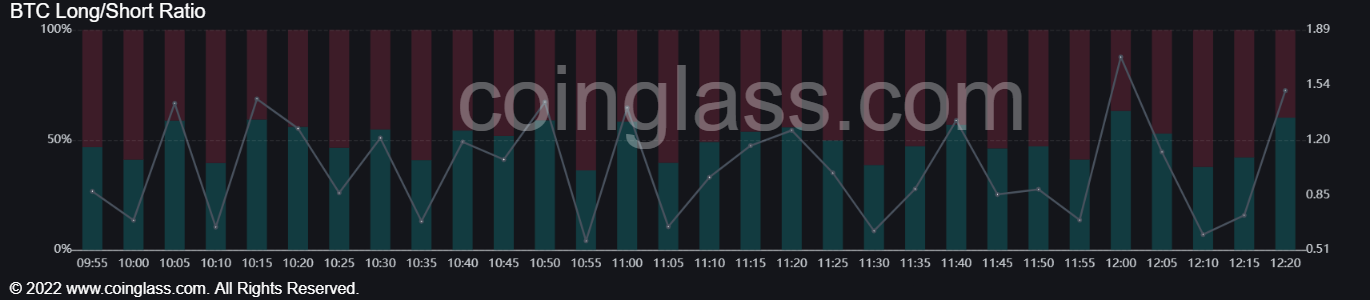

Late longs to the present rally may be vulnerable to liquidation if BTC cost is constantly on the retrace. Based on derivatives data, Bitcoin open interest shows 60.16% of traders are lengthy.

Presently, the marketplace is digesting the views expressed through the FOMC and Powell, so an increase in a nutshell-term volatility isn’t abnormal. Investors should keep close track of the following couple of daily closes to determine whether Bitcoin’s macro trend has altered.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.