Bitcoin (BTC) possessed a 16.5% correction between August. 15 and August. 19 because it tested the $20,800 support. As the drop is startling, the truth is, a $4,050 cost difference is comparatively minor, particularly when one makes up about Bitcoin’s 72% annualized volatility.

Presently, the S&P 500’s volatility is 31%, that is considerably lower, the index traded lower 9.1% between June 21 and June 13. So, comparatively speaking, the index of major U.S.-listed companies faced a far more abrupt movement adjusted for that historic risk metric.

At the beginning of now, crypto investors’ sentiment worsened after less strong conditions in Chinese areas forced the central bank to lessen its five-year loan prime rate on August. 21. Furthermore, a Goldman Sachs investment bank strategist mentioned that inflationary pressure would pressure the U.S. Fed to help tighten the economy, which negatively impacts the S&P 500.

Whatever the correlation between stocks and Bitcoin, that is presently running at 80/100, investors have a tendency to seek shelter within the U.S. dollar and inflation-protected bonds once they fear an emergency or market crash. This movement is actually a “flight to quality” and has a tendency to add selling pressure on all risk markets, including cryptocurrencies.

Regardless of the bears’ best efforts, Bitcoin is not in a position to break underneath the $20,800 support. This movement explains why the $1 billion Bitcoin monthly options expiry on August. 26 may benefit bulls regardless of the recent 16.5% reduction in five days.

Most bullish bets are above $22,000

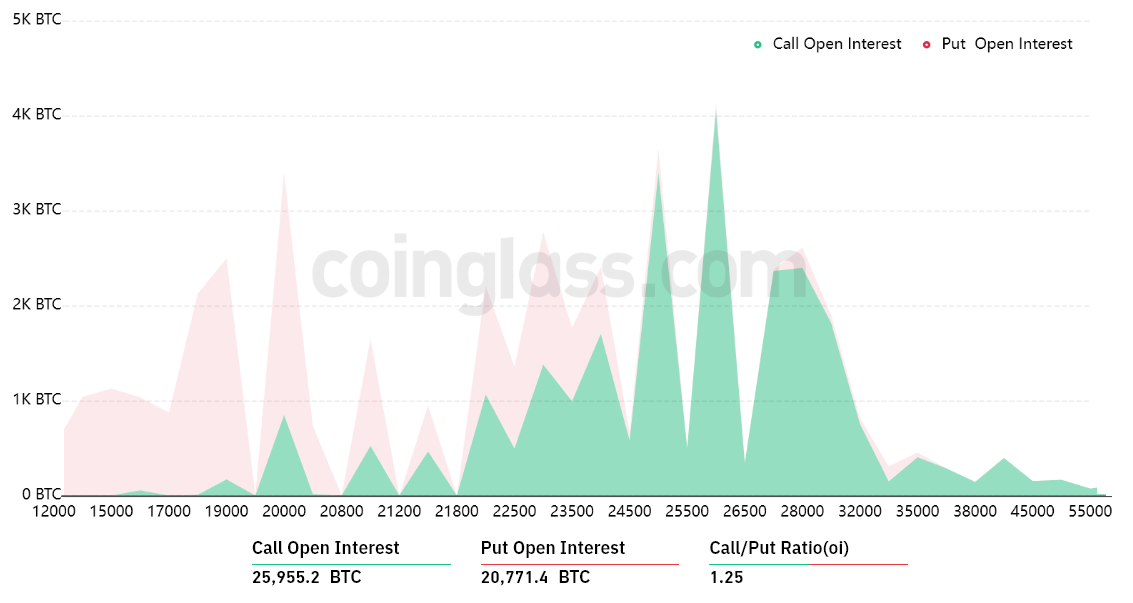

Bitcoin’s steep correction after neglecting to break the $25,000 resistance on August. 15 surprised bulls since 12% from the call (buy) choices for the monthly expiry happen to be placed above $22,000. Thus, Bitcoin bears be more effective positioned while they placed less bets.

A wider view while using 1.25 call-to-put ratio shows more bullish bets since the call (buy) open interest is $560 million from the $450 million put (sell) options. Nonetheless, as Bitcoin presently stands below $22,000, most bullish bets will probably become useless.

For example, if Bitcoin’s cost remains below $22,000 at 8:00 am UTC on August. 26, only $34 million price of these put (sell) options is going to be available. This difference is really because there’s no use within the authority to sell Bitcoin below $22,000 whether it trades above that much cla on expiry.

Bulls could secure a $160 million profit

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on August. 26 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $20,000 and $21,000: 1,100 calls versus. 8,200 puts. The internet result favors bears by $140 million.

- Between $21,000 and $22,000: 1,600 calls versus. 6,350 puts. The internet result favors bears by $100 million.

- Between $22,000 and $24,000: 5,000 calls versus. 4,700 puts. The internet outcome is balanced between bulls and bears.

- Between $24,000 and $25,000: 7,700 calls versus. 1,000 puts. The internet result favors bulls by $160 million.

This crude estimate views the phone call options utilized in bullish bets and also the put options solely in neutral-to-bearish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

Holding $20,800 is crucial, especially after bulls were liquidated in futures market

Bitcoin bulls have to push the cost above $22,000 on August. 26 to balance the scales and steer clear of a possible $140 million loss. However, Bitcoin bulls had $210 million price of leverage lengthy futures positions liquidated on August. 18, so that they are less inclined to push the cost greater for the short term.

With this stated, probably the most probable scenario for August. 26 may be the $22,000-to-$24,000 range supplying a well-balanced outcome between bulls and bears.

If bears show some strength and BTC loses the critical $20,800 support, the $140 million reduction in the monthly expiry would be the least of the problems. Additionally, the move would invalidate the prior $20,800 have less This summer 26, effectively breaking a seven-week-lengthy climbing trend.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.