Bitcoin (BTC) is setting tough records now as hodlers large and small fight some major discomfort.

Data from on-chain analytics firm Glassnode shows more than one-third from the BTC supply being held baffled by lengthy-term hodlers (LTHs) — a brand new all-time high.

Lengthy-term holders shoulder record unrealized losses

Profitability has had a significant hit in recent days, as well as on-chain data confirms that the most seasoned investors suffer.

As BTC/USD crashed to two-year lows of $15,600, investors started to get rid of big, and also at current amounts of $17,200, everything is very little better.

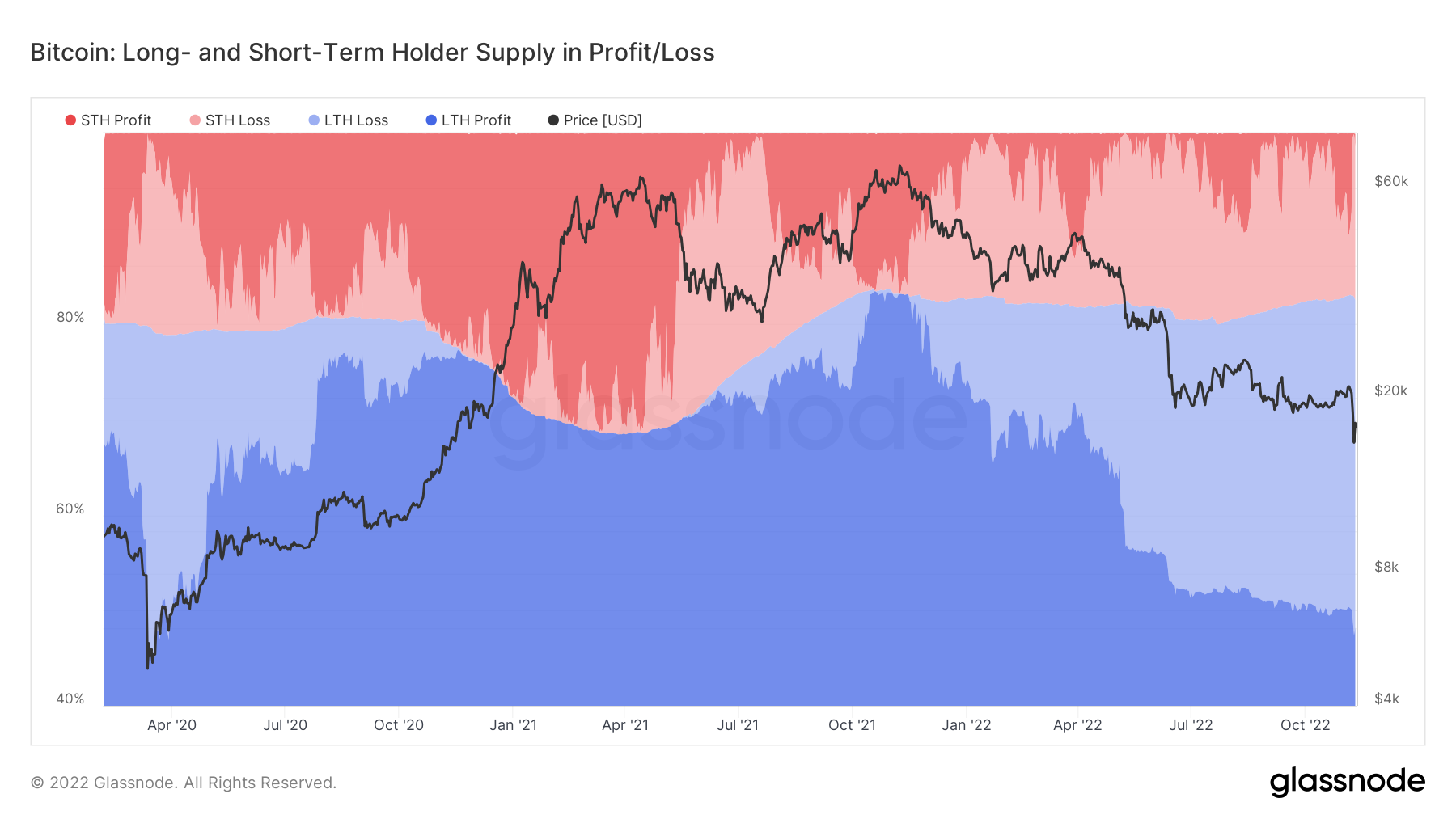

Glassnode implies that LTHs were holding 35.4% from the BTC supply — over 5.9 million coins — baffled on November. 9, decreasing by only onePercent on November. 10.

Short-term holders (STHs) held another 17% from the supply baffled, and STHs in profit taken into account just .06% from the supply on November. 9.

A wallet address is classed being an LTH or STH whether it has held coins for additional or under 155 days, correspondingly.

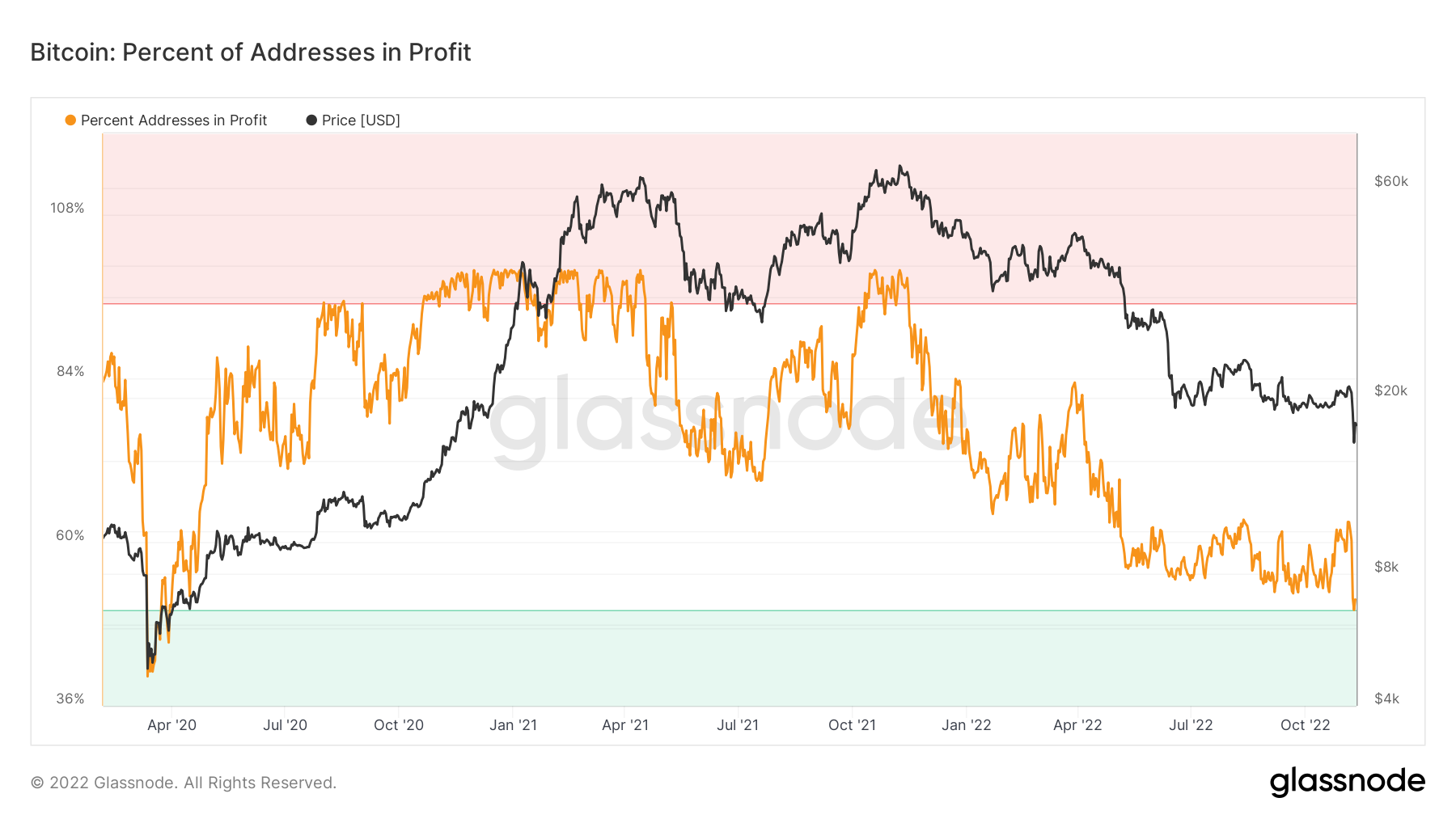

The general quantity of Bitcoin addresses in profit — 50% — is meanwhile presently at its cheapest since March 2020 as a direct consequence from the COVID-19 crash.

BTC/USD sees unparalleled trend line crossover

Other on-chain figures underscore how profitability has were able to sink so low.

Related: Bitcoin cost gains $1K within a few minutes as CPI data deals DXY fresh 2% dip

Based on data from Cointelegraph Markets Pro and TradingView, Bitcoin has witnessed its 200-day moving average (MA) fall below its 200-week counterpart the very first time ever.

Quite simply, Bitcoin’s cost previously 200 days, in relative terms, continues to be distinctively low when compared with historic patterns.

“That’s a replacement,” popular Twitter analytics account TXMC Trades commented.

As Cointelegraph reported, the 200-week MA is really a key bear market cost line within the sand, which Bitcoin has nevertheless violated consistently this season.

The popularity line is constantly on the increase, however, and it has never gone lower.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.