There is a special bond between moms as well as their sons. For pseudonymous Alan, a 28-year-old engineer, a Bitcoin (BTC) loan helped his mother to purchase a home.

Alan told Cointelegraph he required out a Bitcoin-backed loan in 2021 — serendipitously on his sister’s birthday — to gift his mother the tax-free money. She then used the funds to purchase a home in North Yorkshire, England, while Alan stored his Bitcoin.

Alan first used Bitcoin this year, learning it had been a helpful currency to purchase things on the web. He used the peer-to-peer (P2P) service localbitcoins.com, whose team are regular Cointelegraph contributors, to purchase Bitcoin.

Alan described the entire process of buying Bitcoin from real people like a “bizarre experience.” He described the experience ten years ago is incomparable to presenting popular exchanges for example Coinbase, Kraken or Binance nowadays.

During the period of his studies at college, Alan’s curiosity about Bitcoin waxed and waned until 2014 came round and also the “less than 100 pounds,” or $130, that Alan been on Bitcoin became a “couple of grand.” Alan explains the “transition” of Bitcoin the currency into some thing:

“Bitcoin had actual utility, from buying things online to getting actual value. I’ve now got this anonymous money, or ‘anonymous enough’ money, with actual value.”

Hodling onto Bitcoin within the lengthy-term will make sense, because the P2P money produced by Satoshi Nakomoto happens to be an investment tool or perhaps a store of worth.

Go forward to 2016, and also the cost per Bitcoin was around $753, or 600 pounds. Alan understood it had become “something worth buying,” but Alan was still being students coupled with his mind lower for exams:

“I didn’t have cash, and then any Bitcoin Used to do have I had been using to purchase things.”

Alan spoke to his father, suggesting it may be worth “investing a few thousand” in to the orange gold coin. Regrettably, his father didn’t purchase 2016, but Alan hodled on.

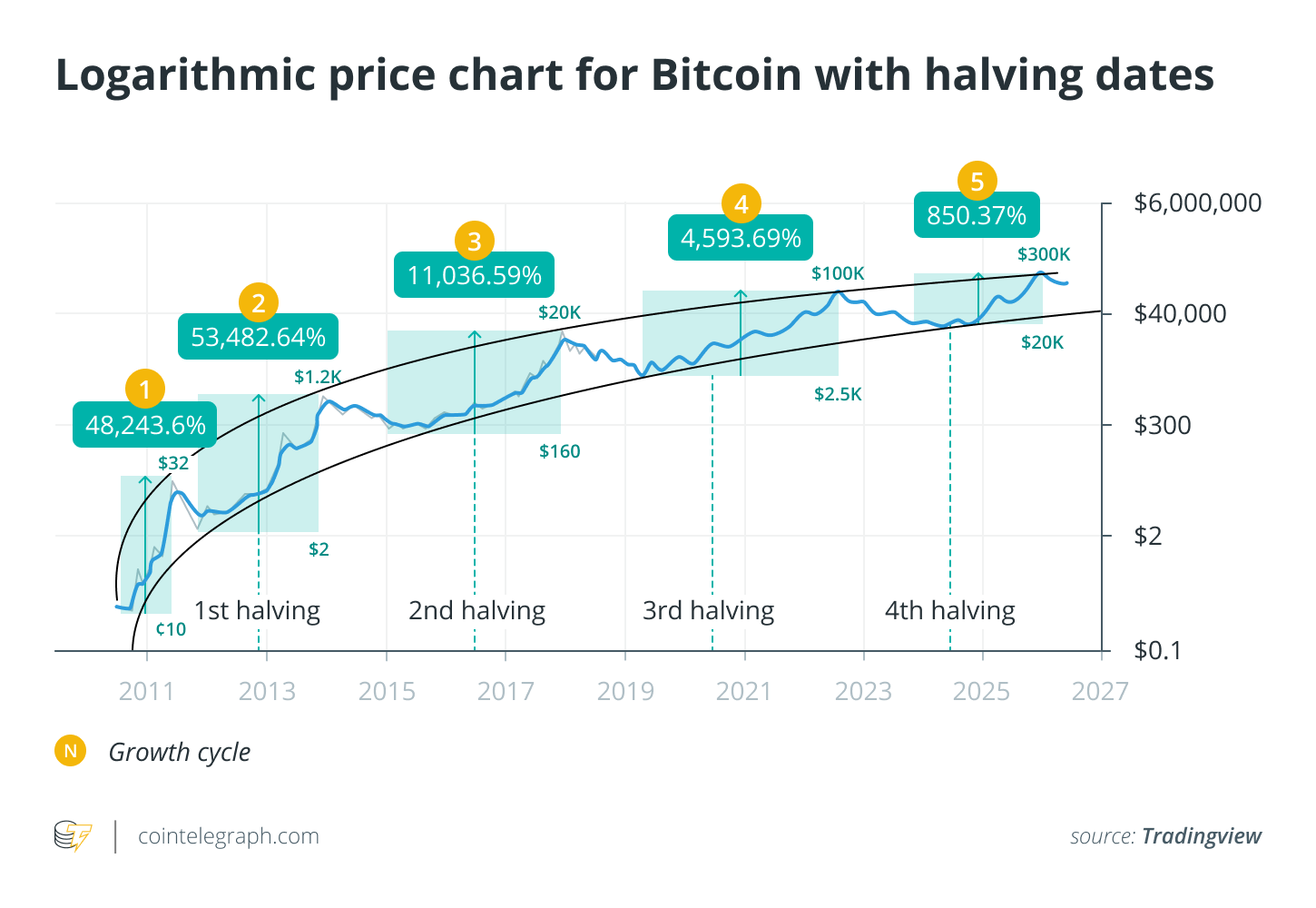

The 2017 Bitcoin bull run thrown around, and also the cost per Bitcoin arrived at almost $20,000. During the time of Alan’s second halving, the procedure whereby the Bitcoin miner reward halves, creating a supply shock, his Bitcoin was starting to grow in financial value.

Within the summer time of 2021, using the cost within the $40,000s, Alan’s mom’s house negotiations emerged in conversation. Alan understood how he could “help out,” and yet, he understood he might take out financing so he didn’t even need to sell.

He chose Celsius, a centralized finance platform coping with decentralized cryptocurrencies to source cash. Despite curiosity about other cryptocurrencies and understanding of decentralized finance (DeFi), Alan described that utilizing a centralized finance provider provides a “lower risk perception,” as they are supported by investment capital:

“You expect they’d be a little more resilient than DeFi protocols. Plus, the 25% ltv is a great limit installed on me because otherwise, I’d most likely liquidate myself.”

On his sister’s birthday, between August 2021, Alan required out a 25% loan-to-value, % interest Bitcoin-backed loan with Celsius. He quickly transferred the cash to his mother to achieve the entire sum needed for that home.

He set up 2.08 BTC as collateral to create $25,000 for that purchase in a loan term period of 36 several weeks. Alan’s mother was overjoyed together with his generosity, and upon learning the money originated from a Bitcoin loan, Alan states she commented, “That’s awesome!”

Related: The 1M euro Bitcoin retirement plan reaches 200K: ‘It’s not very late to invest’

Cointelegraph arrived at to Alex Mashinsky, Chief executive officer of Celsius for comment. He described that it is “an recognition for everyone a residential area that wishes to complete great for others,” adding:

“We hear a whole lot tales about clients who start companies, build companies, buy houses, take care of others, even climb mountain tops by utilizing Celsius loans.”

Alan caveats his Bitcoin-backed loans experience by explaining he has had out further Celsius loans to purchase other activities, but in short of caution: “Sometimes it’s maybe good, sometimes it’s maybe shit.”

Ultimately, Alain described that although “Bitcoin will get a poor ride within the press, the greater good stuff people use it, the greater.” In addition, he’s demonstrated you do not always have to sell your Bitcoin to become generous.

“A large amount of individuals have become incredibly lucky to show small quantities of money into ridiculous piles of wealth. So yeah, provide a bit back somewhere nice. Whether it’s family or simply general charitable organization.”

Alan figured that everybody should “buy your mother a home,” or, even better, he jokes, “buy my mother another house.”