Deriving their names from how big the huge mammals swimming round the earth’s oceans, cryptocurrency whales make reference to individuals or entities that hold considerable amounts of cryptocurrency.

Within the situation of Bitcoin (BTC), someone can be viewed as a whale when they hold over 1,000 BTC, and you will find under 2,500 of these available. As Bitcoin addresses are pseudonymous, it’s ofte hard to determine the master of any wallet.

Even though many associates the word “whale” with a few lucky early adopters of Bitcoin, not every whales are identical, indeed. There are many different groups:

Exchanges: Because the mass adoption of cryptocurrencies, crypto exchanges have grown to be a few of the greatest whale wallets because they hold considerable amounts of crypto on their own order books.

Institutions and corporations: Under Chief executive officer Michael Saylor, software firm MicroStrategy originates to carry over 130,000 BTC. Other publically-traded companies for example Square and Tesla also have bought up large hoards of Bitcoin. Countries like El Salvador also have purchased a great deal of Bitcoin to increase their funds reserves. You will find custodians like Greyscale who hold Bitcoins with respect to large investors.

Individuals: Many whales bought Bitcoin early when its cost was reduced than today. The founders from the crypto exchange Gemini, Cameron and Tyler Winklevoss, invested $11 million in Bitcoin in 2013 at $141 per gold coin, buying over 78,000 BTC. American venture capitalist Tim Draper bought 29,656 BTC at $632 each in a U . s . States Marshal’s Service auction. Digital Currency Group founder and Chief executive officer Craig Silbert attended exactly the same auction and purchased 48,000 BTC.

Wrapped BTC: Presently, over 236,000 BTC is wrapped within the Wrapped Bitcoin (wBTC) ERC-20 token. These wBTCs are mainly stored with custodians who keep up with the 1:1 peg with Bitcoin.

Satoshi Nakamoto: The mysterious and unknown creator of Bitcoin needs a group of their own. It’s believed that Satoshi might have over a million BTC. Although there’s not one wallet which has a million BTC, using on-chain data implies that from the first 1.8 million approximately BTC first produced, 63% haven’t been spent, making Satoshi a multi-millionaire.

Centralization inside the decentralized world

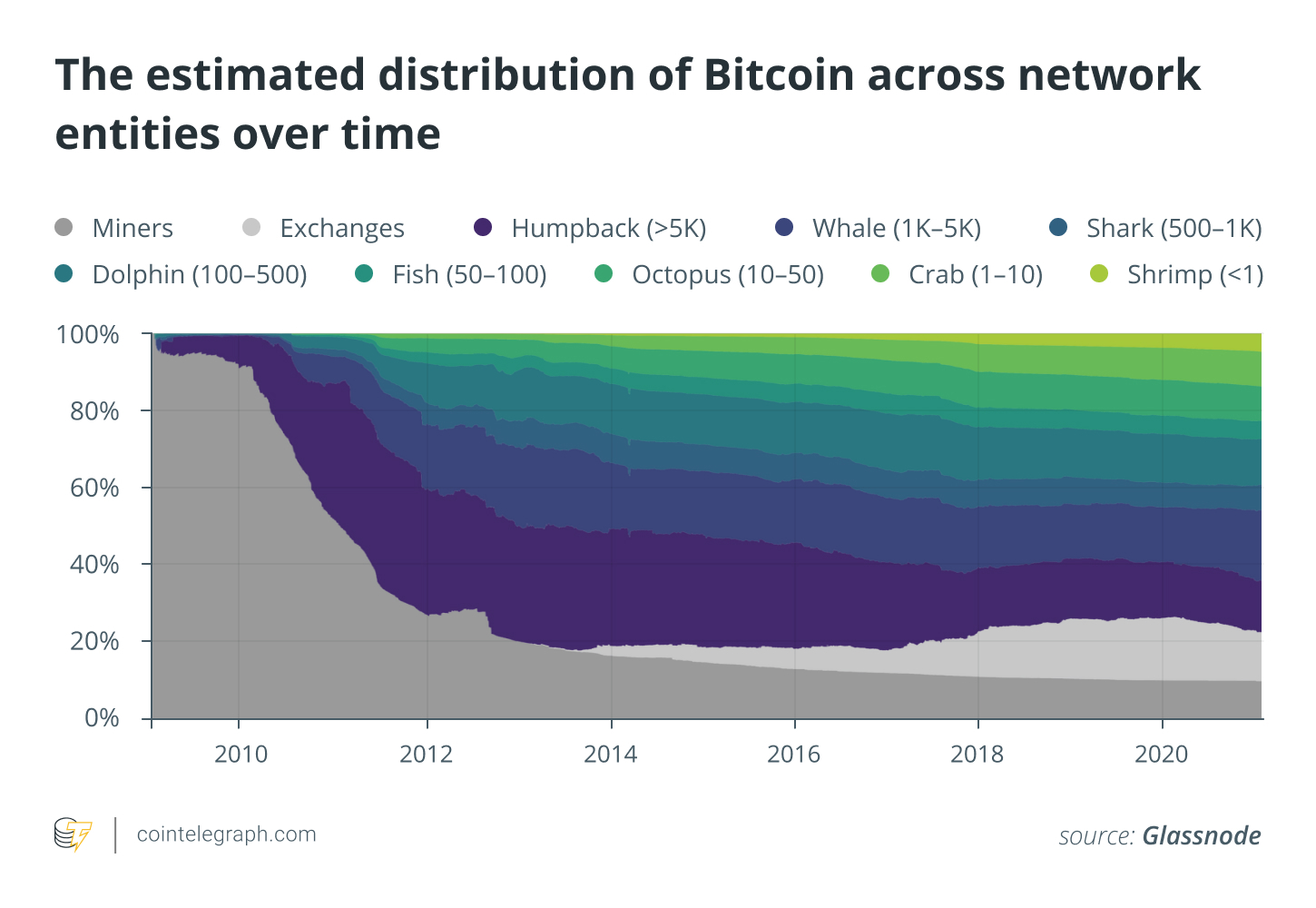

Critics from the crypto ecosystem state that whales get this to space centralized, possibly even more centralized compared to traditional markets. A Bloomberg report claimed that 2% of accounts controlled over 95% of Bitcoin. Estimates condition the top 1% around the globe control 50% from the global wealth, meaning the inequality of wealth in Bitcoin is much more prevalent compared to traditional economic climates: an accusation that breaks the concept Bitcoin could possibly break centralized hegemonies.

The control of centralization within the Bitcoin ecosystem has dire effects that may potentially result in the crypto market easily manipulatable.

However, insights from Glassnode reveal that these figures appear to become exaggerated out on another go ahead and take nature of addresses into consideration. There can be some extent of centralization, but that could be a purpose of free markets. Particularly when there aren’t any market rules and a few whales understand and trust Bitcoin greater than the typical retail investor, this centralization is likely to occur.

The “sell wall”

Sometimes, a whale puts up an enormous to sell an enormous slice of their Bitcoin. They keep your cost less than other sell orders. That triggers volatility, inducing the general decrease in the actual-time prices of Bitcoin. This really is adopted with a squence of events where individuals panic and begin selling their Bitcoin in a cheaper cost.

The BTC cost is only going to stabilize once the whale pulls their large sell orders. So, the cost is how the whales would like it to be to allow them to accumulate more coins in their preferred cost point. The next tactic is actually a “sell wall.”

The alternative of the tactic is called the worry of Really Missing Out, or even the FOMO, tactic. This is where whales put massive buy pressure available on the market at greater prices compared to current demand, which forces bidders to boost the cost of the bids so that they sell orders and fill their buy orders. However, this plan needs substantial levels of capital that aren’t needed to drag off a sell wall.

Watching the buying and selling patterns of whales can often be good indicators of cost movements. You will find websites like Whalemap that focus on tracking every metric of whales and Twitter handles like Whale Alert, that has been helpful information for Twitter users all over the world to remain updated on whale movements.

Whenever a whale constitutes a splash

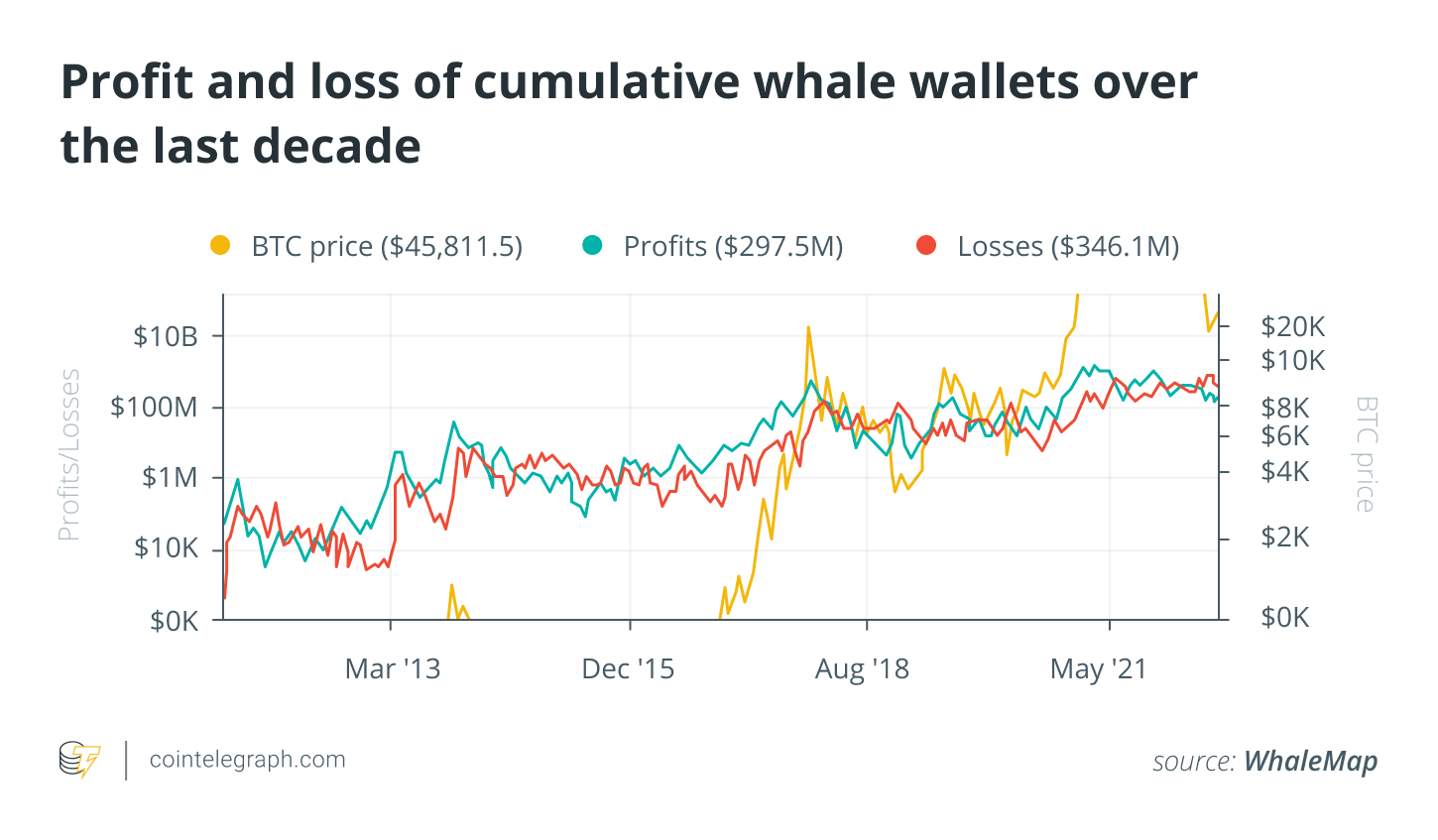

60-four from the best players addresses haven’t yet withdraw or transfer any Bitcoin, showing the greatest whales may be the greatest hodlers within the ecosystem, evidently due to the profitability of the investment.

Evidence that whales mostly stay lucrative is obvious in the above graph. When calculated for any 30-day moving average, within the last decade, whales have continued to be lucrative for more than 70% of times. In lots of ways, their rely upon Bitcoin is exactly what fortifies the cost action. Being lucrative (month-on-month within this situation) during many of their investment period helps reinforce their belief within the hodl strategy.

Even just in 2022, probably the most bearish years within the good reputation for Bitcoin, exchange balances go lower, showing that many HODLers are stocking on their Bitcoin. Most seasoned crypto investors avoid keeping their lengthy-term Bitcoin investments in exchanges, using cold wallets for hodling.

Kabir Seth, the founding father of Speedbox along with a lengthy-term Bitcoin investor, told Cointelegraph:

“Most whales have experienced multiple market cycles of Bitcoin to achieve the persistence to wait for a next one. Within the Bitcoin ecosystem now, the belief of whales is reinforced through the macroeconomics of inflation and much more lately, the correlation using the stock markets. On-chain data of whale wallets reveal that many of them are hodlers. Those that came in this market cycle haven’t made recognized profits to become selling. There’s pointless to think that whales will abandon the Bitcoin ship, particularly when there’s a fiscal anxiety about an impending recession looming.”

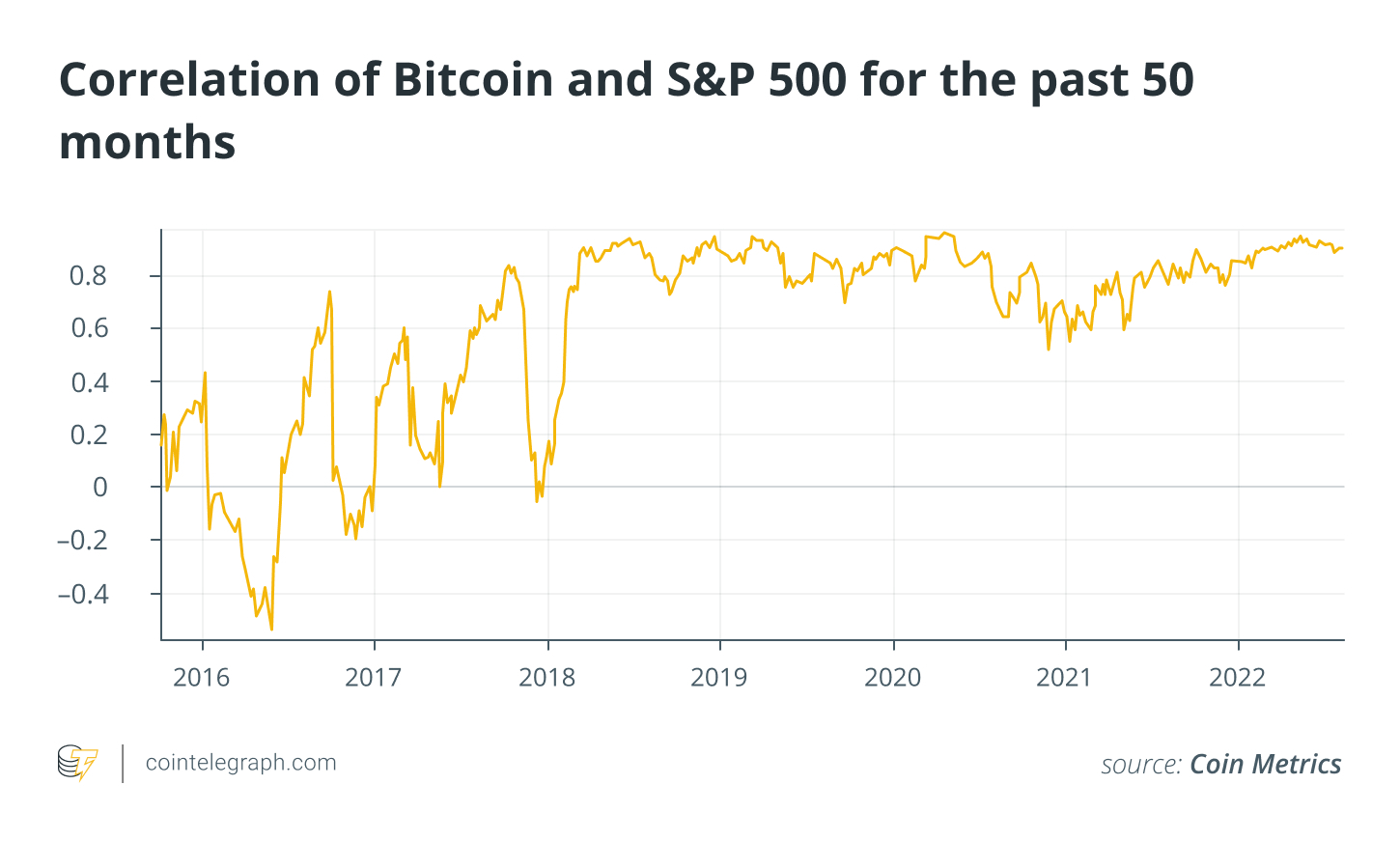

Kabir’s point on macroeconomics and correlation with the stock exchange could be noticed in the graph below, which implies that because the last market cycle at the begining of 2018, Bitcoin has carefully adopted traditional investment assets.

The silver lining within this trend is the fact that Bitcoin has joined the mainstream when it comes to consumer sentiment, altering its status to be a peripheral asset. However, a .6 Pearson correlation using the S&P 500 by no means means a hedge from the traditional markets. Other experts inside the crypto ecosystem also appear to become frustrated with this particular trend.

The correlation using the stock markets is annoying.

— Michaël van de Poppe (@CryptoMichNL) June 7, 2022

Broader macroeconomics may be an essential reason behind the correlation between stocks and Bitcoin. Yesteryear few years saw inflows of funds to stock markets which were unparalleled ever. You will find theories that within an elongated bear market or when it comes to financial catastrophes, the correlation with the stock exchange might break.

Exactly what does it mean whenever a whale sells?

Although, just searching in the on-chain data within the last three several weeks implies that the amount of whale wallets decreased by almost 10%. However, there’s been a corresponding rise in wallets that own from 1 BTC to at least one,000 BTC. The whales appear to become derisking their positions and also the bigger retail investors happen to be accumulating consequently, supplying liquidity towards the whales. The historic trend implies that whenever this happens, you will see a brief-term reduction in Bitcoin prices that will eventually result in whales beginning to strongly accumulate more.

When requested concerning the very recent whale sell-off, Seth stated:

“It’s almost inevitable that you will see some a time period of a couple of days once the Whales will begin selling. This is actually the mechanics of market movements. Presently, the broader market sentiment of Bitcoin would be that the Bottom is within. You will find sentiment analysis tools to verify this. Some whales may be playing from this trend, consequently developing a bigger panic on the market. If there’s a significant sell-off now, Bitcoin prices might tank because the retail support will break. Only whales may have the liquidity to amass then.”

Exactly what the market can study from Kabir’s point and also the whales would be that the way forward for Bitcoin is how one’s bet ought to be. In your area, the sentiments could be manipulated and also the prices could be influenced. However, over time, once the dust settles, hodlers will prevail.