Bitcoin (BTC) has spent more than a year inside a downtrend since its $69,000 all-time highs in November 2021.

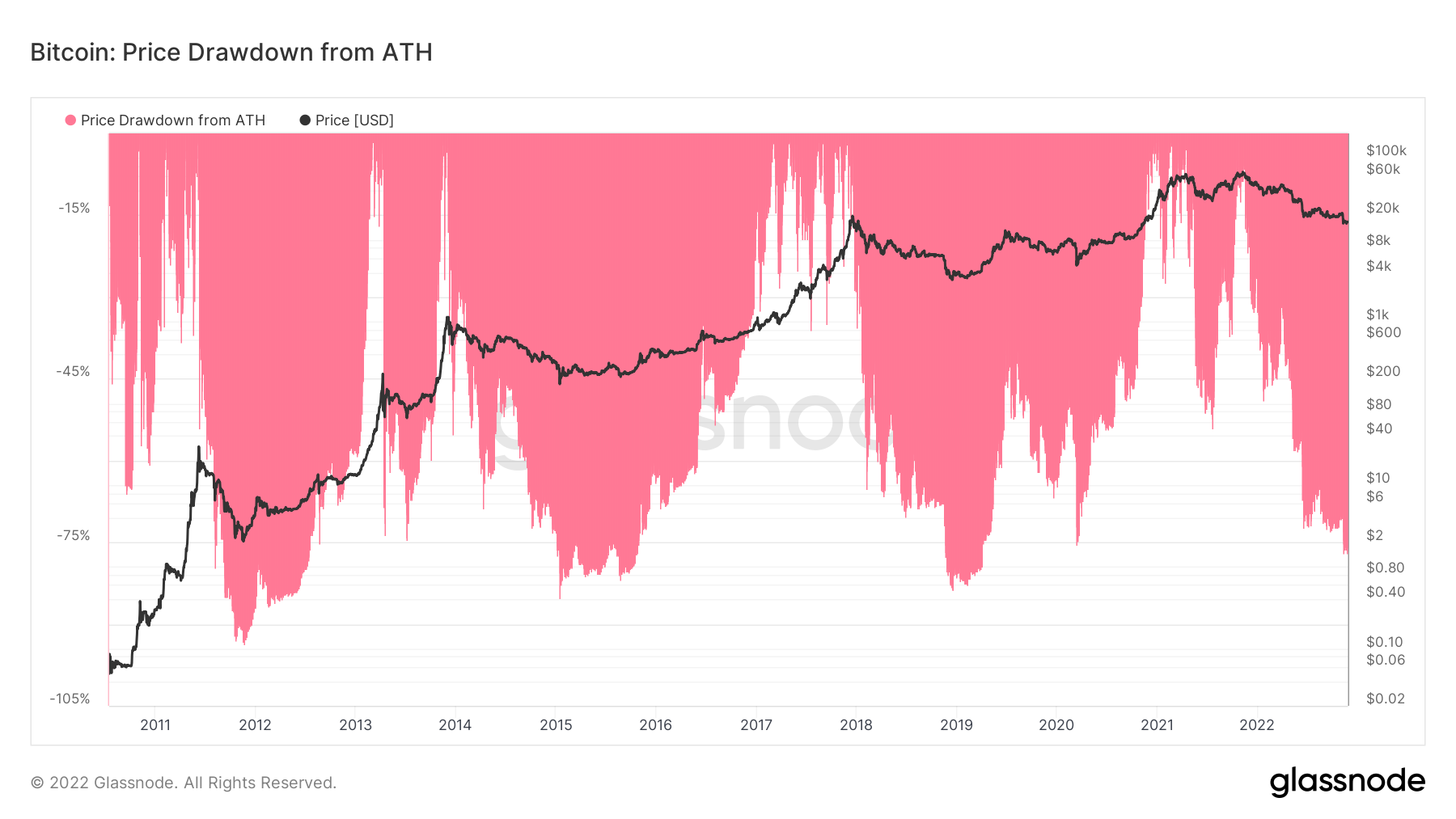

BTC cost performance has provided investors as much as 77% losses, but exactly how reduced can BTC/USD really go?

Bitcoin traders and analysts have lengthy agreed that 2022 may be the year from the largest cryptocurrency’s newest bear market.

After coming off all-time highs to begin the entire year around $46,000, BTC/USD has offered little relief and it has since came back to levels not seen since November 2020, data from Cointelegraph Markets Pro and TradingView confirms.

Which has placed the happy couple in historic bear market bottom territory — getting lost no more than around 77% since the newest peak, Bitcoin might have little room left to fall.

This time around, however, might be different. Cointelegraph analyzes what probably the most popular crypto market commentators think with regards to where Bitcoin will bottom.

CryptoBullet: “Comfortable buying” around $16,000

One well-known social networking personality is sticking with a theory from earlier in 2022 — and it is about a particular on-chain metric.

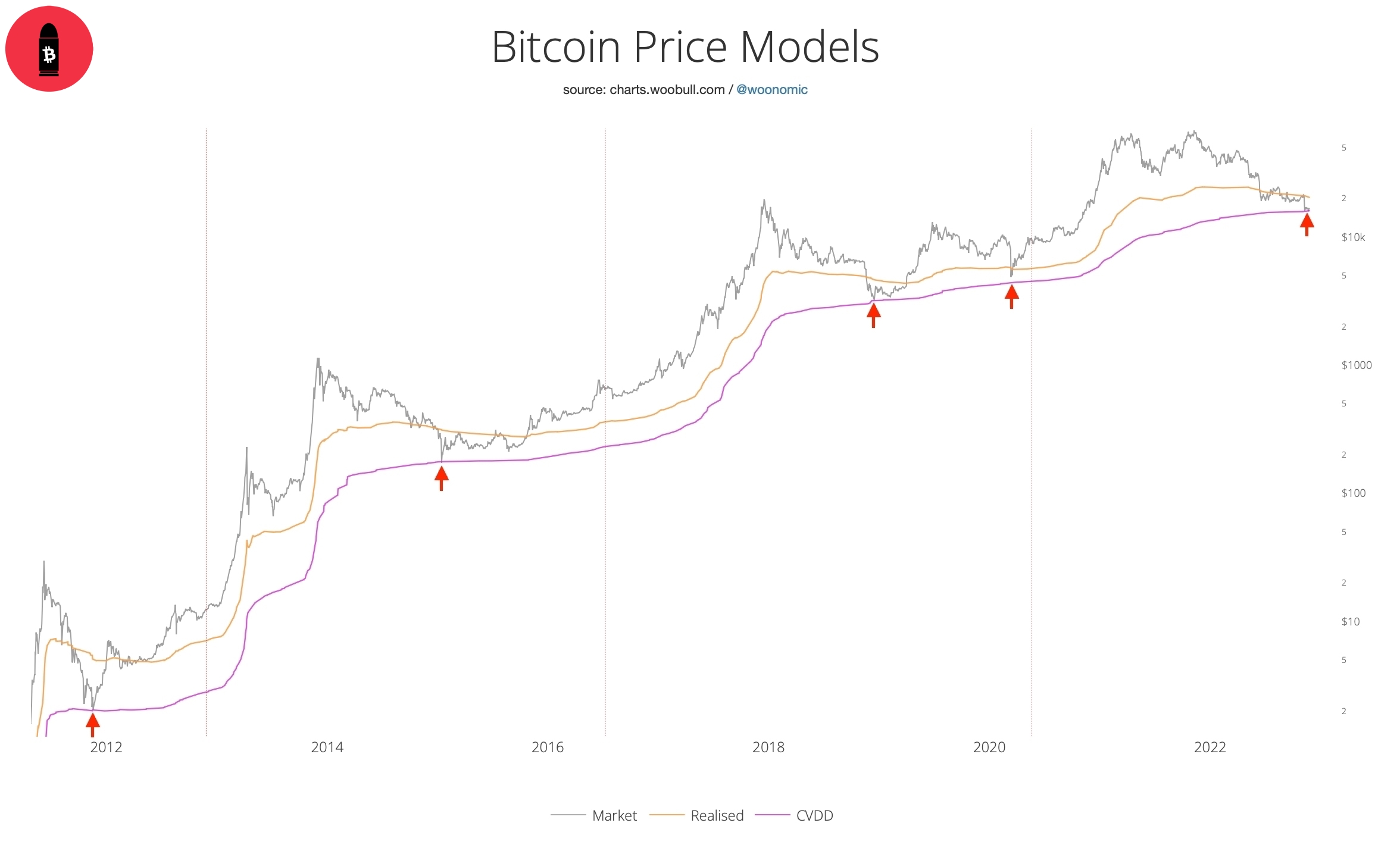

For CryptoBullet, Cumulative Value Days Destroyed (CVDD) still provides a key understanding of macro BTC cost bottoms.

CVDD basically counts just how much “hodled” days a gold coin has accrued if this moves to a different wallet. It’s expressed like a ratio towards the overall chronilogical age of the marketplace, divided by six million, which analytics resource Woobull explains is really a “calibration factor.”

Searching back in its history, CVDD has acted like a significant line within the sand, and when this time around isn’t any different, BTC/USD would be able to give buyers the perfect profit chance.

Based on Woobull, CVDD presently lies around $15,900.

“I feel at ease buying Bitcoin at CVDD,” CryptoBullet told Twitter supporters on November. 26.

“Can it come down? Obviously it may. If another crypto company goes bankrupt as well $BTC will fall below CVDD, although not by much. The majority of the downtrend has ended.”

Filbfilb: $6,500 as “worst situation scenario”

A classic hands within the crypto marketplace is constantly reevaluating precisely how bad the bears may bite now.

Filbfilb, co-founding father of buying and selling suite Decentrader, lately told Cointelegraph that BTC/USD often see $10,000 around 2012 if macro conditions worsen.

Which was prior to the FTX debacle, however, and also the resulting fuel put into the bear market fire is responsible for him to reconsider.

In a livestream along with fellow co-founder, Philip Quick, Filbfilb thus outlined regions of strong bid support as potential bottoms.

These vary, however — a sizable “ladder” of bids lies just beneath place cost and concentrates on $12,000-$14,000. Simultaneously, ultimate support could come as little as $6,000.

Filbfilb furthermore noted that the black swan event for example further crypto bankruptcies might trigger an increase with the upper support field, opening the opportunity of $10,000 or lower next.

A visit to the $6,000 zone, however, is “unlikely” under current conditions, he advised.

Many eyes around the $14,000 prize

Filbfilb’s upper gang of bid support on exchange order books is a well-liked target to have an growing quantity of commentators.

Related: Will Bitcoin hit $110K in 2023? three reasons to become bullish on BTC now

As Cointelegraph reported, $14,000 has become a substantial place around the radar, and records around we already have being planned.

That area would also bring BTC/USD losses versus all-time highs consistent with individuals of previous bear markets.

Not just that, but $13,900 forms a substantial support line on weekly timeframes, trader and analyst Rekt Capital notes, the one that has continued to be untested because the other half of 2020.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.