Bitcoin (BTC) starts its first weeks time of December at three-week highs as bulls and bears fight on.

Following a weekly close just above $17,000, BTC/USD appears going to take full advantage of relief on stocks along with a weakening U.S. dollar.

Because the U . s . States gears as much as release November inflation data, the dollar looks to become a key item to look at as BTC cost action teases a recovery in the pits from the FTX meltdown.

All might not be as straightforward because it appears — miners are facing serious difficulty, data shows, and opinions on stocks’ own capability to continue greater are not even close to unanimous.

Because the finish of the season approaches, will Bitcoin visit a “Santa rally” or face a brand new year nursing fresh losses?

Cointelegraph presents five areas worth watching within the future with regards to BTC/USD performance.

Bitcoin traders diverge over “Santa rally”

Light relief for Bitcoin bulls now comes by means of a good weekly close adopted by an uptick to multi-week highs.

BTC/USD hit $17,418 on Bitstamp within the hrs following the close, using the pair to the greatest levels since November. 11, data from Cointelegraph Markets Pro and TradingView shows.

For traders, there’s need to think that short-term strength may hold, allowing Bitcoin to mind nearer to $20,000.

“No switch to my expectations. Still searching for 19k+,” Credible Crypto confirmed to Twitter supporters on 12 ,. 4.

“$BTC has created a pleasant tight consolidation here following a clean impulse on low time period. May use 16k’s first to get these developed lows but nonetheless expecting continuation up after regardless.”

Fellow trader Dave the Wave meanwhile put belief inside a Christmas rally coming next, while some, including popular commentator Moustache, stated that time it was in the past suitable for recovery.

Evaluating the 2022 bear sell to previous ones, he described that BTC/USD should certainly be locating a bottom, 31 days after its last all-time high.

“The Bitcoin bottom ought to be very close,” he reiterated in the weekend.

Not everybody, however, is really positive. For Crypto Kingpin, there’s room for any proceed to $18,000 before Bitcoin starts “heading lower.”

Whilst not mentioning exact downside targets, he described the weekly close as “conflicting.”

“im still from the belief for the time being this progress on btc belongs to a corrective abc w4 prior to making a brand new low sub $15k into Q1 2023 where we discover an extended term bottom,” one other popular trader, Bluntz, tweeted following the weekly close.

Similarly conservative on lower timeframes is trader Korinek_Trades, who despite with a “huge relief bounce” on Bitcoin acknowledged that downside might take it as little as $12,000.

Crypto voices careful on stocks among “imminent” crash claim

The approaching week in macro marks the precursor towards the all-important U.S. Consumer Cost Index (CPI) print for November, due 12 ,. 13.

Meanwhile, U.S. Producer Cost Index (PPI) and unemployed data later within the week is going to be dates to look out for traders, these typically sparking a minimum of short-term volatility.

Eyeing U.S. equities, meanwhile, a dark tone among crypto traders and beyond seems tense, despite recent strength when confronted with a declining dollar.

The S&P 500 (SPX) finished a few days prior up 1.66% at 4,071 points.

“Unless we remove 4,300 on volume and remain above, this in my experience is really a propped-up rally. Might take a couple of days to climb mind,” Crypto Tony cautioned over the past weekend.

An additional tweet revealed doubts about Bitcoin staying away from knock-on effects despite already considerably underperforming stocks within the wake of FTX.

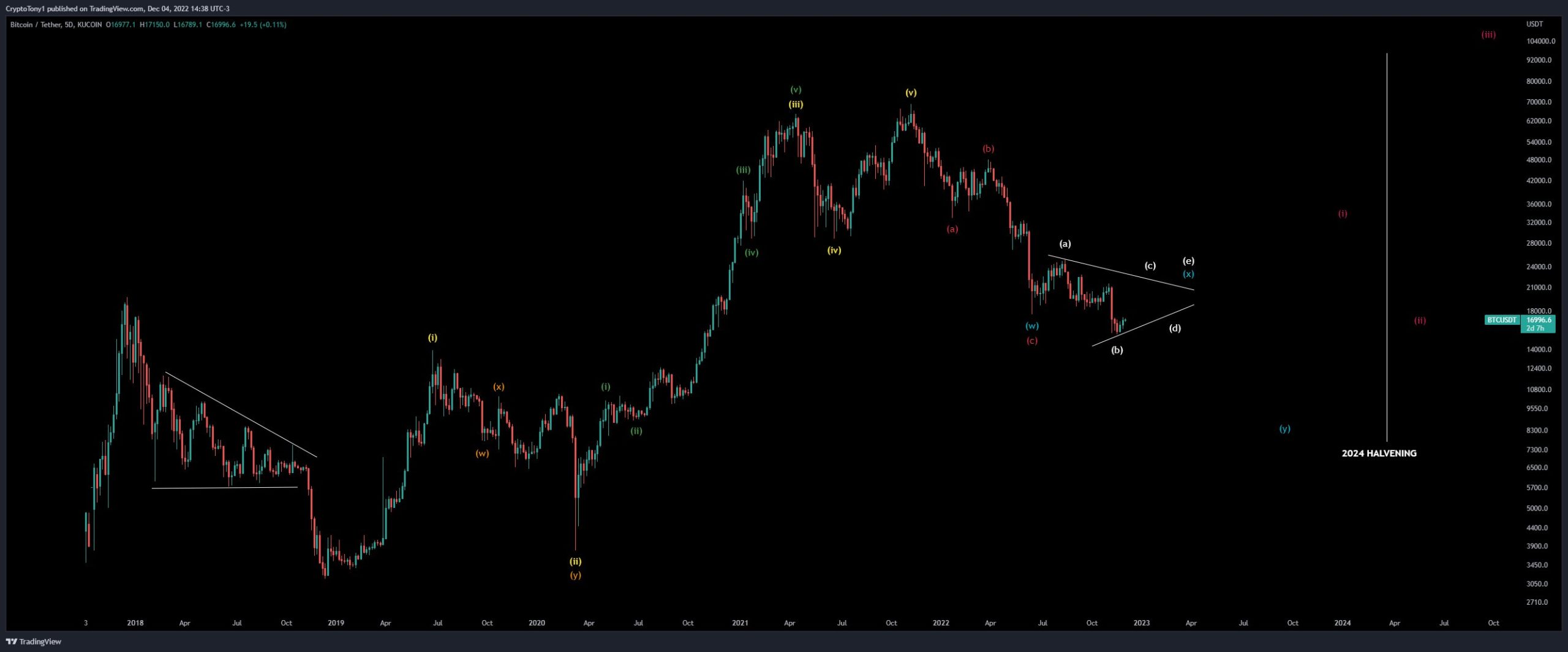

“This is an extremely plausible scenario,” Crypto Tony commented alongside a chart.

“If we all do indeed visit a continuation crash in the stock exchange because of high interest, defaults etc, I expect Bitcoin to follow along with. For now we’ll simply range for me while you will find minimal buyers.”

That sentiment echoed a forecast from popular commentator, Nunya Bizniz, who earlier recommended the SPX may include a “Santa rally” before reversing.

The starkest outlook on equities originated from Michael A. Gayed, the famous portfolio manager and author of investment strategy circular, “The Lead-Lag Report.”

Within an extensive Twitter digest on 12 ,. 3, Gayed went beyond caution, telling readers that the “imminent stock exchange crash” was next.

“My point is there are lags which markets possess a funny method of surprising everyone else from nowhere,” a part of one publish read.

“It isn’t impossible to determine a predicament in which the butterfly produces the hurricane.”

He added that FTX had itself produced unusual market responses even beyond crypto.

Miners already in “giant capitulation”

The FTX saga is starting to exhibit itself within the struggles of Bitcoin miners for an growing extent.

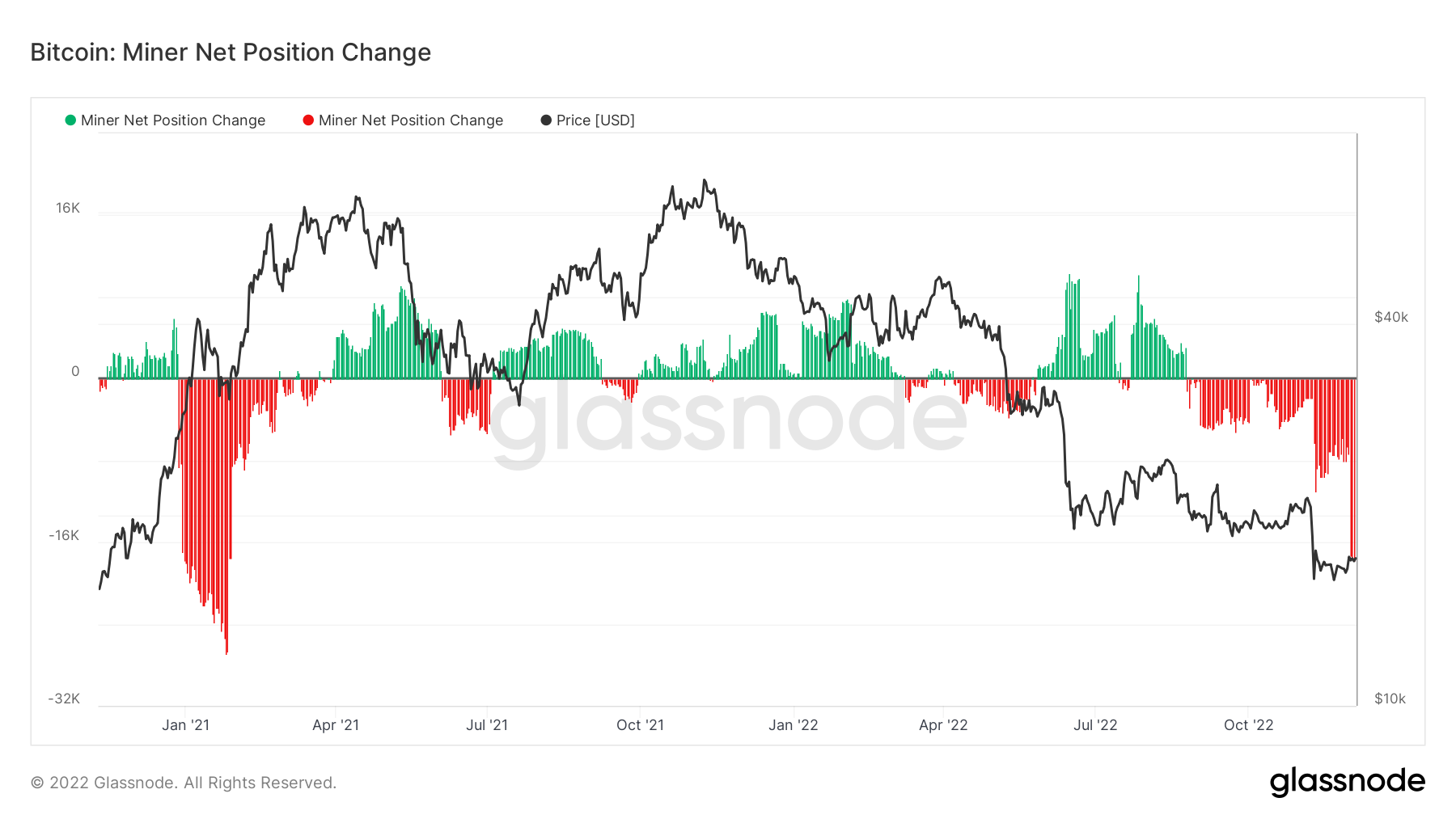

The most recent data implies that the 30-day alternation in the BTC supply locked in miner wallets reaches its most negative since the beginning of 2021.

The figures, from on-chain analytics firm Glassnode, come by means of the Miner Internet Position Change metric. By 12 ,. 3, miners were overall lower 17,721 BTC over thirty days.

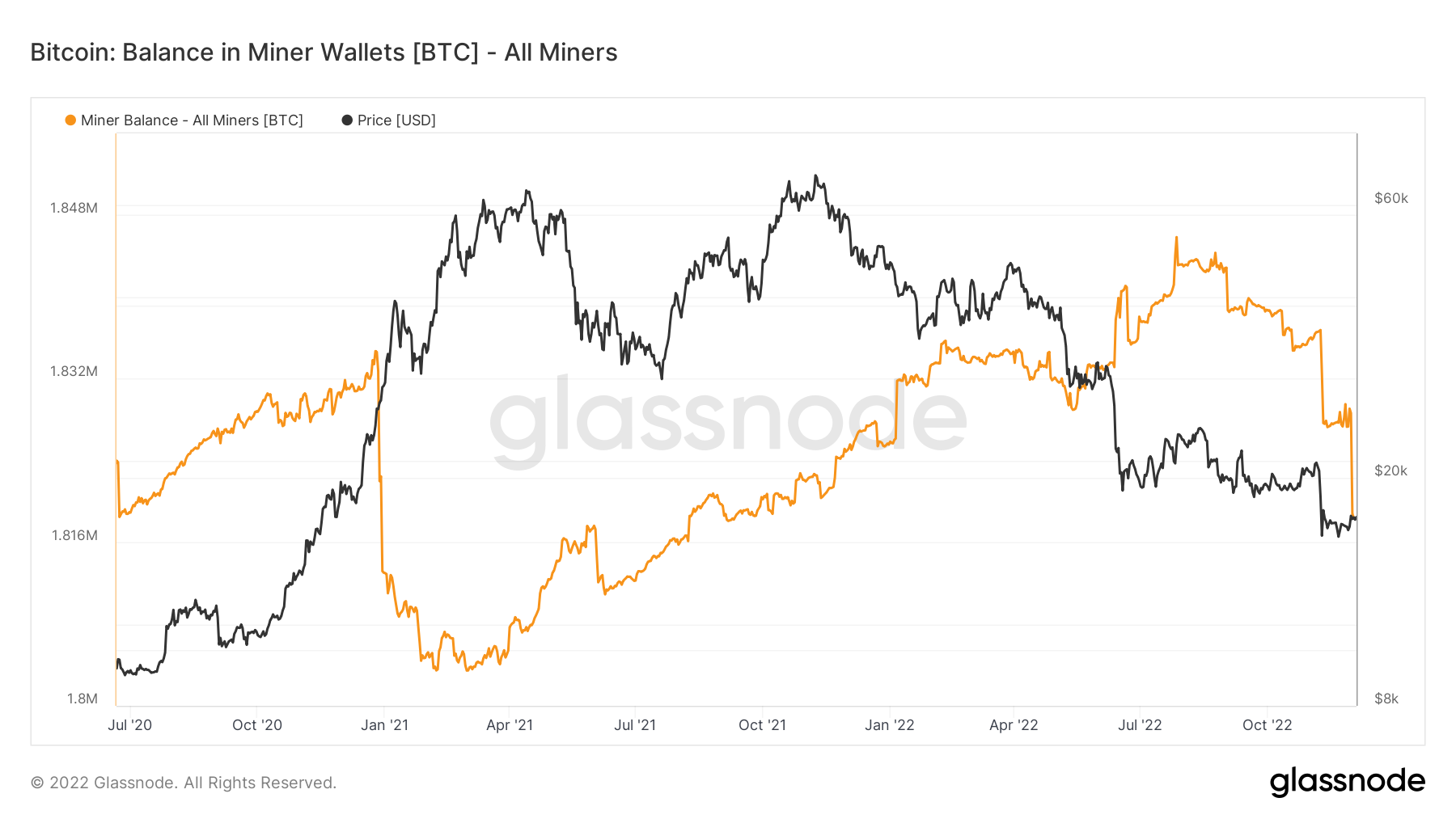

Additional data confirmed miners’ overall BTC balance investing in an additional steep decline at the beginning of December, shedding from 1,828,630 BTC on November. 30 to at least one,818,303 BTC on 12 ,. 3.

The final time that miners’ balances were that low is at September 2021.

As BTC/USD fell 16% during the period of November, miners all of a sudden experienced already slim margins squeezed beyond the purpose of no return.

What this means is “capitulation” because they unplug, commentators argue, and a time period of flux has become entering.

“November would be a horrible here we are at BTC miners,” popular analyst Satoshi Stacker summarized.

“Bitcoin miners choose to go bankrupt in the past cycles before things improved. We are in the center of a huge Bitcoin mining capitulation now.”

An associated listing of harsh financial is a result of public miners underscored the idea.

As Cointelegraph reported, Bitcoin’s Hash Ribbons metric has already been flagging a capitulation phase within the making, its two moving average crossing over just several weeks after miners exited their last capitulation.

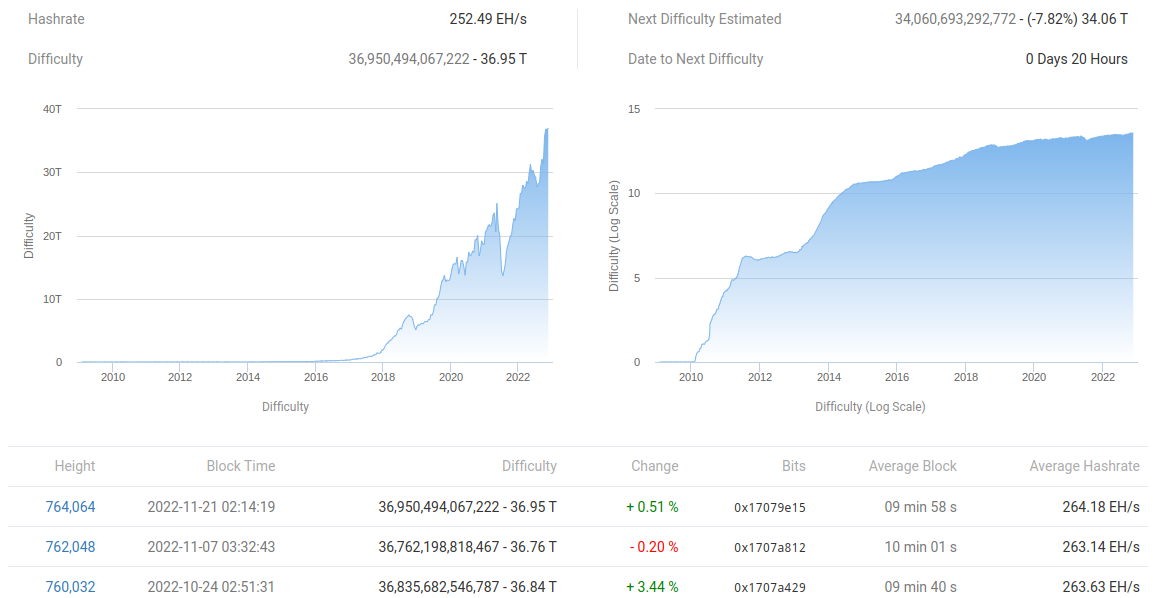

Difficulty looking for greatest stop by 17 several weeks

With Bitcoin miners under stress, network fundamentals are starting to mirror alterations in activity.

At its next automated readjustment on 12 ,. 6, mining difficulty will visit an believed 7.8%, based on data from BTC.com.

The days following a FTX meltdown have created curious alterations in network participation, and analysts have recommended various explanations why fundamentals have diverged from cost action.

As Cointelegraph reported, one theory even contended that Russia was cornering the marketplace with the addition of significant hashing power despite miners en masse seeing considerably reduced profitability.

While hash rate was still being growing after FTX and also the subsequent BTC cost decline, toward the finish of November, things started to alter. Hash rate fell from near all-time highs, and complications with it.

The forthcoming reduction in difficulty may even constitute Bitcoin’s largest since This summer 2021, whenever a single readjustment first viewed it visit over 27%.

Meanwhile, for Timothy Peterson, investment manager at Cane Island Alternative Advisors, there’s even need to think that difficulty may preclude a macro BTC cost bottom.

Inside a tweet on November. 29, he contended that whenever the 200-day moving average of BTC/USD and it is “difficulty value” — a problem-derived BTC cost value — converge, it’s in the past meant a bottoming formation.

“A bitcoin buy signal is at sight. Caveat: according to historic relationships which might no more hold,” he commented.

“Still, I believe difficulty is a great indicator of the minimum degree of interest in bitcoin. The convergence reaches 12k, meaning cost should be +/- 12k for 200 days.”

This type of formation, associated charts demonstrated, might not enter until the center of 2023.

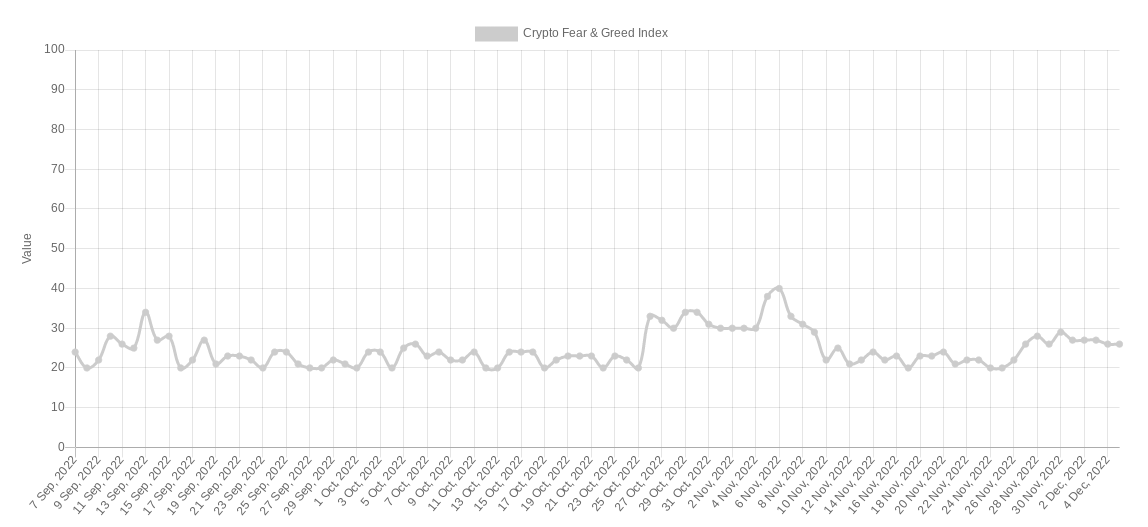

Sentiment avoids “extreme fear”

As Bitcoin cost action staves off further macro lows, sentiment can also be shunning volatility.

Related: Just how much is Bitcoin worth today?

Ever-popular sentiment gauge, the Crypto Fear & Avarice Index, remains associated with a place just above its “extreme fear” zone.

Getting dropped consistent with cost following FTX, a modest recovery continues to be going ahead, regardless of the overall impression that new lows are due.

The curious divergence to a lot of commentators’ prognoses is increased through the condition of matters “on the ground” for investors themselves.

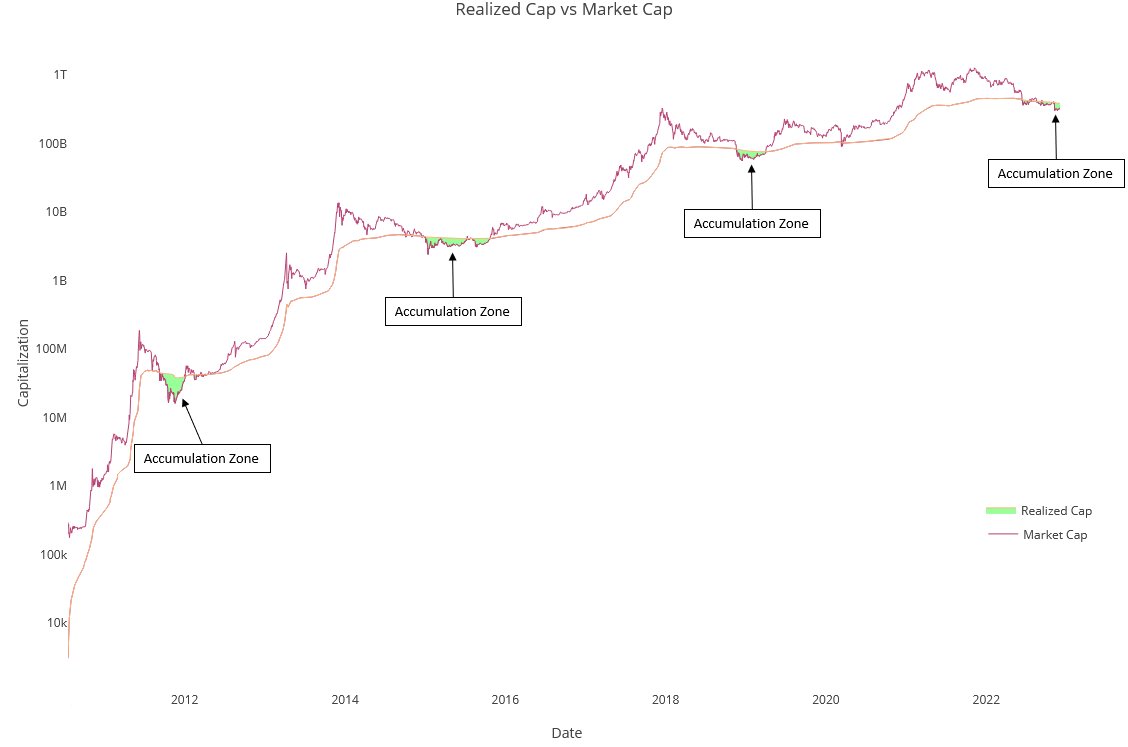

As Cointelegraph reported, recognized and unrealized losses for that BTC supply are hitting levels never witnessed before, and in general, the availability is within internet loss, as reported by the market price to recognized value (MVRV) metric.

MVRV compares Bitcoin’s market cap to the recognized cap — the mixture cost where the availability last moved. Once the latter crosses underneath the former, it’s signaled cost bottoming structures.

Describing individuals structures being an “accumulation zone,” meanwhile, popular commentator CryptoNoob stated that current conditions may even constitute a “lifetime investment opportunity” for Bitcoin.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.