The miners who power the Bitcoin network, and still largely incentivized to do this through the printing of recent BTC tokens, are benefitting from your uptick in daily network charges, based on data supplied by crypto analytics firm Glassnode. At the moment the Bitcoin network rewards its miners with 6.25 Bitcoins for each block it found (about every ten minutes), although the Bitcoin network also charges a little fee for transactions, that also goes towards miners.

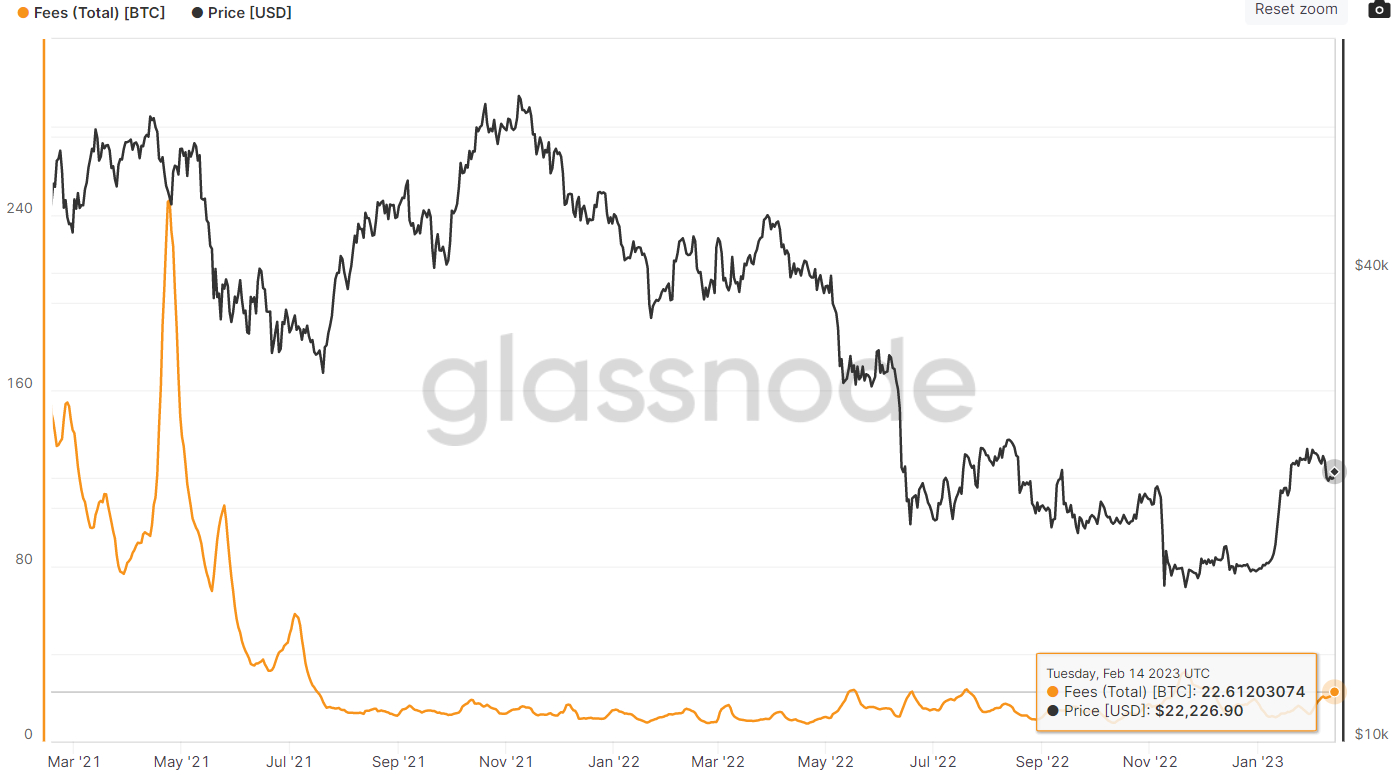

On Tuesday, the seven-day moving average of the fee just arrived at its greatest since early December 2022 at 22.6 BTC. That’s substantially over the 365-day moving average of just around 15 BTC. Which uptick in charges differs towards the uptick observed in Q4 this past year. This past year, Bitcoin proprietors were scrambling to have their BTC off exchanges in wake from the FTX collapse. The charge uptick coincided having a short-resided increase in network activity along with a loss of the BTC cost.

This time around, the uptick in BTC fee revenues coincides with a boost in Bitcoin’s cost forever of the season. Based on Glassnode, “a sustained uptick in fee revenue like a proportion from the total reward signifies that Bitcoin blocks are full, and there’s growing interest in transaction activity”. “Given the restricted block size Bitcoin, it has in the past provided an invaluable early indicator of the macro trend transfer of the network demand profile,” they add.

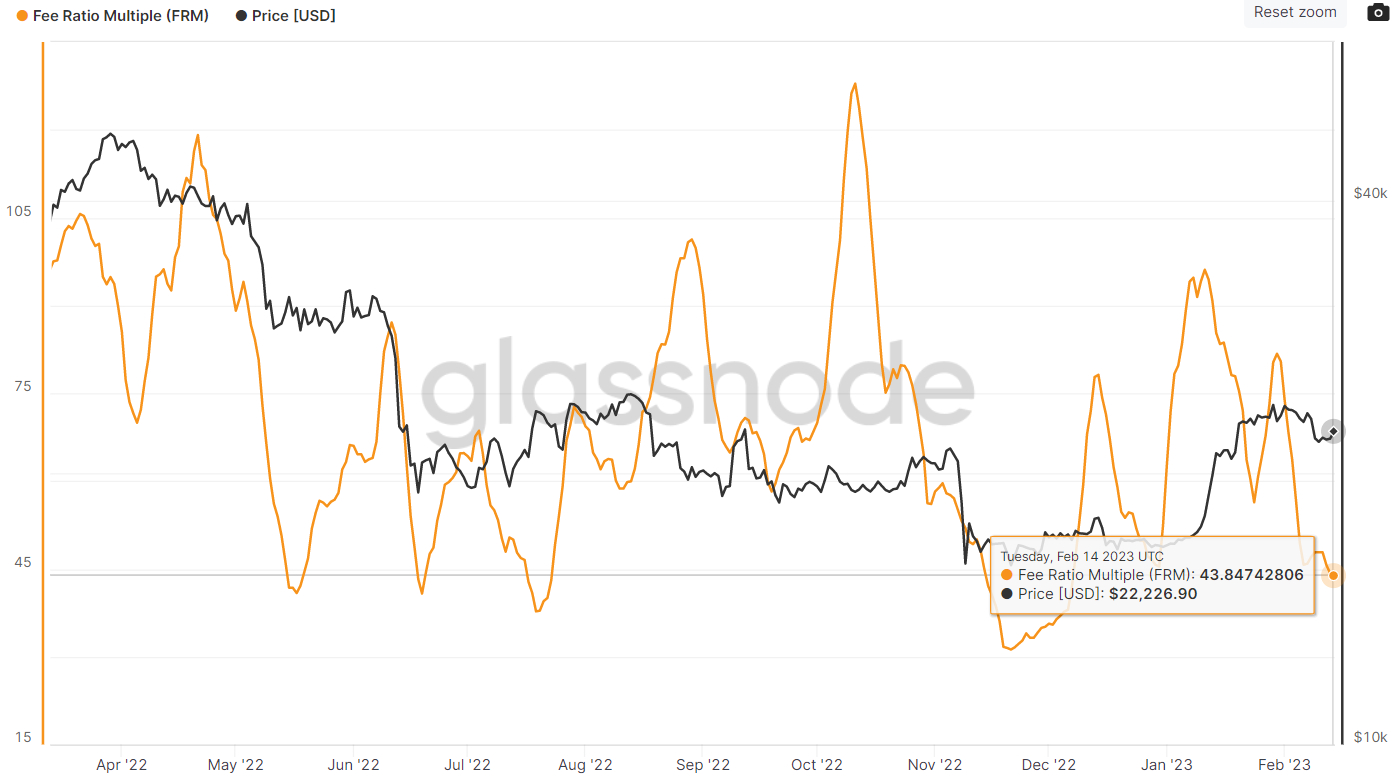

The increase in the BTC-denominated seven-day moving average of daily Bitcoin network charges coincides having a fall in Glassnode’s Bitcoin Fee Ratio Multiple. This multiple is calculated by dividing total miner revenue (including recently minted BTC) by daily network charges. If this multiple goes lower, this means a greater number of Bitcoin miner revenue is originating from network charges. The seven-day Bitcoin Fee Revenue Multiple was last around 43.8 on Tuesday, its cheapest since early December 2022 and well below its 365-day moving average close to 70.

Fee Revenue Momentum Going to Send Bullish Signal for BTC?

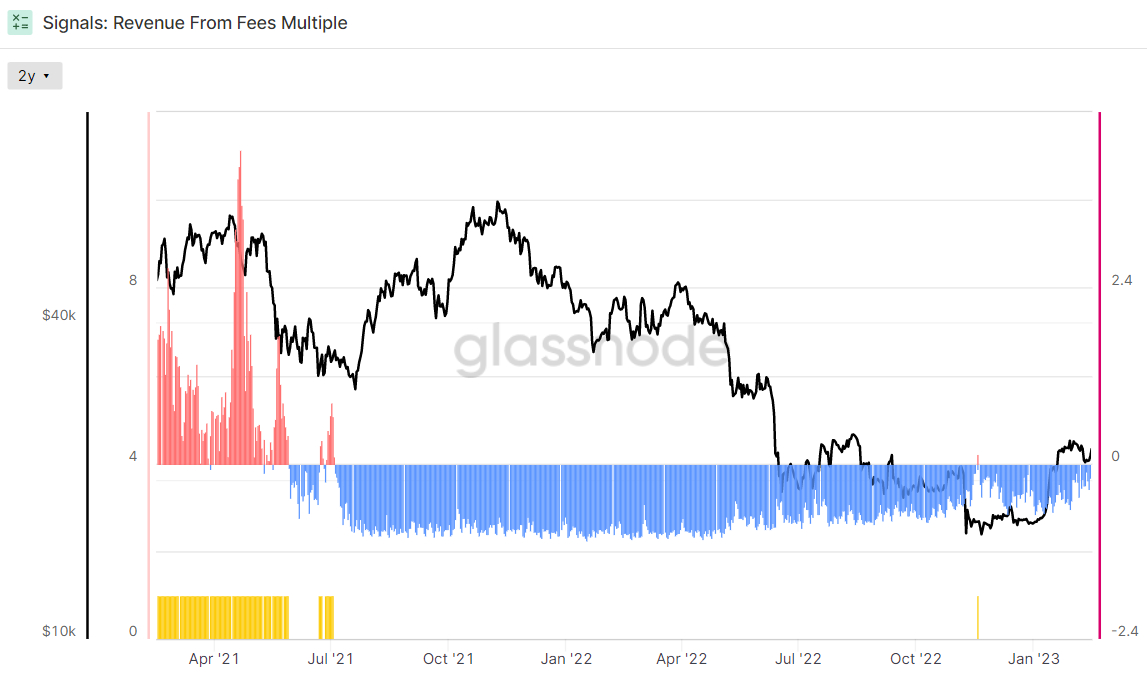

The uptick in BTC-denominated Bitcoin network charges implies that an essential indicator tracked by analysts at Glassnode may be going to turn positive and send its first bullish signal for that Bitcoin market since 2021 (excluding a brief-resided false signal it sent last November). To provide some context first, Glassnode includes a popular dashboard it uses to gauge when Bitcoin may be staging a recovery from the bear market known as “Recovering from the Bitcoin Bear”.

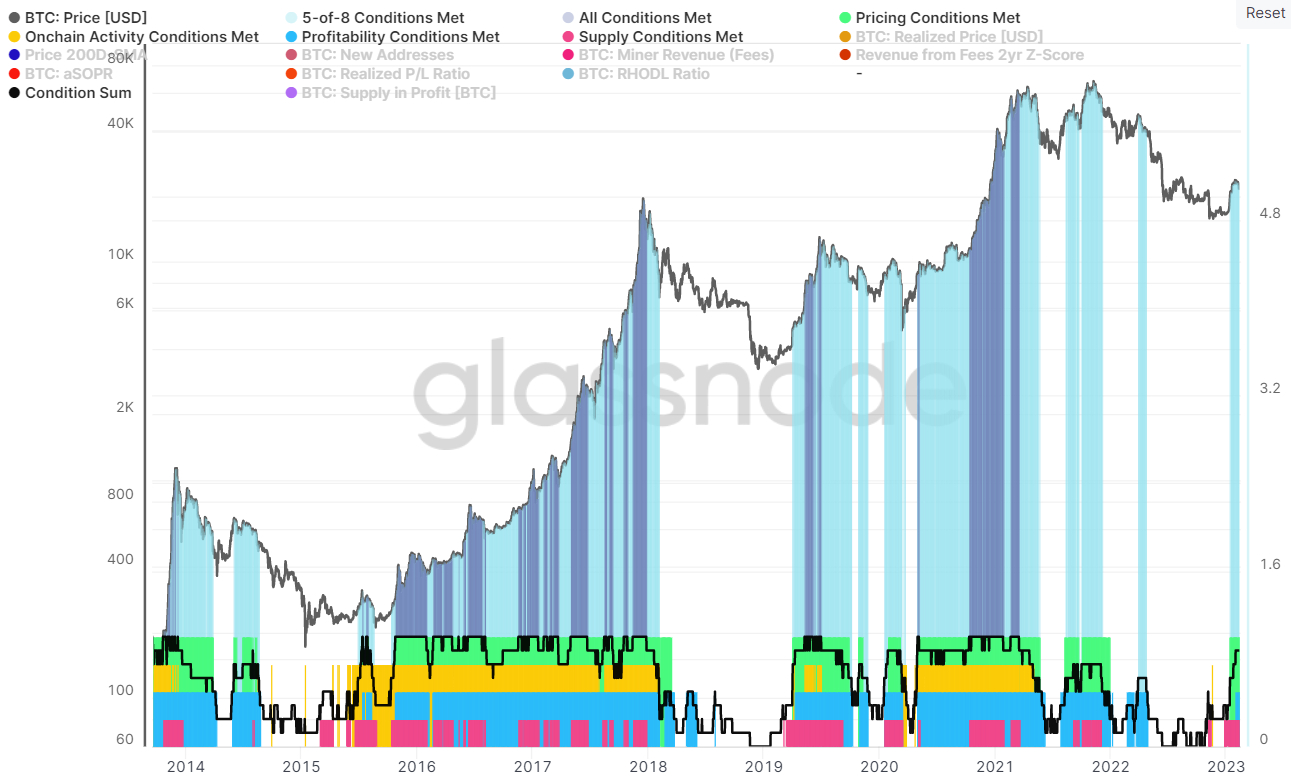

The dashboard monitors eight on-chain and technical metrics. Two take a look at whether Bitcoin is buying and selling above key prices models (the 200DMA and Recognized Cost). Two take a look at whether market profitability is coming back. Two take a look at if the balance of USD wealth has shifted sufficiently in support of longer-term HODLers. The ultimate two take a look at whether momentum around the Bitcoin network has shifted inside a positive direction.

Seven of those eight metrics are flashing bullish signals the Bitcoin bear market of 2022 may be over, as discussed inside a recent article. The only real metric not flashing a bullish signal is Glassnode’s 2-year Z-score from the Revenue Fee Multiple – to get this done, the two-year Z-score must turn positive. For reference, the two-year Z-score is the amount of standard deviations below or above the mean from the latter years’ price of data.

However, among the current increase in BTC-denominated network charges which has driven an autumn within the Fee Revenue Multiple, the Z-score gets not far from zero and can soon turn positive, thus end up being the eighth from Glassnode’s eight metrics to flash eco-friendly. The Z-score continues to be trending greater since the beginning of the entire year and it was last around -.15.

What This Signifies for BTC?

When the 2-year Z-score from the Bitcoin Revenue Fee Multiple turns positive, all eight of Glassnode’s “Recovering from the Bitcoin Bear” dashboard indicators is going to be flashing eco-friendly in symphony the very first time in nearly 2 yrs. Once the dashboard switches from under eight of their indicators flashing eco-friendly to any or all eight, this doesn’t itself mean anything for that Bitcoin cost. Because the graphic below demonstrates, throughout a Bitcoin bull market, it’s quite common to determine the dashboard switching between eight and under eight indicators flashing eco-friendly.

Furthermore significant here’s considering as soon as when all eight from the indicators from the dashboard start flashing eco-friendly the very first time following a prolonged Bitcoin bear market. The final time this happened was during October 2020, when Bitcoin was buying and selling around $11,500. By April 2021, Bitcoin had surged in to the $63,000s. Just before October 2020, all eight indicators hadn’t been flashing eco-friendly since This summer 2019, apart from a short period in April 2020.

Other types of when all eight indicators began flashing eco-friendly the very first time inside a lengthy time carrying out a prolonged Bitcoin bear market use in May 2019 as well as in October 2015. Many of these past aforementioned instances represent excellent moments to possess bought Bitcoin. If all eight of Glassnode’s Dealing with a Bitcoin Bear indicators start flashing eco-friendly, just might be likely, analysts might thus interpret this like a signal that Bitcoin’s risk-reward at current cost levels is excellent indeed.