Bitcoin (BTC) is enjoying what many are calling a “bear market rally” and it has acquired 20% in This summer, but cost action continues to be confusing analysts.

Because the This summer monthly close approaches, the Puell Multiple leaves its bottom zone, resulting in hopes the worst from the losses might be previously.

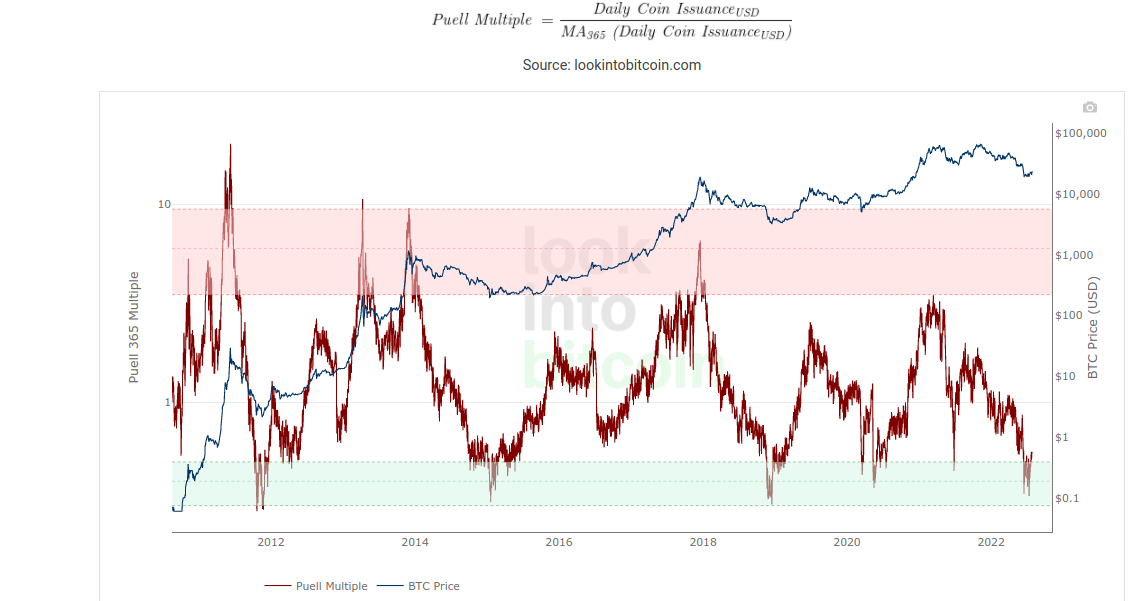

Puell Multiple tries to cement breakout

The Puell Multiple among the best-known on-chain Bitcoin metrics. Its dimensions are the need for found bitcoins on the given day when compared to worth of individuals found previously one year.

The resulting multiple can be used to find out whether a day’s found coins is especially low or high in accordance with the year’s average. From that, miner profitability could be deduced, together with more general conclusions about how exactly overbought or oversold the marketplace is.

After hitting levels which typically accompany macro cost bottoms, the Puell Multiple has become aiming greater — something typically seen at the beginning of macro cost uptrends.

“According to historic data, the breakout out of this zone was supported by gaining bullish momentum within the cost chart,” Grizzly, a contributor at on-chain analytics platform CryptoQuant, authored within the firm’s “Quicktake” market updates on This summer 25.

The Multiple isn’t the only signal flashing eco-friendly in current conditions. As Cointelegraph reported, accumulation trends among hodlers will also be suggesting the macro bottom has already been in.

“Unparalleled macroeconomic conditions”

After its surprise relief bounce within the other half of the month, Bitcoin has become near its greatest levels in six days and from the new macro low.

Related: Bitcoin futures data shows ‘improving’ mood’ despite -31% GBTC premium

As sentiment exits the “fear” zone, market watchers are going to unique phenomena which keep the 2022 bear market very hard to predict with any certainty.

In another of their recent “Quicktake” research pieces, CryptoQuant noted that even cost trendlines aren’t serving as normal now.

Particularly, BTC/USD has crisscrossed its recognized cost level several occasions in recent days, a thing that didn’t exist in prior bear markets.

Recognized cost may be the average where the BTC supply last moved, and presently sits just beneath $22,000.

“The Recognized Cost has signaled the marketplace bottoms in the past cycles,” CryptoQuant described.

“More to the point, the bitcoin cost didn’t mix the Recognized Cost threshold over the past two periods (134 days in 2018 and seven days in 2020). Yet, since June 13, it entered backwards and forwards this level three occasions, which shows the distinctiveness of the cycle because of unparalleled macroeconomic conditions.”

Individuals conditions, as Cointelegraph reported, came by means of forty-year highs in inflation within the U . s . States, rampant rate hikes through the Fed and many lately signals the U.S. economy has joined an economic depression.

Additionally to recognized cost, meanwhile, Bitcoin has created a unique relationship to the 200-week moving average (MA) this bear market.

While normally retaining it as being support with brief dips below, BTC/USD were able to switch the 200-week MA to resistance the very first time in 2022. It presently sits around $22,800, data from Cointelegraph Markets Pro and TradingView shows.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.