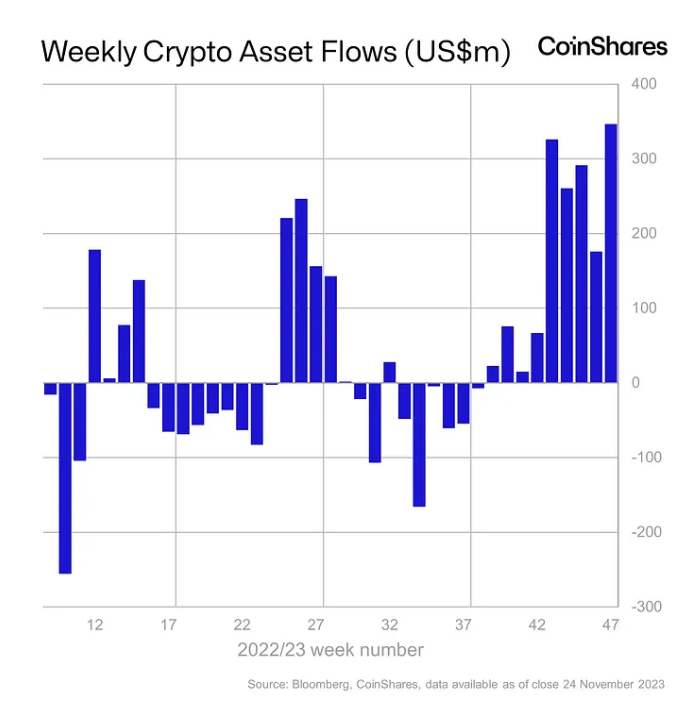

Bitcoin (BTC) exchange-traded products (ETPs) registered $312 million in inflows for that week of November. 24, getting year-to-date inflows close to $1.5 billion, according to CoinShares. The weekly inflows for those cryptocurrencies totaled $346 million, ongoing a nine-week trend of positive internet flows.

New record of inflows aroundDollar346m now, the greatest total observed previously 9 days of inflows.

– #Bitcoin –

$BTC: US$312m inflows (year-to-date inflows US$1.5bn)

Short Bitcoin: US$.9m outflowsETP volumes like a number of total place Bitcoin volumes… pic.twitter.com/gMUPzTy0q4

— CoinShares (@CoinSharesCo) November 27, 2023

Crypto ETPs experience inflows when their shares trade over the prices of the underlying assets, whereas they experience outflows when their shares trade below the need for their underlying assets. Because of this, inflows are frequently seen as an bullish indicator for that overall crypto market, whereas outflows are frequently viewed as bearish.

Before Sept. 25, crypto ETPs had experienced outflows for many days, based on the report. But starting in a few days of Sept. 25–29, the sphere started experiencing sustained weekly inflows. The quantity of inflows also elevated with time. A few days ending on November. 24 saw the biggest inflows from the entire nine-week period.

CoinShares mentioned that Canadian and German ETPs composed the biggest part of inflows for that week, at 87%. U . s . States inflows were subdued at $$ 30 million.

Crypto funds in general are in possession of $45.4 billion in assets under management, the greatest in 18 several weeks.

Inside a previous report, CoinShares speculated these recent inflows might be affected by growing optimism that the U.S. place Bitcoin ETF is going to be approved. On November. 22, BlackRock met using the U.S. Registration so that they can make progress toward this goal. Grayscale met using the SEC for similar reasons.