Bitcoin (BTC) is supplying overwhelming evidence that it’s capitulating, and it’s time to switch bullish consequently, new analysis believes.

Inside a Twitter thread on August. 3, Charles Edwards, Chief executive officer of crypto asset manager Capriole, revealed what he known as the “The 12 Bitcoin Capitulations.”

“Risk-returns skewed positively” for Bitcoin

With BTC cost action dealing with multi-year lows but nonetheless hovering near key bear market support, opinions vary broadly in regards to what may happen next.

Many are demanding coming back to levels even less than June’s $17,600 trough, while some reason that a “bear market relief rally” might take BTC/USD up to $40,000 first.

For Edwards, the raw evidence shows that yesteryear several weeks happen to be bearish enough, which behind the curtain, Bitcoin continues to be silently capitulating.

“The raw count of evidence for major Bitcoin capitulation today is insane,” he authored about his twelve key examples.

“Each occurrence alone is really a rare event and increases the probability that forward risk-returns are skewed positively.”

Additionally to popular on-chain signals formerly included in Cointelegraph including MVRV and NUPL, Edwards’ evidence includes macro triggers for example poor U . s . States equities performance and stagnant M2 money supply growth.

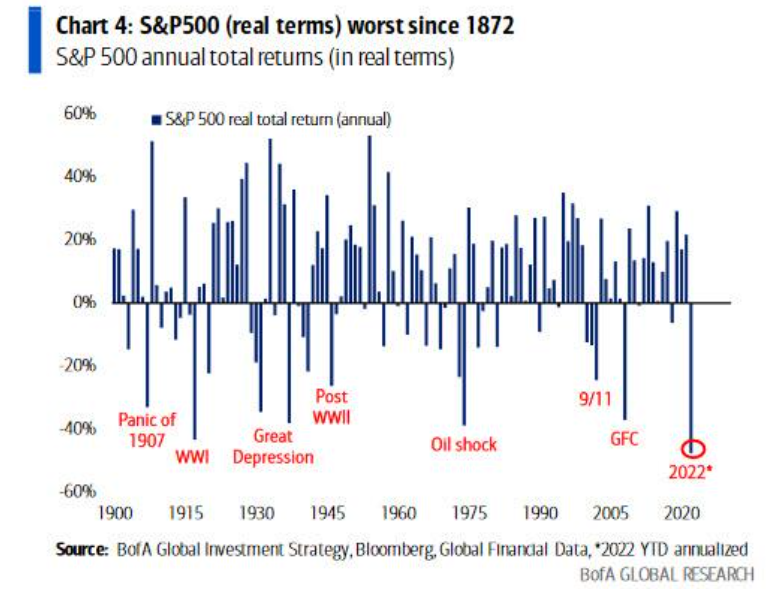

“We have recently seen the _worst_ inflation-adjusted downdraws in traditional markets within the last 8 generations. Enough stated,” he ongoing, noting the S&P 500 had delivered its worst returns in tangible terms since 1872.

The cherry around the cake within the 2022 Bitcoin bear market, however, may be the rate where industry players themselves have capitulated.

For Edwards, personal bankruptcy occasions at Celsius, Voyager yet others, coupled with Tesla selling nearly all its BTC holdings baffled, may be the “ultimate manifestation of capitulation.”

“Take phone degree of institutional capitulation here,” he commented.

“Leverage is among the best indicators for relative over- and under-valuation in Bitcoin, and lots of major leveraged crypto institutions happen to be easily wiped out.”

Based on separate data from monitoring resource Bitcoin Treasuries, Tesla continues to be the public company using the second-largest BTC reserves but has become far behind leader MicroStrategy and it is 129,698 BTC stack.

“Great accumulation zone” returns

As Cointelegraph lately noted, capitulation has additionally been apparent among Bitcoin miners because the dip towards the cheapest prices since late 2020.

Related: In the past accurate Bitcoin metric exits buy focus ‘unprecedented’ 2022 bear market

After initially selling their BTC inventory, however, miners have staged an impressive about turn, new data suggests, in another sign the worst from the capitulation may be over.

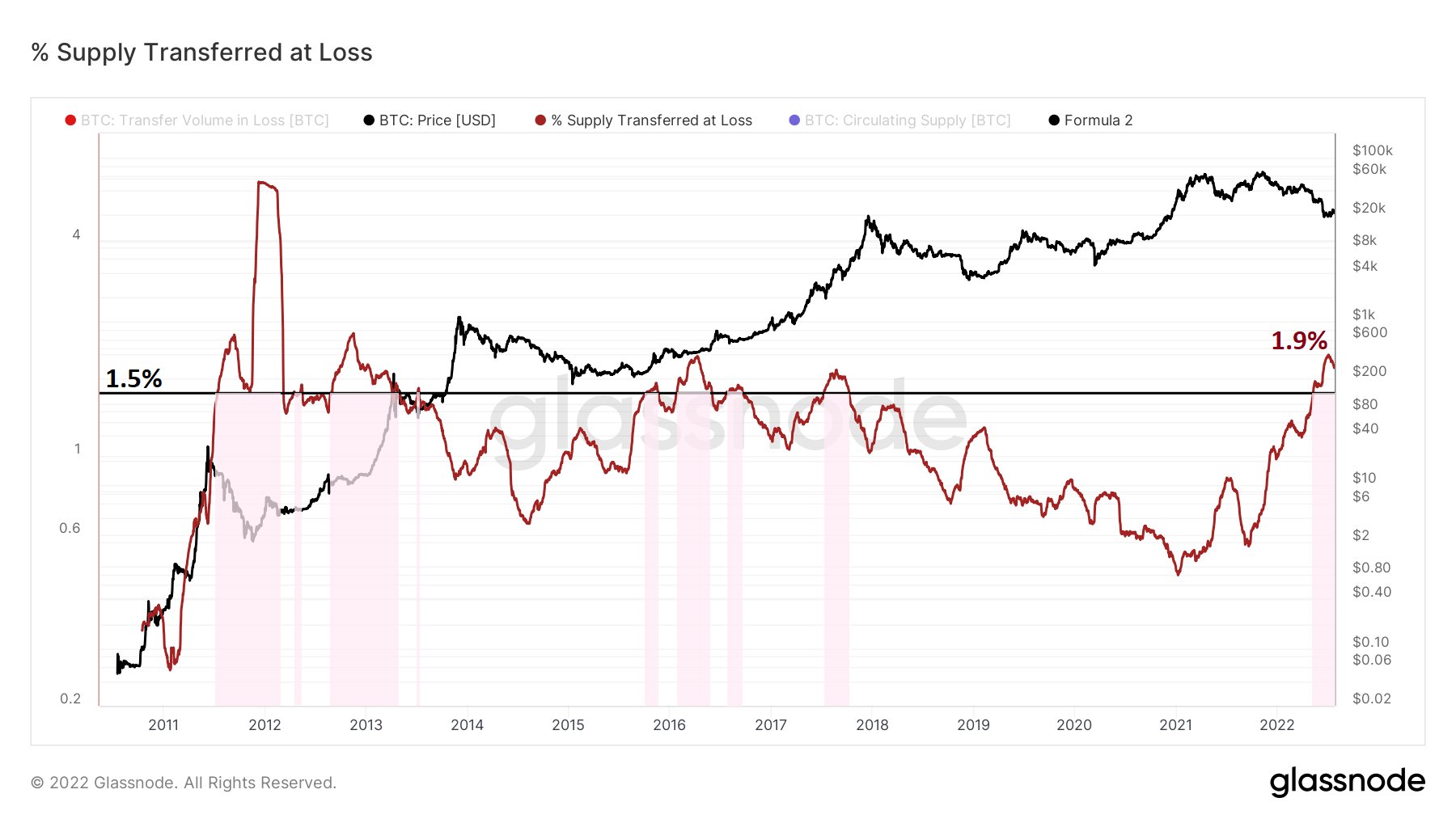

Beyond miners, the quantity of the BTC supply being transferred in a lower cost than the thing that was compensated for this has hit levels Edwards states are suggestive of accumulation.

“The proportion of total supply transferred baffled hit 1.9% recently,” he authored alongside a chart from on-chain analytics firm Glassnode.

“In the past, if this metric breaches 1.5% it shows that a sizable area of the marketplace is in discomfort. Most were also great accumulation zones.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.