Digital asset investment products saw record outflows totaling $423 million a week ago, with institutional investors from Canada representing almost all of the carnage.

Based on the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report, Canadian investors offloaded an astonishing $487.5 price of digital asset products between June 20 and June 24.

The entire outflows for that week were partly offset by $70 million price of inflows using their company countries, with U.S.-based investors accounting in excess of 1 / 2 of the inflows with $41 million.

Outdoors from the U.S., investors from Germany and Europe taken into account inflows totaling $11 million and $10.4 million each. Compared, Brazilians and Australians also pitched along with minor inflows of $1.six million and $1.4 million.

Overall the outflows totaled $422.8 million, marking the biggest weekly shedding by institutional investors since CoinShares records started. Particularly, the figure is much more than double the amount previous record of $198 million published in The month of january this season.

“Regionally, the outflows were almost exclusively from Canadian exchanges and something specific provider. The outflows happened on 17th June but were reflected in last week’s figures because of trade reporting lags, and sure accountable for Bitcoin’s decline to all of usDollarseventeen,760 that weekend.”

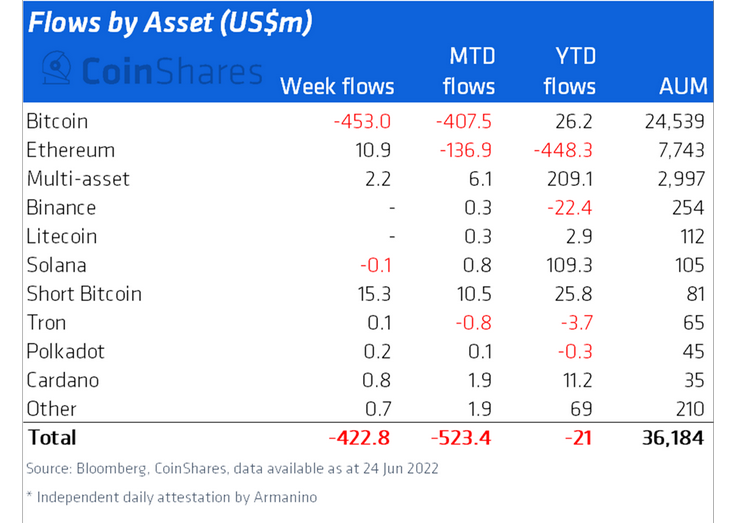

Regarding outflows by asset, investment products offering contact with Bitcoin (BTC) saw $453 million price of outflows, while Solana (SOL) products also saw minor outflows of $100,000.

The sharp offloading of BTC products a week ago has nearly pressed the entire year-to-date (YTD) flows in to the negative, using the figure now standing around just $26.two million price of inflows during 2022 to date.

Related: Final Capitulation — 5 explanations why Bitcoin could bottom at $10,000

Investment products offering contact with shorting the cost of BTC generated the biggest inflows for that week at $15.3 million. CoinShares noted it was mainly because of ProShares launching the very first-ever short Bitcoin exchange-traded fund (ETF) within the U.S. on June 22.

Ethereum (ETH) investment products also bucked an 11-week trend of outflows by posting inflows of $10.9 million. However, YTD Ether products have experienced outflows totaling $448.3 million, which makes it minimal favored investment choice among institutional investors this season.