Since March 2022, traders and thus-known as analysts happen to be forecasting an insurance policy change or pivot in the U . s . States Fed.

Apparently, this type of move would prove the Fed’s only accessible choice is to print into oblivion, further diminishing the need for the dollar and enshrining Bitcoin (BTC) because the world’s future reserve asset and supreme store of worth.

Apparently.

Well, on November. 2, the Given elevated rates of interest through the expected .75%, and equities and crypto rallied like they often do.

However this time, there is a twist. Before the Federal Open Market Committee (FOMC) meeting, there have been a couple of unconfirmed leaks proclaiming that the Given and White-colored House were thinking about a “policy pivot.”

Based on comments from the FOMC and through Jerome Powell’s presser, Powell emphasized the Given understands and monitoring how policy is impacting markets which the latency of great interest rate hikes has been acknowledged and regarded.

The Given stated:

“In to achieve a stance of financial policy that’s sufficiently restrictive to come back inflation to two percent with time. In figuring out the interest rate of future increases within the target range, the Committee will look at the cumulative tightening of financial policy, the lags that financial policy affects business activities and inflation, and economic and financial developments.”

Sounds a little pivot-y, no? The crypto market appeared to consider not, and very soon after Powell gave his live comments, Bitcoin, altcoins and equities retracted their brief single-digit gains.

The shock here isn’t that Bitcoin’s cost retracted before the FOMC meeting, rallied following the believed hike was announced after which retracted before the stock exchange closed. This isn’t surprising, and that i wouldn’t be amazed if BTC returns towards the lower finish of $21,000 since $20,000 seems to become solidified as support.

What’s surprising can there be would be a dash of pivot language, and markets didn’t react accordingly. Allow that to be considered a lesson on buying into narratives too deeply.

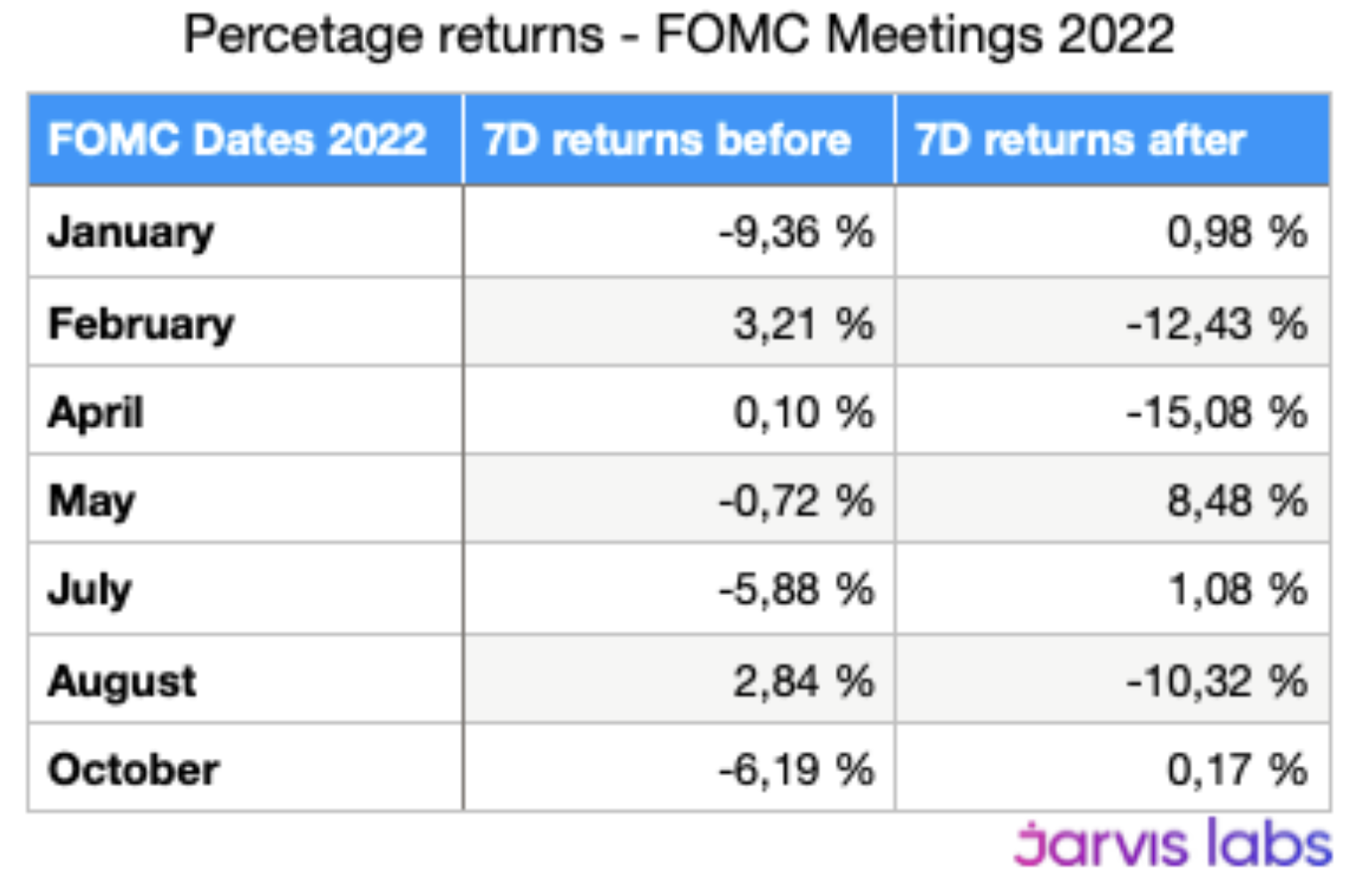

For me, buying and selling the FOMC, consumer cost index (CPI) and rate hikes isn’t what you want. Sure, if you are each day trader, have deep pockets to profit from individuals 2% or 4% moves or are a skilled, skilled professional trader, then be my guest. But, as proven within the following chart from Jarvis Labs, buying and selling FOMC and CPI can actually just chop traders up.

I’m from the mind that intraday cost moves from Bitcoin on the less-than-daily time period are irrelevant in case your motive will be lengthy on Bitcoin while increasing the stack. So, rather of concentrating on micro occasions like the way the Given is constantly on the raise rates, an insurance policy it’s resolute on until inflation drops to the 2% target, let’s take a look at other metrics that assess Bitcoin’s market structure and forecasted performance.

Related: Exactly why is Bitcoin cost up today?

On-chain data suggests it’s time for you to accumulate

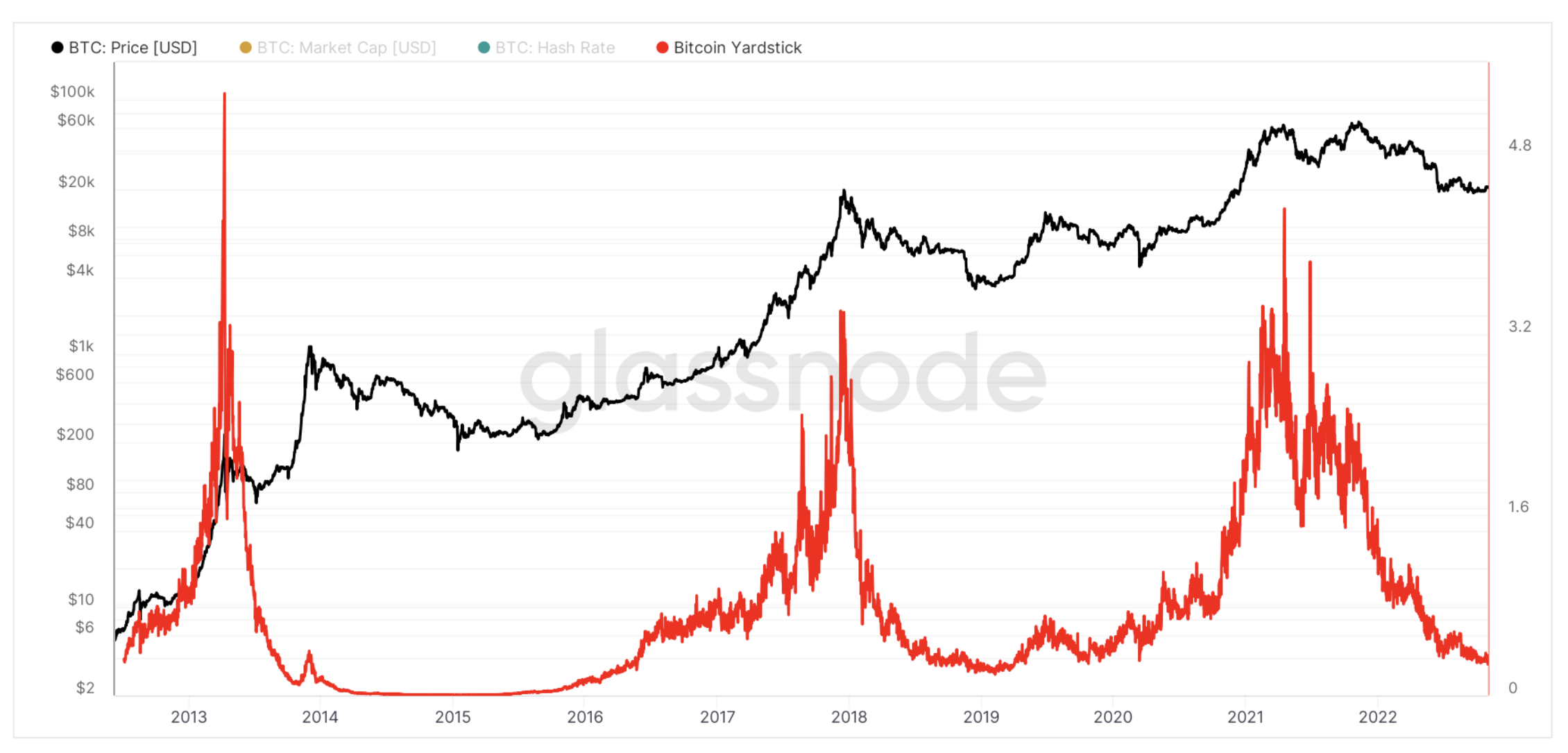

On November. 1, Capriole Investments founder Charles Edwards debuted a brand new on-chain metric known as the Bitcoin Yardstick. Based on Edwards, the metric takes “Bitcoin Market-Cap / Hash-Rate, and normalized (divided by) the two year average” to basically take “the ratio of one’s work completed to secure the Bitcoin network with regards to cost.”

Edwards explains that “lower readings = cheaper Bitcoin = less expensive,” and, in the opinion:

“Today there has been valuations uncommon since Bitcoin was $4-6K.”

Much like Glassnode’s recent report, Edwards also believes that lengthy-term holders have previously capitulated. After citing the chart below, Edwards stated:

“Net unrealized profit and loss (NUPL) is showing a washout in lengthy-term holders. We’ve joined the capitulation zone (red) seen just once every four years previously.”

As discussed in last week’s Bitcoin on-chain update, multiple on-chain metrics are in multi-year lows, and there’s sufficient precedent to point out upside gains far over-shadow the down-side potential right now.

Did Bitcoin’s MACD histogram turn bullish?

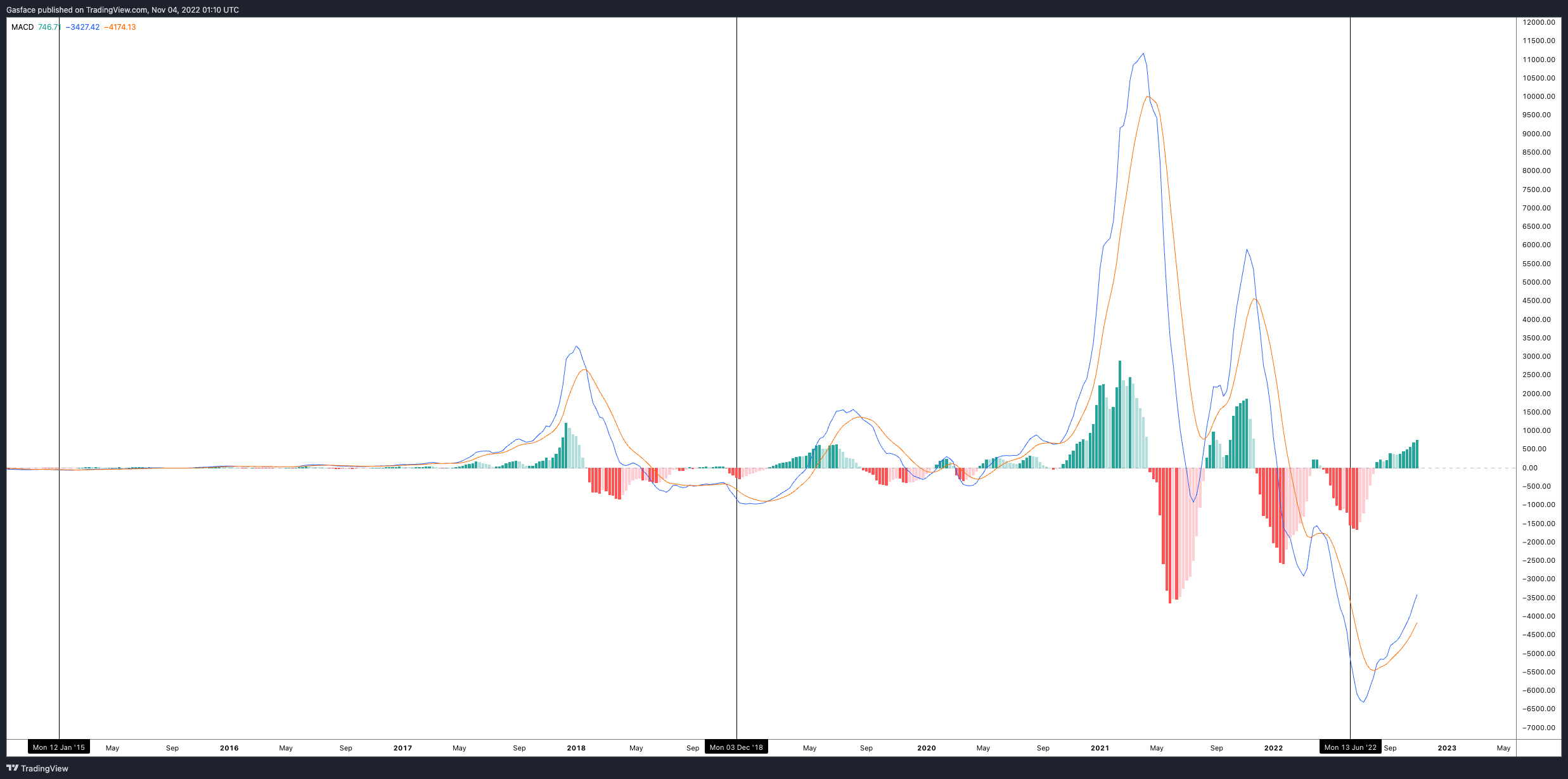

Another metric creating a buzz in trader circles may be the moving average convergence divergence (MACD). Through the week, multiple traders reported the indicator, noting a convergence between your signal line and MACD and also the histogram turning “green” around the weekly time-frame as encouraging signs that Bitcoin is within a bottoming process.

As the indicator isn’t intended to be construed like a pure signal in isolation, crossovers around the weekly and monthly time period, combined with the histogram flipping from red to eco-friendly, have usually been supported with a steady uptick in bullish momentum.

While information is not able to verify whether an industry bottom is really in, evaluating the present readings to previous market cycles and Bitcoin’s cost action does claim that BTC is undervalued in the current range.

BTC’s cost might be carving out a bottom, but this doesn’t eliminate the potential of the periodic crypto- and equities market-related sell-off that may catalyze a quick wick lower towards the yearly low.

This e-newsletter was compiled by Big Smokey, the writer of The Standard Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.