The marketplace cap of Bitcoin (BTC) dropped another 33% in June, that is now starting to numb the Twitter community. Around the upside, many crypto traders who wanted out accomplished it fairly strongly from March to May. But, the less positive news would be that the stagnancy in address activity might need to change for prices to obtain a running begin recovery.

Unlike April and could, the altcoin pack didn’t struggle tremendously greater than Bitcoin. BTC’s 33% drop was pretty center of the road when it comes to corrections. Inside a vacuum, crypto bulls would like seeing altcoins ongoing to lag, pushing more traders back toward Bitcoin like a relative “safe haven.”

Nonetheless, June would be a tale of two halves. June 1-15 saw an enormous 25% further downswing for Bitcoin. Comparatively, June 16-30 was searching up to the finish from the month, which now exhibits yet another 8% slide.

The $20,000 cost level has proven to become both mental support and resistance area. Therefore, a drop below (which would likely occur when this information is printed) may rapidly change traders’ outlook. Panic selling and excessively eager buying should take place when the $19,500 to $19,900 range is hit.

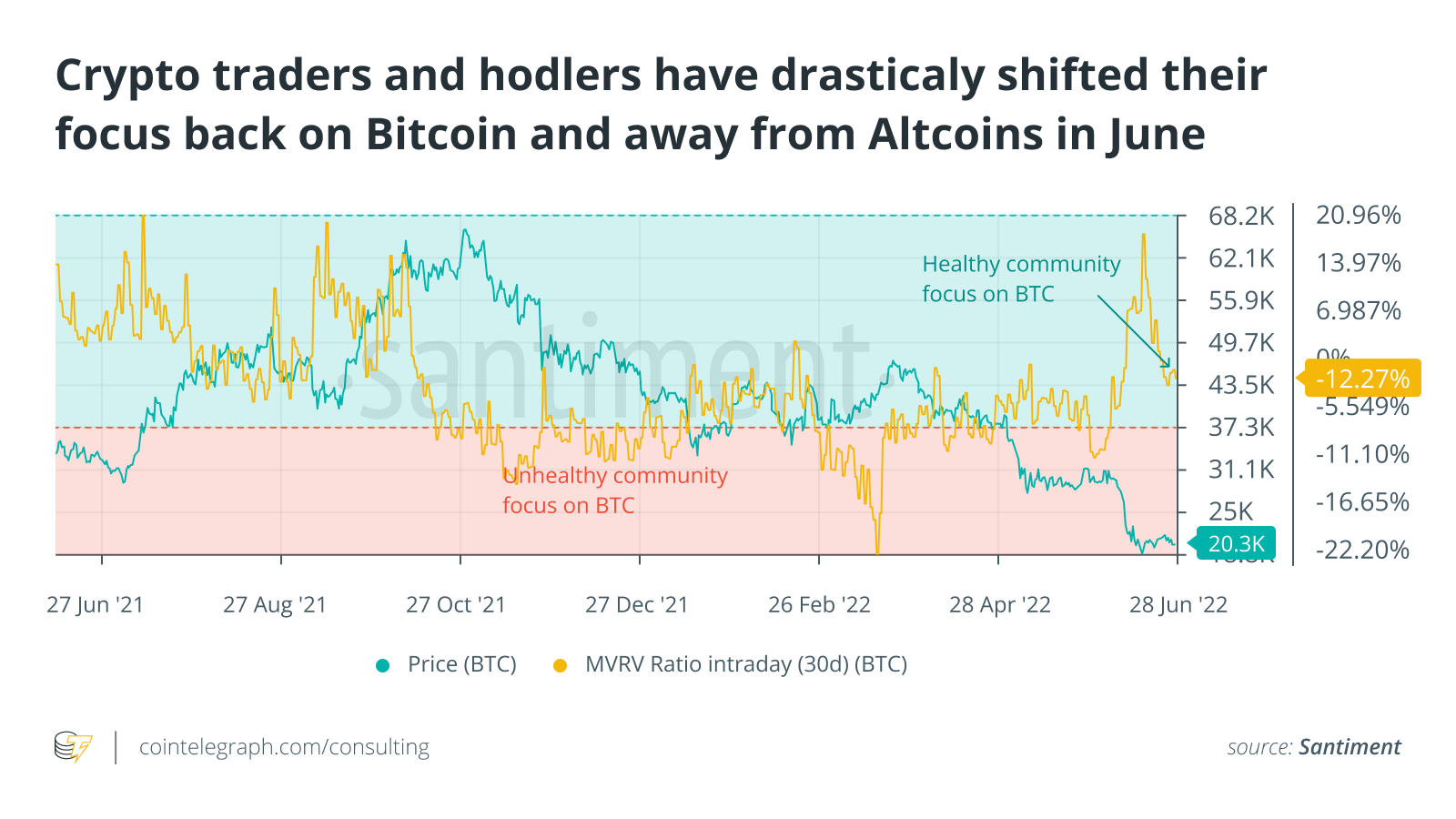

Social dominance has came back to Bitcoin and from altcoins

To date, 2022 has offered like a reality look for altcoins whose market caps have ballooned to astronomic levels previously 2 yrs. As pointed out, Bitcoin was nothing special when compared with alts in June, however it has organized much better than most projects or even a couple of stablecoins. Consequently, the spotlight shines vibrant on Bitcoin, as evidenced with a healthy community focus.

This phenomenon was reflected within the whole a week ago of June. Bitcoin was pointed out on Santiment’s social platforms at its greatest rate within four several weeks, as the discussion around other popular assets like Ether (ETH) and Cardano (ADA) is constantly on the diminish.

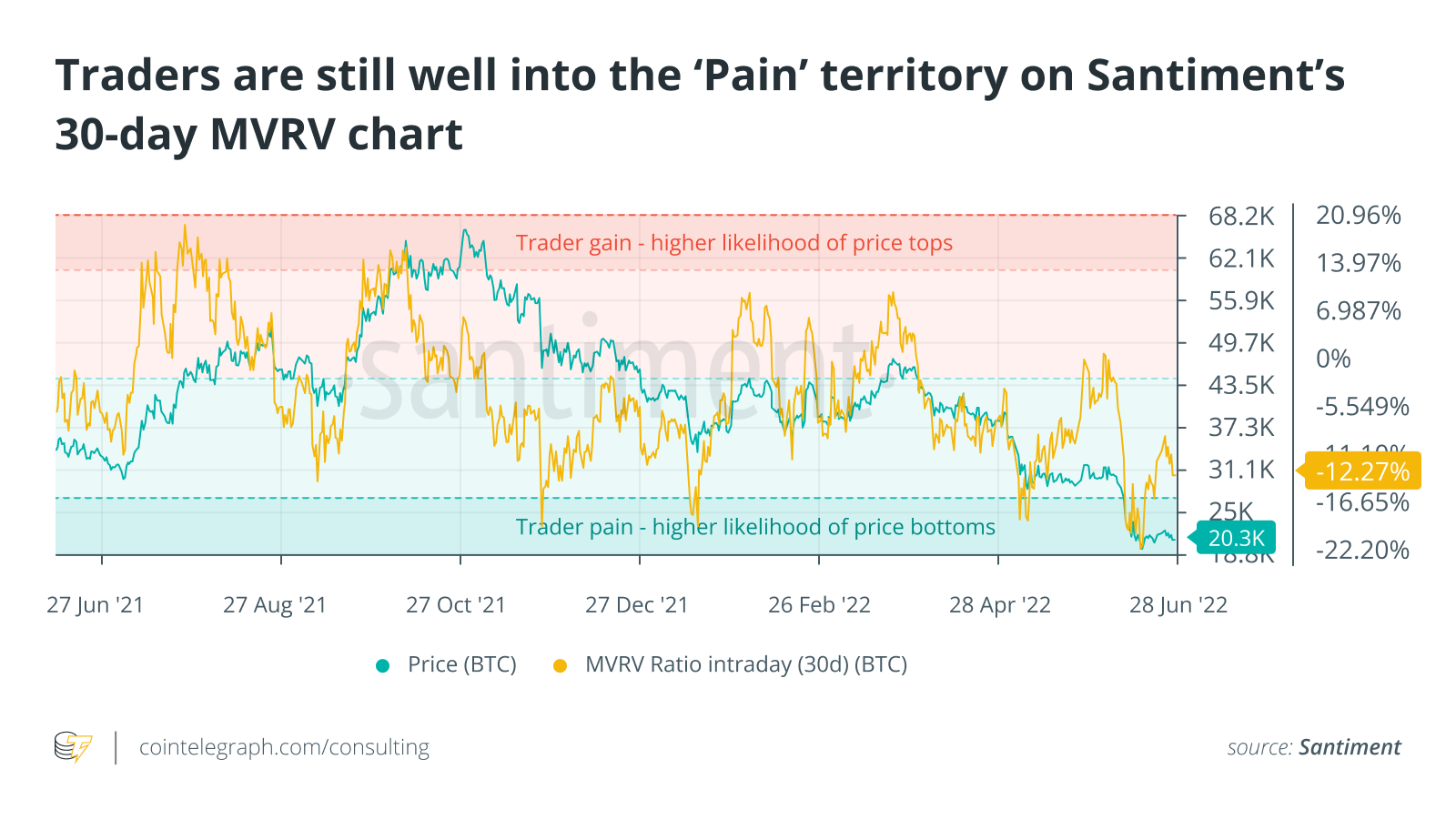

Buying and selling returns still indicate a significant undervaluation of Bitcoin and many altcoins

The typical 30-day buying and selling returns around the BTC network continue to be very negative. And, as lengthy they’re within the yellow-eco-friendly or eco-friendly territory within the below chart, there’s less risk in entering a Bitcoin position (or including to) than historic results.

Cost freefalls have a tendency to reverse when they enter in the extreme low (eco-friendly) territory, and that might be the perfect setup to look out for on Sanbase.

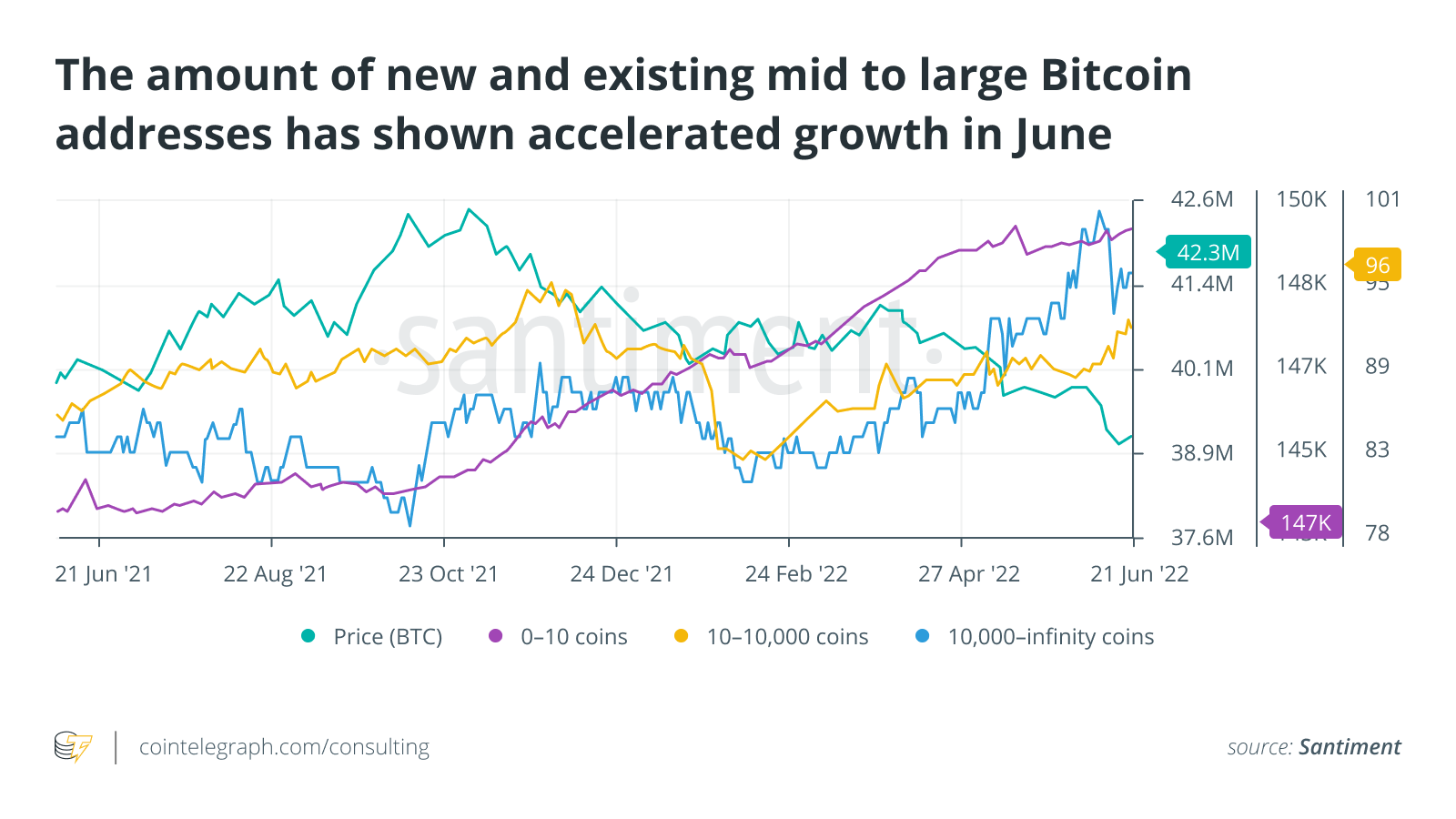

The amount of whale addresses keeps growing quickly

Another positive note for patient crypto hodlers, whatever the asset, is the fact that increasingly more Bitcoin shark and whale addresses are coming back towards the network. The addresses, mainly operated by active human traders, sized 10 to 10,000 BTC, have over 147,000 addresses the very first time since November. Meanwhile, the top-tier addresses owned mainly by exchanges (10,000 or even more) demonstrated over 100 addresses the very first time since December 2020.

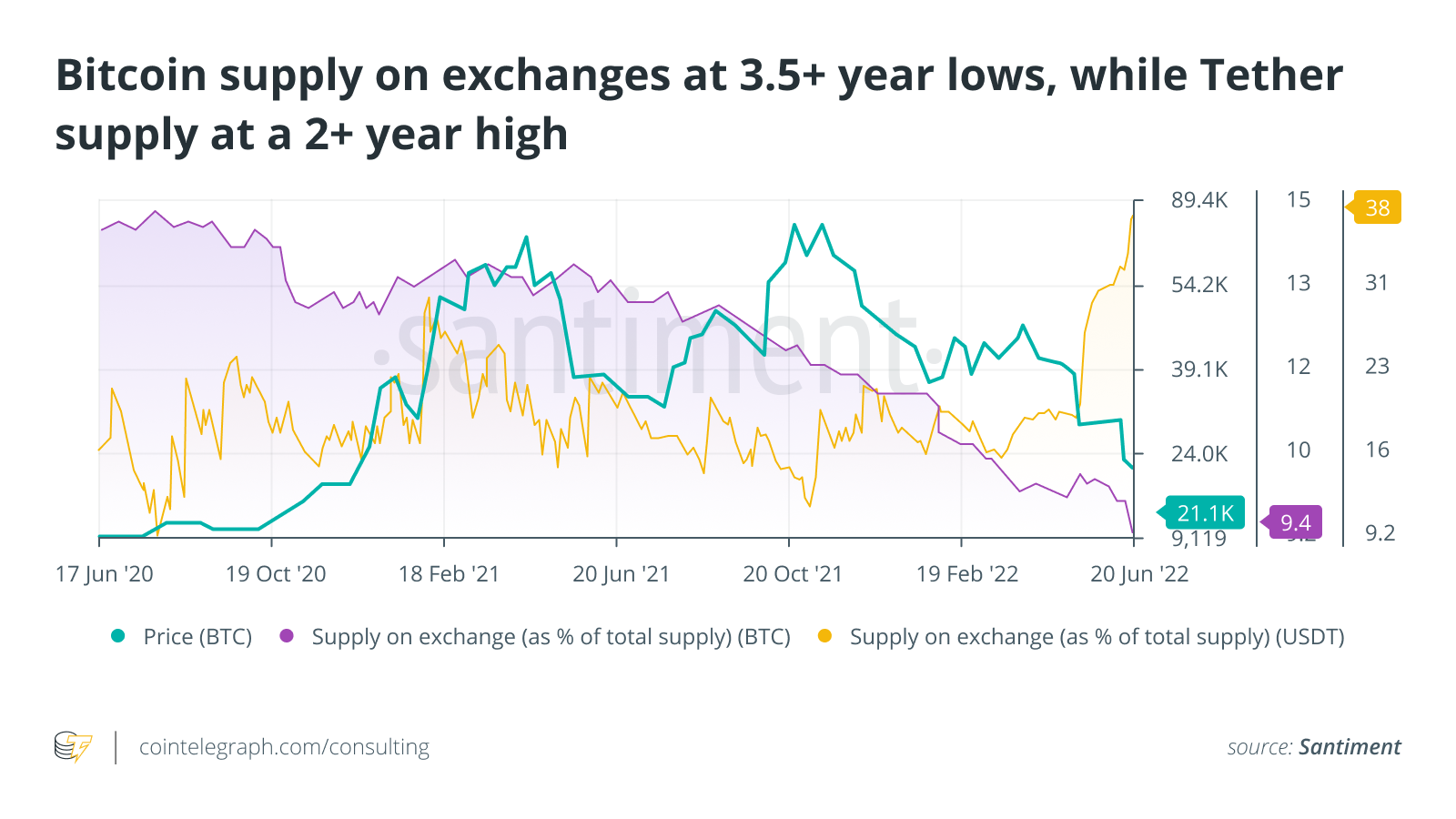

And, talking about supply moving off and on-exchange addresses, the general trend shows BTC ongoing to escape from exchanges following a brief worrisome increase in May. Now, well below 10% of coins located on exchanges, there’s much less selloff risk (according to historic trends). And, to increase this, the quantity of Tether (USDT) relocating to exchanges has skyrocketed, implying more buying power at these covered up prices.

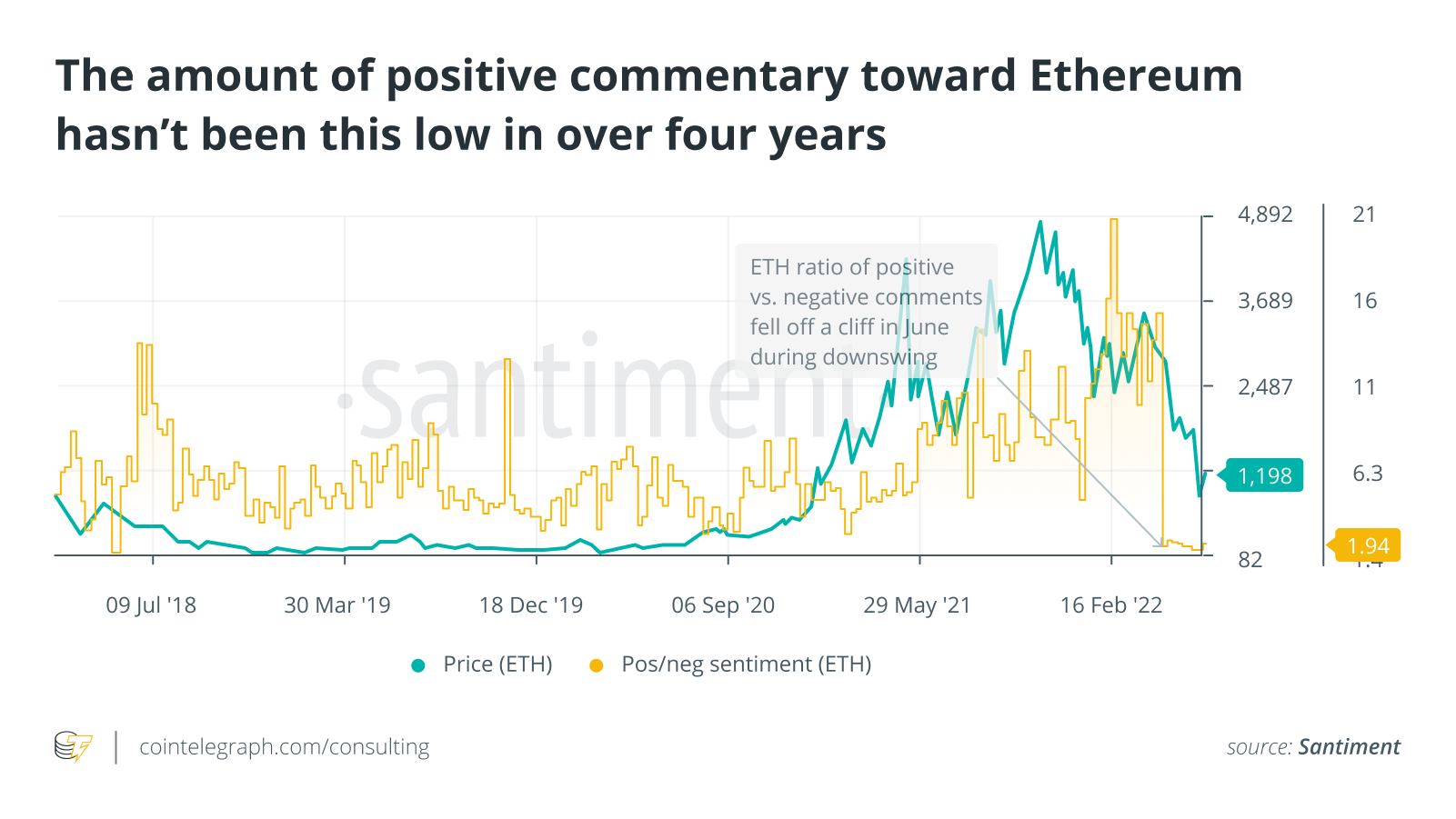

Ethereum seeing much more negativity than every other large-cap asset

To not be overlooked, Ethereum has already established a properly-documented 76% retracement since its all-time full of November. When searching at the number of positive versus. negative commentary being crawled by our social data formula, there seems to become a stunning dropoff in positive comments at the begining of June. The 37% cost drop between June 9 and 13 was the offender and also the last straw for a lot of traders. As counterproductive as it might appear, these “last straws” is exactly what the city at Santiment expects to determine for that sell to stage a comeback.

Cardano can also be seeing the same as gradually moving tumbleweeds around its network. The amount of unique addresses interacting around the Cardano network is lower to the cheapest within annually. The sentiment is progressively sinking for Cardano too, that is likely as a result of simple lack of discussion above all else.

Traders heading in to the other half with extreme skepticism

It’s challenging for the buying and selling community to locate any excitement within the abysmal cost performances that still persist every month in 2022. Yet, cost surges happen once the mainstream casts probably the most doubts. Still, nothing is definite inside a sentiment-driven and frequently self-perpetuating sector like cryptocurrency. But, the greater the crypto community is leaning bearish and proclaiming its crypto winter season, the greater the risk of a recovery going ahead.

Cointelegraph’s Market Insights E-newsletter shares our understanding around the fundamentals that slowly move the digital asset market. This analysis was made by leading analytics provider Santiment, an industry intelligence platform that gives on-chain, social networking and development info on 2,000+ cryptocurrencies.

Santiment develops countless tools, strategies and indicators to assist users better understand cryptocurrency market behavior and identify data-driven investment possibilities.

Disclaimer: The opinions expressed within the publish are suitable for general informational purposes only and therefore are not meant to provide specific advice or recommendations for anyone or on any sort of security or investment product.