For more than a year, the oil-wealthy Central Asian country of Kazakhstan has maintained its position because the third-greatest cause of Bitcoin (BTC) mining after surpassing Russia in Feb 2021.

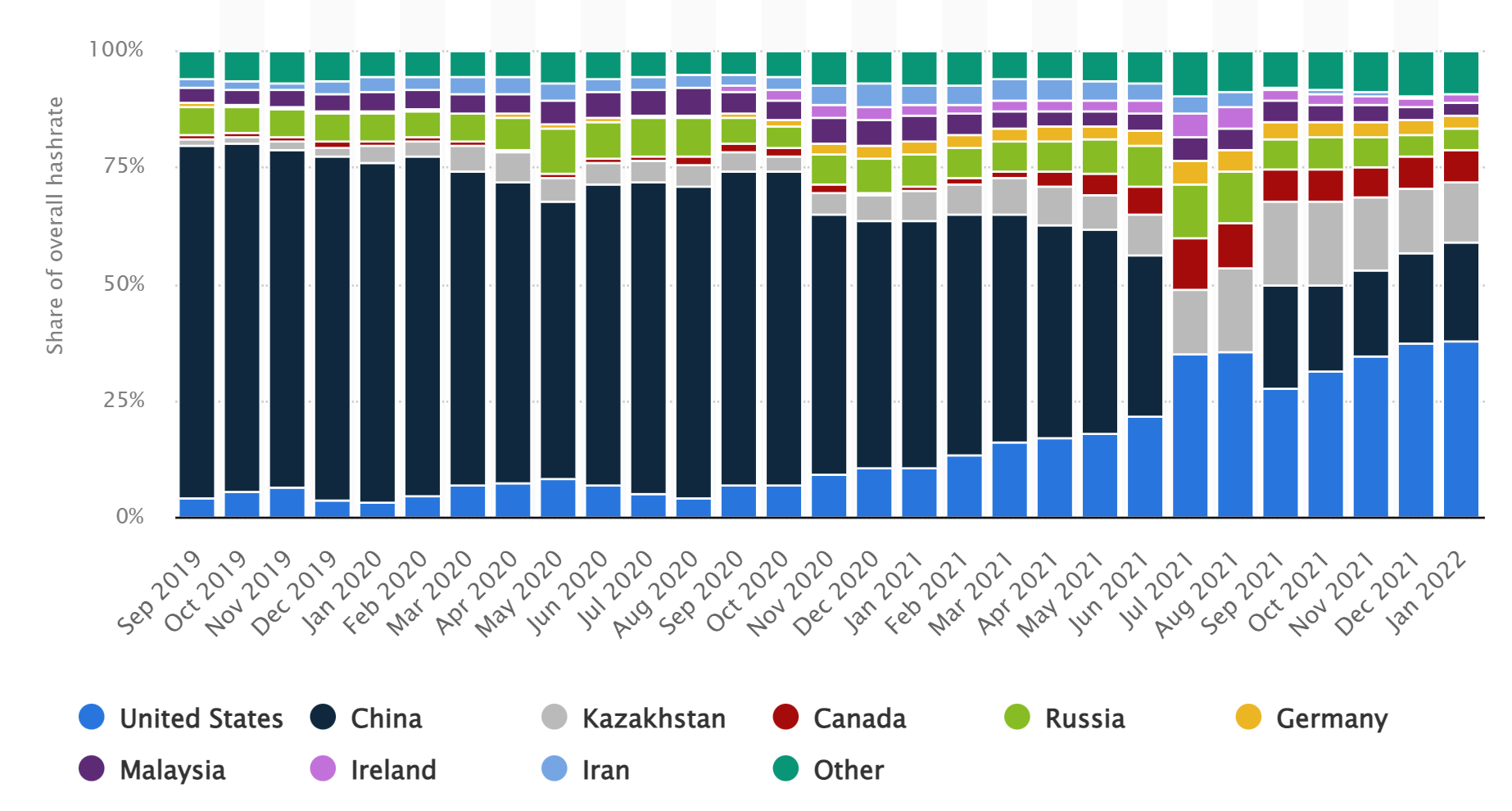

By The month of january 2022, Kazakhstan led to 13.22% from the total Bitcoin hash rate, positioned immediately after the historic leaders the U . s . States (37.84%) and China (21.11%), as proven below.

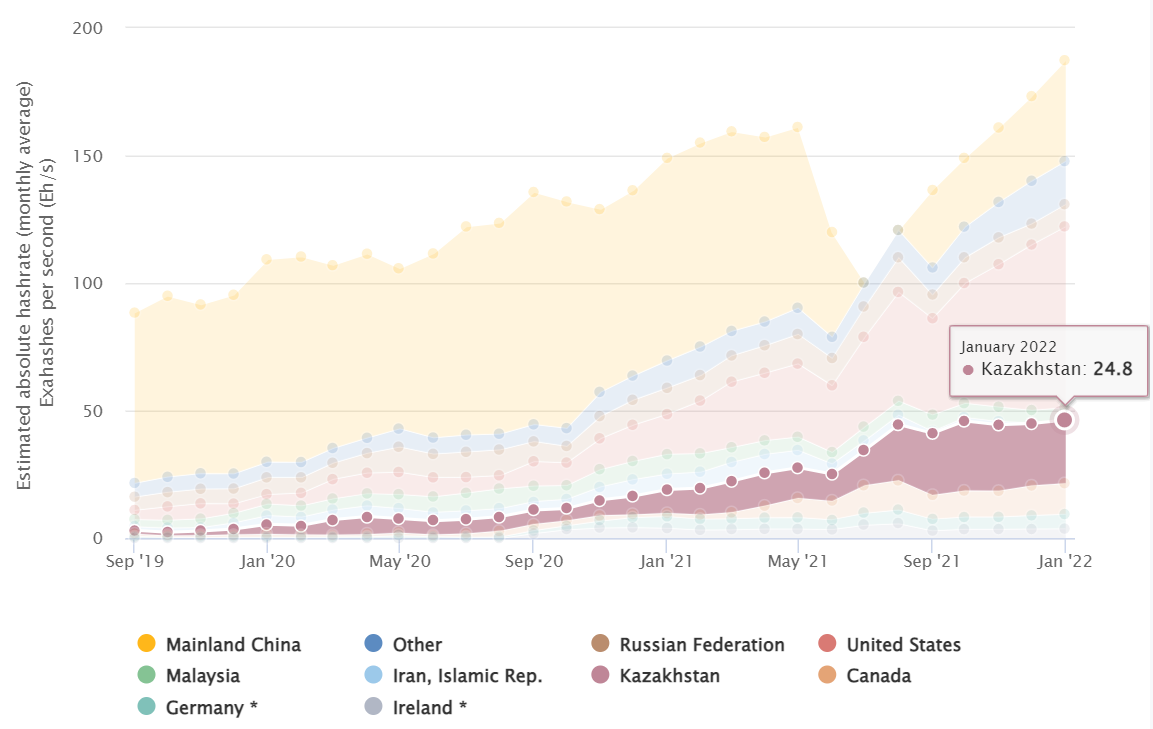

Along similar timelines, Cambridge Center for Alternative Finance data believed that Kazakhstan’s absolute hash rate contribution (monthly average) was 24.8 exahashes per second (Eh/s). Meanwhile, the united states and China contributed 71 Eh/s and 39.6 Eh/s, correspondingly.

The Worldwide Energy Agency (IEA), that is co-funded through the Eu, highlighted Kazakhstan’s heavy reliance upon non-alternative energy, for example oil (50 plusPercent), coal (28%) and gas (17%) until 2020. The research revealed:

Most coal can be used for electricity as well as heat generation, some oil can be used by final consumers, specifically in road transport.

However, the very best three countries adding towards the Bitcoin hash rate still eat away the proportion of other players, for example Malaysia, Germany and Iran. Kazakhstan was one of the primary to welcome the displaced Chinese miners once the Chinese government enforced a blanket ban on Bitcoin and crypto mining and buying and selling.

China started again mining operations in September 2022, however the temporary mining ban stripped the country’s position because the greatest Bitcoin mining hub, placing the united states at the very top since.

Related: Russian users are welcomed by crypto exchanges in Kazakhstan, but there is a catch

Local reports from Kazakhstan highlighted the country’s intent to legalize a mechanism for converting cryptocurrencies to fiat.

Speaking in the worldwide forum Digital Bridge 2022, President Kassym-Jomart Tokayev shared his vision to create Kazakhstan an innovator in the area of technology, cryptocurrency ecosystem and controlled mining.

“We will be ready to go further. If the financial instrument shows its further relevance and security, it’ll certainly receive full legal recognition,” Tokayev mentioned.