Bitcoin (BTC) continues to be not able to revive the $24,000 support since Celsius, a well known staking and lending platform, stopped withdrawals from the platform on June 13. An increasing number of users believe Celsius mismanaged its funds following a collapse from the Anchor Protocol around the Terra (LUNA now LUNC) ecosystem and rumors of their insolvency still circulate.

A level bigger issue emerged on June 14 after crypto investment capital firm Three Arrows Capital (3AC) apparently lost $31.4 million through buying and selling on Bitfinex. In addition, 3AC would be a known investor in Terra, which possessed a 100% crash at the end of May.

Unconfirmed reports that 3AC faced liquidations totaling vast sums from multiple positions irritated the marketplace in early hrs of June 15, causing Bitcoin to trade at $20,060, its cheapest level since 12 ,. 15, 2020.

Let’s check out current derivatives metrics to know whether June 15’s bearish trend reflects top traders’ sentiment.

Margin markets deleveraged following a brief spike in longs

Margin buying and selling enables investors to gain access to cryptocurrency and leverage their buying and selling position to potentially increase returns. For instance, it’s possible to buy cryptocurrencies by borrowing Tether (USDT) to enlarge exposure.

However, Bitcoin borrowers can short the cryptocurrency when they bet on its cost decline, and in contrast to futures contracts, the total amount between margin longs and shorts isn‘t always matched. For this reason analysts monitor the lending markets to find out whether investors are leaning bullish or bearish.

Interestingly, margin traders boosted their leverage lengthy (bull) position on June 14 towards the greatest level in 2 several weeks.

Bitfinex margin traders are recognized for creating position contracts of 20,000 BTC or greater in an exceedingly small amount of time, indicating the participation of whales and enormous arbitrage desks.

Because the above chart signifies, even on June 14, the amount of BTC/USD lengthy margin contracts outpaced shorts by 49 occasions, at 107,500 BTC. For reference, the final time this indicator was below 10, favoring longs, was on March 14. The end result benefited the counter-traders in those days, as Bitcoin rallied 28% next two days.

Bitcoin futures data shows pro traders were liquidated

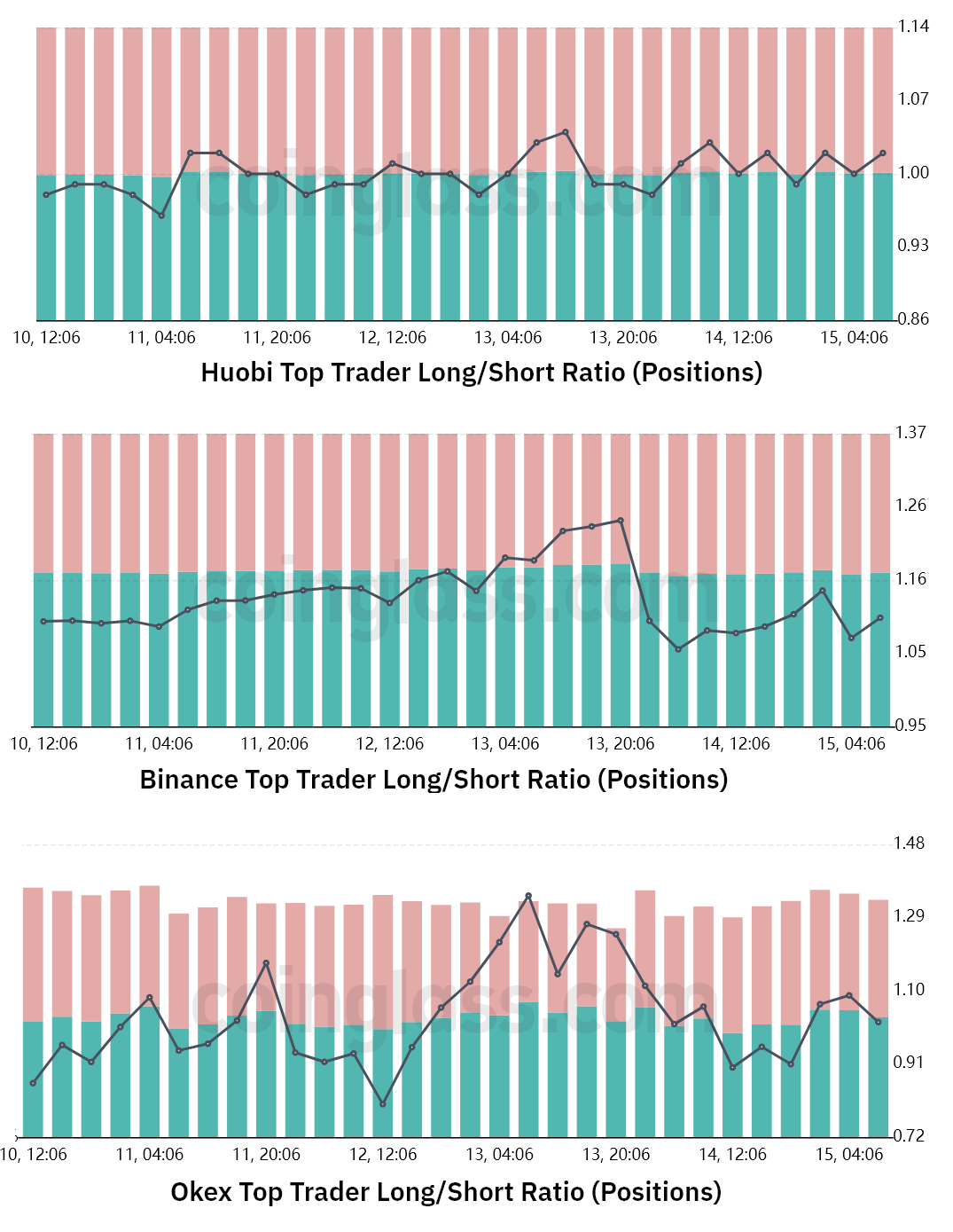

The very best traders’ lengthy-to-short internet ratio excludes externalities that may have impacted the margin instruments. By analyzing these whale positions around the place, perpetual and futures contracts, it’s possible to better understand whether professional traders are bullish or bearish.

You need to note the methodological discrepancies between different exchanges, therefore the absolute figures tight on importance. For instance, while Huobi traders have stored their lengthy-to-short ratio relatively unchanged between June 13 and Ju15, professional traders at Binance and OKX reduced their longs.

This movement could represent liquidations, meaning the margin deposit was inadequate to pay for their longs. In these instances, the exchange’s automatic deleveraging mechanism happens by selling the Bitcoin position to lessen the exposure. In either case, the lengthy-to-short ratio is affected and signals a less bullish internet position.

Liquidations could represent a buying chance

Data from derivatives markets, including margin and futures, reveal that professional traders were certainly not expecting this type of deep and continuous cost correction.

Despite the fact that there’s been a higher correlation to the stock exchange and also the S&P 500 index published a 21.6% year-to-date loss, professional crypto traders weren’t expecting Bitcoin to decrease another 37% in June.

While leverage enables someone to maximize gains, it may also pressure cascading liquidations like the recent occasions seen now. The automated buying and selling systems of exchanges and DeFi platforms sell investors’ positions at whatever cost can be obtained once the collateral is inadequate to pay for the danger which put heavy pressure on place markets.

These liquidations sometimes produce a perfect access point for individuals savvy and brave enough to counter-trade excessive corrections because of insufficient liquidity and the lack of bids around the buying and selling platforms. Whether it may be the final bottom is one thing that’ll be impossible to find out until a couple of several weeks following this volatility has transpired.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.