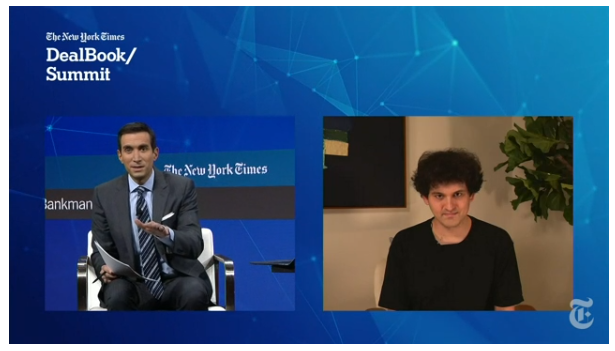

Former FTX Chief executive officer Mike Bankman-Fried apologized or accepted failure a minimum of 12 occasions throughout his appearance in the New You are able to Times’ DealBook Summit on November. 30.

Inside a wide-varying video interview, Bankman-Fried was requested to reply to numerous questions all around the downfall of the now-defunct exchange, with a few even suggesting that his statements could be employed to incriminate him in court proceedings.

Inside a November. 30 Twitter publish, crypto attorney Jeremy Hogan, Partner at Hogan & Hogan stated the “light mix-examination” of Bankman-Fried in the DealBook Summit has came back “at least 3 incriminating statements to date.”

SBF gets an easy mix-examination in the NYT/Dealbook Summit and it has made a minimum of 3 incriminating statements to date.

How come his lawyers (or parents) letting him do that?? pic.twitter.com/Nd0poutAA0

— Jeremy Hogan (@attorneyjeremy1) November 30, 2022

Alan Rosca in the law practice Rosca Scarlato stated it had been “pretty astonishing that he’s essentially testifying in the DealBook summit. Difficult to consider a precedent with this.Inches

Bankman-Fried’s first concession came while greeting interviewer Andrew Sorkin, as he stated in mention of collapse of FTX:

“Clearly, I made lots of mistakes or a few things i will give anything so that you can do once again.Inches

An apology came moments later when Sorkin faced him having a letter compiled by an FTX customer who lost $two million in existence savings following the exchange collapsed.

“I’m deeply sorry by what happened,” stated Bankman-Fried as a result of the client’s story.

Later, when discussing the allegations that Alameda used FTX client funds to pay for loans, Bankman-Fried stated that although he “didn’t know precisely that which was going on” at Alameda,” he concedes it had been still his duty as FTX Chief executive officer to “make i was doing diligence.”

“A large amount of they are stuff that I have learned during the last month which i learned […] I mark that as a reasonably large oversight which i wasn’t more conscious of,” he stated.

Bankman-Fried accepted failure again when quizzed about FTXs former standing in the market and losing trust in crypto since the exchange has collapsed, stating: “I mean, like, look, I messed up.Inches

“I was Chief executive officer, I had been the Chief executive officer of FTX. And That I mean I only say this over and over, that which means I’d an obligation this means that I had been responsible ultimately for doing the best things and that i mean, we did not. Like, we all messed up big.”

He ongoing to concede FTX’s failings, stating “there absolutely were management failures” oversight failures, and transparency failures.

Toward the finish from the interview, Sorkin directly requested Bankman-Fried whether he’d been truthful using the audience and whether he agreed that there was occasions he had lied.

Bankman-Fried stated he wasn’t conscious of any occasions he lied, but described there were occasions when asking on your behalf or “marketer” for FTX, he would paint FTX “as compelling […] as you possibly can.Inches

“I wasn’t speaking about do you know the risks associated with FTX […] I clearly wish which i spent additional time dwelling around the downsides and fewer time taking into consideration the upsides.

Related: ‘I never opened up the code for FTX:’ SBF has lengthy, candid talk to vlogger

Bankman Fried was requested what his lawyers are telling him right now, and whether or not this was advisable for him to become speaking openly. He clarified “very much not.”

“I mean, you realize, the classic advice, don’t say anything […] recede right into a hole.”

Bankman-Fried stated he believes he’s an obligation to speak to people and explain what went down and also to “try and do what’s right.”

“I do not see what good is accomplished by me just sitting kept in an area pretending the outdoors world does not exist,” he described.

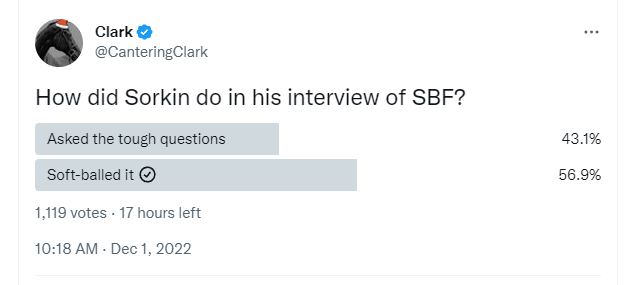

‘Soft-balled it,’ states community

As the interview made an appearance to pay for numerous confronting issues for Bankman-Fried, some locally still think that the questions weren’t challenging enough, nor was there an sufficient follow-as much as a few of the hard-hitting questions.

A Twitter poll launched with a self-announced crypto trader “Cantering Clark” found which more than 1 / 2 of the fir,119 respondents believed Sorkin “Soft-balled” the job interview with Bankman-Fried.