Bitcoin (BTC) starts the final week of “Uptober” inside a firmly average mood because the buying and selling range to finish all buying and selling ranges is constantly on the stick.

Following a welcome make an effort to bust out, BTC/USD remains certain to a narrow corridor now in position for days.

A few of the cheapest volatility ever implies that Bitcoin finds a brief be the “stablecoin” — even some major fiat currencies are presently more volatile.

The more the established order drags on, however, the greater convinced commentators are that the major trend change will enter.

Now is just like any, they argue — macroeconomic data, geopolitical instability and classic volatility round the monthly close are factors playing with regards to trembling up a decidedly boring Bitcoin market.

Bulls get their work eliminate to make certain that this type of breakout would be to the upside — multi-week buying and selling ranges offer stiff resistance, while behind the curtain, miners are suggesting that the capitulation could yet take everybody unexpectedly at some point.

Cointelegraph takes a closer inspection in the market setup and highlights five topics to keep in mind while tracking BTC cost action now.

Greatest weekly close since early September

Bitcoin offered some interesting cost behavior in to the March. 23 weekly close, BTC/USD seeing its largest “green” hourly candle in days before topping out at $19,700.

A retracement had been happening in the close, which nevertheless were able to become Bitcoin’s greatest since early September around $19,580, data from Cointelegraph Markets Pro and TradingView shows.

Optimism supported the move, which by March. 24 had dissipated to depart Bitcoin pretty much where it absolutely was before.

For Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, it is now time to leave behind rangebound BTC.

“Bitcoin still stuck within this range,” he told Twitter supporters your day prior.

“Coming week is really a large one with the occasions, which just about causes it to be inevitable that we’ll get out of the number. I am watching this final resistance. It must break, after which, the party can begin.”

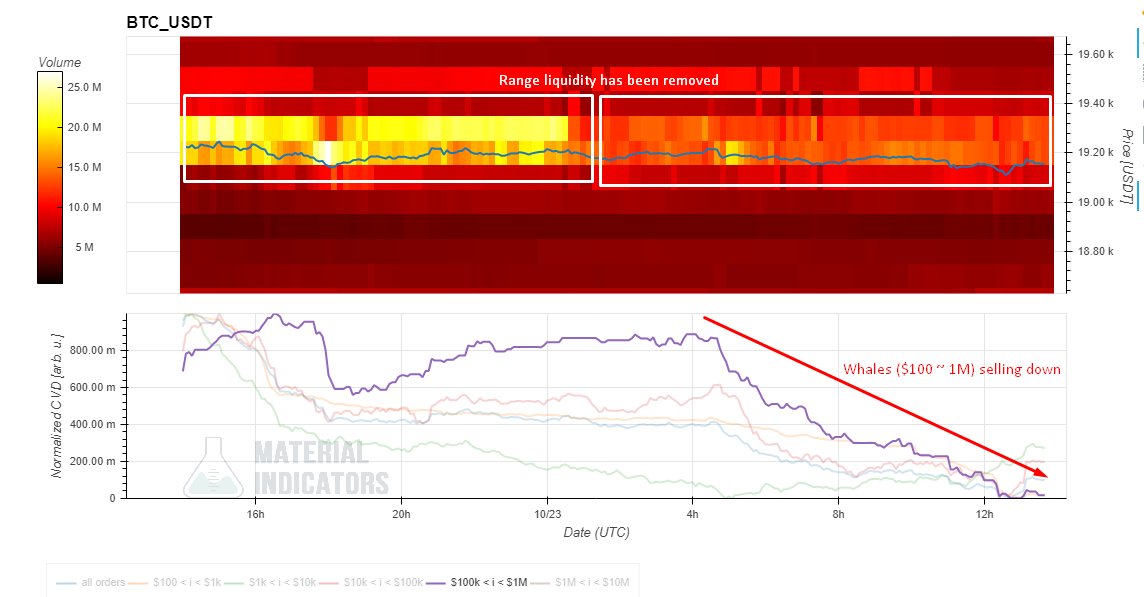

Order book data told an identical story. Analyzing trader behavior on major exchange Binance, Maartunn, a cause of on-chain analytics platform CryptoQuant, flagged whales draining liquidity in the established cost corridor.

“Liquidity in the range continues to be removed, or at best considerably reduced,” he summarized, adding that “Whales ($100k ~ $1M) can sell lower.”

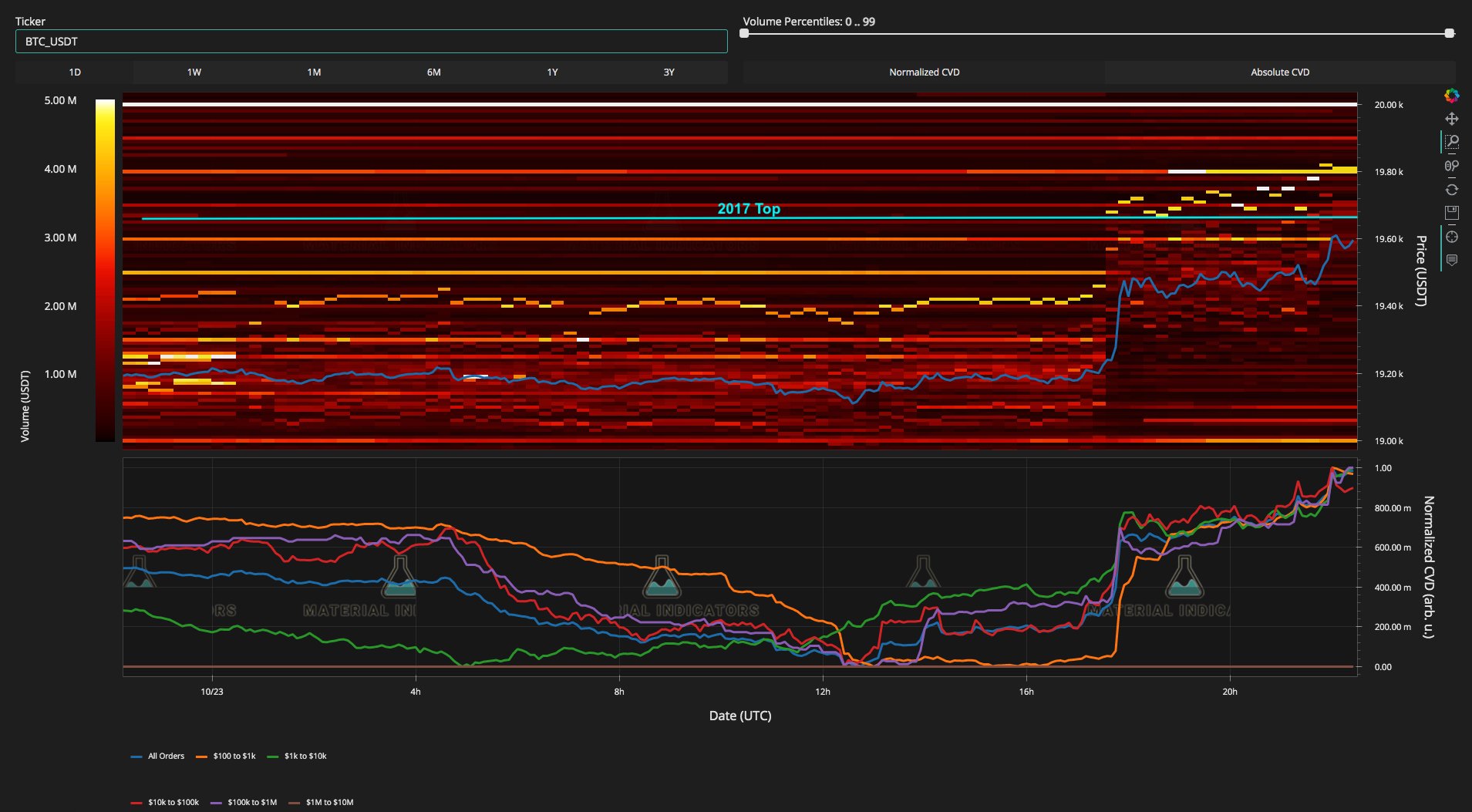

Material Indicators, which tracks order book liquidity changes, further noted the level of resistance akin to Bitcoin’s old all-time high from 2017 had softened.

“First retest from the 2017 Top unsuccessful, however the sell wall which was developing resistance at this level continues to be diffused right into a ladder upward,” it described right before the weekly close.

Popular trader and analyst Jackis meanwhile predicted a “wild” November for Bitcoin, whilst not being attracted on if the move could be up or lower.

“Bitcoin cost finds an equilibrium around 19K. Following a prolonged EQ there always comes a time period of displacement,” he authored in the weekend.

“Watch for any prolonged duration of cost acceptance above/below 19,5K/18,5K and position accordingly.”

Given, ECB in concentrate run-as much as rate hike decision

Van de Poppe’s commitment of a “large” week when it comes to macroeconomic occasions will probably bear fruit on March. 28 using the discharge of U . s . States Personal Consumption Expenses (PCE) Index for September.

While typically less impactful to crypto markets because the Consumer Cost Index (CPI), PCE nevertheless comes in a critical point now.

A few days after might find the Fed meet to select rate of interest hikes, these according to specific data inputs including PCE and CPI.

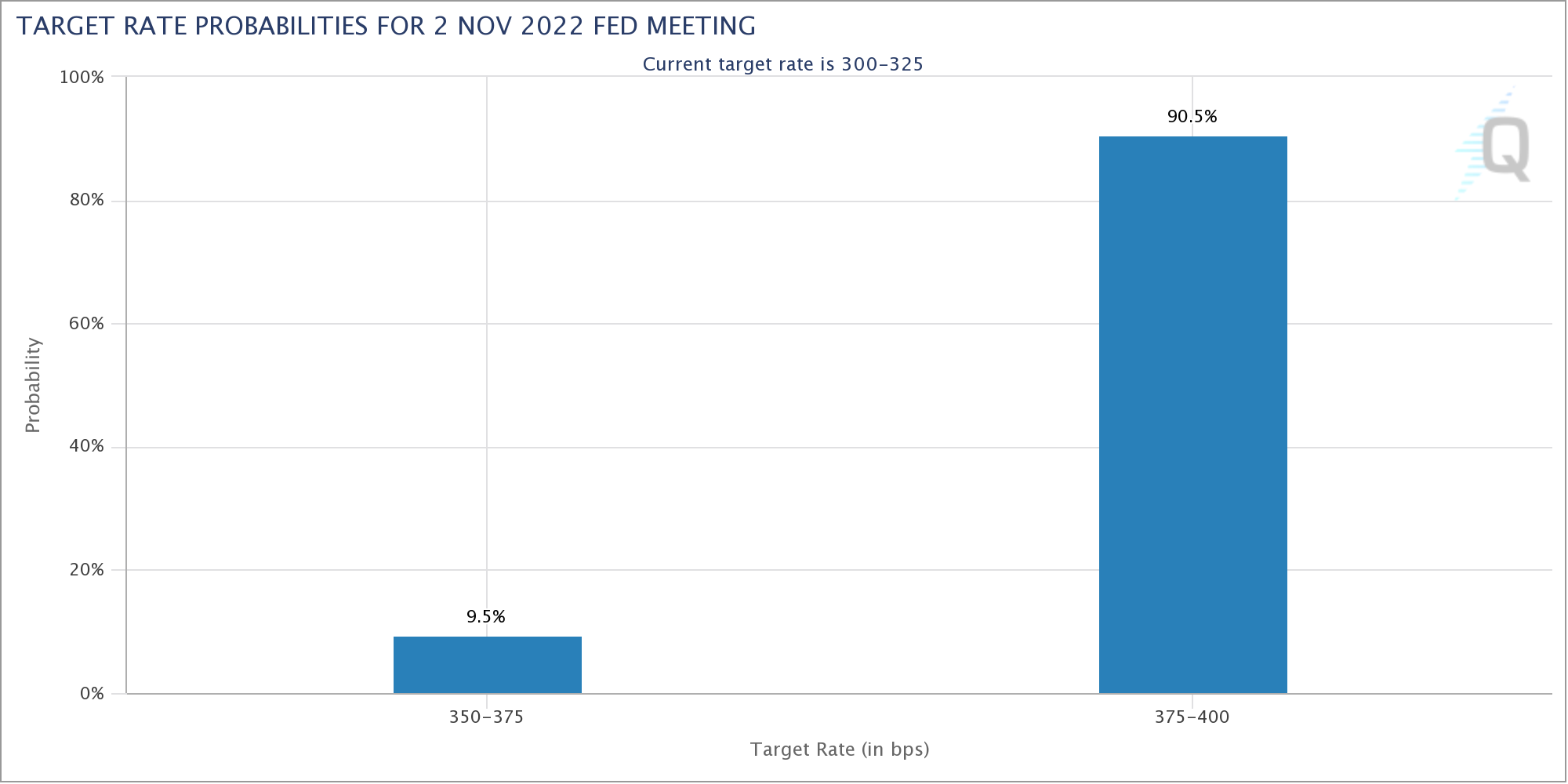

The marketplace presently overwhelmingly expects another 75-basis-point hike — keeping pressure on risk assets including Bitcoin — but a week ago already saw rumors of the softening from the Fed’s stance in the future.

Any loosening of policy will be a boon to stocks, a thing that highly-correlated crypto markets would naturally take advantage of.

“The average Bitcoin bear market lasts 12.5 several weeks. This really is known as the Golden Bull Cycle ratio,” hopeful developer James Bull commented in the weekend.

“We are actually at month 11 and also the Given is thinking about to prevent the hiking of great interest rates.”

Summarizing expectations in the Given, meanwhile, Charlie Bilello, founder and Chief executive officer of Compound Capital Advisors, confirmed that 75 basis points wasn’t tipped to create a reappearance after early November.

“Rate cuts begin in 12 , 2023, continue in 2024,” he added.

CME Group’s FedWatch Tool had the risk of 75 basis points in November at 90.5% during the time of writing.

Past the U.S., March. 27 will discover a press conference in the European Central Bank, plus a speech from the president, Christine Lagarde.

The Eurozone is presently coping with record inflation, that has exceeded 20% in certain E.U. member states. The ECB, however, continues to be decidedly slower compared to Given in responding with rate hikes.

“ECB on Thursday likely to deliver 75bps hike. However, delay on balance sheet reduction QT to once they achieve neutral rate from 1.5 to twoPercent versus .75 current (a minimum of other half of 2023),” economist Daniel Lacalle tweeted concerning the established order.

“The ECB continues to be behind the bend. It doesn’t achieve its mandate nor calm markets.”

“Ripping” hash rate results in Russia questions

To within Bitcoin and a feeling of unease is brewing over network fundamentals and the healthiness of the mining sector.

Phone data offers unusual, though not entirely welcome, conclusions — hash rate might be whatsoever-time highs, however the growth is probably unsustainable and can come at a price.

Despite place cost action declining overall, miners are dedicating increasingly more computing capacity to the blockchain.

Which means that already thin income are becoming squeezed even more, with smaller sized miners vulnerable to getting to abandon ship over lost financial incentives.

The entity adding hash rate may also be assumed to possess big enough capital to still make money regardless of the current condition from the network.

“Bitcoin hash rates are absolutely ripping,” William Clemente, co-founding father of research firm Reflexivity Research, authored in the weekend.

“Thinking about who this entity(s) is the fact that feels it’s beneficial to mine with BTC cost lower 70%, energy prices high, & hashprice whatsoever-time lows. Question if it is a sizable player(s) with excess energy or use of dirt-cheap energy.”

Knowing that, commentator Steve Barbour showed up in an unusual conclusion.

“Guys, it’s Russia. Russia is how the hashrate goes,” he contended.

“Manufacturers have accepted to selling more ASICs to Russia compared to US lately and do you know what whenever you inflate pipelines and bottleneck energy? bitcoin fixes it.”

As the entity or entities remain a mysterious, the figures speak on their own. Based on monitoring resource MiningPoolStats, hash rates are presently above 270 exahashes per second (EH/s), while BTC.com offers approximately 259 EH/s.

Because of the added hash rate, difficulty elevated by another 3.44% on March. 24, reaching another all-time a lot of 36.84 trillion.

To date, however, that old adage of “price follows hash rate” is yet to demonstrate itself as concerns heighten over sustainability.

Supply in loss surges

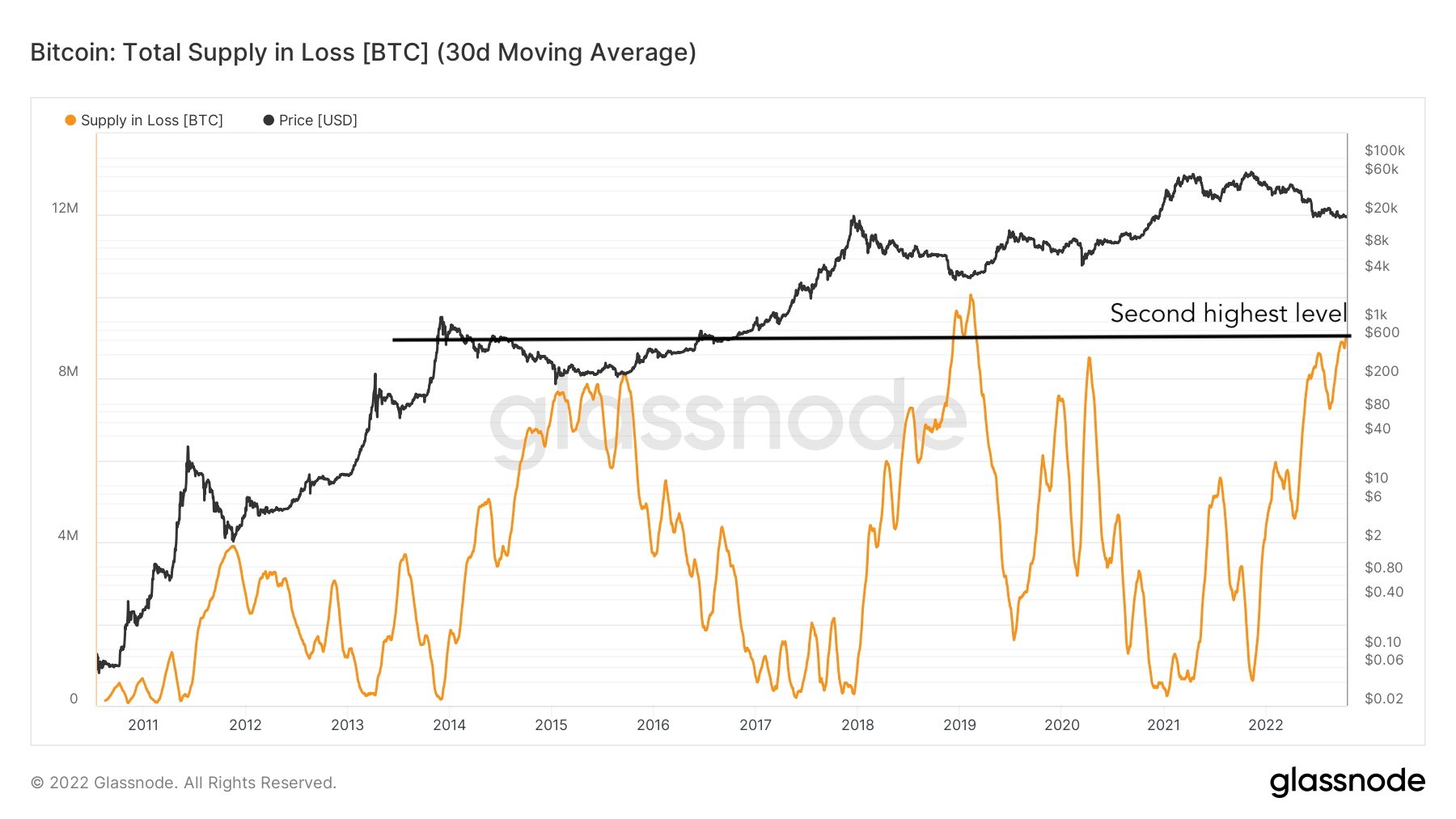

If miners haven’t yet explore the field of capitulation, it’s already “here” for that average Bitcoin hodler, one analytics entity believes.

Searching at data since the BTC supply baffled, buying and selling resource Bet on Trades figured that bear market discomfort had already joined.

The 30-day moving moving average of BTC being held baffled, not comprising lost or lengthy-term hodled coins, has become almost whatsoever-time highs.

“Capitulations is here now,” Bet on Trades summarized on Twitter.

“BTC total supply in loss 30-day moving average has become at its second greatest level ever.”

An associated chart from on-chain analytics firm Glassnode place the in-loss tally in excess of 8 million BTC.

Responses highlighted the figure is gloomier if while using circulating supply, with Bet on Trades also acknowledging the June lows of $17,600 still constituted the “main capitulation event.”

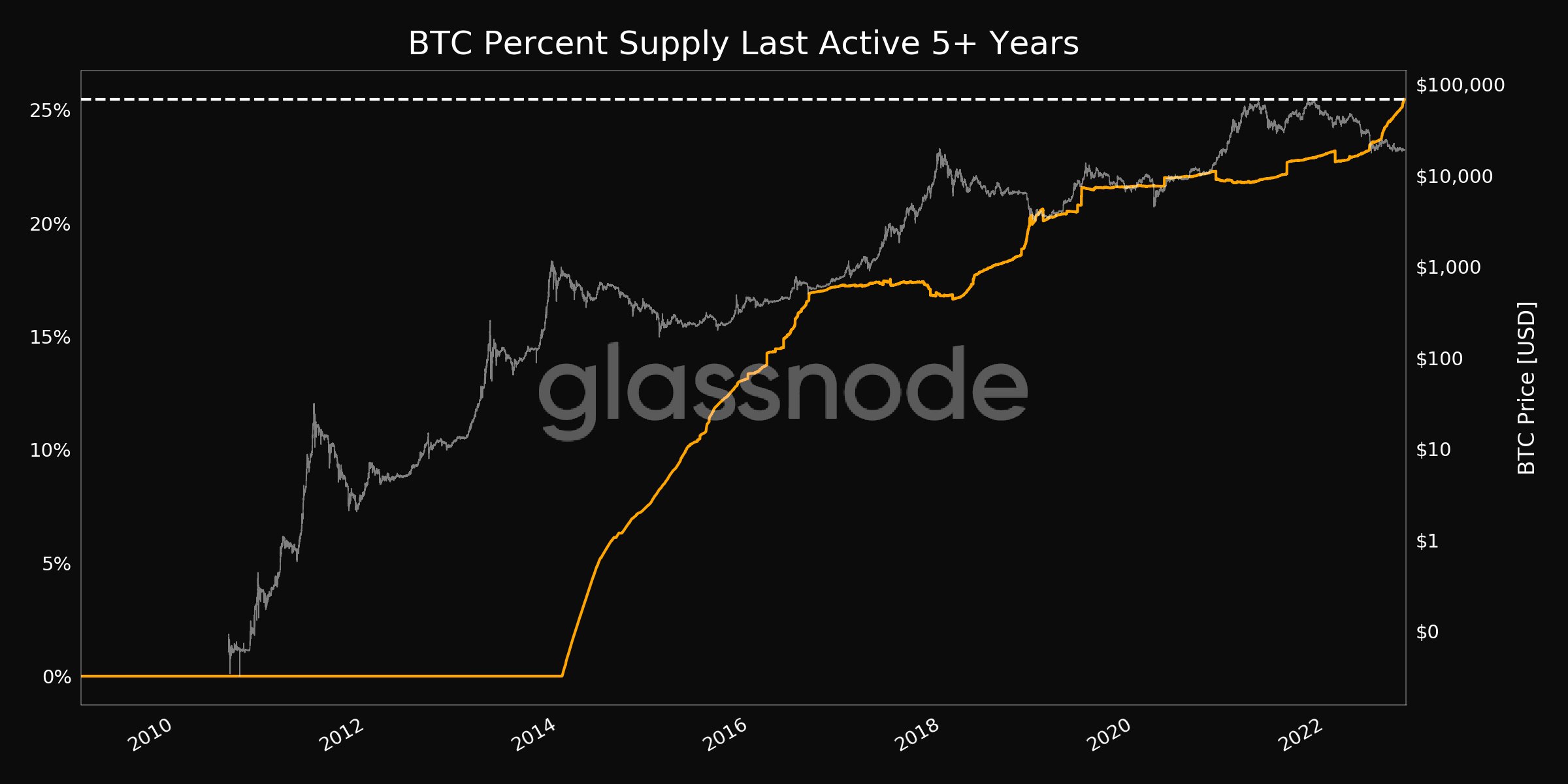

The availability concern is increasingly prescient — Glassnode also confirms that the quantity of the BTC supply now dormant not less than 5 years has become greater than ever before at 25.47%.

Uptober? What Uptober?

Little interest remains in “Uptober,” which in comparison has unsuccessful to provide versus October 2021.

Related: Global recession may last until near 2024 Bitcoin halving — Elon Musk

At current prices, BTC/USD is simply .36% from the start of month — a manifestation of precisely how nonvolatile Bitcoin is becoming.

Data from data resource Coinglass implies that October 2022 may be the flattest October on record percentage-wise, along with a shadow of this past year, which delivered 40% gains.

Individuals wishing for any dramatic turnaround in November get their work eliminate — this past year saw a brand new all-time high, however the month ultimately closed with Bitcoin lower 7.1%.

2020, however, saw BTC/USD add 43% in November, using the crown owned by 2017’s 53.5% increase.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.