Even though most market participants construed the latest Given policy announcement as increasing numbers of dovish than expected, therefore, the drop in america dollar and US yields, Bitcoin markets saw a “sell the fact” reaction, using the BTC cost pulling back dramatically and lengthy liquidations spiking.

BTC/USD was last altering hands within the mid-$27,000s, getting at some point been as little as the $26,600s, lower around 2.2% during the last 24 hrs according to CoinGecko.

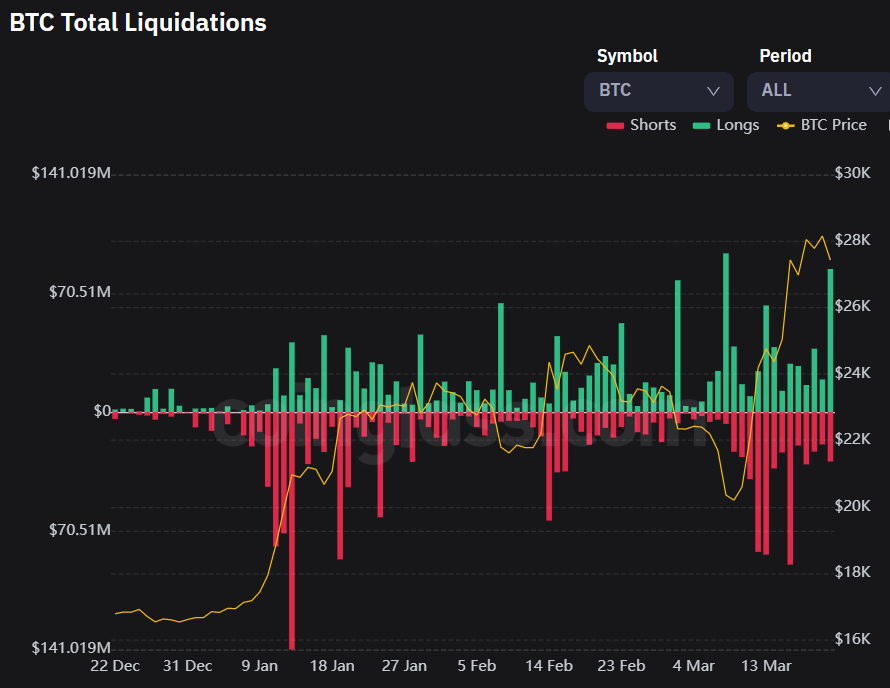

Based on crypto derivatives analytics website coinglass.com, around $60.two million in Bitcoin futures lengthy positions were liquidated within the first couple of hrs following the Fed’s policy announcement.

Lengthy liquidations during the day were last around $85 million, their greatest level because the 8th of March.

Given Presses Ahead With Rate Hike, But Results In as Dovish

The Given lifted its benchmark rate of interest range by 25 bps to 4.75-5.% not surprisingly, but softened its language on the possibilities of further hikes after acknowledging that recent US bank troubles added downside risk towards the economic outlook.

Where it’d before stated “ongoing increases” “will” be appropriate, it now states “some” additional policy firming “may be appropriate”.

The Given left its quantitative tightening schedule, which enables $95 billion in maturing assets to roll of their balance sheet each month, unchanged, although noting that inflationary pressures remain elevated, an unsurprising acknowledgment in wake of latest upside inflation and jobs data surprises.

Finally, the median conjecture in the Fed’s new us dot plot demonstrated the central bank sees rates of interest ending the entire year at 5.1%, unchanged in the December us dot plots minimizing than consensus market expectations for five.4%.

This, combined with Fed’s transfer of language, appeared to become enough to spur a dovish reaction in currency and bond markets. The United States Dollar Index (DXY) was last lower around .6% near 102.50, as the US 2-year yield fell 23 bps back under 4.%.

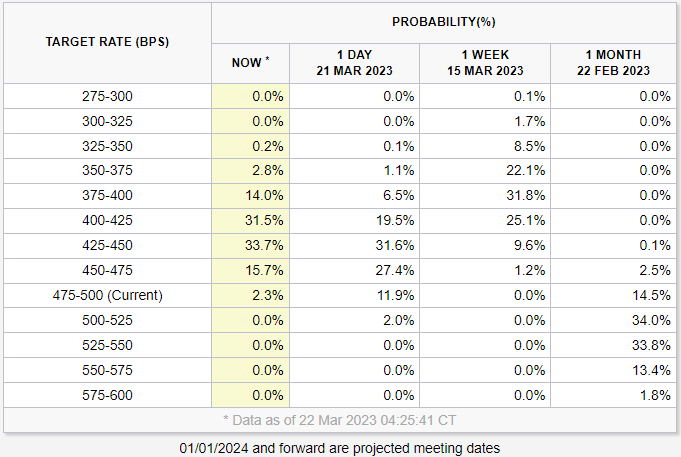

US money markets saw a dovish transfer of their prices of where US rates of interest could be headed this season.

As reported by the CME’s Given Watch Tool, the probability of the Given getting launched into between 50-75 bps of rate hikes through the finish of 2023 has become costing around 65% versus around 50% eventually ago.

Bitcoin Bulls Prone to Purchase the Dip, $30,000 around the corner?

Before the Given meeting, the Bitcoin cost have been around the front feet, hitting new nine-month highs within the $28,900s earlier within the session.

Using the Given meeting taken care of, a lot of traders made an appearance to wish to consider profit, resulting in what some labeled a “sell the fact” response to the dovish meeting.

Obviously, downside in US equity markets on Wednesday may also have considered on crypto, regardless of the correlation backward and forward asset classes getting weakened substantially as recently.

The stop by stocks was brought by downside in bank names after US Treasury Secretary Jesse Yellen commented that the federal government isn’t thinking about extending deposit insurance in the current $250,000 per account to pay for all deposits.

This comment may spark some fears among bank customers their deposits (above $250,000) aren’t safe, raising the chance of a financial institution run, that could explain the down-side in bank stocks.

But Wednesday’s resurgence people bank stability fears will probably attract Bitcoin dip buyers.

Indeed, because the collapse of three US banks earlier this year, Bitcoin continues to be serving as a secure haven against instability within the traditional financial sector.

If downside in US bank stock names continues, it might not be lengthy until BTC hits $30,000, or perhaps the next major resistance area surrounding $32,500-$33,000.

Given Bitcoin’s traditional negative correlation towards the US dollar and US yields, downside in these two traditional assets also favors a possible recovery within the Bitcoin cost to fresh multi-month highs.