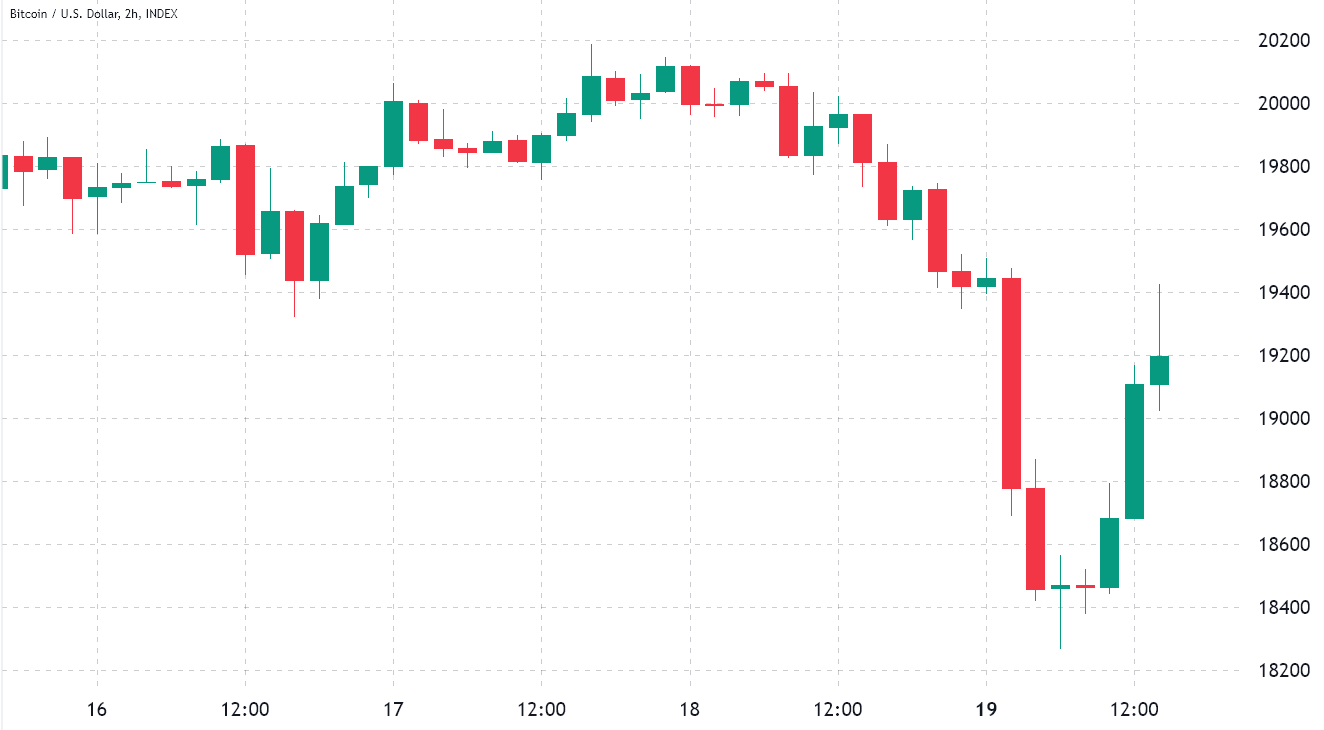

Bitcoin (BTC) faced a 9% correction in early hrs of Sept. 19 because the cost traded lower to $18,270. Although the cost rapidly bounced back above $19,000, this level was the cheapest cost observed in three several weeks. However, pro traders held their ground and weren’t inclined to accept loss, as measured by derivatives contracts.

Pinpointing the explanation behind the crash is very difficult, however, many say U . s . States President Joe Biden’s interview on CBS “an hour” elevated concerns about global warfare. When answering whether U.S. forces would defend Taiwan in case of a China-brought invasion, Biden responded: “Yes, if actually, there is an unparalleled attack.”

Others cite China’s central bank decreasing the borrowing price of 14-day reverse repurchase contracts to two.15% from 2.25%. The financial authority is showing indications of weakness in the present market conditions by injecting more income to stimulate the economy among inflationary pressure.

There’s also pressure in the approaching U.S. Fed Committee meeting on Sept. 21, that is likely to hike rates of interest by .75% as central bankers scramble to alleviate the inflationary pressure. Consequently, yields around the 5-year Treasury notes soared to three.70%, the greatest level since November 2007.

Let us take a look at crypto derivatives data to know whether professional investors altered their position while Bitcoin crashed below $19,000.

There wasn’t any effect on BTC derivatives metrics throughout the 9% crash

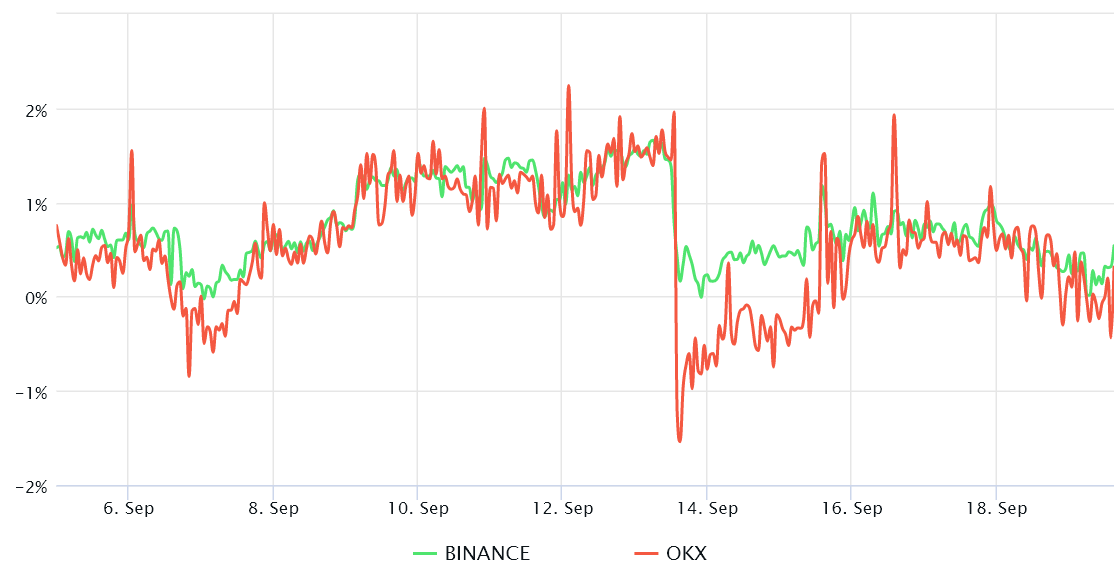

Retail traders usually avoid quarterly futures because of their cost difference from place markets, but they’re professional traders’ preferred instruments simply because they avoid the fluctuation of funding rates that frequently happens in a continuous futures contract.

The indicator should trade in a 4% to eightPercent annualized premium in healthy markets to pay for costs and connected risks. Thus, it’s possible to securely state that derivatives traders have been neutral to bearish within the last two days because the Bitcoin futures premium held below 2% the whole time.

More to the point, the shakeout on Sept. 19 didn’t cause any significant effect on the indicator, which is .5%. This data reflects professional traders’ unwillingness to include leveraged short (bear) positions at current cost levels.

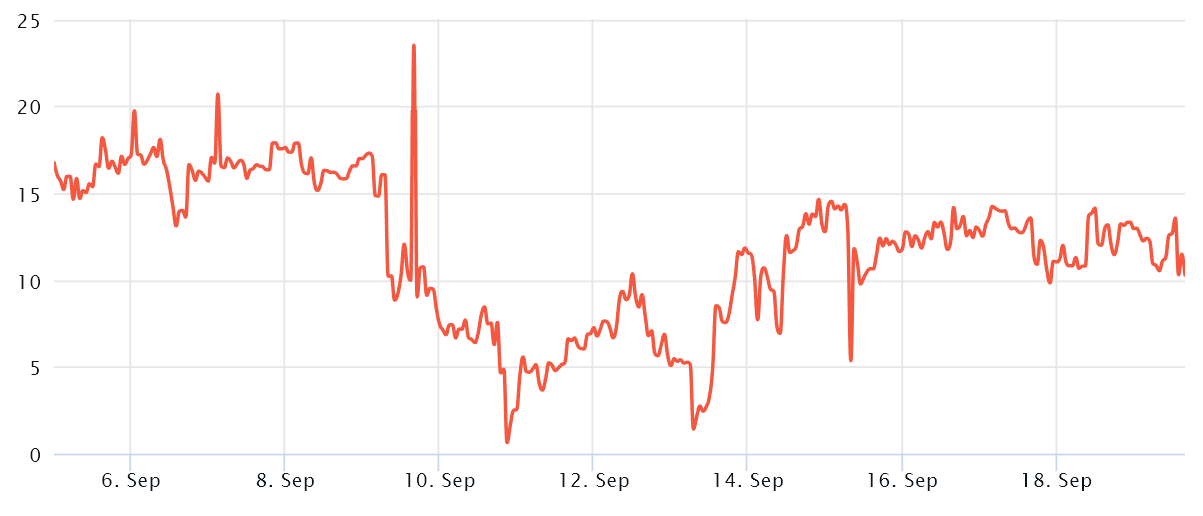

You have to also evaluate the Bitcoin options to exclude externalities specific towards the futures instrument. For instance, the 25% delta skew is really a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give greater odds for any cost dump, resulting in the skew indicator to increase above 12%. However, bullish trends have a tendency to drive the skew indicator below negative 12%, meaning the bearish put choices are discounted.

The 30-day delta skew have been close to the 12% threshold since Sept. 15, and signaled that options traders were less inclined to provide downside protection. The negative cost move ahead Sept. 19 wasn’t enough to switch individuals whales bearish, and also the indicator presently is 11%.

Related: Bitcoin, Ethereum crash continues as US 10-year Treasury yield surpasses June high

The underside might be in, however it depends upon macroeconomic and global hurdles

Derivatives metrics claim that the Bitcoin cost dump on Sept. 19 was partly expected, which is the reason the $19,000 support was obtained in under two hrs. Still, none of the will matter when the U.S. Fed enhances the rates of interest over the consensus or maybe stock markets collapse further because of the energy crisis and political tensions.

Therefore, traders should continuously scan macroeconomic data and monitor the central banks’ attitude prior to trying to pin a flag around the ultimate bottom of the present bear market. Presently, the chances of Bitcoin testing sub-$18,000 prices remain high, especially thinking about the weak interest in leverage longs on BTC futures.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.