Despite data showing the Bitcoin (BTC) cost might have fallen to begin being unprofitable for that average miner, Marathon Digital Holdings states it’ll continue trying to accumulate the key crypto asset.

Charlie Schumacher, VP of Corporate Communications at Marathon Digital told Cointelegraph on June 15 that although the organization “isn’t safe from the macro atmosphere,” it’s “fairly well insulated and well-positioned” to weather the present downturn, because of the inexpensive of operations and glued prices for power.

“For reference, in Q1 2022, our cost to make a Bitcoin was roughly $6,200. We have fixed prices for power, so we’re not susceptible to alterations in the power markets.”

Schumacher added that the organization continues to be focused on its Bitcoin production and also the accumulation from the crypto asset, with the fact that the asset continuously appreciate over time.

“Because we report our financials in USD, the cost of Bitcoin will invariably possess a material effect on our financial results. To fairly evaluate our progress internally, we attempt to concentrate more about our Bitcoin production. You need to keep in mind that Bitcoin mining is really a zero-sum game,” he added.

“Granted, that Bitcoin may be worth less when it comes to dollars at that time it’s found, however if you simply have confidence in Bitcoin’s capability to appreciate within the lengthy-run, earning more BTC isn’t a poor factor.”

Inside a June 9 statement, Marathon stated it’s been accumulating or “hodling” its Bitcoin and it has not offered any since October 2020. By June 1, 2022, Marathon held roughly 9,941 BTC, that is worth around $200 million at current prices.

$MARA‘s May 2022 #bitcoin production and miner installation update has gone out:

– 19,000 miners (c. 1.9 EH/s) prepared to be energized

– Total #BTC holdings = 9,941 BTC #HODL

– Still on pace to attain 23.3 EH/s by early 2023https://t.co/tgDetL9upF— Marathon Digital Holdings (@MarathonDH) June 9, 2022

Continue mining

Actually, Schumacher made the reality that because the cost of Bitcoin declines, the same is true the amount of people who could mine profitably, that will pressure inefficient miners out as well as reduce the impossibility of mining new blocks.

“When the problem rate declines, individuals who is able to continue mining possess the chance to earn more bitcoin.”

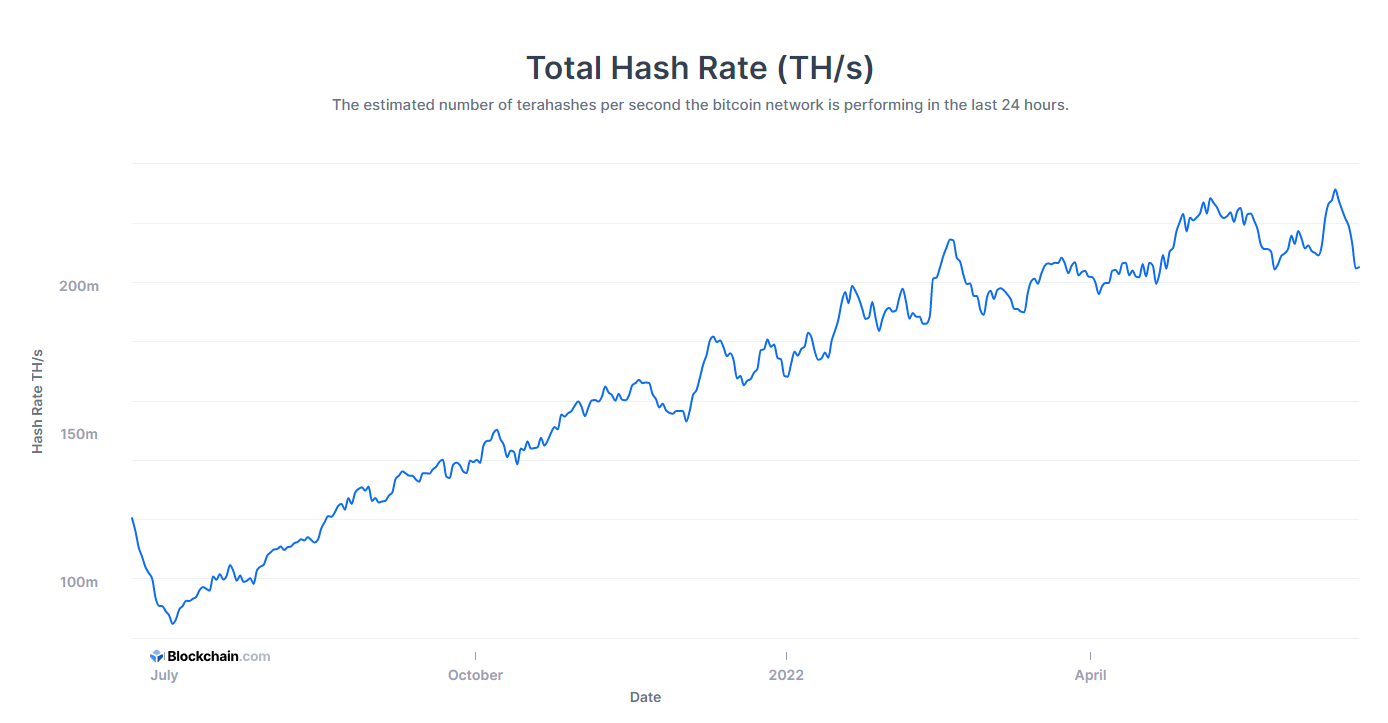

Bitcoin’s current hash rate, also referred to as Bitcoin’s processing power, fell from your all-time-high (ATH) of 231.428 EH/s on June 12 to 205.163 EH/s during the time of writing.

A far more pronounced effect happened last year after China’s attack on cryptocurrency mining facilities, which went from the hash rate market peak of 180.666 in May 2021 to 84.79 in This summer 2021.

Cost meets average price of mining

A week ago, crypto market data and analytics platform CryptoRank highlighted that on June 16, the cost of BTC was on componen using the average price of mining, noting that for many, it might be also unprofitable to mine right now.

#BTC Cost Drops to Average Price of Mining

As a result of significant stop by $BTC cost in the last several weeks, $mining is becoming less lucrative. For many #Bitcoin miners, it could be also unprofitable right now.

https://t.co/nYhYMYoYXp pic.twitter.com/WOjCUSkG7x

— CryptoRank Platform (@CryptoRank_io) Next Month, 2022

Markus Thielen, chief investment officer of digital asset manager IDEG Singapore, told Cointelegraph that there might be fallout in the mining industry since many had set their budgets in Q4 2021, prior to the alternation in market conditions.

“We really expect that you will see some drop out as the majority of the miners made an appearance to create their 2022 budgets at the begining of Q4 2021 and market conditions have materially altered.”

Thielen stated they estimate that some of the smaller sized miners that don’t have economies of scale have a break-even rate close to $26,000 to $28,000. Bitcoin is presently costing $20,085 during the time of writing.

Related: Bitcoin heads for dismal weekly close as BTC cost rejects at $20K

A week ago, a study by S3 Partners identified Marathon Digital Holdings to be among the U.S.-listed companies using the most short-seller interest alongside MicroStrategy and Coinbase.