Bitcoin News

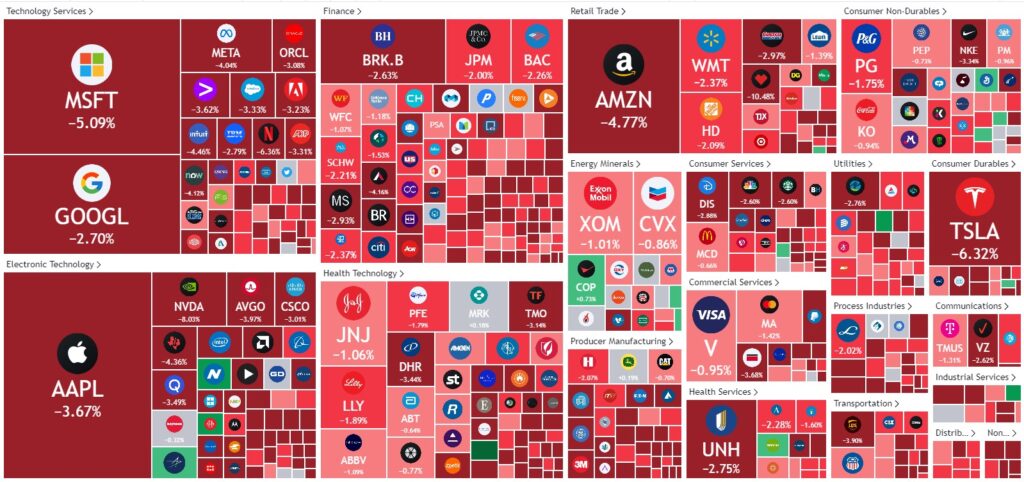

Bitcoin News- Friday stock exchange closing portrayed around $930 billion liquidity as a whole.

- The amount of people unemployed or seeking jobs remains 3.5% less than the forecasted rate.

The worldwide market, both crypto, and also the stock have trampled lower publish the U.S employment rate release. The present rates are alike towards the one before the global covid pandemic. The amount of people unemployed or seeking jobs remains 3.5% less than the forecasted rate.

This drop rates are expected straight to hit the Fed reaching boost the rate of interest throughout the approaching November meeting. The amount for rate of interest hikes can also be forecasted to become .75%.

The Friday closing portrayed around $930 billion in liquidity, and also the S&P 500 closed 2.8% lower. Most analysts believe the Given rates to increase to 4.25% or 4.5%, and will also be continual within the first 1 / 2 of 2023.

Battling Crypto Market

Despite major technological developments happening within the cryptocurrency industry, the marketplace continues to be falling lower. Although the hype for various coins continues to be in phase, the development of the identical isn’t as predicted. The influence of various government institutions such as the SEC, CFTC, and Given can also be quite strong.

According to CMC data, Bitcoin (BTC) instantly dropped from $20,020 to $19,626, and Ethereum (ETH) also hit a drop to $1,272. The entire market capital went below $862 Billion, using the 24 hrs buying and selling amount of $51 Billion. The marketplace capital fell .86% during the last day.

Suggested For You Personally