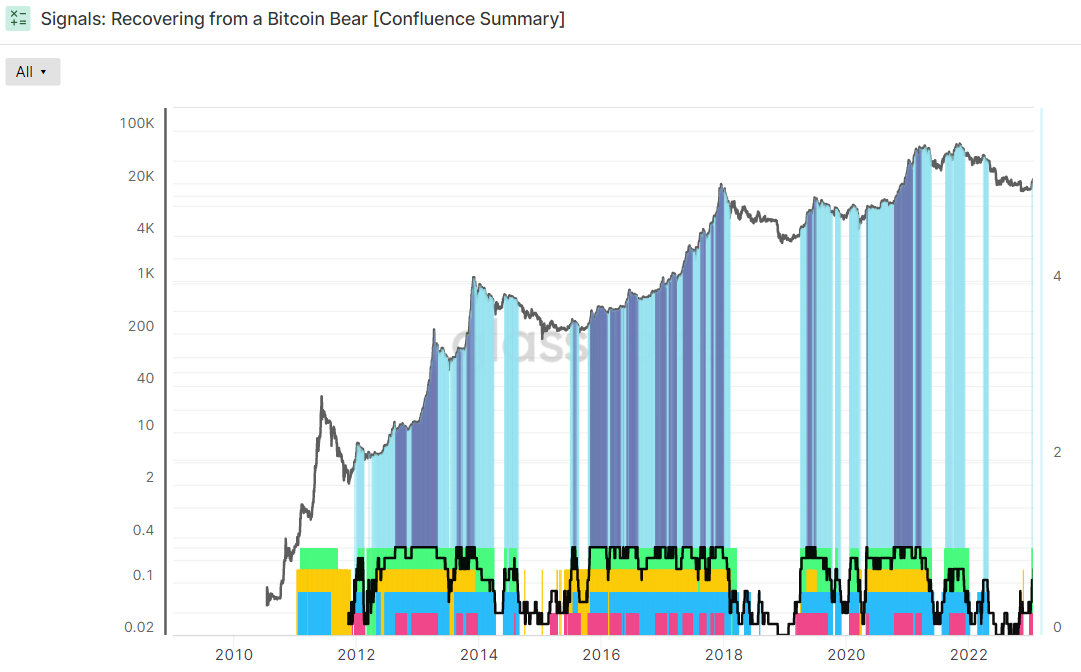

Six from eight indicators viewed by analysts at crypto data analytics platform Glassnode to recognize when Bitcoin is transitioning from a bear market are flashing bullish signals, along with a seventh will probably also soon turn eco-friendly. Glassnode’s “Recovering from the Bitcoin Bear” dashboard of indicators seeks to assist Bitcoin investors identify once the Bitcoin marketplace is moving perfectly into a healthier trend by watching a combination of on-chain, technical and network fundamental indicators.

In the past, a minimum of 5 of those indicators are flashing eco-friendly when Bitcoin costs are rising. Meanwhile, when all eight indicators start flashing bullish signals, it has in the past been an excellent buy signal. On the other hand, when under five of those indicators are flashing eco-friendly, Bitcoin’s cost is usually inside a lengthy-term decline. Light blue denotes periods of time where a minimum of five from eight bullish conditions happen to be met. Fast denotes periods of time when all eight are met.

Signal 1 and a pair of: Place Prices Buying and selling Above Key Prices Models

Glassnode groups these indicators into four groups. The very first is if Bitcoin is buying and selling above key Prices Models – the 200-Day Simple Moving Average (SMA) and also the Recognized Cost, that is an on-chain indicator that shows the mean cost of when each Bitcoin around the network last moved (the typical cost wallets “paid” for his or her Bitcoins once they received them).

With Bitcoin’s 200DMA around $19,600 and it is Recognized Cost around $19,800, Bitcoin lately broke to northern these two key levels the very first time since December 2021. Both of them are thus flashing eco-friendly.

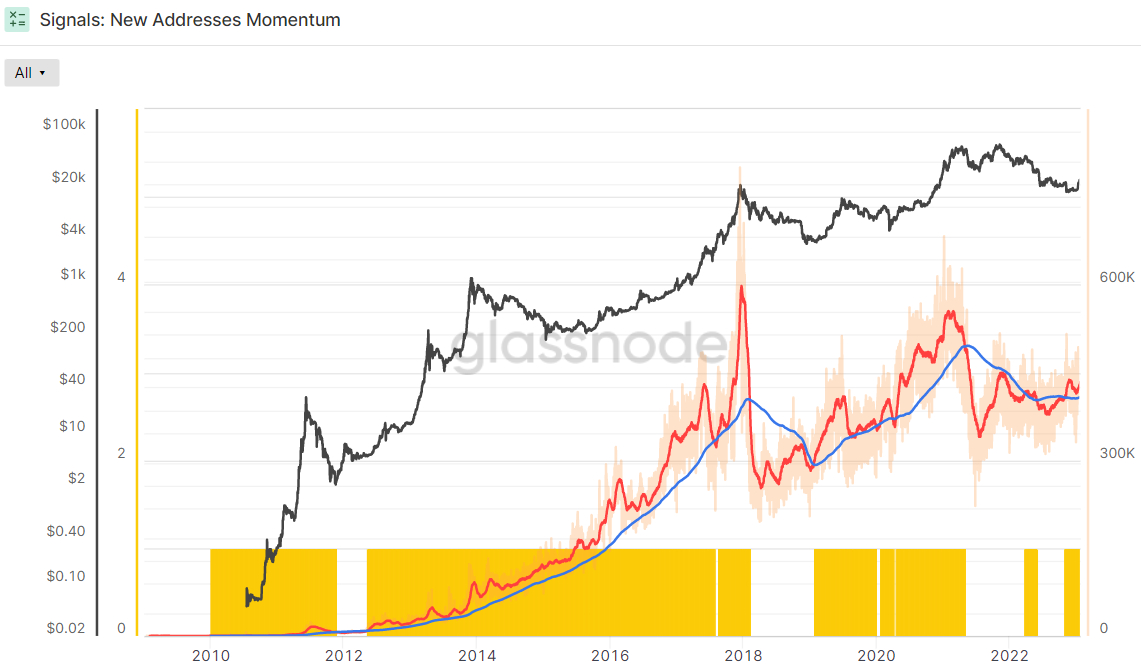

Signal 3 and 4: Network Utilization is Growing

The 30-Day SMA of recent Addresses lately broke above its 200-Day SMA and it is thus flashing eco-friendly. It has in the past happened at the beginning of bull markets.

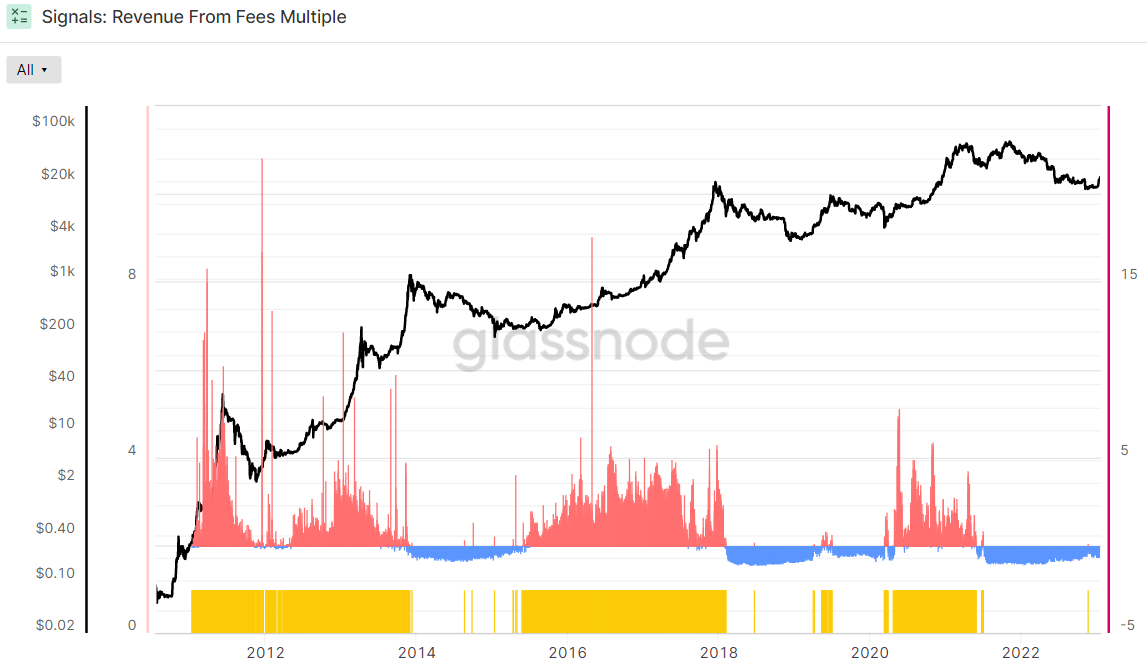

Meanwhile, the Revenue From Charges Multiple continues to have an adverse 2-year Z-score close to -.33. The Z-score is the amount of standard deviations below or above the mean of the data sample. In cases like this, Glassnode’s Z-score is the amount of standard deviations below or above the mean Bitcoin Fee Revenue from the last 2-years.

This indicator is thus still not flashing eco-friendly. However, as history shows, this could change very rapidly.

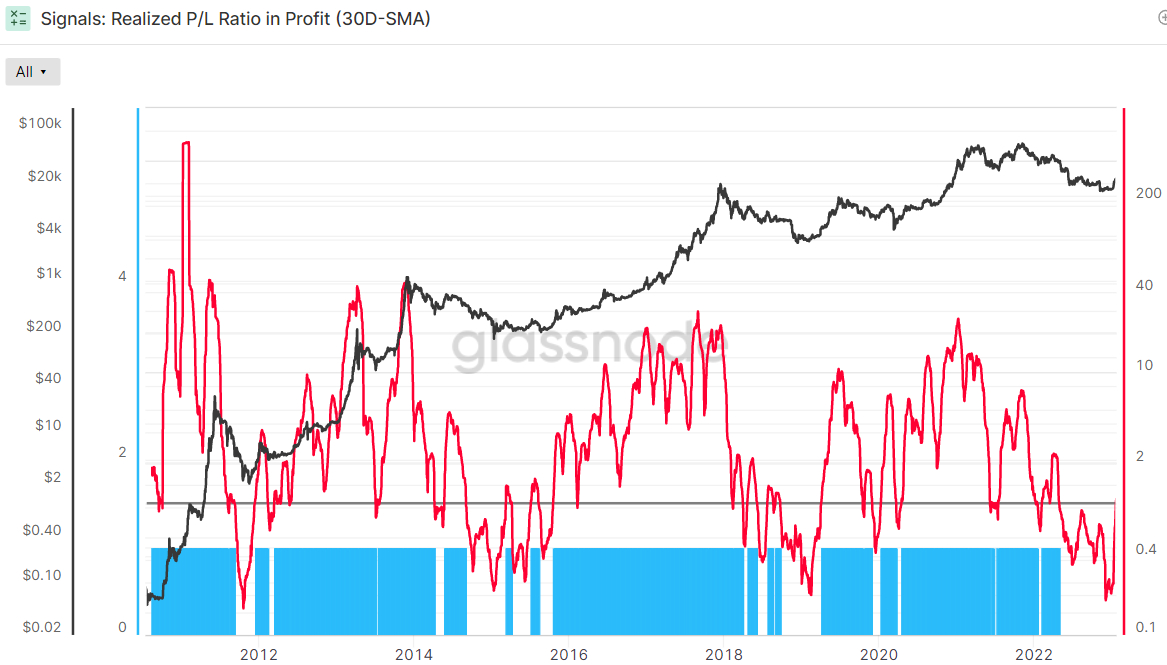

Signals 5 and 6: Market Profitability is Coming back

The 30-Day Simple Moving Average (SMA) from the Bitcoin Recognized Profit-Loss Ratio (RPLR) indicator lately moved above one the very first time last April. This means that the Bitcoin marketplace is realizing a larger proportion of profits (denominated in USD) than losses.

Based on Glassnode, “this generally ensures that sellers with unrealized losses happen to be exhausted, along with a healthier inflow of demand exists to soak up profit taking”. Hence, this indicator is delivering a bullish sign.

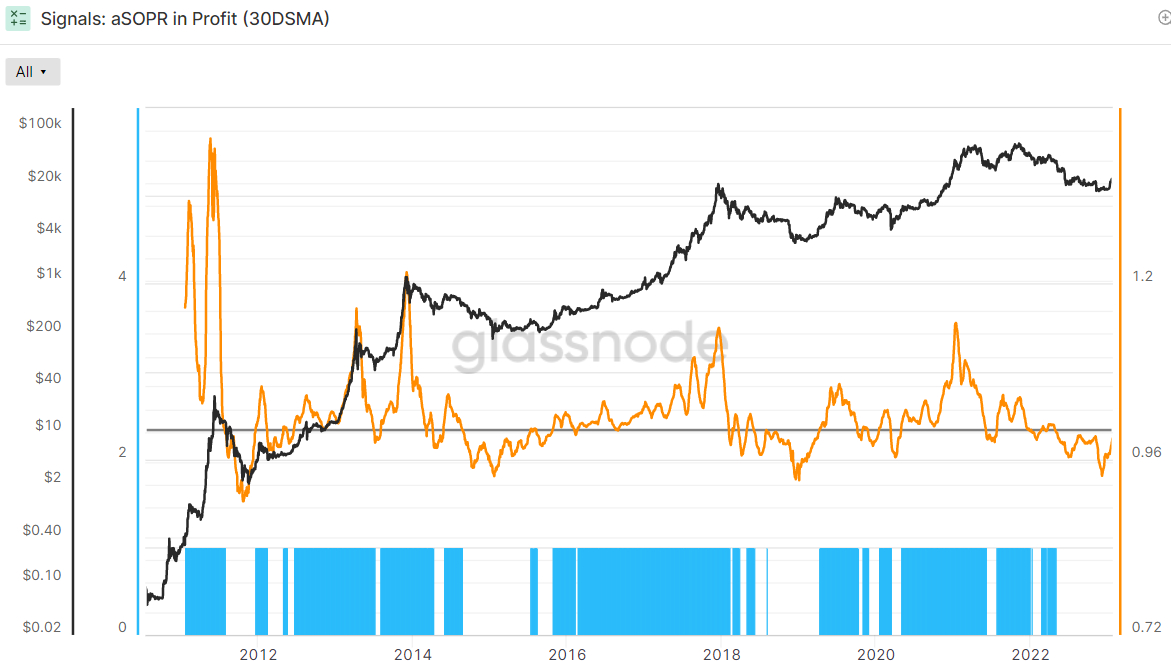

Meanwhile, although the Adjusted Spent Output Profit Ration (aSOPR), an indication that reflects the quality of recognized profit and loss for those coins managed to move on-chain, remains below 1 (indicating the marketplace isn’t yet in profit), it’s fast paced greater and appears prone to soon mix 1. It had been last at .988.

This is actually the seventh indicator that is not yet delivering a bullish signal, but soon likely is going to be. Searching back during the last eight many years of Bitcoin history, the aSOPR rising above 1 following a prolonged spell below it’s been an incredible buy signal.

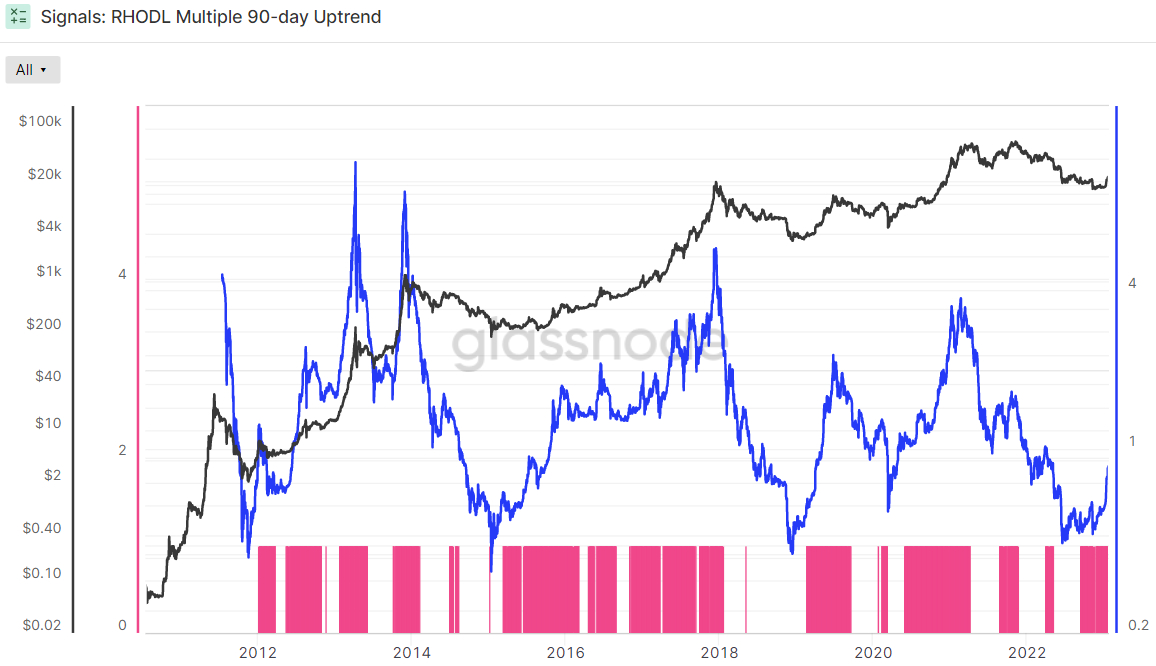

Signals 7 and eight: BTC Balance Has Moved In support of The HODLers

The Bitcoin Recognized HODL Multiple has been around an upward trend during the last 3 months, a bullish sign based on Glassnode. The crypto analytics firm claims that “when the RHODL Multiple transitions into an upward trend more than a 90-day window, it signifies that USD-denominated wealth is beginning to shift back towards new demand inflows”. It “indicates earnings are being taken, the marketplace is capable of doing absorbing them… (and) that longer-term holders are beginning to invest coins” Glassnode states.

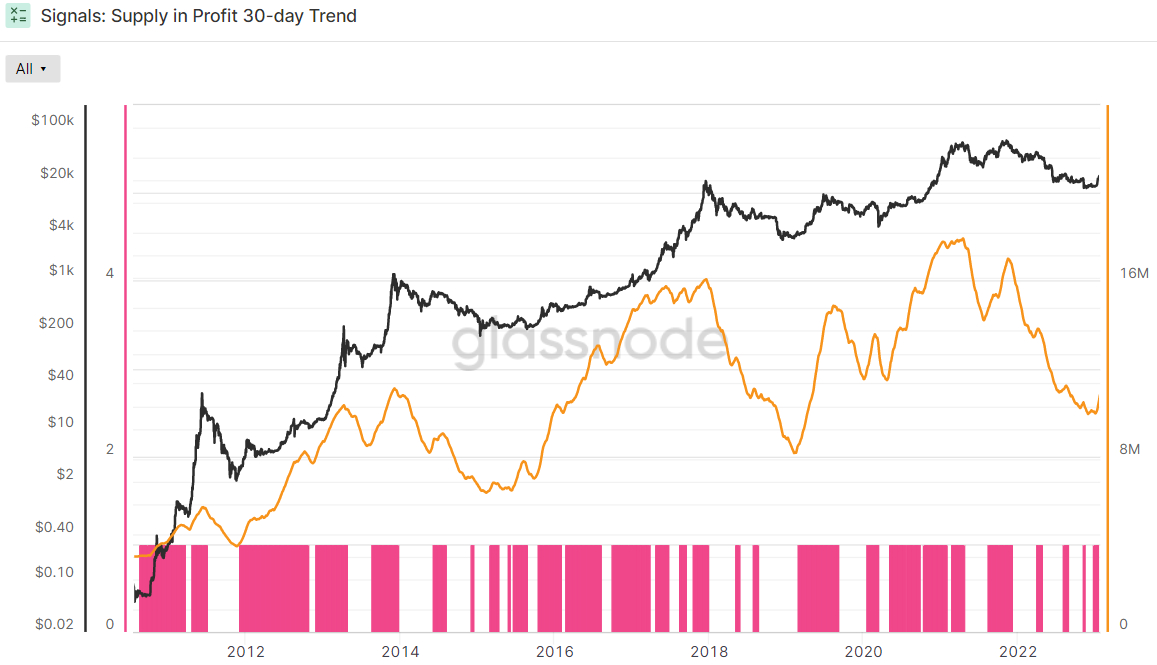

Glassnode’s final indicator in the Dealing with a Bitcoin Bear dashboard is if the 90-day Exponential Moving Average (EMA) of Bitcoin Supply in Profit has been around an upward trend during the last thirty days or otherwise. Supply in Profit is the amount of Bitcoins that last moved when USD-denominated prices were less than they’re at this time, implying these were bought for any lower cost and also the wallet is possessing a paper profit. This indicator can also be flashing eco-friendly.

We Are Too Inside A Bitcoin Bull Market?

2022’s macro headwinds seem to be abating. US inflation is fast shedding to more acceptable levels along with the US economy grinding to some halt according to recent survey data and company earnings, the bond market’s assessment the Given won’t have the ability to tighten rates a lot more in 2023 is searching as an more and more accurate call.

This narrative is a key driver of Bitcoin’s 2023 rally to date, and lots of think could further support its cost within the several weeks ahead. Although some still deride the most recent move greater as yet another bear market rally, the above mentioned-noted indicators in Glassnode’s dashboard claim that this latest move greater is possibly some thing.

Which aren’t the only real on-chain indicators flashing signals of the incoming bull market. Based on analysis published on Twitter by @GameofTrade_, 6 on-chain metrics such as the Accumulation trend score, Entity-adjusted dormancy flow, Reserve risk, Recognized cost, MVRV Z-score and Puell multiple are “calling for any generational lengthy-term buying opportunity”.

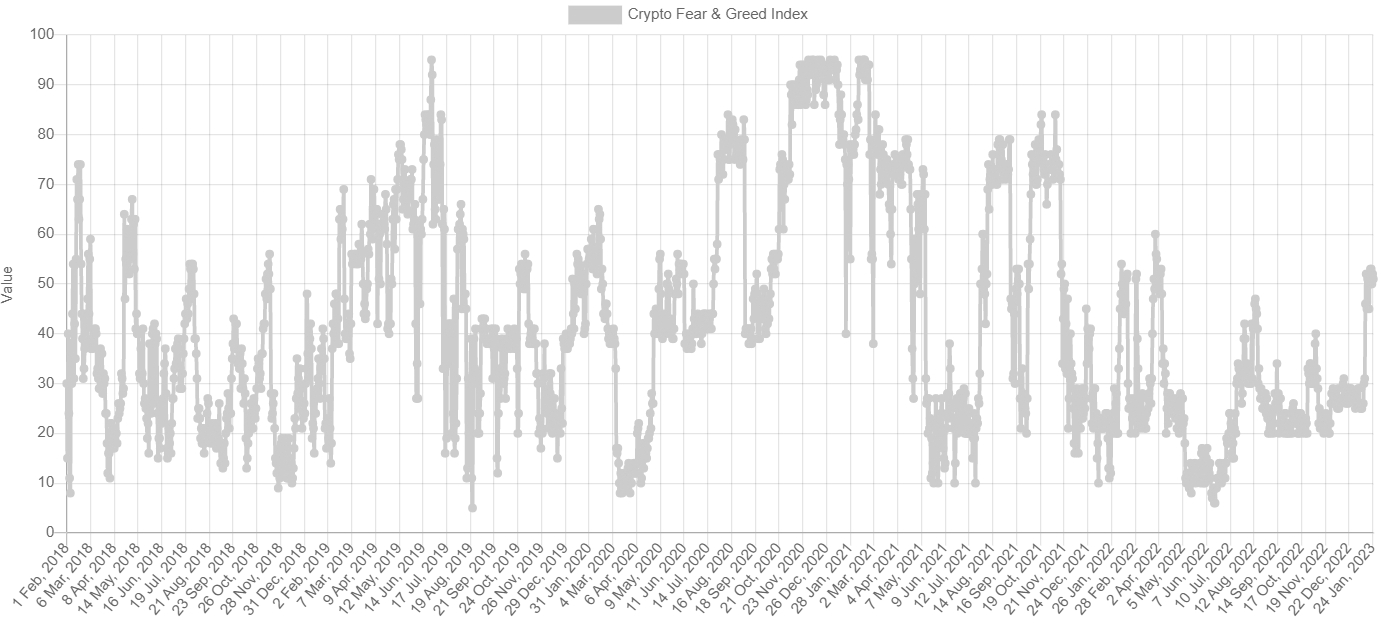

Elsewhere, the broadly adopted Bitcoin Fear & Avarice Index lately moved back to neutral territory (i.e. above 50) the very first time following a prolonged spell of Fear and Extreme Fear. An enduring recovery back to neutral frequently comes at the outset of the following Bitcoin bull market, for example at the begining of 2019 and on the other hand in mid-2020.

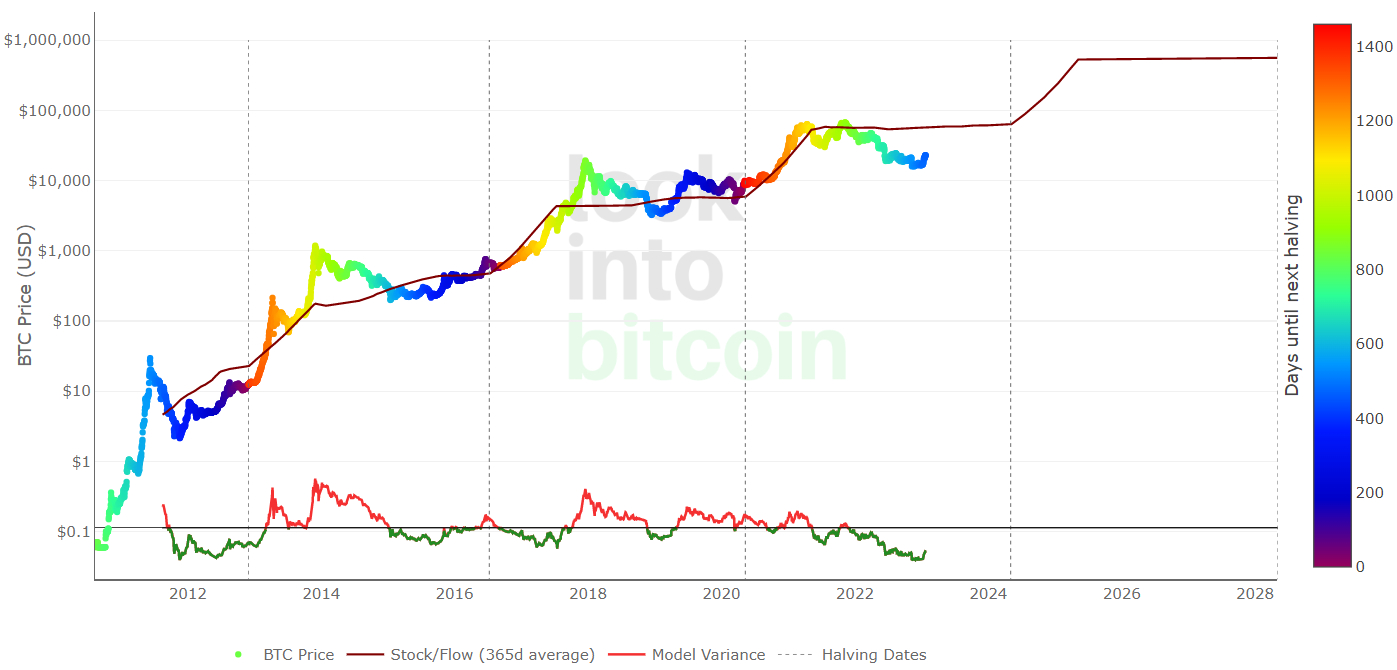

Analysis from crypto-focused Twitter account @CryptoHornHairs designed a jaw-shedding observation that Bitcoin is following almost exactly within the actions of the near-four-year market cycle that it’s been following within the last greater than eight years. After bottoming last November, Bitcoin may rally for an additional nearly 1000 days, case study suggests, before entering its next bear market in 2025.

A broadly adopted Bitcoin prices model is delivering an identical story. Based on the Bitcoin Stock-to-Flow prices model, the Bitcoin market cycle is roughly 4 years, with prices typically bottoming somewhere near to the center of the four-year gap between “halvings” – the Bitcoin halving is really a four-yearly phenomenon in which the mining reward will get halved, thus slowing the Bitcoin inflation rate. Past cost history shows that Bitcoin’s newest surge can come following the next halving in 2024.