MicroStrategy (MSTR) stock opened up greater on August. 3 as investors digested the news of their Chief executive officer Michael Saylor’s exit following a depressive quarterly earnings report.

Microstrategy fill up 142% since May lows

Around the daily chart, MSTR’s cost surged by nearly 14.5% to $324.55 per share, the greatest level since May 6.

The stock’s intraday gains came as part of a wider recovery that began on May 12 at $134. Since that time, MSTR is continuing to grow by 142% versus Nasdaq’s 26.81% gains within the same period.

Bad Q2, Saylor’s resignation

The August. 3 MSTR rally came each day after MicroStrategy reported a big loss in the second quarter (Q2) earnings call. Interestingly, the business’s major Bitcoin exposure would be a large reason behind its poor quarterly performance.

In conclusion: MicroStrategy is definitely an it firm that provides business intelligence, mobile software and cloud-based services. Only one of their primary corporate strategies is to purchase Bitcoin to carry it lengthy-term.

Regrettably, holding Bitcoin has cost MicroStrategy an impairment loss of $917.84 million from the 129,698 BTC holdings in Q2, mainly because of the crypto’s 50% year-to-date (YTD) cost drop. Compared, MSTR stepped 42% within the same period.

In addition, MicroStrategy’s revenue fell 2.6% year-over-year to $122.07 million. The internet quarterly losses motivated Saylor—who has strongly backed the Bitcoin investment strategy since August 2020—to quit because the firm’s Chief executive officer and be a professional chairman.

MSTR responded positively to Saylor’s resignation and also the appointment of Phong Le, president of MicroStrategy, as his substitute, suggesting that investors are comfy using the alternation in leadership.

What’s next for MSTR?

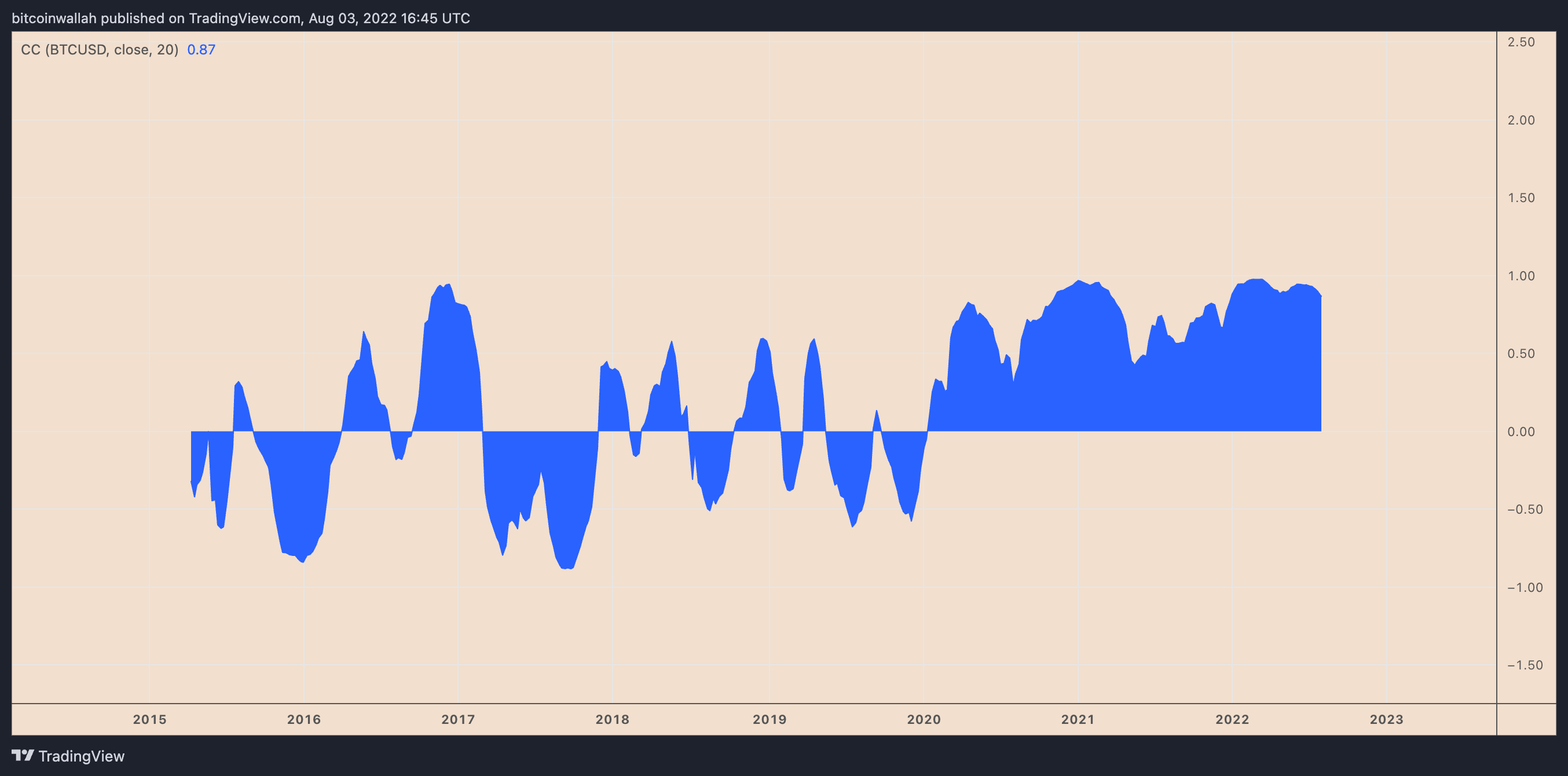

MSTR’s course through out 2022 depends largely on Bitcoin’s performance, given their consistently positive correlation recently. But several metrics are meaning in a correction ahead.

For example, MicroStrategy’s enterprise value-to-revenue (EV/R) ratio what food was in 10.76 on August. 3, or perhaps in “overvalued” territory.

Similarly, MSTR’s forward cost-to-earnings (P/E) ratio has arrived at 54.95, greater than double the amount market average of 20–25. Quite simply, the marketplace expects MicroStrategy to exhibit enormous future earnings growth despite its underperformance in recent quarters.

MicroStrategy also offers amassed $2.4 billion in lengthy-term financial obligations with $46.six million in interest expenses. Therefore, the organization will find it not able to satisfy its debt obligations whether it is constantly on the suffer losses in the current pace.

Quite simply, MicroStrategy could pledge its nearly $2 billion price of Bitcoin holdings as collateral or sell these to raise investment capital.

Related: A history of Bitcoin crashes and bear markets: 2009–2022

“Nevertheless, crypto and MSTR bulls may remain invested,” noted Juxtaposed Ideas, a Seeking Alpha contributor, in the latest analysis, stating that most are prepared to “gamble on Bitcoin’s eventual recovery to $40,000” or beyond by 2023 or 2024.

“That might be an optimistic catalyst because of its future stock recovery, coming back some much-needed capital towards the highly volatile investment.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.