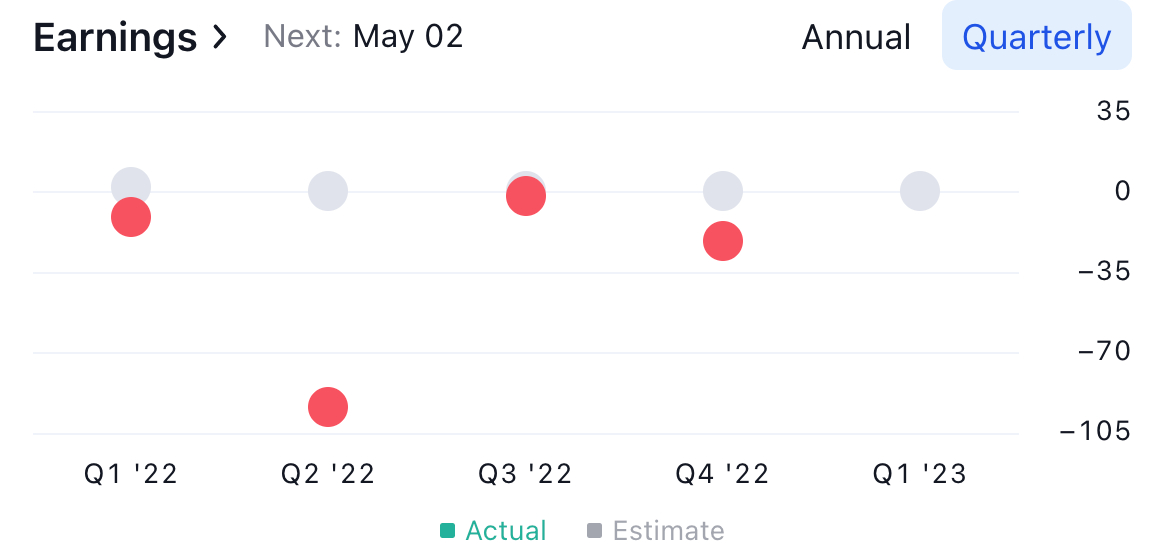

Bitcoin (BTC) bull Michael Saylor’s big bet might be going to backfire for his company MicroStrategy, following the firm on Thursday reported an enormous loss for that 4th quarter of this past year.

The internet loss for MicroStrategy for that 4th quarter wound up at $249.7m, using the number pulled lower considerably with a $197.6m loss in the firm’s bitcoin investment strategy, the report revealed.

By the finish from the 4th quarter, MicroStrategy held roughly 132,500 BTC, worth some $1.840bn. The organization has recorded a cumulative impairment loss on its BTC holding of $2.153bn since acquisition.

Eighth consecutive quarterly loss

Yesterday’s reported loss marks the eighth consecutive quarterly loss MicroStrategy has reported. Regardless of this, the organization has continued to be steadfast in the belief in Bitcoin.

“Our corporate strategy and conviction in obtaining, holding, and growing our bitcoin position for that lengthy term remains unchanged,” MicroStrategy’s chief financial officer Andrew Kang was quoted as saying in an announcement sent by the organization.

Meanwhile, within an earnings call within 24 hours, MicroStrategy founder and chairman Michael Saylor pointed to the rise in their share cost because the bitcoin strategy was announced in August of 2020.

“At that — at the time before, our stock involved $121 to $122 a share. Today, the stock closed at $292 a share. So, obviously, we measure our success based on the development of shareholder value,” Saylor stated.

Stock tucked after-hrs

Shares of MicroStrategy, using the ticker MSTR, traded up with a respectable 9% to $292.13 on Thursday, but tucked in after-hrs buying and selling to $284 because the loss was reported. Forever of 2022, the stock has become lower some 46%.

Since MicroStrategy made its first bitcoin purchase on August 11 of 2020, bitcoin has roughly bending in cost, from around $11,500 to $23,000. The organization ongoing to purchase bitcoin through the entire 2020-2021 bull market, and it has also kept away from selling throughout the subsequent bear market.

MicroStrategy made its newest bitcoin purchase at the end of December this past year, if this spent $42.8m to purchase 2,395 BTC.

Bitcoin touched a minimal of $15,476 in November this past year, but has since seen a substantial recovery. During the time of writing, BTC traded at $23,530, up roughly 50% in the November low.