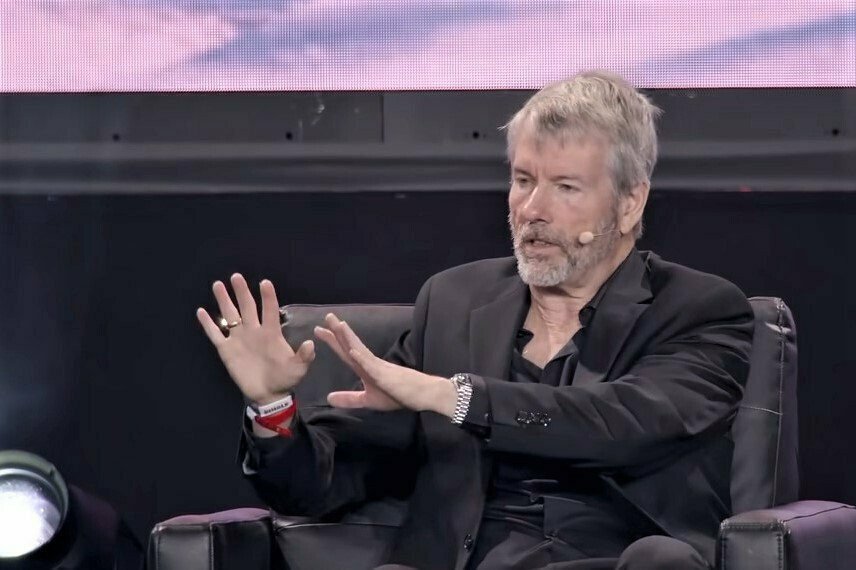

Michael Saylor, the co-founder and former Chief executive officer of MicroStrategy, has addressed Charlie Munger’s critique of Bitcoin, claiming he hasn’t taken time to know Bitcoin.

Inside a Friday interview with CNBC, Saylor stated he’s “supportive” to Munger’s critique from the broader crypto market, noting that a large number of altcoins are nothing more than avenues for “gambling.” However, he contended that Warren Buffett’s right-hands man might have were built with a different understanding of Bitcoin if he studied it.

“If he would be a business leader in South Usa or Africa or Asia and that he spent one hundred hrs staring at the problem, he’d become more bullish on bitcoin than I’m,” Saylor described, adding:

“The Western elites haven’t had time to review … but I’ve never really met someone by having an incentive residing in all of those other world that spent a while considering it that wasn’t passionate about bitcoin.”

The statements came after Munger’s op-erectile dysfunction for that Wall Street Journal that requested for any blanket ban on cryptocurrencies. Entitled “Why America Should Ban Crypto,” the content contended that the cryptocurrency is “a gambling contract” and advised regulators to do something and introduce a regulatory framework.

“A cryptocurrency isn’t a currency, not really a commodity, and never a burglar. Rather, it’s a gambling hire a virtually 100% edge for that house, joined into inside a country where gambling contracts are typically controlled only by claims that compete in laxity,” Munger stated within the op-erectile dysfunction.

This isn’t the very first time Munger has lashed out at digital assets. Formerly, he had stated that buying and selling in cryptocurrencies is “just dementia” and known as Bitcoin “a poor combo of fraud and delusion” that will work for kidnappers.

Particularly, Warren Buffett, the chairman and Chief executive officer of Berkshire Hathaway, also shares exactly the same mindset together with his friend Munger with regards to cryptocurrencies, calling Bitcoin “rat poison squared” in 2018.

Meanwhile, Michael Saylor’s big bet on Bitcoin hasn’t gone not surprisingly because the firm has reported an enormous loss for that 4th quarter of this past year. The internet loss for MicroStrategy for that 4th quarter wound up at $249.seven million, using the number pulled lower considerably by a $197.six million loss in the firm’s bitcoin investment strategy.

However, within the interview with CNBC, Saylor stated he remains as bullish on Bitcoin. Also, he shares additional information about MicroStrategy’s intends to develop Lightning enterprise software. “Microstrategy is really developing MicroStrategy Lightning, our very own enterprise Lightning offering,” he stated, adding:

“We’re likely to allow CMOs to provide Lightning rewards or bitcoin rewards, just like a frequent flier program, to thousands and thousands or countless their clients, all their employees and every one of their prospects, in the speed of sunshine off an internet site — and we’re very passionate about this.”