Bitcoin (BTC) prepares to exit a harsh November just above $16,000 — what is around the menu for BTC cost now?

Currently of the items analyst Willy Woo has known as “unprecedented deleveraging,” Bitcoin is way from from the forest after losing over 20% this month.

The outcome from the FTX implosion remains unknown, and indicators still flow in despite the very first wave of crypto business bankruptcies.

Particularly now, eyes take presctiption miners, who’re seeing profits squeezed by falling place prices and surging hash rates.

Upheaval is incorporated in the air, and really should another “capitulation” among miners occur, the whole ecosystem might be set for an additional shock.

As “max pain” looms for that average hodler, Cointelegraph analyzes a few of the primary factors affecting BTC/USD for the short term.

Bitcoin miners due “capitulation” — Analyst

Like others, Bitcoin miners are visiting a major squeeze with regards to selling accrued BTC in a profit.

It remains seen just how much financial discomfort the typical miner is within, only one classic metric is getting ready to call “capitulation” once again.

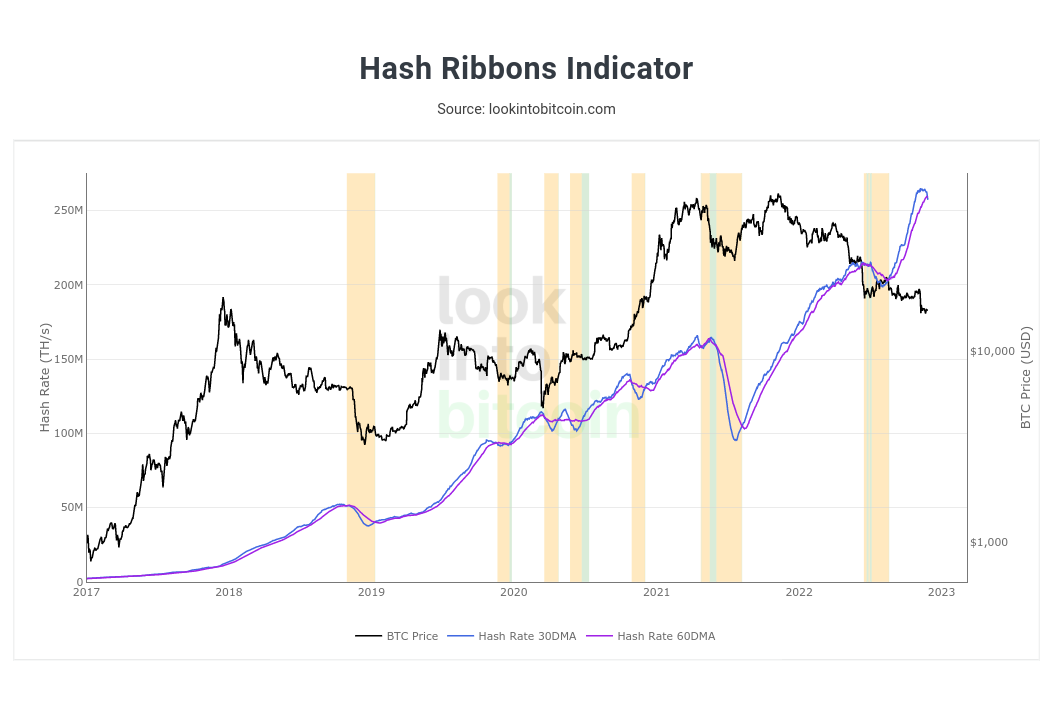

Just several weeks following the last such period, Hash Ribbons is warning that the weather is again becoming unsustainable.

Hash Ribbons uses two moving averages of hash rate to infer conclusions about miner participation within the Bitcoin network. Crossovers from the trend lines denote capitulatory and recovery phases.

For Kripto Mevismi, a cause of on-chain analytics platform CryptoQuant, time is approaching for that former to reappear.

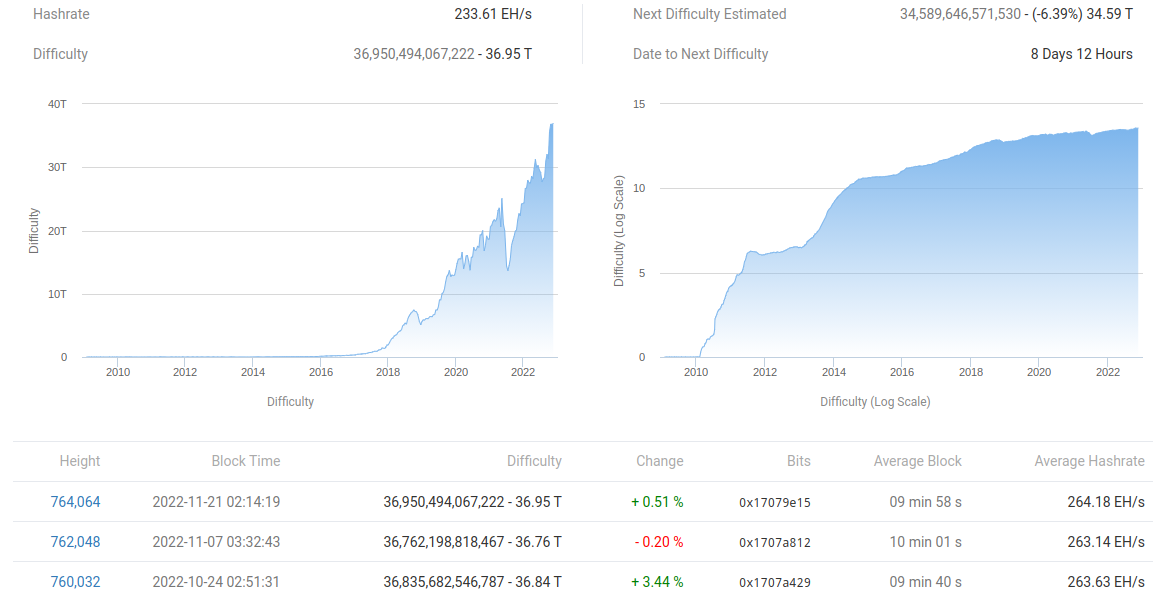

“So at this time bitcoin difficulty is actually high for miners to ensure that means pricing is getting greater and conducting business in this sort of atmosphere gets harder,” he authored inside a blog publish:

“That’s why miners fail to work entirely pressure. Should they have efficient- new generation mining machines, installed them into work but that is all. Inflation is high and individuals feels aftereffect of living costs, bitcoin cost is declining, mining cost and difficulty gets greater. Tough atmosphere for miners.”

Kripto Mevismi added that the significant alternation in mining difficulty may help the problem.

Estimates from BTC.com for the following adjustment on 12 ,. 6 place the difficulty drop at 6.4% during the time of writing. Should it visit fruition, it will likely be the biggest such drop since This summer 2021.

BTC.com yet others likewise estimate that hash rates are now declining from record levels as miners wind lower operations.

BTC/USD eyes volatility into monthly close

BTC/USD were able to prevent significant weekly losses in the latest candle close on November. 27.

Around $16,400, the weekly close would be a whisker greater compared to previous week, using the pair still circling two-year lows, data from Cointelegraph Markets Pro and TradingView shows.

With too little volatility characterizing intraday cost action, traders and analysts remain careful about the next phase.

“It’s a lengthy holiday weekend so expect items to get interesting once we move for the Weekly and Monthly close,” on-chain analytics resource Material Indicators authored partly of the tweet a week ago.

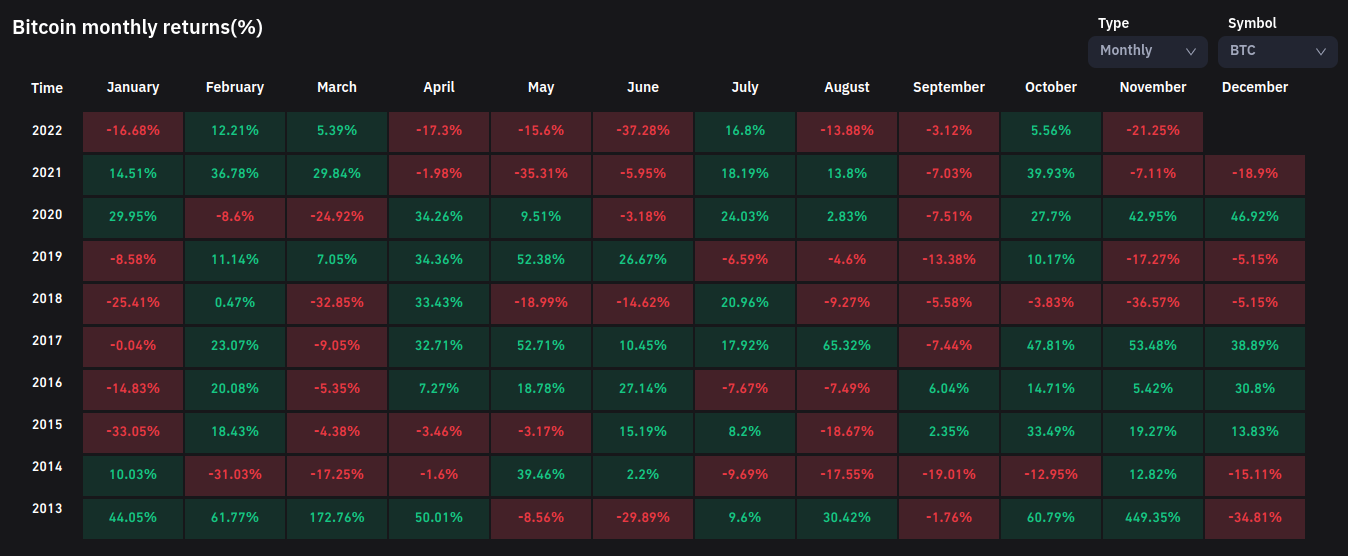

A subsequent publish reiterated the November. 30 close may likely spark fresh instability, with BTC/USD presently 21.25% lower versus the beginning of the month.

This will make November 2022 Bitcoin’s worst November since its previous bear market year in 2018, data from Coinglass confirms.

On shorter timeframes, popular trader Crypto Tony, meanwhile, highlighted $16,000 like a key zone to switch for greater levels to go in next, and keep conscious from the longer-term trend.

“Lower highs together with consolidating below a significant resistance zone. If you wish to enter securely, wait for switch from the lows,” he summarized in the weekend.

As Cointelegraph extensively reported, Bitcoin’s next bear market bottom may be the discussion reason for as soon as at the moment, and certain targets have grown to be accepted others.

One vocal commentator with further downside, Il Capo of Crypto, thus reiterated his opinion that $12,000 might be next for BTC/USD.

Highlighting the connection between perpetual futures buying and selling volume and place cost, he cautioned the market structure wasn’t supportive of further gains.

“12000-14000 is probably. 40-50% drop for altcoins,” he stressed.

Underneath the Bitcoin ocean, hodlers accumulate

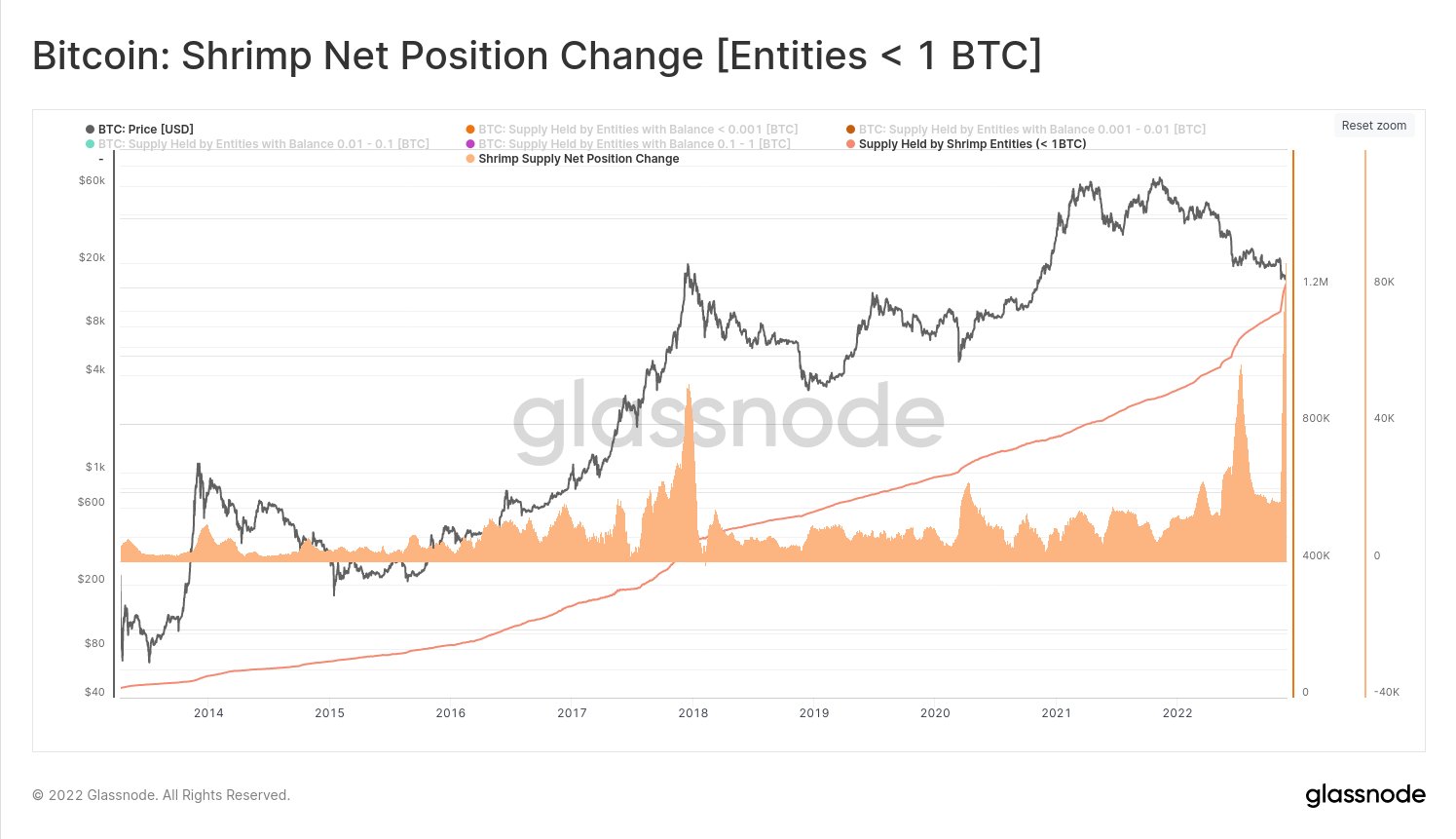

Small or big, the populace from the Bitcoin ecosystem is “aggressively” contributing to its BTC exposure this month.

Inside a positive sign for any future supply squeeze — where demand comes facing a bigger part of illiquid supply — accumulation seems to become gathering pace.

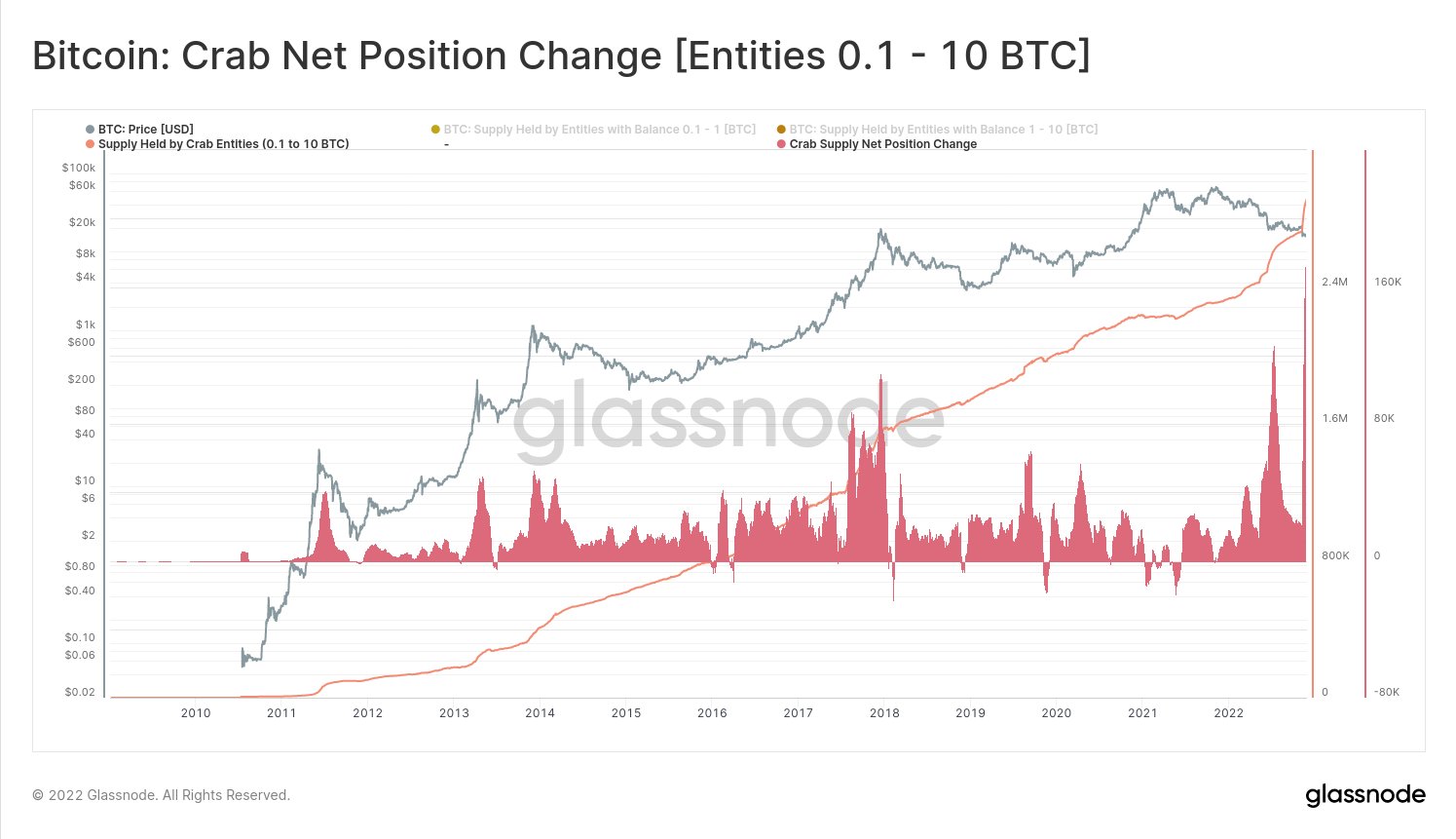

Based on on-chain analytics firm Glassnode, it’s retail investors mostly accountable for the present trend.

The smaller sized investors, known variously as “crabs” and “shrimps” based on wallet balance, are growing in figures.

“Bitcoin Shrimps (< 1$BTC) have added 96.2k $BTC for their holdings since FTX collapsed, an exciting-time high balance increase. This cohort now now hold over 1.21M $BTC, equal to 6.3% from the circulating supply,” Glassnode demonstrated inside a Twitter thread concerning the phenomenon.

An additional publish noted:

“Crabs (as much as 10 $BTC) also have seen aggressive balance increase of 191.6k $BTC during the last 30-days. This can be a convincing all-time-high, eclipsing the This summer 2022 peak of 126k $BTC/month.”

As Cointelegraph reported, area of the rise in smaller sized wallet figures might be lower to switch users withdrawing funds to personal storage.

Woo flags inbound “max pain”

For Willy Woo, the analyst behind popular statistics resource Woobull, on-chain metrics are going to Bitcoin’s next macro bottom being imminent.

Highlighting three of these a few days ago, Woo demonstrated that for those intents and purposes, Bitcoin is behaving just as it did within the pit of previous bear markets.

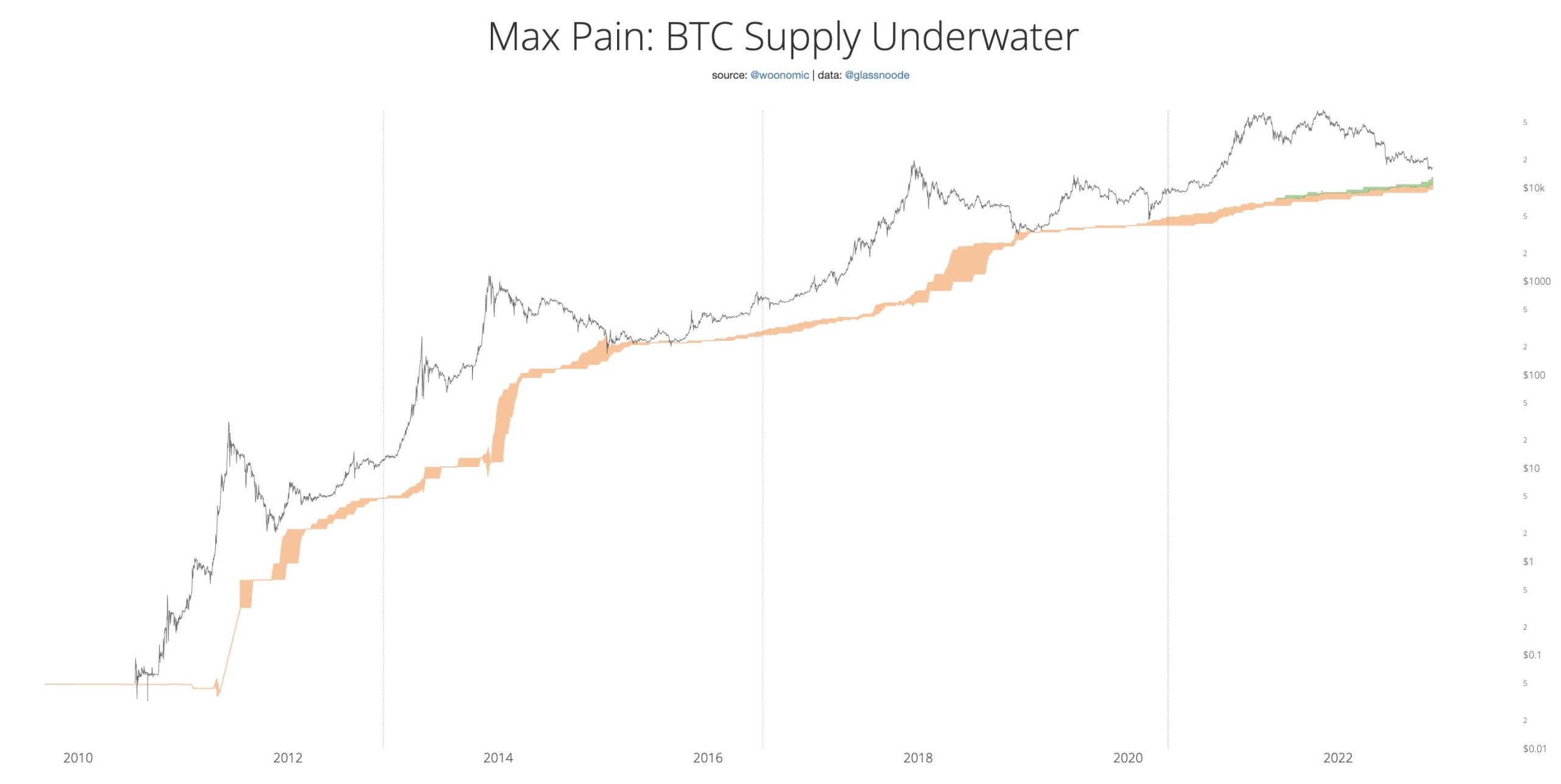

The area of the BTC supply held in an unrealized loss, for instance, is approaching macro lows, a phenomenon taught in “Max Pain” model.

“Bitcoin bottom gets close underneath the Max Discomfort model. In the past BTC cost reaches macro cycle bottoms when 58%-61% of coins are underwater (orange). Eco-friendly shading adjusts for that coins secured inside GBTC Trust,” Woo described alongside a chart.

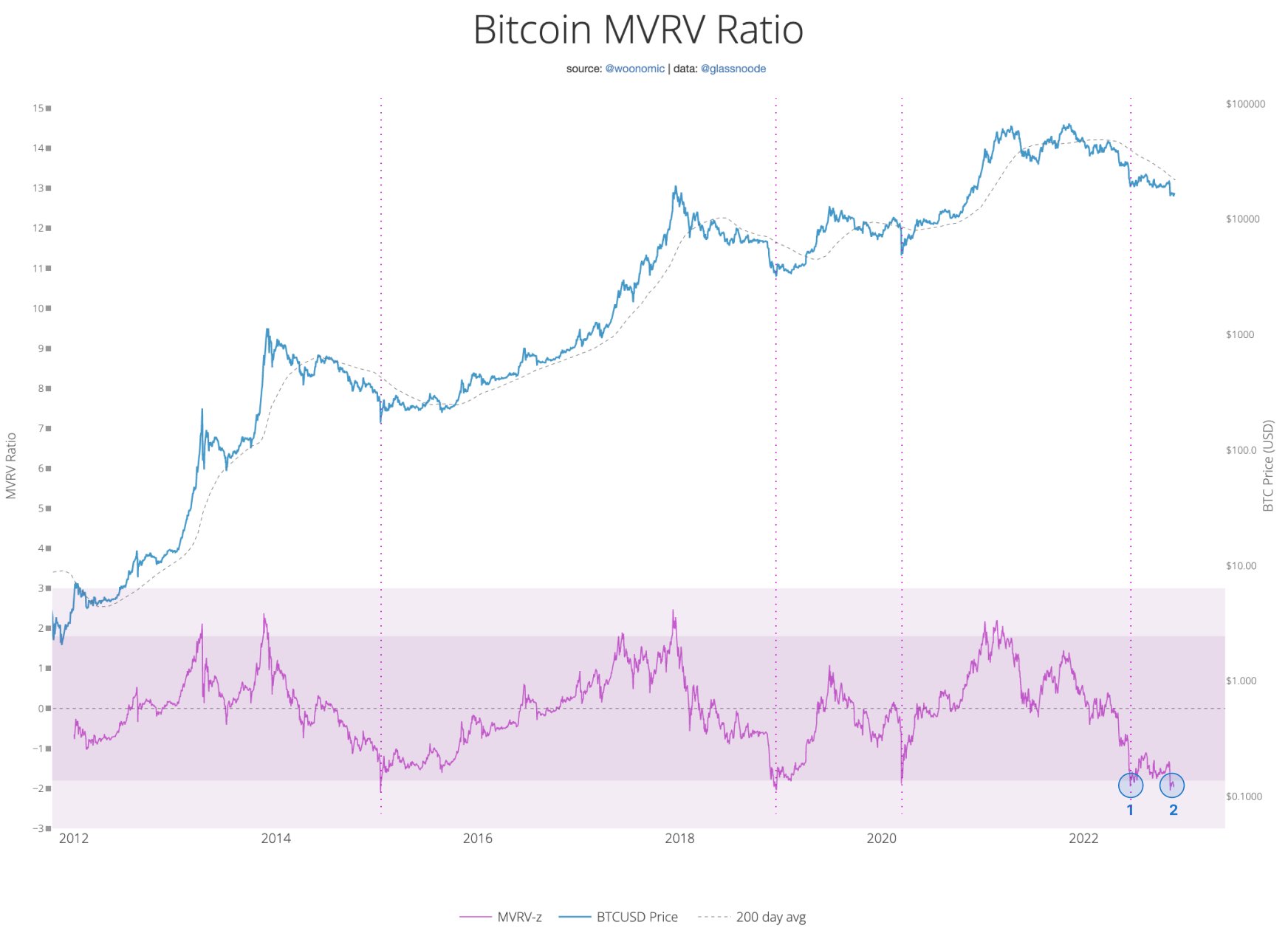

Ongoing, he noted the MVRV Ratio value for BTC/USD can also be targeting a “buy” zone, that has in the past given investors maximum potential profit.

MVRV is Bitcoin’s market cap divided by recognized cap — the mixture cost where each Bitcoin last moved. The resulting number has delivered purchase and sell zones akin to cost extremes.

“MVRV ratio is insidewithin all the worth zone,” Woo’s commentary mentioned:

“Under this signal i was in already bottoming (1) before the latest FTX white-colored swan debacle introduced us back to a buy zone (2).”

Woo’s third chart, Cumulative Value Days Destroyed (CVDD), was lately included in Cointelegraph.

“Use these charts at the own discretion, we’re within an unparalleled duration of deleveraging,” he added, cautioning that “Past cycles don’t always reflect future ones.”

Macro mood rocked by China protests

Some key economic data in the U . s . States is due now, but crypto analysts tend to be more centered on China.

By having an already fragile established order hanging on inflation trends, unrest within the world’s factories could unsettle market performance, some warn.

China is incorporated in the grip of the wave of protests from the government’s policy on COVID-19, with multiple metropolitan areas defying lockdowns to demand an finish to “COVID zero.”

With this thought, risk assets might be set for a tough ride when the situation spirals unmanageable.

“Crucial section of Bitcoin couldn’t break, so we are still consolidating within that range. On support now,” Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, described:

“If this really is lost, I’d expect new lows to appear around the markets, most likely based on China & FTX contagion now.”

Even mainstream media were warning of potential repercussions at the time, with John Toro, mind of buying and selling at exchange Independent Reserve, telling Bloomberg that “elevated contagion risk has been profiled in to the cryptocurrency complex.”

Asian stock markets were modestly lower at the time, with Hong Kong’s Hang Seng and also the Shanghai Composite Index lower 1.6% and .75%, correspondingly, during the time of writing.

Bonus: Bitcoin bottoms in oil

On the related macro note, Bitcoin has become lined up for “outperformance” in U.S. dollar terms, one well-known analyst has stated.

Related: Bitcoin may require $1B more about-chain losses before new BTC cost bottom

In WTI oil terms, BTC cost action has already been in a macro low — and history requires an upsurge, with a significant appreciation trend from the USD.

“We’re finally at funnel bottom,” TechDev confirmed over the weekend:

“Bitcoin’s oil (energy) purchasing power capped in April 2021. Now looks poised for an additional leg of outperformance (and increase in USD value).”

An associated chart came specific parallels to Bitcoin’s performance in the pit from the last bear market at the end of 2018.

As Cointelegraph reported, meanwhile, TechDev is way in the only voice with an upside to characterize BTC cost action entering 2012.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.