The following Bitcoin halving, in which the BTC reward delved to network validators per block found is going to be halved, is on its way in only more than one year and this may be a vital theme within the Bitcoin market within the coming quarters. That’s because past halvings have consistently were built with a huge cost impact.

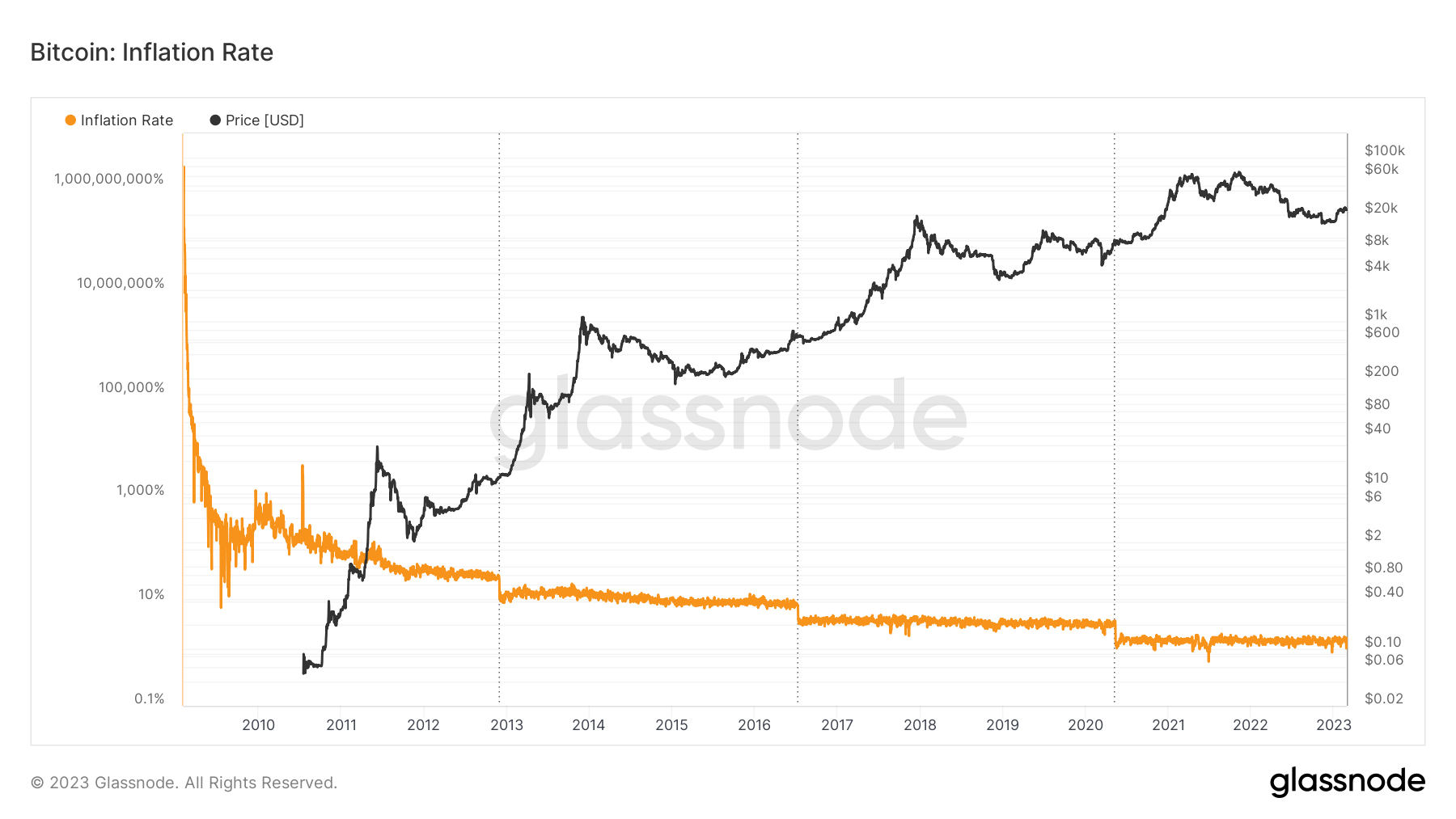

For reference, the present Bitcoin block reward is about 6.25 BTC, with blocks taking typically around ten minutes to mine. In April 2024, this block reward is going to be slowed to three.125 BTC, slowing Bitcoin’s inflation rate from around 2.% close to 1.%. Bitcoin’s inflation rate is made to continue falling and tends towards zero to guarantee the BTC supply never surpasses 21 million.

Halvings Normally Proceed a Ferocious Rally

There’ve to date been three Bitcoin halving occasions, the very first in November 2012, the 2nd in This summer 2016 and the newest one out of April 2020. The 3 have began massive run-ups within the Bitcoin cost. During the time of the 2012 halving, Bitcoin was buying and selling around $12. Within around twelve months, it’d rallied above $1,000.

The 2nd halving required place when Bitcoin’s cost was around $650. Within under annually . 5, Bitcoin’s cost had arrived at $19,000. Finally, within the 2020 halving required place when Bitcoin’s cost was under $9,000. Prices then continued hitting record highs in November 2021 of $69,000.

Bitcoin has thus published gains in the date from the halving to another market peak of roughly 83x, 29x and 8x. Unsurprisingly, with Bitcoin maturing being an asset class and getting enjoyed substantial development in its market capital, the speed of their publish-halving gains has slowed and may yet slow further.

Most likely the 2024 halving could cause a far more modest 2-3x gain when searching at Bitcoin’s peak cost within the publish-2024 halving period. Having a litany of on-chain and technical indicators all screaming that 2022’s bear marketplace is over and 2023 off and away to an excellent start for that world’s largest cryptocurrency by market capital, a ongoing gradual recovery in 2023 and into 2024 could perform them, despite ongoing macro/liquidity headwinds in the Fed’s tightening efforts.

Say Bitcoin has the capacity to recover towards the $30-40K region when from the next halving. We’re able to then very well be searching in a publish-halving rally to northern $100K.

Other Models Indicate Lengthy-term Bitcoin Upside

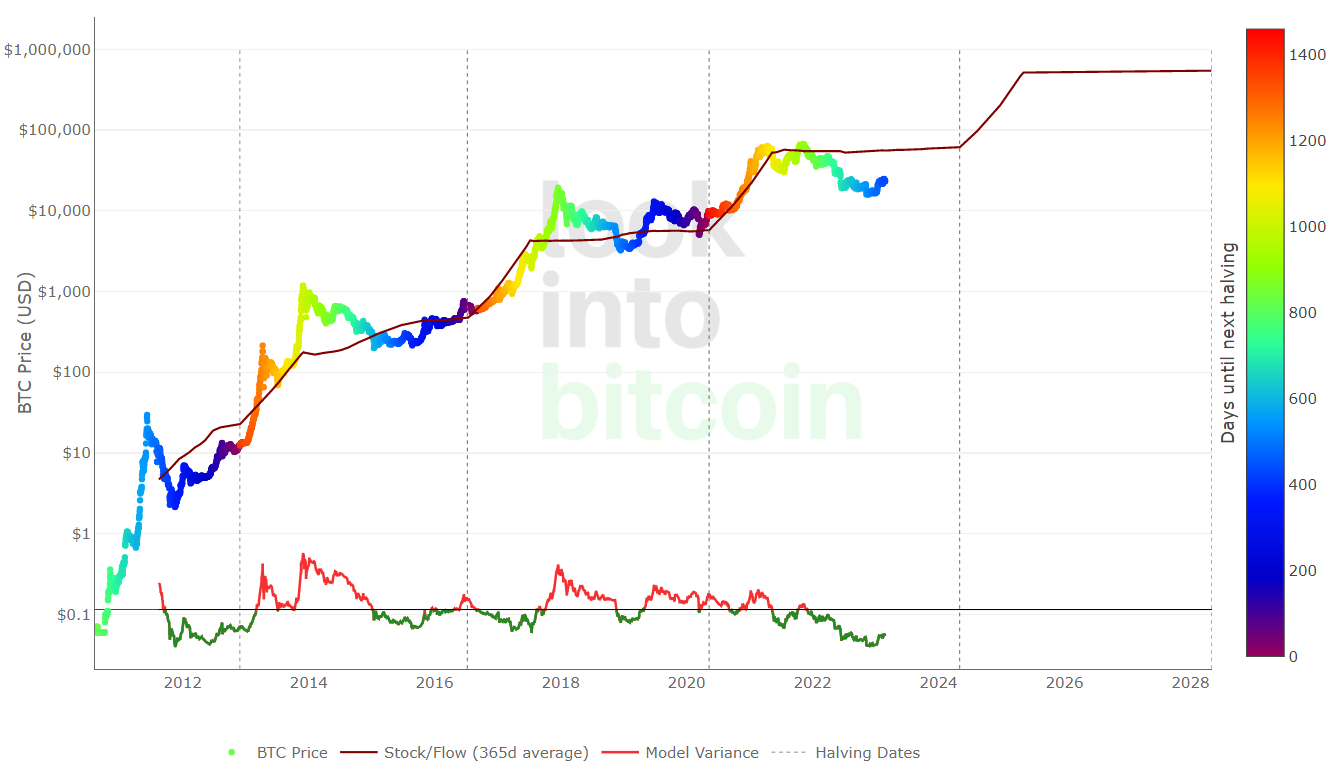

Numerous broadly adopted lengthy-term Bitcoin prices models/forecasting tools tend to be more bullish on Bitcoin compared to above back from the fag box analysis. Based on the broadly adopted stock-to-flow, which shows an believed cost level in line with the quantity of BTC available for sale in accordance with the quantity being found every year, Bitcoin’s fair cost at this time is about $55K and may go above $500K within the next publish-halving market cycle. That’s around 20x gains from current levels.

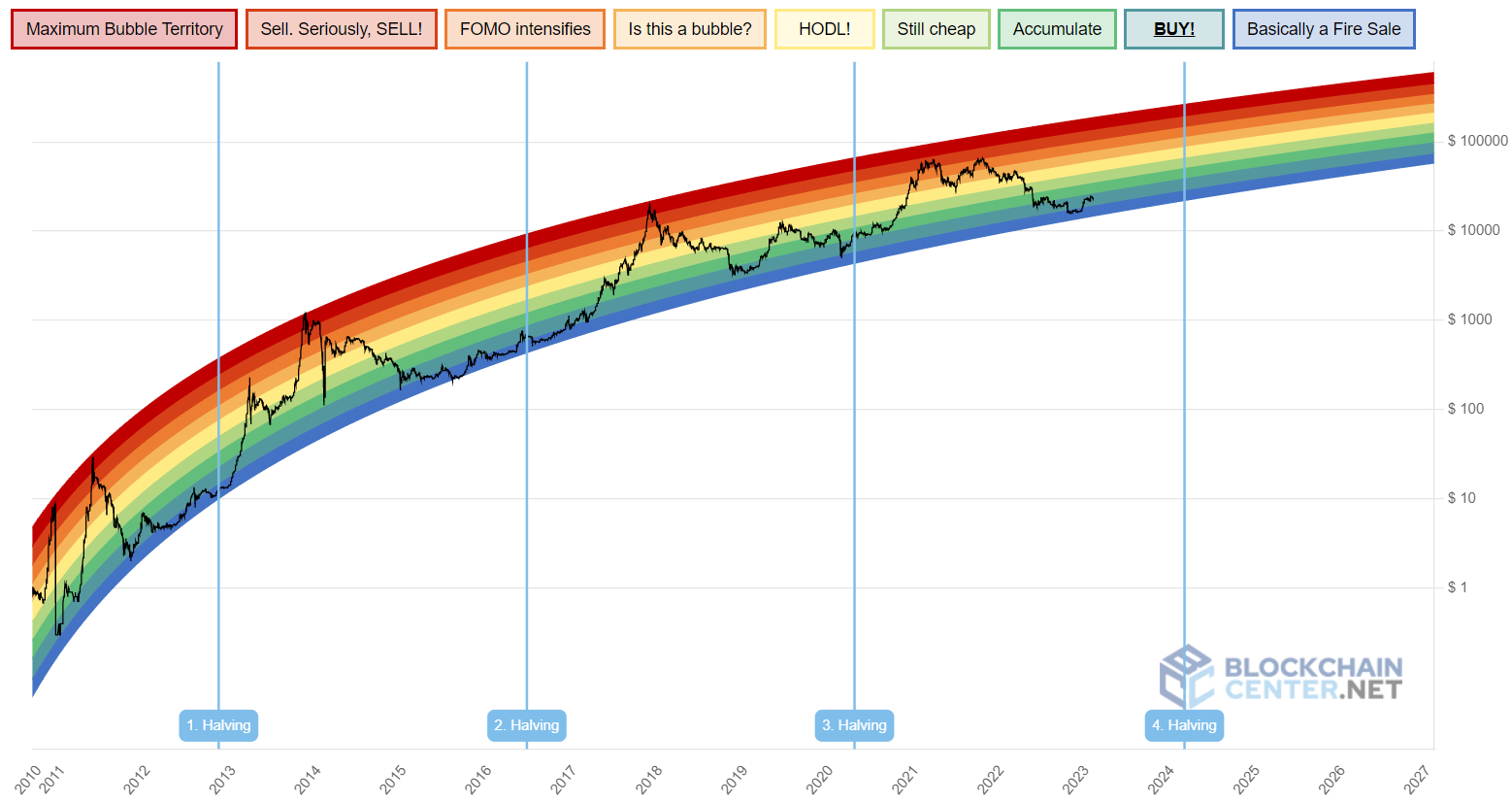

Meanwhile, Blockchaincenter.net’s popular Bitcoin Rainbow Chart implies that, at current levels, Bitcoin is incorporated in the “BUY!” zone, getting lately retrieved in the “Basically a fireplace Sale” focus late 2022. Quite simply, the model shows that Bitcoin is progressively dealing with being highly oversold. During its last bull run, Bitcoin could achieve the “Sell. Seriously, SELL!” zone. Whether it can continue doing this task within the next publish-halving market cycle within, say, someone to 1 1 / 2 years following the next halving, the model suggests a potential Bitcoin cost within the $200-$300K region. That’s around 8-13x gains from current levels.