Bitcoin’s latest resurgence, which saw the world’s largest cryptocurrency by market capital hit a brand new nine-month full of the mid-$26,000s on Tuesday, continues to be supported by a few key technical as well as on-chain indicators roaring to health insurance and once more send a bullish BTC signal.

Although the Bitcoin cost has dropped back underneath the $25,000 mark once more by the Wednesday Asia Off-shore session, BTC continues to be up over 27% versus last week’s lows within the mid-$19,000s. At that time, concerns about a number of high-profile failures of crypto/start-up/tech-friendly banks was weighing around the cost.

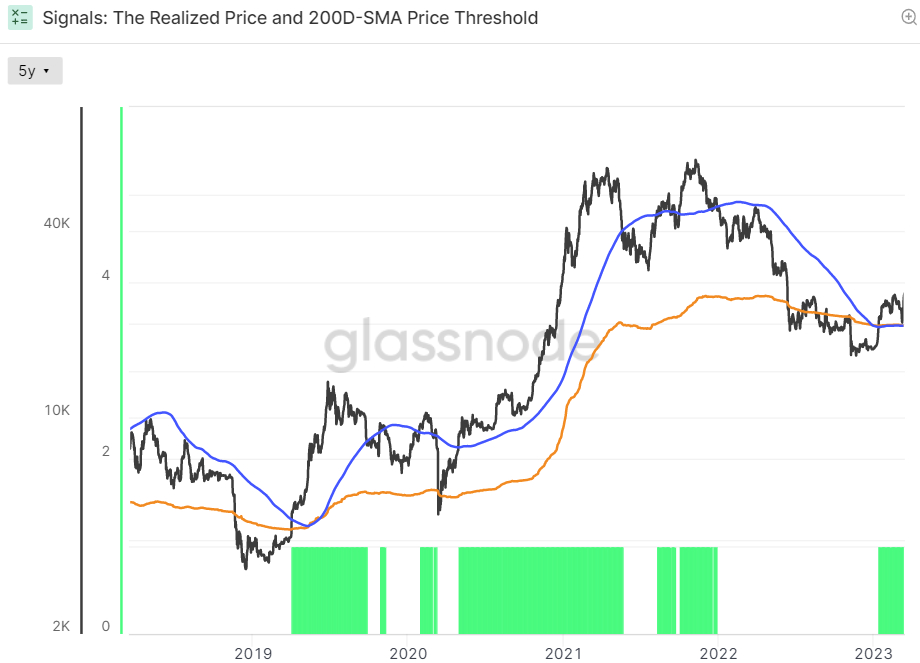

But bulls strongly defended key lengthy-term by means of the 200DMA and Recognized Cost (in the $19,700-800 range). Then, news over the past weekend that US government bodies could be walking into 1) safeguard depositors and a pair of) introduce a brand new $25 billion bank liquidity program to bolster balance sheets helped propel BTC greater.

Other key narratives pumping the rally include 1) the concept that financial stability concerns make significant further Given tightening significantly less likely and a pair of) financial stability concerns raise the benefit of Bitcoin, addressing an alternate, decentralized economic climate.

Bitcoin’s strong defense of their 200DMA and Recognized Cost has additionally helped spur confidence within the rally. After showing some indications of weakness a week ago, the most recent rally has sent numerous key on-chain metrics trending within the right direction.

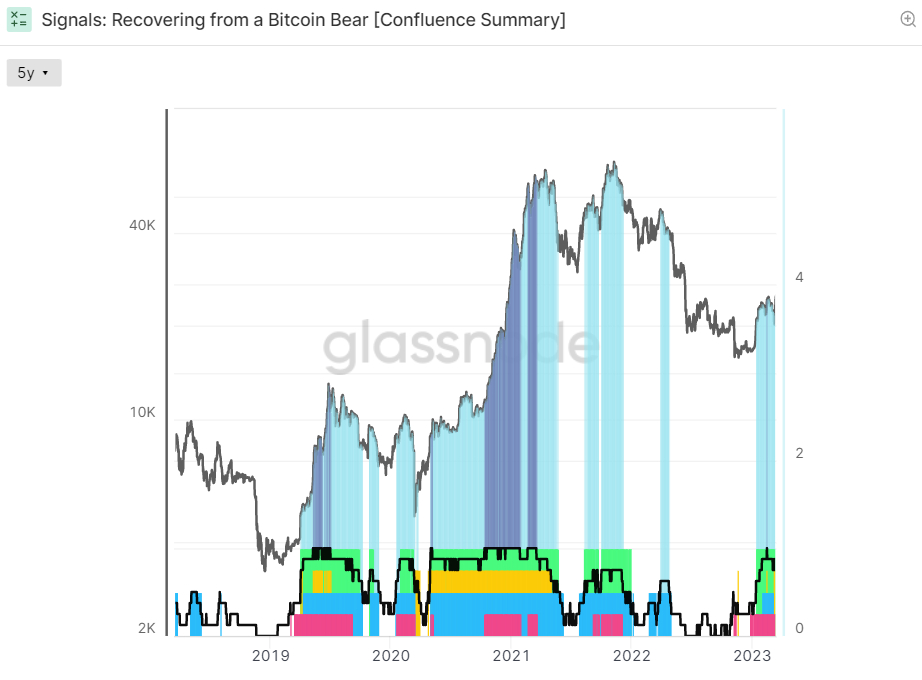

More particularly, if Bitcoin holds onto recent gains and/or extend upside for the next key resistance around just above $28,000 (as numerous technicians now deem likely), crypto analytics firm Glassnode’s broadly adopted “Recovering from the Bitcoin Bear” dashboard of on-chain and technical indicators will probably once more start flashing a bull market signal.

Dealing with a Bitcoin Bear

Glassnode’s “Recovering from the Bitcoin Bear” dashboard tracks eight indicators to determine whether Bitcoin is buying and selling above key prices models, whether network utilization momentum is growing, whether market profitability is coming back and if the balance of USD-denominated Bitcoin wealth favors the lengthy-term HODLers.

The chart is shaded light blue when five from eight indicators are flashing eco-friendly and fast when all eight are flashing eco-friendly.

When all eight are flashing eco-friendly, it has in the past been a powerful bullish sign for that Bitcoin market. Right now, seven of eight indicators are flashing eco-friendly. Bitcoin is buying and selling easily above its 200DMA and Recognized Cost, the very first two. A rest above these key levels is observed by many people being an indicator that near-term cost momentum is shifting inside a positive direction.

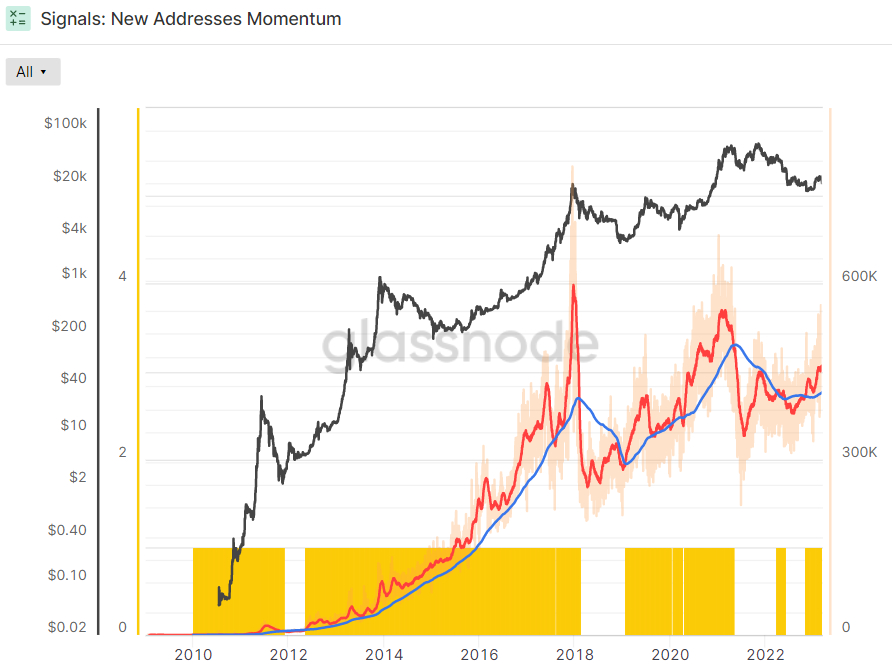

The 30-Day SMA of recent Bitcoin address creation moved above its 365-Day SMA a couple of several weeks ago, an indication the rate where new Bitcoin wallets are now being produced is speeding up. It has in the past happened at the beginning of bull markets.

Meanwhile, Revenue From Charges Multiple was the indicator that switched positive on Wednesday, simply to then turn negative again on Thursday. The Z-score is the amount of standard deviations below or above the mean of the data sample. In cases like this, Glassnode’s Z-score is the amount of standard deviations below or above the mean Bitcoin Fee Revenue from the last 2-years.

What this means is the 3rd and 4th indicators associated with whether network utilization is trending positively once more will also be delivering a bullish signal.

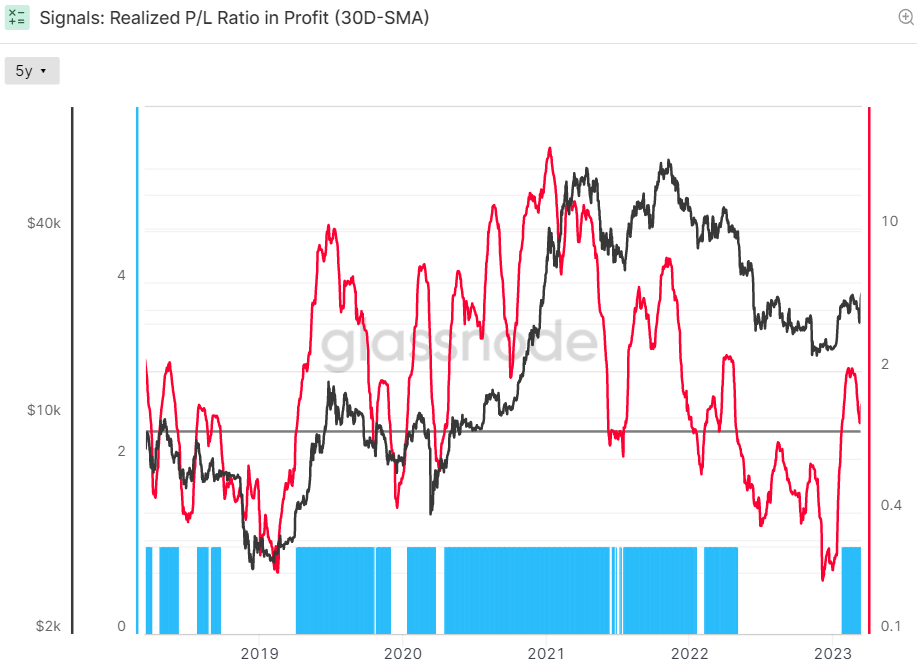

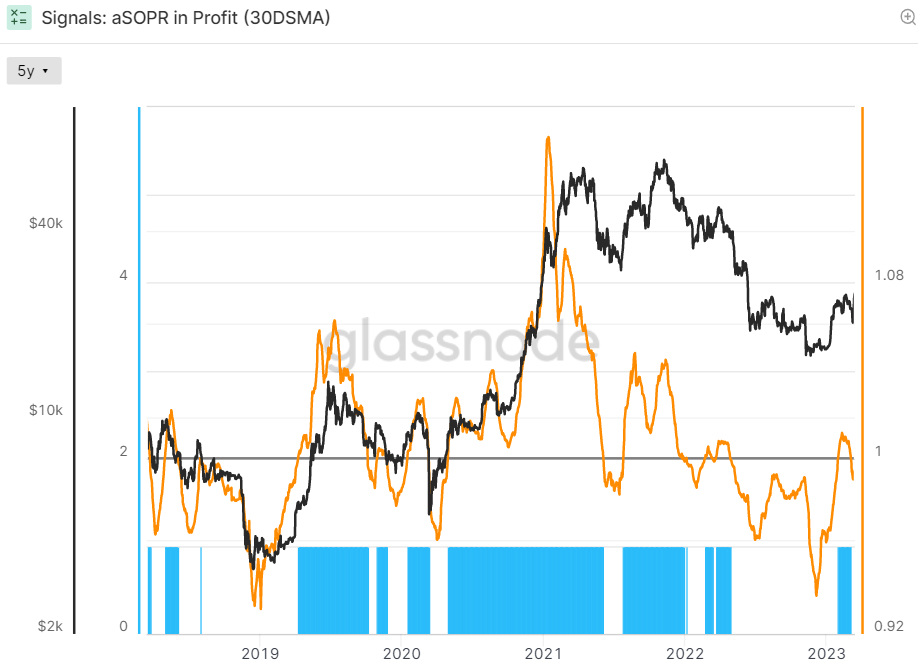

Getting to the 5th and sixth indicators associated with market profitability, despite pulling back dramatically in recent days to mirror the current stop by the Bitcoin market, the most recent reversal to new nine-month highs has stored the 30-Day Simple Moving Average (SMA) from the Bitcoin Recognized Profit-Loss Ratio (RPLR) indicator above one.

This means that the Bitcoin marketplace is realizing a larger proportion of profits (denominated in USD) than losses. Based on Glassnode, “this generally ensures that sellers with unrealized losses happen to be exhausted, along with a healthier inflow of demand exists to soak up profit taking”. Hence, this indicator is constantly on the send a bullish signal.

Meanwhile, the 30-day SMA of Bitcoin’s Adjusted Spent Output Profit Ration (aSOPR) indicator, an indication that reflects the quality of recognized profit and loss for those coins managed to move on-chain, lately dipped below one (meaning it’s no longer delivering a bull signal). That basically implies that, typically in the last thirty days, the marketplace is not in profit.

However, the final cost bounce, if sustained, is anticipated to lift this indicator to northern one shortly. That will mean all eight of Glassnode’s indicators are flashing eco-friendly. Searching back during the last eight many years of Bitcoin history, the aSOPR rising above 1 following a prolonged spell below it’s been an incredible buy signal.

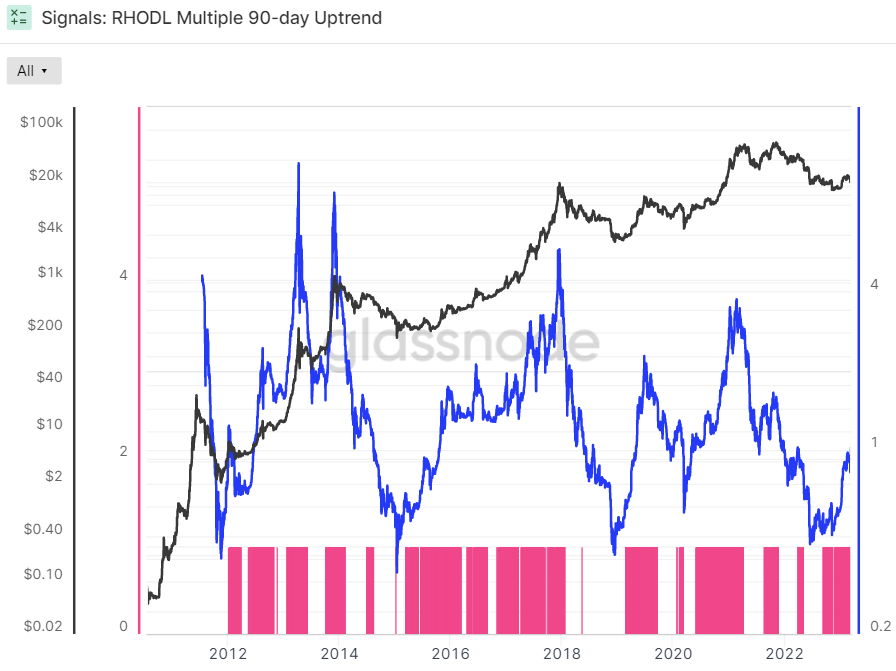

Finally, you will find the ultimate two indicators that report as to whether the total amount of USD wealth had sufficiently thrown back in support of the HODLers to signal weak-hands seller exhaustion.

The Bitcoin Recognized HODL Multiple has been around an upward trend during the last 3 months, a bullish sign based on Glassnode. The crypto analytics firm claims that “when the RHODL Multiple transitions into an upward trend more than a 90-day window, it signifies that USD-denominated wealth is beginning to shift back towards new demand inflows”. It “indicates earnings are being taken, the marketplace is capable of doing absorbing them… (and) that longer-term holders are beginning to invest coins” Glassnode states.

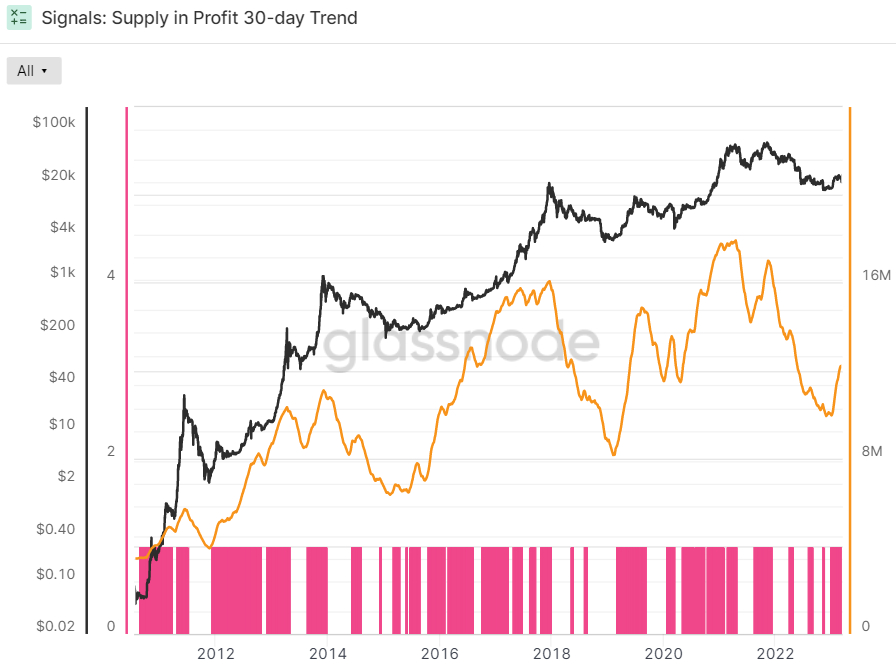

Glassnode’s final indicator in the Dealing with a Bitcoin Bear dashboard is if the 90-day Exponential Moving Average (EMA) of Bitcoin Supply in Profit has been around an upward trend during the last thirty days or otherwise. Supply in Profit is the amount of Bitcoins that last moved when USD-denominated prices were less than they’re at this time, implying these were bought for any lower cost and also the wallet is possessing a paper profit. This indicator can also be flashing eco-friendly.

Analysis of Bitcoin Market Cycles Also Give Need to be Bullish

The above mentioned positive transfer of Bitcoin’s on-chain trends come at any given time when more generally reported so-known as “core” on-chain metrics, like the amount of active addresses, the amount of addresses having a non-zero balance, the speed of recent address creation and the amount of daily transactions have been trending inside a positive direction, indicating rising demand to make use of the Bitcoin blockchain.

Various ways of analysing Bitcoin’s longer-term market cycle also give reason behind optimism. At the begining of The month of january, crypto-focused Twitter account @CryptoHornHairs identified that Bitcoin is following nearly exactly within the road to a roughly four-year market cycle that’s been respected perfectly let’s focus on over eight years.

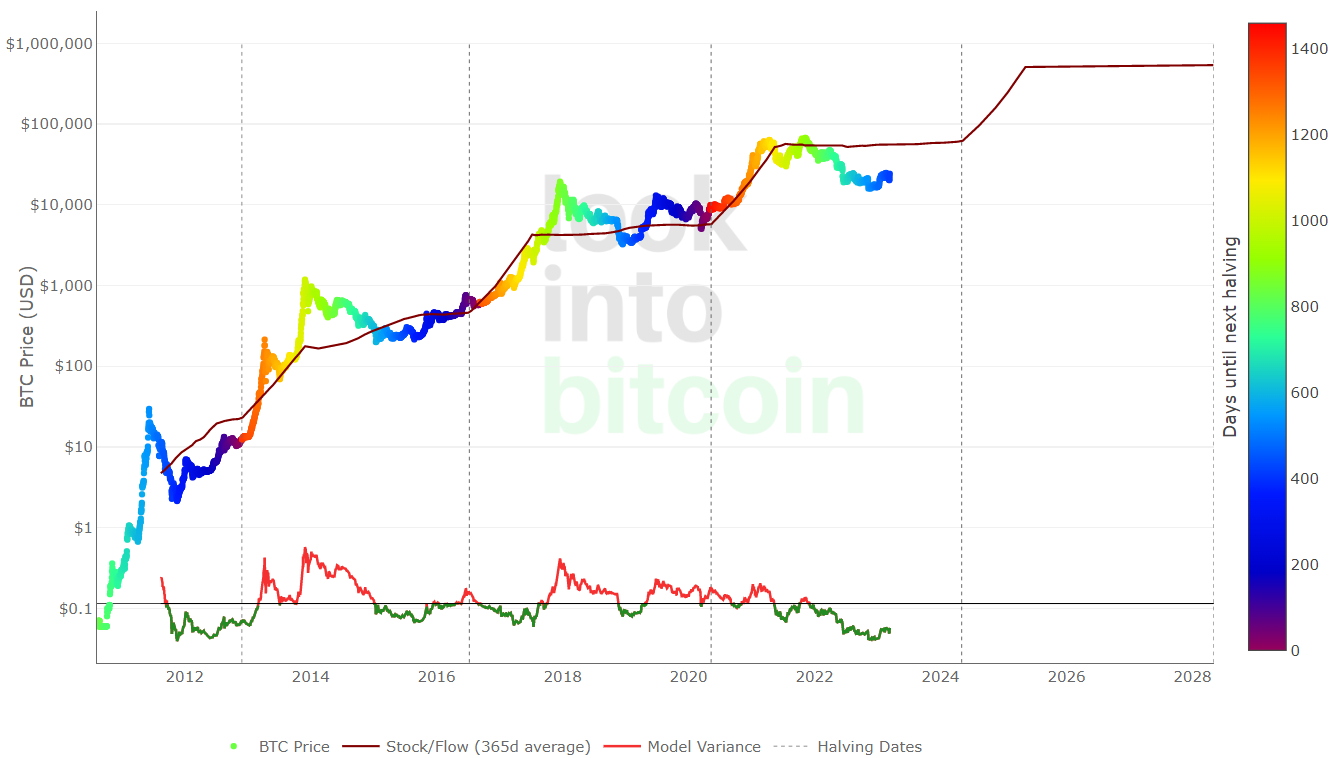

Elsewhere, a broadly adopted Bitcoin prices model is delivering an identical story. Based on the Bitcoin Stock-to-Flow prices model, the Bitcoin market cycle is roughly 4 years, which shows an believed cost level in line with the quantity of BTC available for sale in accordance with the quantity being found every year.

Bitcoin’s fair cost at this time is about $55K and may go above $500K within the next publish-halving market cycle – that’s around 20x gains from current levels.

Finally, Blockchaincenter.net’s popular Bitcoin Rainbow Chart implies that, at current levels, Bitcoin is incorporated in the “BUY!” zone, getting lately retrieved in the “Basically a fireplace Sale” focus late 2022. Quite simply, the model shows that Bitcoin is progressively dealing with being highly oversold. During its last bull run, Bitcoin could achieve the “Sell. Seriously, SELL!” zone.

Whether it can continue doing this task within the next publish-halving market cycle within someone to 1 1 / 2 years following the next halving, the model suggests a potential Bitcoin cost within the $200-$300K region. That’s around 8-13x gains from current levels.