Based on crypto data analytics firm CryptoQuant, an on-chain metric is giving out a definitive Bitcoin buy signal the very first time since 2019. CryptoQuant’s Profit and Loss (PnL) Index, a catalog built from three on-chain indicators concerning the profitability from the Bitcoin market, lately entered back above its 365-Day Simple Moving Average (SMA) following a prolonged spell below it.

The PnL Index chopped each side of their 365-Day SMA in 2020 and 2021. The final time that it broke decisively to northern its 365-Day SMA following a prolonged period below it had been in 2019, a couple of several weeks following the market had bottomed. “The CQ PnL Index has provided a definitive buy signal for BTC,” CryptoQuant note, before proclaiming that “the index crossover has implied the beginning of bull markets in past cycles”.

“It continues to be feasible for the index to fall back below,” CryptoQuant cautioned inside a blog publish. However the Bitcoin bulls is going to be adding this indicator to some growing listing of other on-chain and technical signals which are all also flashing bullish signs.

Growing Listing of On-chain/Technical Indicators Say Bitcoin Bottom Is Within

As discussed inside a recent article, an growing confluence of indicators (searching at eight prices model, network utilization, market profitability and balance of wealth signals) tracked by Glassnode are suggesting that Bitcoin might be in early stages of dealing with a bear market.

Which aren’t the only real on-chain indicators flashing signals of the incoming bull market. Based on analysis published on Twitter by @GameofTrade_, 6 on-chain metrics such as the Accumulation trend score, Entity-adjusted dormancy flow, Reserve risk, Recognized cost, MVRV Z-score and Puell multiple are “calling for any generational lengthy-term buying opportunity”.

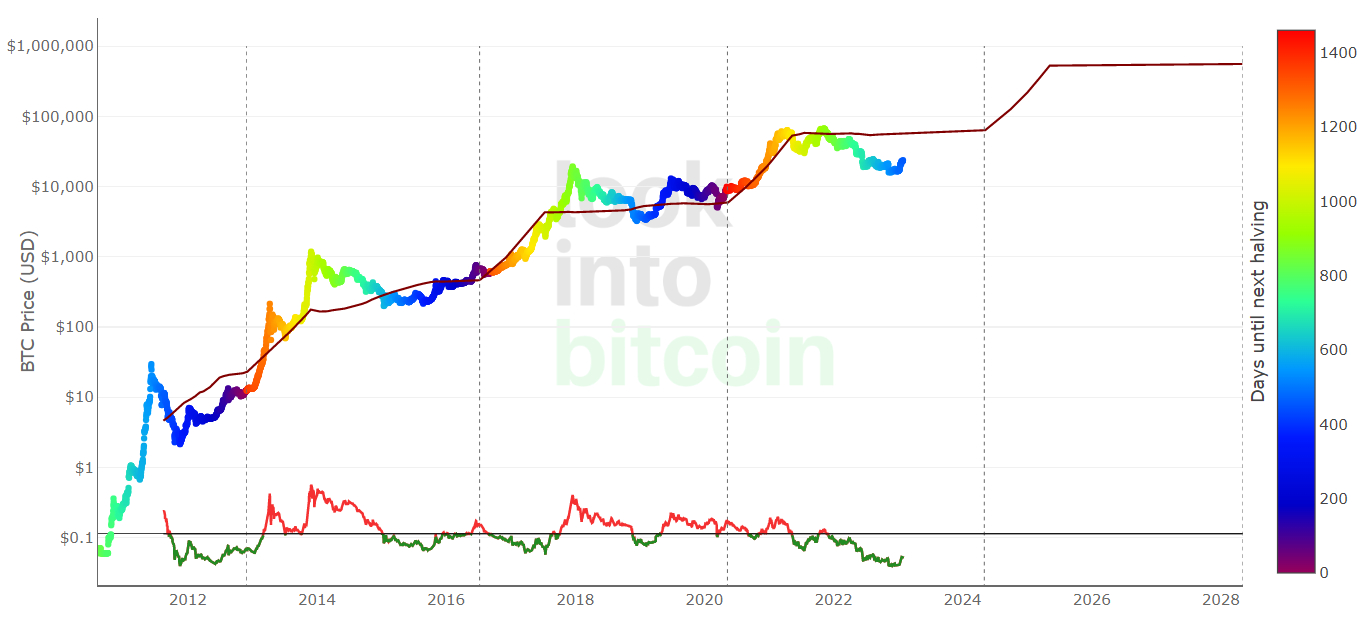

Meanwhile, analysis of Bitcoin’s longer-term market cycles also shows that the world’s largest cryptocurrency by market capital may be just starting out of the near-three-year bull market. Based on analysis from crypto-focused Twitter account @CryptoHornHairs, Bitcoin is following exactly within the road to a roughly four-year market cycle that’s been respected perfectly let’s focus on over eight years.

Elsewhere, a broadly adopted Bitcoin prices model is delivering an identical story. Based on the Bitcoin Stock-to-Flow prices model, the Bitcoin market cycle is roughly 4 years, with prices typically bottoming somewhere near to the center of the four-year gap between “halvings” – the Bitcoin halving is really a four-yearly phenomenon in which the mining reward will get halved, thus slowing the Bitcoin inflation rate. Past cost history shows that Bitcoin’s newest surge can come following the next halving in 2024.

But Macro Headwinds Could Send Prices Lower Now

The suggestions above-noted indicators suggest Bitcoin is presently an excellent lengthy-term buy. You need to stress the “long-term” here. That is because the macro headwinds that pummelled the world’s largest cryptocurrency by market capital haven’t completely disappeared at this time.

Indeed, multiple macro strategists have noted that, entering this week’s crucial Given policy announcement, there’s a substantial risk that markets might be underestimating the Fed’s resolve to at least one) continue raising US rates of interest and a pair of) hold them at elevated levels for a while.

Money financial markets are presently prices the Given delivers just 50 bps in further rate hikes – one on Wednesday (taking rates to 4.50-4.75%) and something in March (where rates then peak at 4.75-5.%). Markets then expect a cutting cycle to start in serious prior to the finish of 2023.

Now, such market prices isn’t absurd – inflation in america is shedding quickly and appears prone to soon fall to the Fed’s 2.% target, while multiple economic leading indicators are flagging the chance the economy enters recession later this season. The market’s view seems to become the Given may wish to start easing to aid growth.

And when the market’s expectations concerning the economy are right, then your Given most likely will begin easing later this season. But, knowing by recent commentary from officials, the Given is nowhere near prepared to signal an easing bias. The 2021 “transitory” inflation debacle badly broken the central bank’s credibility, and also the Given really wants to still signal an intent to consider a difficult stance on inflation.

Given Chair Jerome Powell and co. might signal the bank promises to press ahead using more than another 50 bps in rate hikes, which may jolt markets, especially risk assets, for the short term. Bitcoin’s big The month of january run-up could come across the very first day of Feb such an incident.

Technicians have flagged too little major support levels in front of the $21,500 area, that could be easily retested in this scenario. A retest of $20,000 and also the 200-Day Moving Average and Realized Cost just beneath it ought to also ‘t be eliminated. What can be most fascinating could be how Bitcoin would respond at such levels. Given the suggestions above indicators signaling the bear marketplace is over, many dip buyers might be wanting to get hold of Bitcoin at $20,000 once more.