Bitcoin (BTC) briefly broke above $25,000 on August. 15, however the excitement lasted under an hour or so and it was adopted with a 5% retrace within the next five hrs. The level of resistance demonstrated to become tougher than expected but might have provided bulls false expect the approaching $335 million weekly options expiry.

Investors’ fleeting optimism reverted to some sellers’ market on August. 17 after BTC dumped and tested the $23,300 support. The negative move required place hrs prior to the discharge of the government Open Markets Committee (FOMC) minutes from the This summer meeting. Investors expect some insights on if the Fed continues raising rates of interest.

The negative newsflow faster on August. 16 following a federal court within the U . s . States approved the U.S. Irs (IRS) to pressure cryptocurrency broker SFOX to reveal the transactions and identities of customers who’re U.S. taxpayers. Exactly the same strategy was utilized to acquire information from Circle, Coinbase and Kraken between 2018 and 2021.

This movement explains why betting on Bitcoin cost above $25,000 on August. 19 appeared just like a sure factor a few days ago, which might have incentivized bullish bets.

Bears did not expect BTC to maneuver above $24,000

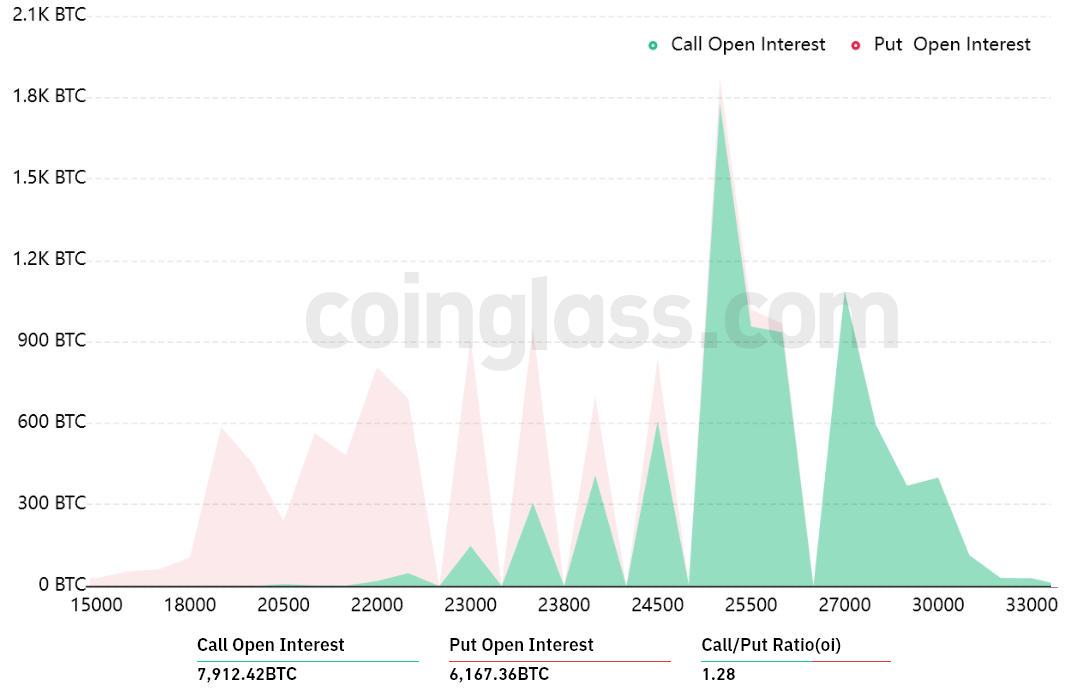

Outdoors interest for that August. 19 options expiry is $335 million, however the actual figure is going to be lower since bears were excessively-positive. These traders may have been fooled through the short-resided dump to $22,700 on August. 10 as their bets for Aug’s options expiry extend lower to $15,000.

The Fir.29 call-to-put ratio shows the main difference between your $188 million call (buy) open interest and also the $147 million put (sell) options. Presently, Bitcoin stands near $23,300, meaning most bullish bets will probably become useless.

If Bitcoin’s cost moves below $23,000 at 8:00 am UTC on August. 19, only $a million price of these call (buy) options is going to be available. This difference is really because the right to purchase Bitcoin at $23,000 is useless if BTC trades below that much cla on expiry.

There’s still expect bulls, but $25,000 appears distant

Here are the 3 probably scenarios in line with the current cost action. The amount of options contracts on August. 19 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $21,000 and $23,000: 30 calls versus. 2,770 puts. The internet result favors the put (bear) instruments by $60 million.

- Between $23,000 and $25,000: 940 calls versus. 1,360 puts. The internet outcome is balanced between bulls and bears.

- Between $25,000 and $26,000: 3,330 calls versus. 100 puts. The internet result favors the phone call (bull) instruments by $80 million.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a put option, effectively gaining positive contact with Bitcoin over a specific cost, but regrettably, there is no good way to estimate this effect.

Related: Former Goldman Sachs banker explains why Wall Street will get Bitcoin wrong

Bears will attempt to pin Bitcoin below $23,000

Bitcoin bulls have to push the cost above $25,000 on August. 19 to learn $80 million. However, the bears’ best situation scenario requires pressure below $23,000 to maximise their gains.

Bitcoin bulls just had $144 million in leveraged futures lengthy positions liquidated on August. 16, so that they must have less margin they are driving the cost greater. With this particular stated, bears possess the upper hands to suppress BTC below $23,000 in front of the August. 19 options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.