The 14-Day Exponential Moving Average (EMA) of the amount of transactions happening around the Bitcoin network hit its greatest level since April 2021 earlier this year, based on data from crypto analytics firm Glassnode. The 14-Day EMA of transactions lately surpassed 300,000, with analysts and cryptocurrency market commentators citing the lately deployed Bitcoin NFT protocol known as Ordinals.

Based on crypto derivatives firm BitMEX, by the 7th of Feb, over 13,000 Ordinal NFTs have been minted directly to the Bitcoin blockchain, taking on 526MB of block space and connected having a spend of 6.77 BTC (worth around $150,000 at current prices).

The deployment of Ordinal NFTs directly to the Bitcoin blockchain continues to be questionable, with a few claiming its is the opposite of pseudonymous Bitcoin creator Satoshi Nakamoto’s original vision from the Bitcoin blockchain only getting used for financial purposes. Regardless of whether you accept the presence of Bitcoin-based NFTs or otherwise, they’re creating a mark around the network.

So can Ordinals create a wider uptick in network activity that benefits the Bitcoin cost?

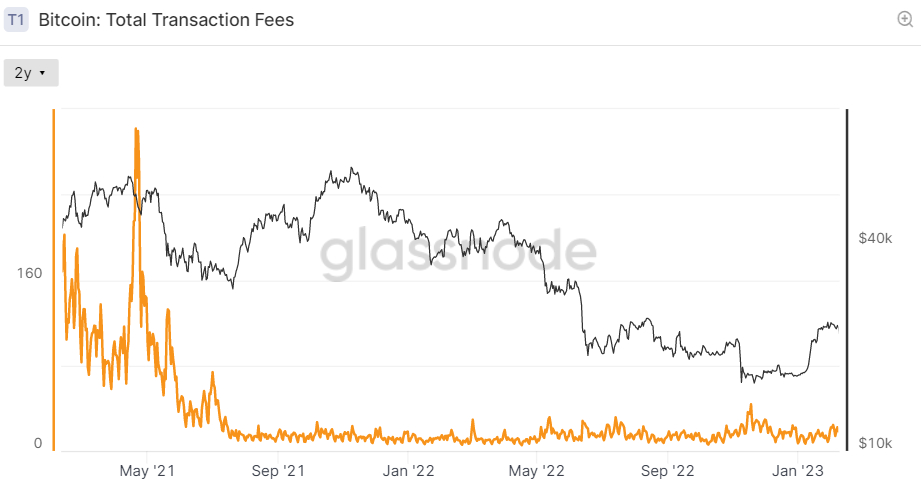

Bitcoin Network Charges Not Impacted Yet

Some analysts and commentators have expressed concerns that the presence of the Ordinal NFTs, that have led to numerous Bitcoin blocks striking the 4MB limit, might put upwards pressure on network charges. However, based on Glassnode data, there’s been no notable uptick in network charges by yet.

Some have contended when the Ordinal NFTs would result in a increase in the Bitcoin network charges, this may be great for miners, thus representing a lengthy-term positive for that Bitcoin network’s security. However, considering that charges haven’t yet get, Bitcoin miner revenue in accordance with its the recent past remains supressed. Glassnode’s 4-year Z-Score of Miner Revenue from Charges remains near to its lows it has continued to be stuck around since This summer 2021.

The way the Ordinal NFTs Bitcoin Network Activity Might Change up the BTC Cost

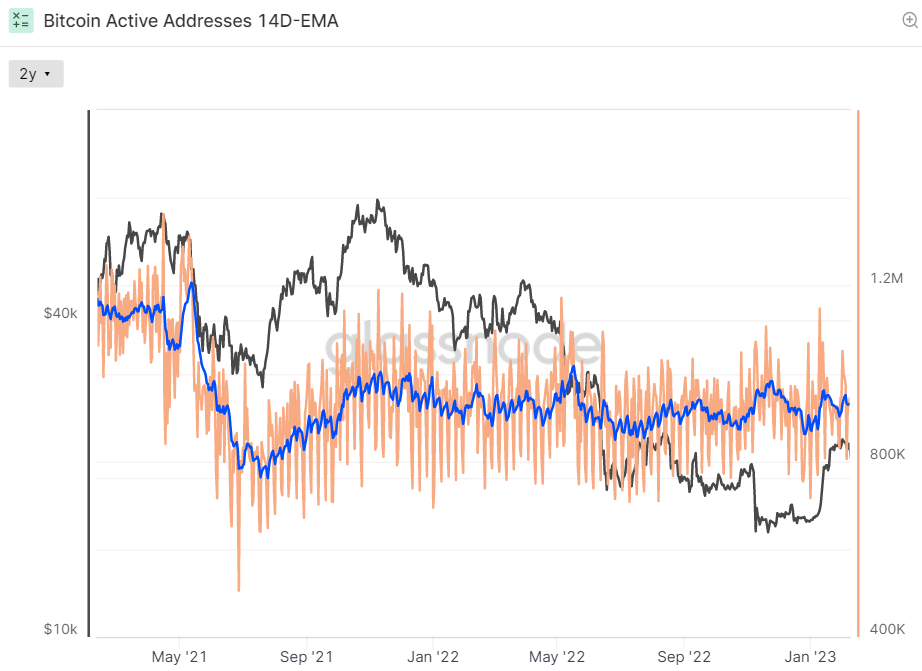

Using the Ordinal NFTs getting had minimal effect on network charges so far, it may most likely be assumed the new, questionable protocol’s effect on the BTC cost has to date been minimal. Meanwhile, although it has elevated transaction traffic, Ordinals doesn’t appear to possess had any effect on the amount of unique daily people that use the Bitcoin blockchain.

Glassnode’s 14-Day EMA of Active Addresses, that the firm defines as “the quantity of unique addresses which were whether sender or receiver that day”, was around 940,000 by the 8th of Feb, near to the range it has continued to be within for more than a year . 5.

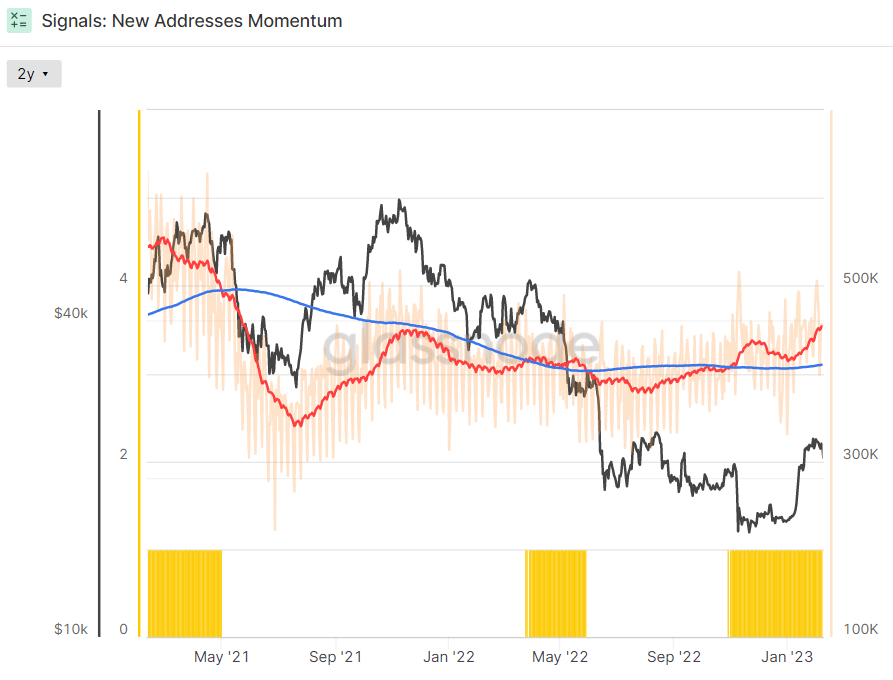

Another indicator of network activity tracked by analysts at Glassnode, New Addresses Momentum, continues to be delivering positive signs as recently. However this positive trend started in Q4 2022 once the collapse of FTX triggered a drop to fresh annual lows within the Bitcoin cost, which 1) encouraged users to consider child custody of the crypto from exchanges the very first time (meaning plenty of new wallet creation) and a pair of) attracted new users who wished to buy the dip.

The 30-Day Simple Moving Average (SMA) of recent addresses rose over the 365-Day SMA of recent addresses at the begining of November, and it has been above it since.

Therefore it appears as if the appearance of Bitcoin NFTs through the Ordinals protocol has yet to possess a reasonable effect on Bitcoin network activity and adoption to affect the cryptocurrency’s cost. But this can be a brand-new technology and it is eventual effect on the Bitcoin network is not yet been seen. Bitcoin investors, no matter their feelings towards Bitcoin-based NFTs, should watch this space.